Improve Business Credit Score Fast: Proven Strategies for Success

Improving your business credit score can significantly impact your company’s financial health. A good credit score opens doors to better financing options and favorable terms.

In today’s competitive market, maintaining a strong business credit score is essential. It not only boosts your credibility with lenders but also helps secure better interest rates and higher credit limits. Flex, a financial platform, can simplify this process by integrating various financial functions into one easy-to-use system. From streamlined banking and payments to robust expense management, Flex offers comprehensive solutions that support business growth. With benefits like flexible credit terms and enhanced security, Flex Flex Banking & Treasury Products is designed to help your business thrive. Let’s explore how you can improve your business credit score and leverage these tools for success.

Introduction To Business Credit Score

A business credit score is crucial for any company. It impacts many aspects of your business. Improving your business credit score can lead to better financial opportunities. Let’s explore what a business credit score is and why it is important.

What Is A Business Credit Score?

A business credit score is a number that reflects the financial health of your business. This score is based on various factors such as payment history, debt levels, and the age of your business. It helps lenders and suppliers assess the creditworthiness of your company.

Business credit scores typically range from 0 to 100. A higher score indicates better creditworthiness. Key factors influencing the score include:

- Payment history: Timeliness of bill payments.

- Debt levels: The amount of debt your business carries.

- Business age: How long your business has been operating.

Why Is A Good Business Credit Score Important?

Maintaining a good business credit score is essential for several reasons. Firstly, it can lead to lower interest rates on loans and credit cards. Financial platforms like Flex offer competitive terms for businesses with strong credit scores, including up to 2.99% APY on cash on hand and 0% interest for 60 days on purchases.

Secondly, it enhances your business’s reputation with suppliers and vendors. They are more likely to extend favorable payment terms if your credit score is high. This can improve your cash flow management.

Additionally, a good credit score can increase your borrowing capacity. Products like Flex’s credit card offer growing credit limits that adapt to your business needs. This is particularly beneficial for scaling businesses that require more capital.

Lastly, it ensures better security for your financial data. Flex incorporates advanced security measures such as robust encryption and multi-factor authentication, giving you peace of mind.

| Key Benefits | Details |

|---|---|

| Lower Interest Rates | Access to 0% interest for 60 days on purchases. |

| Enhanced Reputation | Better payment terms with suppliers and vendors. |

| Increased Borrowing Capacity | Growing credit limits with business needs. |

| Improved Security | Advanced security measures for financial data protection. |

Improving your business credit score can open doors to financial growth and stability. Utilizing platforms like Flex can help you manage and enhance your credit score efficiently.

Key Strategies To Improve Your Business Credit Score

Improving your business credit score can open doors to better financing options and terms. Implementing key strategies consistently can make a significant difference in your score.

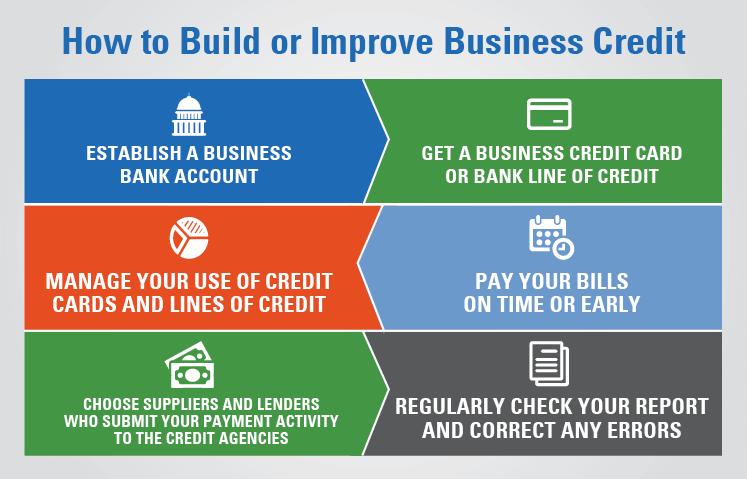

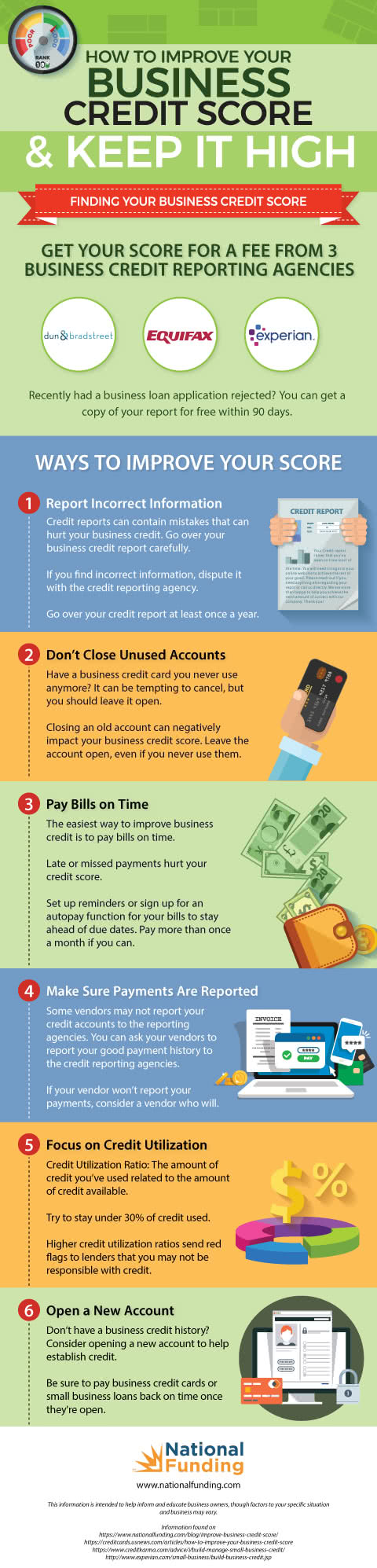

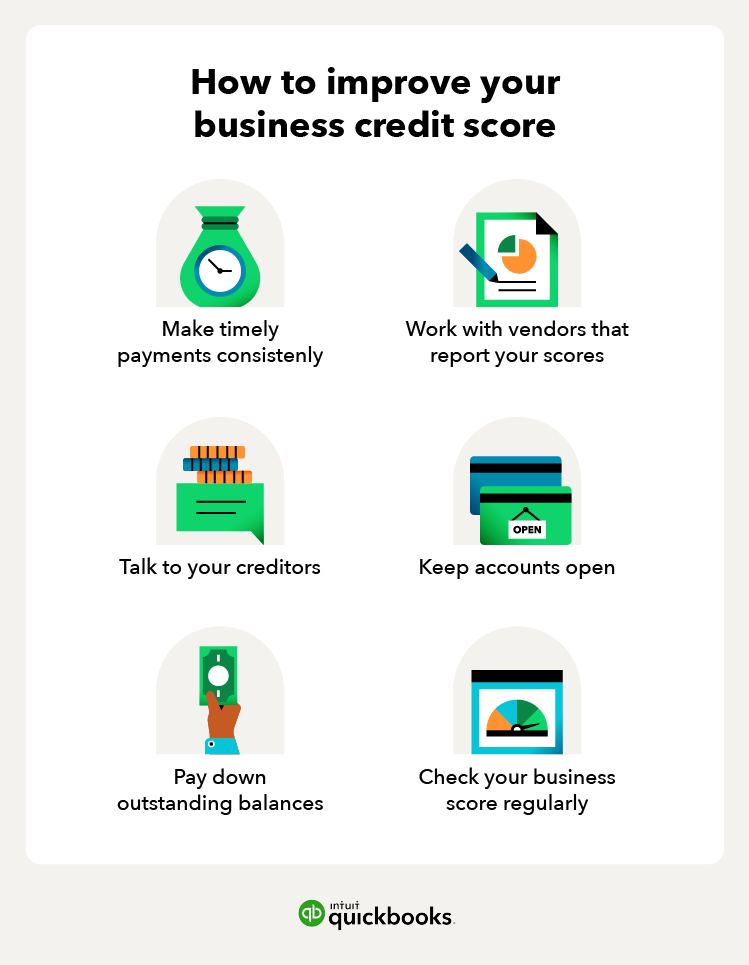

Monitor Your Business Credit Reports Regularly

Regularly monitoring your business credit reports is crucial. Ensure that all information is accurate and up-to-date. Dispute any discrepancies immediately to prevent negative impacts on your credit score.

Build A Strong Payment History

Timely payments are essential. Pay all your bills and invoices on time. Establishing a strong payment history demonstrates reliability and boosts your credit score.

Increase Your Credit Limits

Requesting higher credit limits can help improve your credit utilization ratio. A lower credit utilization ratio positively affects your credit score. Utilize platforms like Flex for flexible credit terms and high credit limits.

Diversify Your Credit Mix

Maintaining a diverse credit mix is beneficial. Utilize various types of credit, such as credit cards, loans, and lines of credit. This demonstrates your ability to manage different credit types effectively.

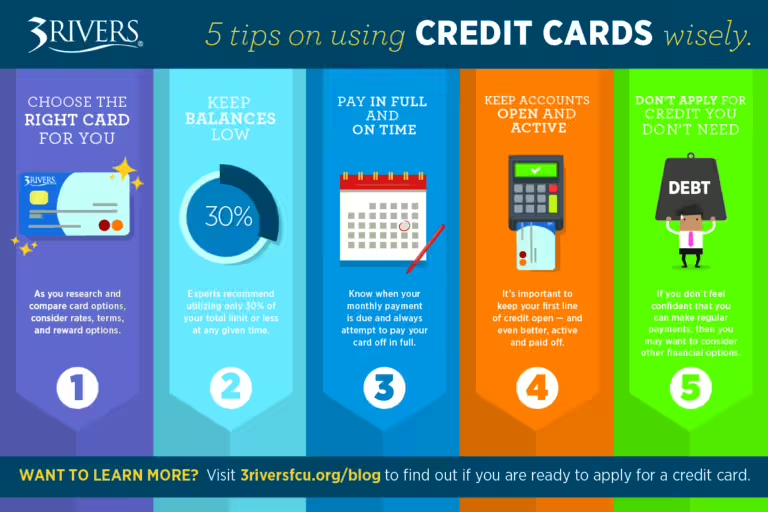

Keep Your Credit Utilization Low

Keeping your credit utilization low is vital. Aim to use less than 30% of your available credit. This indicates responsible credit usage and positively impacts your credit score.

Flex offers a comprehensive platform to support your business financial needs:

| Main Features | Benefits |

|---|---|

|

|

For more information, visit Flex Banking & Treasury Products.

Practical Tips For Managing Business Credit

Managing business credit effectively can lead to improved financial health and growth. Here are practical tips to help you manage your business credit score efficiently.

Establishing Trade Lines With Vendors

Establishing trade lines with vendors is essential for building business credit. Start by working with suppliers who report to credit bureaus. This will help you create a credit history.

- Choose vendors that report payments to credit agencies.

- Negotiate favorable terms to ensure timely payments.

- Maintain good relationships with vendors to improve credit terms over time.

Using a platform like Flex can simplify managing these trade lines. Flex provides streamlined banking and payment solutions, which make it easier to keep track of vendor payments.

Paying Off Debts Strategically

Paying off debts strategically can significantly impact your business credit score. Prioritize high-interest debts and those that affect your credit the most.

- Identify debts with the highest interest rates.

- Focus on paying off these debts first.

- Consider consolidating debts to manage them more efficiently.

Flex offers Net-60 terms on all purchases, giving you 60 days of 0% interest. This can help you manage cash flow and pay off debts more effectively.

Avoiding Frequent Credit Inquiries

Avoiding frequent credit inquiries is crucial to maintaining a healthy credit score. Too many inquiries can negatively impact your score.

- Limit the number of credit applications you submit.

- Space out your credit inquiries over time.

- Only apply for credit when necessary.

Using Flex, you can manage your expenses and credit needs without frequent inquiries. Their scalable credit limits grow with your business, reducing the need for multiple credit applications.

Maintaining Accurate And Up-to-date Information

Maintaining accurate and up-to-date information is vital for your business credit profile. Ensure all details are current and correct.

| Action | Benefit |

|---|---|

| Regularly review your credit reports | Identify and correct errors promptly |

| Update business information | Ensure credit agencies have accurate data |

| Monitor credit utilization | Maintain a healthy credit ratio |

Platforms like Flex provide proactive protection and robust encryption. This ensures your financial data remains secure and accurate.

By following these practical tips, you can manage your business credit effectively, leading to better financial opportunities and growth.

Tools And Resources For Monitoring Business Credit

Maintaining a healthy business credit score is vital for your business’s financial health. Various tools and resources can help monitor and improve your business credit score. Below are some essential tools and resources to keep your business credit in check.

Credit Monitoring Services

Credit monitoring services are crucial for keeping an eye on your business credit score. These services provide real-time updates and alerts about any changes to your credit report. They help you detect fraudulent activities and ensure your credit information is accurate.

- Experian Business Credit Advantage: Offers detailed credit reports and alerts.

- Dun & Bradstreet CreditMonitor: Provides credit score insights and alerts.

- Equifax Business Credit Monitoring: Delivers comprehensive credit reports and notifications.

Financial Management Software

Financial management software can also play a significant role in monitoring and improving your business credit score. These tools help you manage your finances efficiently, ensuring timely payments and accurate financial records.

| Software | Features |

|---|---|

| Flex Banking & Treasury Products |

|

Flex Banking & Treasury Products is a comprehensive platform designed to simplify financial tasks. It consolidates various back-office functions into one seamless, easy-to-use platform, providing increased cash flow and enhanced security.

Consulting With Credit Professionals

Consulting with credit professionals can offer personalized advice and strategies to improve your business credit score. These experts can help you understand your credit report, identify areas for improvement, and develop a plan to boost your credit score.

- Credit Counseling Services: Provide guidance on managing credit and improving scores.

- Financial Advisors: Offer comprehensive financial planning and credit management.

- Business Consultants: Specialize in business credit and financial health.

Engaging with credit professionals ensures you receive expert advice tailored to your business needs, helping you maintain a robust credit score.

Common Mistakes To Avoid

Improving your business credit score is essential for financial health. Avoiding common mistakes can make a significant difference. Here are some pitfalls to watch out for:

Ignoring Your Business Credit Score

Many business owners overlook their credit scores. Your business credit score impacts loan approvals, interest rates, and vendor terms. Regularly check your score to spot issues early. Use services like Flex to manage your finances efficiently, ensuring your score remains high.

Mixing Personal And Business Finances

Separating business and personal finances is crucial. Mixing the two can harm your credit score. Use different accounts and credit cards for business expenses. Flex offers Team Cards to help manage business expenses separately.

| Personal Finances | Business Finances |

|---|---|

| Personal Credit Card | Business Credit Card |

| Personal Bank Account | Business Bank Account |

Overextending Credit Lines

Using too much credit can lower your score. Keep credit utilization low, ideally below 30%. Flex offers credit limits that grow with your business, helping you manage credit efficiently.

- Maintain a low balance on credit cards.

- Pay off debts quickly.

- Avoid applying for multiple credit lines at once.

By avoiding these common mistakes, you can maintain a healthy business credit score. Flex provides tools like expense management and digital receipt capture to support your financial health.

Pros And Cons Of Focusing On Business Credit Score Improvement

Improving your business credit score can be a strategic move for any company. A higher score can lead to better financing options, lower interest rates, and improved supplier terms. However, focusing too much on credit score improvement has its challenges and potential downsides. Let’s explore both the benefits and challenges associated with this focus.

Benefits Of A High Business Credit Score

A high business credit score can bring several advantages:

- Better Financing Options: Lenders are more likely to offer loans with favorable terms.

- Lower Interest Rates: High credit scores can qualify your business for lower interest rates, saving money over time.

- Improved Supplier Terms: Suppliers may offer better payment terms, enhancing cash flow management.

- Increased Credibility: A high credit score reflects financial stability, attracting potential investors and partners.

- Higher Credit Limits: Businesses with high scores often receive higher credit limits, aiding in growth and expansion.

Challenges And Potential Downsides

While the benefits are substantial, focusing on improving your business credit score can come with challenges:

- Time-Consuming: Monitoring and improving your credit score requires consistent effort and attention.

- Costly: Sometimes, improving credit scores can involve costs, such as paying off existing debt or investing in financial management tools.

- Short-Term Distractions: Focusing too much on credit scores might divert attention from other crucial business operations.

- Potential for Overborrowing: Higher credit limits can tempt businesses to take on more debt than they can handle.

Understanding both the benefits and the challenges can help in making an informed decision about how much focus to place on improving your business credit score.

Ideal Scenarios And Recommendations

Improving your business credit score can open many doors. It helps secure better financing terms, establish credibility, and manage expenses effectively. Here’s a detailed look into ideal scenarios and expert recommendations for different business types.

Start-ups Vs. Established Businesses

Start-ups often face challenges in securing financing. Establishing a good credit score early can be crucial. Start with a Flex Credit Card. It offers 0% interest for 60 days and credit limits that grow with your business.

Established businesses usually have more financial history. Focus on consolidating various back-office functions into a seamless platform. Flex Banking & Treasury Products can be useful. It simplifies banking, payments, and expense management.

Industries That Benefit Most From High Credit Scores

Certain industries benefit more from high credit scores. Retail businesses need substantial inventory financing. A higher credit score can secure better terms.

Manufacturing sectors also benefit. They often need significant capital for machinery and raw materials. Flex’s financial platform can help manage these expenses efficiently.

Service-based industries, like consulting and IT, can leverage good credit to invest in technology and talent. Flex offers streamlined digital receipt capture and free ACH/wire payments, enhancing financial management.

Long-term Vs. Short-term Credit Strategies

Long-term strategies focus on building a solid credit history. Use Flex’s net-60 credit card to manage cash flow. Pay off balances within the 60-day grace period to avoid interest.

Short-term strategies aim for immediate financial needs. Flex’s high APY on cash on hand can boost cash flow quickly. Also, issuing new team cards can manage short-term expenses effectively.

Both strategies benefit from Flex’s enhanced security features. Proactive protection, robust encryption, and automated fraud monitoring ensure your financial data remains safe.

Benefits Of Using Flex Banking & Treasury Products

| Feature | Benefit |

|---|---|

| Banking | Simplified banking, payments, and expense management |

| Payments | Free ACH/wire payments |

| Receipt Capture | Streamlined digital receipt capture |

| Team Cards | Issue new team cards |

| APY | Earn up to 2.99% APY on cash on hand |

| Credit Card | 0% interest for 60 days, credit limits grow with your business |

| Expense Management | Effortlessly manage all expenses |

| Security | Proactive protection, robust encryption, Multi-Factor Authentication (MFA) |

Flex offers a single platform that consolidates various financial functions. This makes it easier to manage and grow your business efficiently.

Frequently Asked Questions

How Can I Improve My Business Credit Score?

Improving your business credit score involves paying bills on time, reducing debt, and monitoring your credit report regularly. Maintaining a healthy credit utilization ratio and ensuring accurate information on your credit report are also essential steps.

Why Is A Good Business Credit Score Important?

A good business credit score is important because it helps secure better financing options, lower interest rates, and favorable terms from suppliers. It also enhances your business’s reputation and credibility.

What Factors Affect My Business Credit Score?

Several factors affect your business credit score, including payment history, credit utilization, length of credit history, and public records. Consistency in managing these factors positively influences your score.

How Often Should I Check My Business Credit Report?

You should check your business credit report at least once a year. Regular monitoring helps identify inaccuracies and detect potential fraud early, ensuring your credit score remains accurate.

Conclusion

Improving your business credit score is crucial. It opens doors to better opportunities. Regularly check your credit reports. Pay bills on time. Reduce debt. Consider using tools like Flex Banking & Treasury Products. They offer simplified banking and flexible credit terms. Flex can help you manage expenses and improve cash flow. Learn more about their features here. Taking these steps can boost your business credit score, leading to growth and stability. Act now for a stronger financial future.