Online Credit Card Application: Fast, Easy & Secure Approval

Applying for a credit card online is quick and convenient. It allows you to handle financial matters without visiting a bank.

In today’s digital age, online credit card applications are becoming the norm. They offer a seamless experience, allowing you to compare options and apply from the comfort of your home. Many providers, like Wallester, offer unique features to make the process even smoother. Wallester stands out with its business expense cards and white-label solutions. They provide various benefits, including 300 free virtual cards, easy management, and no hidden fees. Additionally, Wallester ensures security with compliance to financial regulations and continuous fraud monitoring. Ready to learn more about how to apply for a credit card online? Visit Wallester for detailed information and start your application today!

Introduction To Online Credit Card Applications

In today’s digital age, applying for a credit card online has become increasingly popular. It is a convenient, fast, and secure way to manage your personal finances. With just a few clicks, you can complete your application from the comfort of your home.

What Is An Online Credit Card Application?

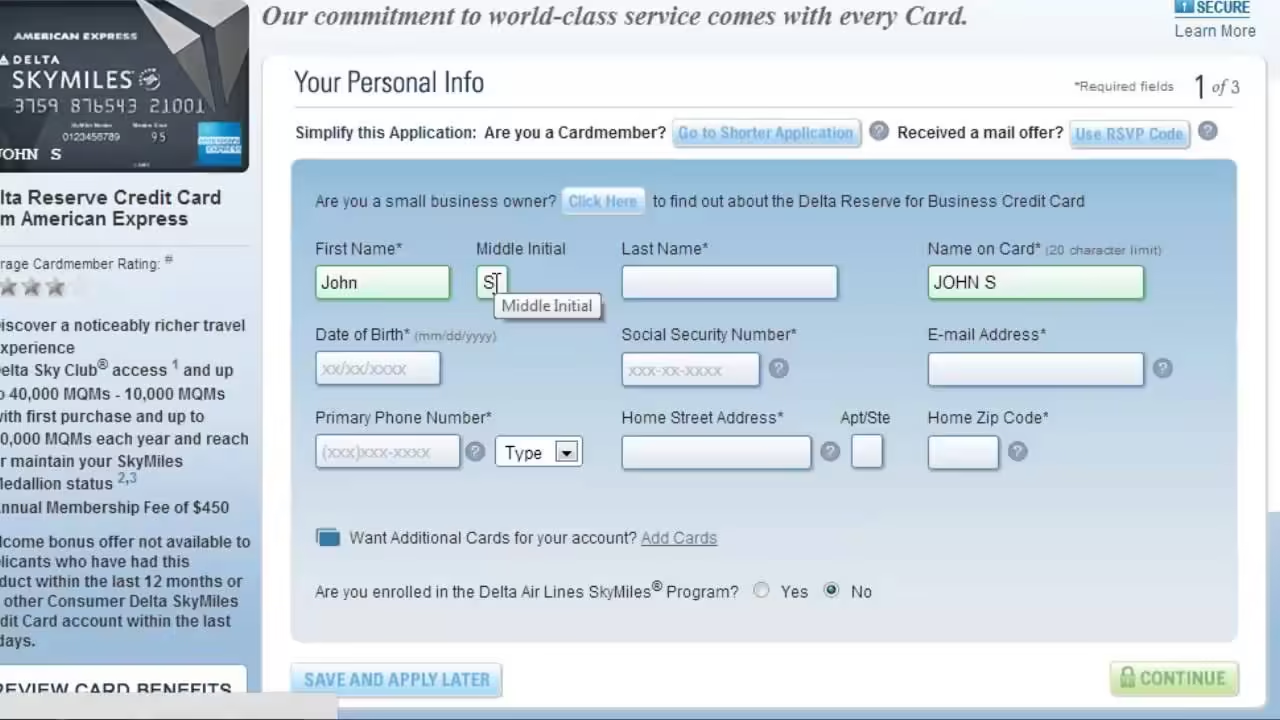

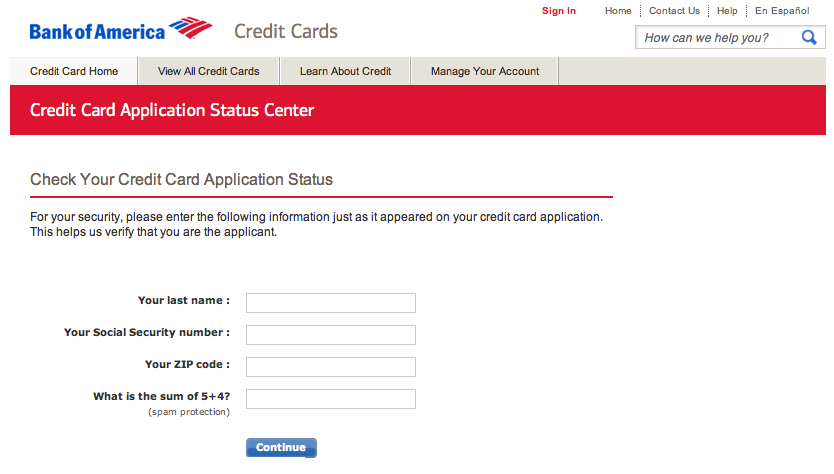

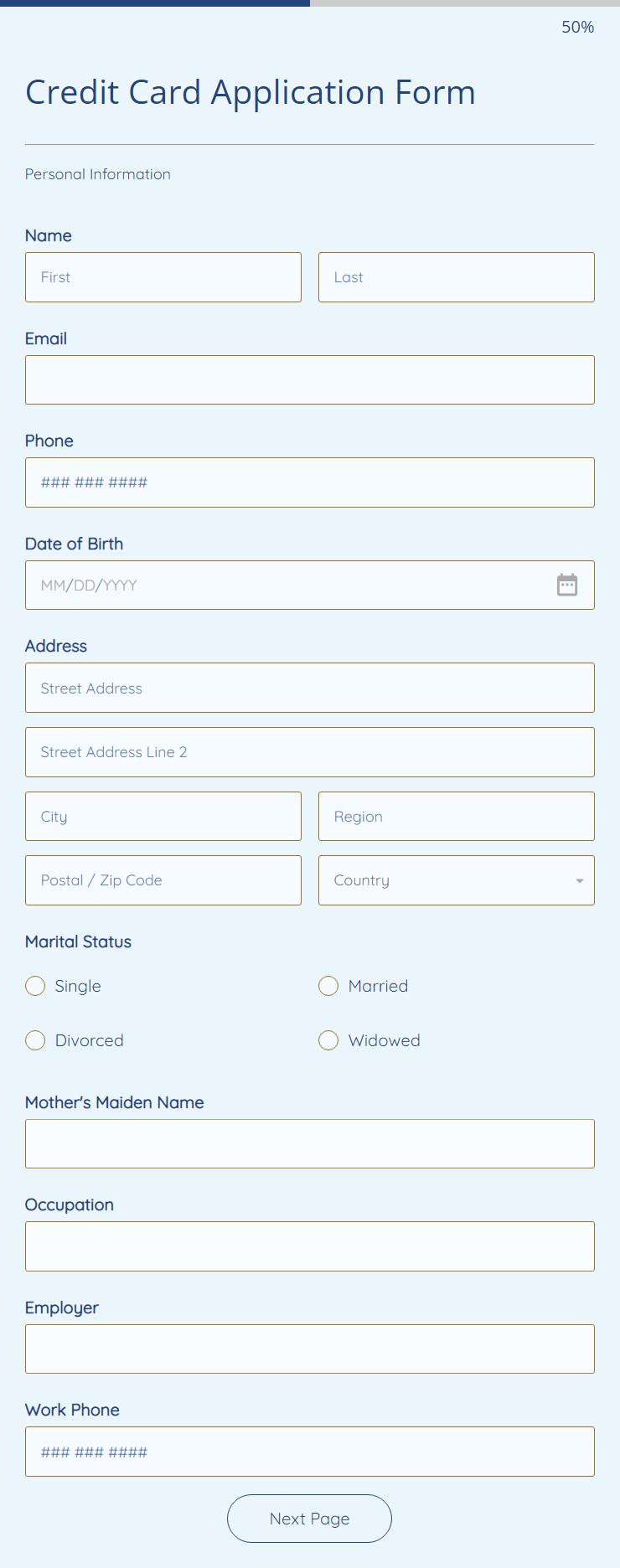

An online credit card application is a digital form that allows you to apply for a credit card through a website or mobile app. Instead of visiting a bank, you provide your information electronically.

This process typically involves entering personal details, financial information, and agreeing to terms and conditions. The application is then submitted online for review.

Why Choose Online Applications Over Traditional Methods?

There are several reasons to choose online applications over traditional methods:

- Convenience: Apply anytime, anywhere, without visiting a bank.

- Speed: Quick processing and often faster approval times.

- Security: Encrypted data transmission to protect your information.

- Comparison: Easily compare different credit card offers online.

Wallester offers a range of financial services focused on personal loans, credit solutions, and tailored financing options.

Main Features

| Feature | Description |

|---|---|

| Business Expense Cards | 300 free virtual cards, no hidden fees, easy corporate spending management |

| White-Label Card Issuing | Branded card program launch, instant issuance, open API, real-time tracking |

| Additional Features | Client Portal, White-Label Mobile Wallets, KYC and AML compliance, card tokenization, 3D Secure protection, Visa-branded cards, continuous fraud monitoring |

Benefits

- Security and Compliance: Operates under Estonia’s financial regulations, Visa Principal Member, PCI DSS compliance

- Efficiency: Free Wallester Business solution with no hidden fees

- User-Friendly Setup: Easy 3-step setup for Wallester Business

- Global Reach: Services in the EEA, UK, Switzerland, Ireland, Australia, and the USA

Pricing Details

Wallester Business Solution is lifetime free with no hidden fees.

Contact And Support

For more details, visit Wallester’s official website or contact their support.

Key Features Of Online Credit Card Applications

Online credit card applications offer several advantages that make the process more efficient and user-friendly. Understanding these key features can help you navigate through the application process smoothly. Here are the main aspects to consider:

Streamlined Application Process

Online credit card applications, like those offered by Wallester, provide a streamlined application process. This means you can complete your application quickly and easily without dealing with lengthy paperwork.

The process typically involves filling out an online form, submitting required documents, and receiving instant feedback on your application status. This reduces the time and effort needed to apply for a credit card.

Instant Approval Decisions

One of the standout features of online credit card applications is the ability to receive instant approval decisions. This feature allows applicants to find out if they are approved or not within minutes.

This is particularly beneficial for those who need a credit card urgently for personal or business expenses. Wallester ensures a fast approval process, enhancing user experience and satisfaction.

User-friendly Interface

An essential feature of online credit card applications is a user-friendly interface. A well-designed interface makes the application process intuitive and straightforward.

Wallester’s platform, for instance, offers an easy-to-navigate user interface that guides applicants through each step. This reduces the likelihood of errors and ensures a smooth application process.

Secure Data Handling

Security is a top priority in online credit card applications. Wallester employs secure data handling practices to protect user information.

This includes compliance with KYC and AML regulations, 3D Secure protection for online payments, and continuous fraud monitoring. These measures ensure that your personal and financial data remain safe throughout the application process.

Overall, online credit card applications offer a convenient, efficient, and secure way to apply for a credit card. Wallester’s solutions are designed to enhance user experience, making it easier for individuals and businesses to manage their financial needs.

Pricing And Affordability

Applying for a credit card online can be a convenient way to manage personal finances. Understanding the pricing and affordability of these cards is crucial. Wallester offers a range of financial services, including business expense cards and white-label card issuing solutions. Let’s break down the costs involved.

Interest Rates And Fees

Interest rates and fees play a significant role in the overall cost of a credit card. Wallester Business Solution offers a lifetime free service with no hidden fees, making it an attractive option for businesses looking to manage corporate spending.

- Interest Rates: Not specified for Wallester Business Solution.

- Fees: No hidden fees.

Traditional credit cards often come with various fees, including annual fees, late payment fees, and foreign transaction fees. Wallester’s transparent fee structure can help users save money.

Promotional Offers And Rewards

Promotional offers and rewards can add significant value to a credit card. Wallester provides several features that enhance the user experience:

- 300 free virtual cards.

- Easy corporate spending management.

- Instant card issuance.

- Real-time tracking and monitoring.

These features, combined with compliance with KYC and AML regulations, make Wallester a reliable choice for businesses.

Comparing Costs With Traditional Credit Cards

Comparing the costs of Wallester Business Solution with traditional credit cards can highlight the advantages:

| Feature | Wallester Business Solution | Traditional Credit Cards |

|---|---|---|

| Annual Fee | None | Varies (often $50-$150) |

| Interest Rates | Not specified | 15%-25% APR |

| Hidden Fees | None | Possible |

| Virtual Cards | 300 free | Not typically available |

Wallester’s cost-effective and transparent pricing makes it a compelling option for businesses. The absence of hidden fees and the availability of free virtual cards offer significant savings.

Pros And Cons Of Online Credit Card Applications

Applying for credit cards online has become increasingly popular. It offers convenience and speed, but it also comes with some potential drawbacks. Let’s explore the advantages and considerations.

Advantages Of Online Applications

- Convenience: Apply anytime, anywhere.

- Speed: Get faster approvals and instant decisions.

- Comparison: Easily compare different credit card offers.

- Paperless Process: No physical paperwork needed.

Online applications are convenient. You can apply from the comfort of your home. This saves time and effort. Speed is another big advantage. Online applications often get processed faster. You might even get an instant decision.

Comparing different credit card offers is easier online. You can quickly see the benefits and drawbacks of each card. This helps you make an informed choice. The process is also paperless. You don’t need to deal with physical paperwork, which is more eco-friendly and less of a hassle.

Potential Drawbacks And Considerations

- Security Concerns: Risk of online fraud and data breaches.

- Application Rejection: Higher chances without personal guidance.

- Information Overload: Too many options can be overwhelming.

- Technical Issues: Problems with website or submission errors.

There are some security concerns with online applications. There’s a risk of fraud and data breaches. Always ensure the website is secure before entering personal information.

Applications might get rejected more often online. This happens if you don’t meet specific criteria and there’s no personal guidance to help you through the process. Having too many options can be overwhelming. It’s sometimes hard to choose the best card for your needs.

Technical issues can also be a problem. Website glitches or submission errors can delay your application. Always double-check your information before submitting.

Wallester offers secure and efficient financial services. They provide business expense cards and white-label card issuing solutions. With features like real-time tracking and compliance with KYC and AML regulations, Wallester ensures a smooth and secure online application experience.

For more information, visit Wallester’s official website.

Ideal Users For Online Credit Card Applications

Applying for a credit card online offers a seamless and efficient experience. But who stands to benefit most from this method? Let’s explore the ideal users for online credit card applications. Understanding the best candidates can help you decide if this process is right for you.

Who Should Consider Online Applications?

Online credit card applications are perfect for tech-savvy individuals. If you are comfortable navigating websites and filling out forms, this method suits you. Busy professionals also find online applications convenient. You can apply anytime, anywhere, without visiting a bank.

Frequent travelers benefit too. If you travel often, you can apply for a card without being in your home country. Students looking for their first credit card find the online process straightforward and accessible. Lastly, individuals seeking quick approval will appreciate the faster processing times.

Scenarios Where Online Applications Excel

Several scenarios highlight the advantages of online applications. Immediate needs for a credit card make this method appealing. If you need a card quickly, online applications often provide faster approval times. Comparison shopping is easier online. You can compare various credit card offers side by side, ensuring you choose the best one.

Access to exclusive online-only offers is another benefit. Many issuers provide special deals for online applicants. Remote living situations also make online applications ideal. If you live far from a bank, applying online saves you travel time. Ease of document submission is a significant advantage. Uploading required documents online is more convenient than mailing or delivering them in person.

In summary, online credit card applications cater to a wide range of users and scenarios. From tech-savvy individuals to busy professionals, the convenience and speed of online applications make them an excellent choice for many.

Conclusion And Final Recommendations

Applying for a credit card online can be a quick and easy process. With the right information and tools, you can get the perfect card to suit your needs. Wallester offers a range of financial services that make the process even smoother.

Summary Of Benefits

- Security and Compliance: Wallester operates under Estonia’s financial regulations. It is also a Visa Principal Member and PCI DSS compliant.

- Efficiency: The Wallester Business solution is free for life with no hidden fees.

- User-Friendly Setup: Easy 3-step setup for Wallester Business, including account creation, card issuance, and real-time expense control.

- Global Reach: Services are available in the EEA, UK, Switzerland, Ireland, Australia, and the USA.

Final Thoughts On Online Credit Card Applications

With Wallester, you get a secure and efficient way to manage your financial needs. The free Wallester Business solution offers great value with no hidden fees. You can issue up to 300 free virtual cards, making corporate spending management easy.

The white-label card issuing solution allows you to launch a branded card program with instant issuance and real-time tracking. This can be a great option for businesses looking to offer financial services under their own brand.

Overall, Wallester provides a comprehensive solution for both personal and corporate clients. Whether you need business expense cards or white-label card issuing, Wallester has you covered.

| Feature | Details |

|---|---|

| Business Expense Cards | 300 free virtual cards, no hidden fees, easy corporate spending management |

| White-Label Card Issuing | Branded card program launch, instant issuance, open API, real-time tracking |

| Security and Compliance | KYC and AML regulations, 3D Secure protection, continuous fraud monitoring |

| User-Friendly Setup | Easy 3-step setup, real-time expense control, client portal |

For more information, visit the official website and explore the range of services offered by Wallester.

Frequently Asked Questions

How Do I Apply For A Credit Card Online?

To apply for a credit card online, visit the bank’s website. Complete the application form with your personal and financial details. Submit the form and wait for approval.

What Documents Are Needed For An Online Credit Card Application?

You typically need identification proof, income proof, and address proof. Common documents include a government-issued ID, recent pay stubs, and utility bills.

How Long Does Online Credit Card Approval Take?

Online credit card approval usually takes a few minutes to a few days. It depends on the bank’s verification process.

Is It Safe To Apply For A Credit Card Online?

Yes, it is safe to apply for a credit card online. Ensure you use a secure and reputable bank website to protect your personal information.

Conclusion

Applying for a credit card online has never been easier. Wallester offers reliable solutions for both personal and business needs. Their user-friendly setup and secure services make managing finances simple. Interested in learning more? Visit the Wallester website for detailed information on their offerings and benefits. Explore Wallester today and take control of your financial future.