Wallester Application Process: Simplified Steps for Success

Navigating the Wallester application process can be straightforward. Whether you’re a business seeking efficient expense management or looking to launch a branded card program, Wallester has you covered.

Wallester offers a range of solutions, including 300 free virtual business expense cards and white-label card issuing. Their products simplify corporate spending and provide robust security features. Instant issuance, real-time tracking, and comprehensive fraud monitoring are just a few of the benefits. Wallester also supports seamless integration with existing financial systems. The application process is designed to be user-friendly, ensuring businesses can quickly access these powerful tools. In this guide, we’ll walk you through the steps to get started with Wallester, ensuring a smooth and efficient application experience. For more details, visit Wallester’s website.

Introduction To Wallester Application Process

Wallester offers a streamlined application process for businesses seeking to manage corporate expenses efficiently. This section provides an overview of Wallester and the purpose of its application process.

What Is Wallester?

Wallester is a financial technology company offering a range of business expense cards. These cards are designed to simplify corporate spending management. Wallester provides both physical and virtual Visa-branded cards with 300 free virtual cards. The solution includes features like instant issuance, real-time expense tracking, and comprehensive fraud monitoring.

| Feature | Description |

|---|---|

| Instant Issuance | Cards are issued instantly upon approval. |

| Real-Time Tracking | Track expenses in real-time for better control. |

| Fraud Monitoring | Continuous monitoring to prevent fraudulent activities. |

| 3D Secure Protection | Enhanced security for online payments. |

| Open API | Seamless integration with existing financial systems. |

Purpose Of Wallester Application

The purpose of the Wallester application is to provide businesses with an efficient way to manage their corporate expenses. By using Wallester, companies can enhance control over employee spending and ensure compliance with financial regulations.

- Efficient Management: Simplifies the tracking and management of corporate expenses.

- Enhanced Control: Businesses can monitor and control employee spending.

- Seamless Integration: Integrates smoothly with existing financial systems.

- Improved Security: Comprehensive fraud protection and compliance with regulations.

- Customization: Features can be tailored to fit specific business needs.

The Wallester application process ensures a quick and smooth entry into the market for branded card programs. The service operates under strict financial regulations and provides high security and compliance standards.

Key Features Of Wallester Application

Wallester Application offers a range of features designed to simplify corporate spending and enhance financial management. Let’s delve into the key features that make Wallester stand out.

User-friendly Interface

The Wallester Application boasts a user-friendly interface that simplifies navigation. Users can easily access various functionalities without getting overwhelmed. The intuitive design ensures that even non-tech-savvy individuals can manage their business expenses efficiently.

- Simple and clean design

- Easy access to all features

- Seamless navigation

Comprehensive Application Tracking

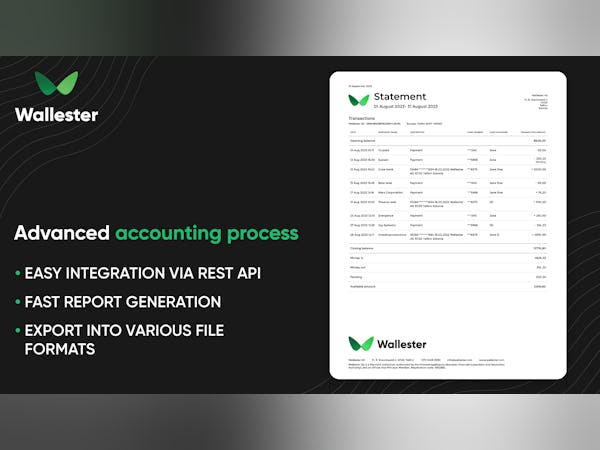

Wallester provides comprehensive application tracking, allowing users to monitor their expenses in real time. The tracking system is integrated with an open API for seamless integration with existing financial systems.

| Feature | Description |

|---|---|

| Real-Time Expense Tracking | Monitor expenses as they occur |

| Open API Integration | Integrate with existing financial systems |

| Instant Issuance | Issue virtual cards immediately |

Secure Data Handling

Security is a top priority for Wallester. The application uses 3D Secure protection for online payments, ensuring that all transactions are safe. Additionally, Wallester complies with KYC and AML regulations, providing a secure environment for users.

- 3D Secure Protection: Enhanced security for online payments.

- KYC and AML Compliance: Adherence to financial regulations.

- Card Tokenization: Secure digital wallet integration with Apple Pay and Google Pay.

- Continuous Fraud Monitoring: Real-time fraud detection and prevention.

Wallester Application’s focus on user-friendly design, comprehensive tracking, and secure data handling makes it a valuable tool for managing corporate expenses efficiently and securely.

Step-by-step Guide To Wallester Application

Applying for Wallester Business Expense Cards can seem daunting, but it doesn’t have to be. This step-by-step guide will walk you through the process, ensuring a smooth and efficient application experience. Let’s get started!

Creating An Account

Start by visiting the Wallester website. Click on the “Sign Up” button to begin creating your account. You will need to provide some basic information, including:

- Your full name

- Email address

- Phone number

Once you have entered this information, create a strong password to secure your account. After submitting these details, you will receive a verification email. Click the link in the email to verify your account and proceed to the next step.

Filling Out Application Details

After verifying your account, log in to Wallester and navigate to the application form. Here, you will need to provide more detailed information about your business, such as:

- Company name

- Company address

- Tax Identification Number (TIN)

- Type of business

Ensure all information is accurate and up-to-date to avoid any delays in the application process.

Uploading Necessary Documents

Next, you will need to upload several documents to support your application. These may include:

- Proof of identity (passport or driver’s license)

- Proof of address (utility bill or bank statement)

- Company registration documents

Make sure the documents are clear and legible. Scan or take high-quality photos of each document before uploading them to the platform.

Review And Submission

Before submitting your application, review all the entered information and uploaded documents. Ensure everything is correct and complete. This step is crucial as any errors can delay the approval process. Once you are satisfied, click the “Submit” button to complete your application.

After submission, Wallester’s team will review your application. You will receive a notification once your application is approved or if any additional information is required.

By following these steps, you can efficiently apply for Wallester Business Expense Cards, streamlining your corporate spending management with ease.

Pricing And Affordability

Understanding the pricing and affordability of Wallester is crucial for any business considering their services. Wallester offers a range of solutions aimed at simplifying corporate expenses and launching branded card programs. Let’s dive into the cost and value aspects to help you make an informed decision.

Cost Of Using Wallester

Wallester’s business expense cards are designed to be cost-effective. The Wallester Business solution is free for users. This is possible due to earnings from partnerships with Visa and other entities.

Key features of these cards include:

- 300 free virtual cards

- Instant issuance

- Open API for integration

- Real-time expense tracking

There are no hidden fees, making it a transparent and affordable choice for businesses.

Available Subscription Plans

Wallester provides a White-Label solution, which allows businesses to launch their branded Visa card programs. The pricing for this service is not specified publicly. Businesses are advised to contact Wallester for tailored pricing information.

This solution includes:

- Instant issuance of branded Visa cards

- Real-time tracking and management

- Optional features like client portals and mobile wallets

Value For Money

Wallester ensures high value for money with their comprehensive features and benefits. Their services offer:

- Efficient management of corporate expenses

- Enhanced control over employee spending

- Seamless integration with existing financial systems

- Improved security and compliance with financial regulations

- Customizable options to fit specific business needs

Given these benefits, Wallester’s solutions are designed to provide significant value without compromising on quality or security.

Pros And Cons Of Wallester Application

Understanding the pros and cons of the Wallester application is crucial for making an informed decision. This section delves into the advantages and potential drawbacks of using Wallester for business expense management and white-label card issuance.

Advantages Of Using Wallester

The Wallester application offers numerous advantages for businesses:

- 300 free virtual cards: Simplifies corporate spending management.

- Instant issuance: Quick and easy setup of physical and virtual Visa cards.

- Open API: Seamless integration with existing financial systems.

- Real-time expense tracking: Keeps spending transparent and under control.

- Comprehensive fraud monitoring: Ensures high security.

- 3D Secure protection: Provides additional security for online payments.

- Compliance with KYC and AML: Adheres to crucial financial regulations.

- Card tokenization: Enables use with digital wallets like Apple Pay and Google Pay.

- Customizable features: Tailored to fit specific business needs.

The Wallester Business Expense Cards and White-Label Card Issuing solutions offer comprehensive benefits designed to enhance financial management and security for businesses.

Potential Drawbacks

While the Wallester application has many benefits, there are some potential drawbacks to consider:

- No specific refund or return policies: May be a concern for some users.

- Pricing details: Not specified, requiring businesses to contact for tailored information.

- Limited availability: Services are available only in specific regions including the EEA, UK, Switzerland, Ireland, Australia, and the USA.

- Launch timeframe: White-Label programs take 4 to 8 weeks to launch, which might be lengthy for some businesses.

These points should be taken into account to ensure that Wallester aligns with your business needs and expectations.

For more detailed information, visit the Wallester website.

Who Should Use Wallester?

The Wallester Business Expense Cards cater to a diverse range of users. These cards are designed to streamline corporate spending management. Understanding who should use Wallester can help businesses make informed decisions.

Ideal Users

Wallester is perfect for organizations that need efficient expense management. Ideal users include:

- Small and Medium Enterprises (SMEs): Those looking to control and monitor employee spending.

- Large Corporations: Enterprises that need scalable solutions for their financial operations.

- Startups: New businesses requiring cost-effective financial tools without hidden fees.

- Freelancers and Consultants: Independent professionals managing multiple clients and projects.

Specific Scenarios For Best Use

Here are specific scenarios where Wallester shines:

| Scenario | Benefit |

|---|---|

| Travel and Entertainment Expenses | Real-time tracking ensures transparency and reduces fraud. |

| Online Purchases | 3D Secure protection and card tokenization for secure transactions. |

| Employee Reimbursements | Instant issuance of virtual cards for quick reimbursements. |

| Vendor Payments | Open API integration for seamless financial management. |

| Custom Business Needs | Customizable solutions to fit specific business requirements. |

Frequently Asked Questions

What Is The Wallester Application Process?

The Wallester application process involves submitting an online application form, providing necessary documents, and undergoing verification. Once approved, users receive their Wallester card and can start using it.

How Long Does Wallester Approval Take?

Wallester approval typically takes between 24 to 48 hours. The exact time can vary based on the completeness of your application and the documents submitted.

What Documents Are Needed For Wallester Application?

You need to provide identification documents, proof of address, and financial information. Ensure all documents are up-to-date and legible for a smooth verification process.

Can I Track My Wallester Application Status?

Yes, you can track your application status through the Wallester portal. Regular updates are provided to keep you informed about your application progress.

Conclusion

Navigating the Wallester application process is straightforward and user-friendly. Wallester Business Expense Cards offer significant benefits. They simplify corporate spending, enhance control, and ensure security. The availability of both physical and virtual cards adds flexibility. Want to streamline your business expenses? Check out Wallester for more information. Their solutions provide real-time tracking and seamless integration, ensuring efficient financial management. The open API and compliance with financial regulations offer peace of mind. Start managing your expenses better today.