Business Financing Options: Unlock Your Path to Success

Navigating the world of business financing can be overwhelming. With so many options available, it’s crucial to understand which one best fits your needs.

Securing the right financing is essential for any business looking to grow or maintain stability. Whether you’re a startup or an established company, having access to funds can make a significant difference. This blog post will introduce you to various business financing options, helping you make informed decisions. Understanding these options can provide a roadmap to financial success. From traditional loans to modern financial platforms like Flex, each option has its unique benefits. By the end of this post, you will have a clearer picture of the financing landscape, enabling you to choose the right path for your business. Learn more about Flex, a comprehensive financial platform designed to streamline your business finances.

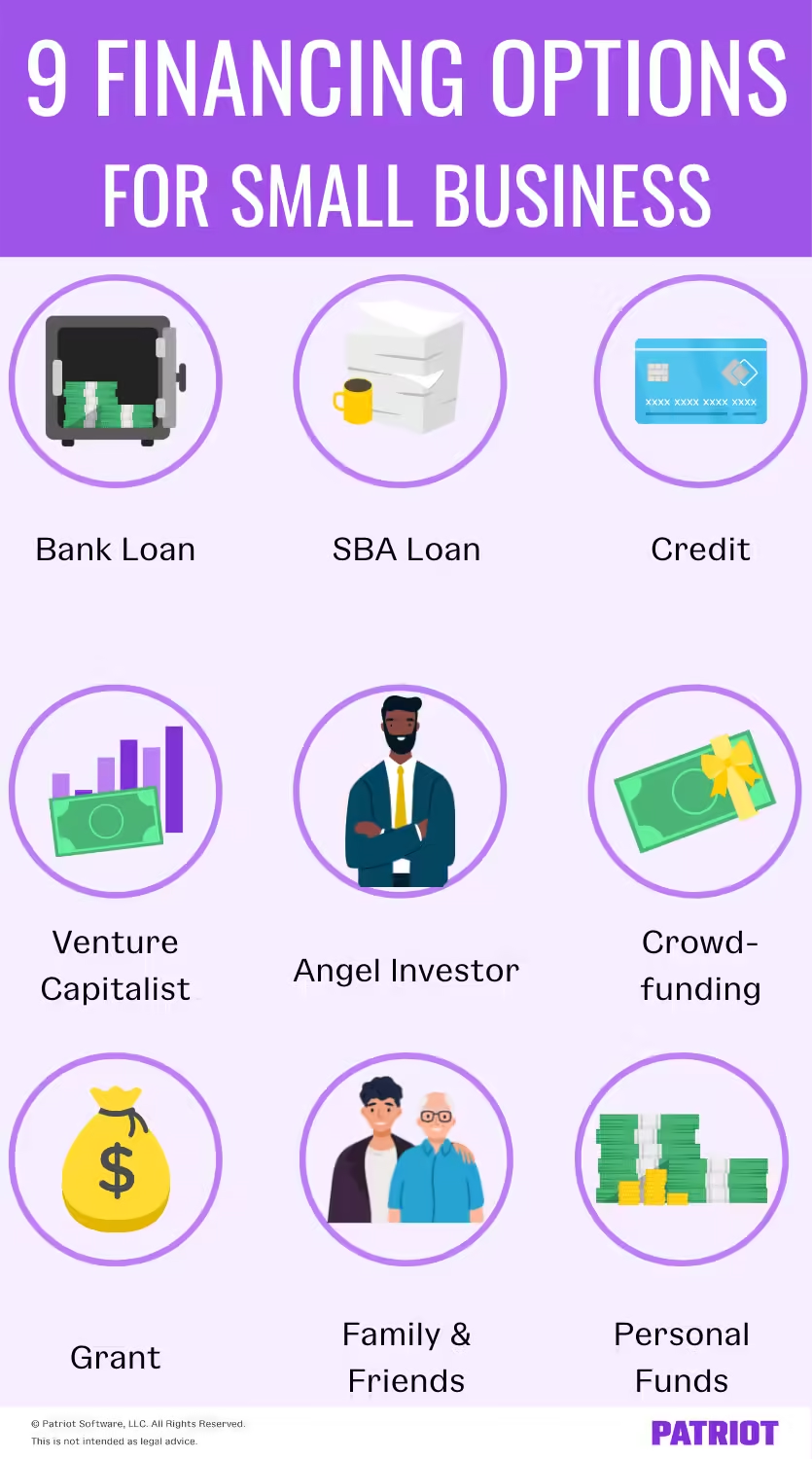

Introduction To Business Financing Options

Understanding the different business financing options is crucial for any entrepreneur. Proper financing ensures the growth and sustainability of your business. In this section, we will explore what business financing is and why it is important for your business growth.

What Is Business Financing?

Business financing involves acquiring funds to start, run, or expand a business. These funds can come from various sources including loans, credit cards, or investors. The goal is to ensure that your business has the financial resources to operate smoothly and grow over time.

For instance, the Flex Financial Platform offers comprehensive solutions like Flex Banking and Flex Credit Card to streamline financial management. Businesses can benefit from features such as:

- Streamlined receipt capture

- Issuance of new team cards

- Free ACH/wire payments

- Up to 2.99% APY on cash balances

- Net-60 on all purchases with 0% interest if paid within 60 days

The Importance Of Financing For Business Growth

Financing is the lifeblood of any business. It allows companies to invest in new projects, purchase inventory, hire staff, and ultimately grow. Without adequate financing, businesses may struggle to scale and compete in the market.

Consider the Flex Credit Card as an example. It provides:

- 0% interest for 60 days if the balance is paid within the grace period

- Credit limits that grow with your business

- Individual employee cards at no extra cost

These features help businesses manage cash flow more effectively and invest in growth opportunities.

Furthermore, security is a top priority. The Flex Financial Platform includes:

- Proactive protection against phishing attempts

- Robust encryption protocols

- Multi-Factor Authentication (MFA)

- Automated fraud monitoring

- FDIC insurance up to $3M through Thread Bank

- Additional coverage up to $75M through ADM

These security features ensure that your financial data remains safe, allowing you to focus on growing your business with peace of mind.

Traditional Financing Options

Traditional financing options remain popular for businesses. They provide reliable sources of funds to support growth. Explore the different types available to find the best fit for your business needs.

Bank Loans: How They Work And Their Benefits

Bank loans are a common choice for many businesses. They offer large amounts of capital with fixed repayment terms.

- Submit an application to a bank.

- The bank evaluates your creditworthiness.

- If approved, you receive a lump sum.

- Repay the loan with interest over a set period.

- Large loan amounts: Suitable for significant investments.

- Fixed interest rates: Predictable monthly payments.

- Long repayment terms: Manageable financial planning.

Lines Of Credit: Flexibility For Your Business Needs

Lines of credit offer flexibility for managing cash flow. You borrow as needed and pay interest only on the amount used.

- Apply for a line of credit with a lender.

- If approved, you get a credit limit.

- Draw funds up to the credit limit.

- Repay what you use, with interest.

- Flexible borrowing: Use funds as needed.

- Interest on used amount: Save on interest costs.

- Revolving credit: Reuse the credit line after repayment.

Sba Loans: Government-backed Security

SBA loans are backed by the government. They help small businesses obtain financing with favorable terms.

- Apply for an SBA loan through a participating lender.

- The SBA guarantees a portion of the loan.

- Receive funds upon approval.

- Repay the loan with interest over time.

- Lower down payments: Easier access to funds.

- Competitive interest rates: Reduce borrowing costs.

- Extended repayment terms: Improve cash flow management.

Alternative Financing Solutions

Businesses need flexible financing options for growth. Traditional loans can be restrictive. Alternative financing solutions offer different ways to secure funds. These methods can be quicker and more adaptable. Let’s explore some popular options.

Crowdfunding: Engaging The Public For Funds

Crowdfunding involves raising money from a large number of people. This method uses online platforms. Popular sites include Kickstarter and Indiegogo. Businesses pitch their ideas to the public. Supporters can contribute small amounts of money. This can add up to a significant sum.

Benefits of Crowdfunding:

- Access to a wide audience

- No need to repay funds

- Builds community and customer base

Challenges of Crowdfunding:

- Can be time-consuming

- Requires strong marketing efforts

- Success is not guaranteed

Invoice Financing: Unlocking Cash Flow

Invoice financing allows businesses to borrow money against their unpaid invoices. This helps improve cash flow. Companies don’t have to wait for clients to pay. Instead, they get immediate access to funds.

How Invoice Financing Works:

- Business sells invoices to a financing company.

- Financing company advances a percentage of the invoice value.

- Clients pay the invoice to the financing company.

- Financing company deducts fees and sends the remaining balance.

Benefits of Invoice Financing:

- Quick access to cash

- Improves cash flow

- Reduces credit risk

Merchant Cash Advances: Quick Access To Funds

Merchant cash advances provide businesses with a lump sum of money. In return, businesses agree to repay a percentage of their daily credit card sales. This option offers quick access to funds.

How Merchant Cash Advances Work:

- Business receives a lump sum from the lender.

- Repayment is made through daily credit card sales.

- Repayment continues until the advance is paid off.

Benefits of Merchant Cash Advances:

- Fast approval process

- No collateral needed

- Flexible repayment based on sales

Challenges of Merchant Cash Advances:

- Higher costs compared to traditional loans

- Can impact daily cash flow

- Repayment can be expensive

Equity Financing

Equity financing involves raising capital through the sale of shares in a business. This method helps businesses grow without incurring debt. It also brings in new stakeholders who contribute valuable expertise and connections.

Angel Investors: Early-stage Funding

Angel investors provide capital for startups in exchange for ownership equity. They are often individuals with substantial wealth looking for high-potential opportunities.

- Provide seed money to help businesses get off the ground

- Typically invest their own funds

- Can offer valuable mentorship and advice

Angel investors are ideal for early-stage companies that need initial funding. They often take an active role in guiding the business towards growth.

Venture Capital: High-growth Potential

Venture capital (VC) firms invest in startups with high growth potential. These firms usually manage pooled funds from multiple investors.

| Key Features | Details |

|---|---|

| Funding Amount | Can range from thousands to millions of dollars |

| Investment Stages | Series A, B, C, etc. |

| Equity Stake | Typically a significant percentage of the company |

Venture capital firms look for businesses with the potential for substantial returns. They often provide not just funds but also strategic guidance and resources.

Private Equity: Leveraging Strategic Investments

Private equity (PE) firms invest in more mature companies. They often aim to optimize operations and increase profitability before selling the business or taking it public.

- Invest in established companies

- Focus on long-term value creation

- Often involve large capital investments

Private equity investments can bring significant growth and operational improvements. These firms typically seek to enhance the company’s value through various strategies before exiting the investment.

Comparing Financing Options

Choosing the right business financing option can be daunting. Each option has its own set of terms and conditions. To help you make an informed decision, we will compare various financing options based on cost, approval processes, and repayment terms.

Cost And Interest Rates: What To Expect

Understanding the cost and interest rates of different financing options is crucial. Here’s a comparison:

| Financing Option | Interest Rate | Additional Fees |

|---|---|---|

| Bank Loan | 5% – 10% | Origination fees, late fees |

| Credit Card (Flex) | 0% for 60 days | Interest starts accruing after 60 days |

| Line of Credit | 8% – 14% | Maintenance fees, draw fees |

Flex Credit Card offers a competitive 0% interest rate for the first 60 days, provided the balance is paid within the grace period. This can be a cost-effective option for short-term financing needs.

Approval Processes: Speed And Requirements

Approval speed and requirements vary significantly among financing options. Here’s an overview:

- Bank Loan: Typically requires a detailed business plan, good credit score, and collateral. Approval can take several weeks.

- Flex Credit Card: Requires basic business information. Approval is usually fast, making it ideal for quick access to funds.

- Line of Credit: Generally requires a good credit score and financial statements. Approval times can range from a few days to a few weeks.

The Flex Credit Card stands out for its quick approval process, making it a great option for businesses needing rapid access to capital.

Repayment Terms: Short-term Vs Long-term

Repayment terms are a key consideration when choosing a financing option. Here’s how different options compare:

- Bank Loan: Typically long-term, with repayment periods ranging from 3 to 10 years. Suitable for large, long-term investments.

- Flex Credit Card: Offers a short-term financing solution with a net-60 repayment term. If the balance is paid within the grace period, it remains interest-free.

- Line of Credit: Provides flexibility with both short-term and long-term repayment options. Businesses can draw and repay funds as needed.

Flex Credit Card offers the advantage of short-term, interest-free financing, provided the balance is paid within 60 days. This can help maintain cash flow without incurring additional costs.

By comparing these key aspects, businesses can better understand which financing option aligns with their needs. The Flex Financial Platform provides a versatile and cost-effective solution for managing business finances, combining the benefits of simplified banking, flexible credit terms, and robust security features.

Pros And Cons Of Different Financing Options

Choosing the right financing option for your business is crucial. Each option has its own set of advantages and disadvantages. Understanding these can help you make an informed decision that aligns with your business goals.

Traditional Financing: Stability Vs Rigidity

Traditional financing, such as bank loans, offers stability. Banks provide predictable terms, fixed interest rates, and structured repayment plans. These features can be beneficial for planning and budgeting.

However, traditional financing can be rigid. The application process is often lengthy and requires extensive documentation. Approval rates are lower, especially for small businesses or startups. This rigidity can limit flexibility and delay access to funds.

| Pros | Cons |

|---|---|

| Stable and predictable terms | Lengthy application process |

| Fixed interest rates | Extensive documentation required |

| Structured repayment plans | Lower approval rates for small businesses |

Alternative Financing: Innovation Vs Risk

Alternative financing includes options like online lenders, crowdfunding, and invoice factoring. These options often provide faster access to funds and require less stringent documentation.

Innovative solutions like the Flex Financial Platform offer features like Net-60 credit terms and 0% interest for 60 days if the balance is paid within the grace period. This can improve cash flow and provide flexibility in managing expenses.

Despite the benefits, alternative financing carries higher risks. Interest rates and fees can be higher, and terms may be less predictable. Businesses must carefully assess the risks before opting for these solutions.

| Pros | Cons |

|---|---|

| Faster access to funds | Higher interest rates |

| Less documentation required | Less predictable terms |

| Flexible features (e.g., Net-60 terms) | Higher fees |

Equity Financing: Growth Potential Vs Ownership Dilution

Equity financing involves selling shares of your business to investors. This option can provide significant capital for growth without the need for repayment. It is ideal for startups and businesses looking to scale rapidly.

However, equity financing comes with the drawback of ownership dilution. Selling shares means giving up a portion of your business. This can lead to reduced control over business decisions. Investors may also expect a high return on their investment, which can add pressure to achieve quick growth.

| Pros | Cons |

|---|---|

| Significant capital for growth | Ownership dilution |

| No repayment required | Reduced control over business decisions |

| Ideal for scaling rapidly | High return expectations from investors |

Specific Recommendations For Different Business Needs

Every business has unique financial needs. Understanding these needs helps in choosing the right financing options. Here are specific recommendations based on different business stages and requirements.

Startups: Finding The Right Seed Funding

Startups often require seed funding to get off the ground. Seed funding can come from various sources:

- Angel Investors: Provide early-stage capital in exchange for equity.

- Venture Capitalists: Offer larger sums but expect higher returns and control.

- Crowdfunding: Raises small amounts from many people, typically via online platforms.

- Grants: Free money that does not need to be repaid, often from government or private entities.

Using a product like the Flex Financial Platform can simplify financial management. It allows startups to manage expenses and payments efficiently. Plus, the Flex Credit Card offers net-60 terms and 0% interest for 60 days, easing initial cash flow challenges.

Small Businesses: Balancing Flexibility And Cost

Small businesses need to balance flexibility and cost. Here are some financing options:

- Business Lines of Credit: Provides flexible access to funds as needed.

- Term Loans: Fixed amounts with fixed repayment schedules, suitable for specific projects.

- SBA Loans: Government-backed loans with favorable terms for small businesses.

- Merchant Cash Advances: Advances against future sales, providing quick access to cash.

Flex Banking can help small businesses streamline their financial operations. Features like free ACH/wire payments and up to 2.99% APY on cash balances can enhance cash flow management. The Flex Credit Card also supports growth with high credit limits and individual employee cards.

Expanding Enterprises: Strategic Growth Financing

Expanding enterprises require strategic financing to support growth. Consider these options:

- Equity Financing: Selling shares of the company to raise capital.

- Mezzanine Financing: Combines debt and equity financing, suitable for large expansion projects.

- Asset-Based Loans: Loans secured by company assets like inventory or receivables.

- Corporate Bonds: Issuing bonds to investors to raise large sums of money.

The Flex Financial Platform offers robust financial management tools. Expanding enterprises can benefit from Flex’s security features and high credit limits. This platform ensures seamless financial operations, providing the necessary support for strategic growth.

Conclusion: Choosing The Best Financing Path For Your Business

Deciding on the right financing option can significantly impact your business growth. This section will guide you through assessing your needs and making an informed decision.

Assessing Your Business Needs

Before choosing a financing option, evaluate your business requirements. Consider factors like cash flow, growth projections, and operational costs. Identify the specific areas needing funding, such as inventory, equipment, or expansion.

Flex Financial Platform, for example, offers a range of features to help manage these needs. Its simplified banking, payments, and expense management system can streamline financial operations. Additionally, Flex Credit Card provides a 60-day interest-free period, which can improve cash flow.

Making An Informed Decision

Once you understand your business needs, compare the available financing options. Look for flexibility, interest rates, and repayment terms. Flex Financial Platform stands out with its Net-60 on all purchases and 0% interest for 60 days if the balance is paid within the grace period.

Security is another crucial factor. Flex offers robust encryption, multi-factor authentication, and FDIC insurance up to $3M through Thread Bank. These features ensure your financial data remains secure.

To sum up, consider both your business needs and the features of the financing option. Flex Financial Platform, with its comprehensive solutions, can be a strategic choice to accelerate your business growth.

| Feature | Flex Financial Platform |

|---|---|

| Interest-Free Period | 60 days |

| APY on Cash | Up to 2.99% |

| Security | Encryption, MFA, FDIC insurance |

| Employee Cards | No extra cost |

Frequently Asked Questions

What Are Common Business Financing Options?

Businesses can use loans, lines of credit, and grants. Each option has different requirements and benefits. Research to find the best fit.

How Do Business Loans Work?

Business loans provide a lump sum of money. You repay with interest over a fixed term. They often require collateral.

What Is A Business Line Of Credit?

A business line of credit offers flexible borrowing. You access funds as needed and pay interest on the amount used.

Can Startups Get Business Financing?

Yes, startups can get financing through venture capital, angel investors, or small business loans. Research and prepare a solid business plan.

Conclusion

Choosing the right financing option is crucial for business success. Evaluate your needs. Consider options like loans, grants, and credit cards. Flex Financial Platform offers flexible solutions. It simplifies financial management and improves cash flow. Explore more about Flex here. Make informed decisions. Boost your business growth today.