Personalized Financial Solutions: Unlock Your Financial Freedom

Managing personal finances can be challenging. Everyone’s financial situation is unique.

Personalized financial solutions can help you achieve your financial goals more effectively. In today’s fast-paced world, traditional financial strategies often fall short. They don’t consider individual needs and circumstances. That’s where personalized financial solutions come in. These solutions tailor financial planning and management to your specific situation. Whether you are looking to manage expenses, invest wisely, or plan for retirement, personalized financial solutions can offer the guidance you need. By understanding your unique financial landscape, these solutions can provide targeted advice and tools, ensuring you make the best decisions for your financial future. Explore how Wallester can help you with tailored financial services here.

Introduction To Personalized Financial Solutions

In today’s fast-paced world, managing finances can be challenging. Personalized financial solutions offer tailored services to meet individual needs. These solutions help you achieve financial goals efficiently. Wallester Business Solutions stands out in this area. It provides unique financial services, including business expense cards and white-label card issuing. Let’s explore what personalized financial solutions are and their importance.

Understanding Personalized Financial Solutions

Personalized financial solutions are tailored to fit unique financial situations. They offer customized plans based on individual or business needs. Wallester Business Solutions exemplifies this with features like:

- Business Expense Cards: 300 free virtual cards with no hidden fees.

- White-Label Card Issuing: Instant issuance of branded cards.

- Open API: Seamless integration for real-time tracking.

These features ensure efficient management of corporate spending. They also allow businesses to launch branded card programs quickly.

Importance Of Financial Freedom

Financial freedom is the ability to manage and control your financial life. It means having enough savings and investments. It provides security and peace of mind. Wallester Business Solutions contributes to financial freedom by offering:

- Cost-Efficiency: Free business expense cards with no hidden fees.

- Security: Compliance with KYC and AML regulations.

- Convenience: Easy setup and real-time expense management.

These benefits help businesses save money and time. They ensure secure and efficient financial management.

| Feature | Benefit |

|---|---|

| Business Expense Cards | Free and manage spending efficiently |

| White-Label Card Issuing | Instant issuance, seamless integration, real-time tracking |

| Security | Compliance with KYC, AML regulations |

Wallester Business Solutions helps businesses achieve financial freedom. It offers tailored services that ensure efficiency and security.

Key Features Of Personalized Financial Solutions

Personalized financial solutions offer a tailored approach to managing your finances. These solutions address individual needs, helping you achieve your financial goals. Below are the key features of personalized financial solutions:

Comprehensive Financial Planning

Comprehensive financial planning provides a detailed roadmap for your financial journey. It includes an analysis of your income, expenses, assets, and liabilities. This planning ensures that you understand your current financial status and helps you to set realistic goals. A financial advisor can create a customized plan that aligns with your life objectives.

| Components | Description |

|---|---|

| Income Analysis | Review of all income sources |

| Expense Tracking | Monitoring daily, monthly, and yearly expenses |

| Asset Management | Evaluation of current assets |

| Liability Assessment | Understanding debts and obligations |

Tailored Investment Strategies

Tailored investment strategies match your risk tolerance and financial goals. These strategies diversify your investments, reducing risk and maximizing returns. Advisors consider factors like market trends, economic conditions, and your financial aspirations when crafting these strategies.

- Risk Assessment

- Diversification

- Market Trend Analysis

- Return Maximization

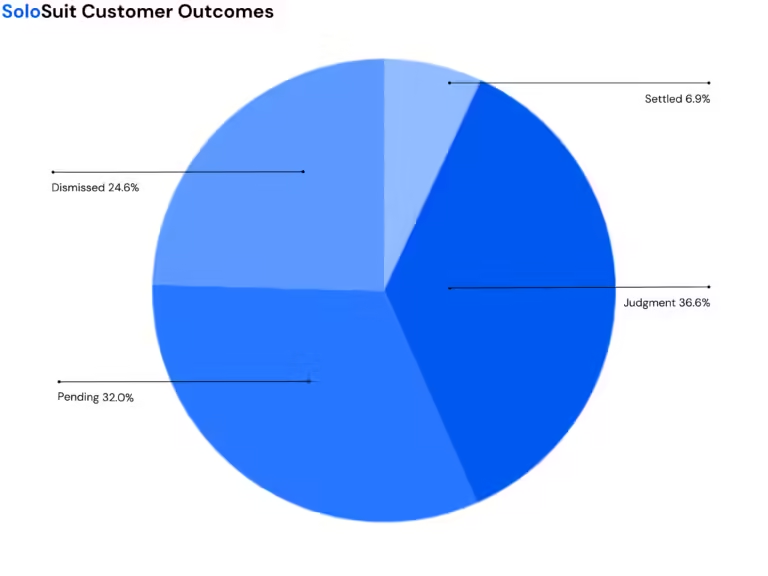

Debt Management And Reduction

Effective debt management and reduction plans help you control and reduce debt. These plans involve budgeting, consolidation, and strategic repayments. By prioritizing high-interest debts, you can save on interest and become debt-free faster.

- Budgeting

- Debt Consolidation

- Strategic Repayments

- Interest Savings

Retirement Planning

Retirement planning ensures you have sufficient funds for a comfortable retirement. It includes setting retirement goals, estimating future expenses, and creating savings plans. Advisors might suggest 401(k) plans, IRAs, or other retirement accounts to secure your future.

| Type | Description |

|---|---|

| 401(k) Plans | Employer-sponsored retirement savings plans |

| IRAs | Individual retirement accounts |

| Pension Plans | Defined benefit retirement plans |

Tax Optimization

Tax optimization strategies help minimize tax liabilities while maximizing savings. These strategies involve making informed decisions about investments, retirement accounts, and deductions. Advisors ensure you take advantage of all available tax benefits.

- Investment Choices

- Retirement Account Contributions

- Tax Deductions

- Credits and Exemptions

Pricing And Affordability Breakdown

Understanding the pricing and affordability of personalized financial solutions is crucial. This section will break down the costs involved, compare them with traditional financial services, and highlight the long-term benefits. Let’s dive into the details.

Cost Of Personalized Financial Services

Personalized financial services, like those offered by Wallester, focus on providing tailored solutions to meet individual or business needs. The cost structure is often more transparent and straightforward.

| Service | Cost |

|---|---|

| Business Expense Cards | Free (300 virtual cards) |

| White-Label Card Issuing | Free (Company earns from Visa partnerships) |

| Compliance & Security Features | Included |

Wallester offers free business expense cards with no hidden fees. The platform earns revenue through partnerships with Visa and others, making it a cost-efficient choice for businesses.

Comparing Costs With Traditional Financial Services

Traditional financial services often come with various fees and charges. These can include account maintenance fees, transaction fees, and hidden costs. Here’s a comparison:

| Service | Traditional Services | Wallester |

|---|---|---|

| Account Maintenance | $10 – $30/month | Free |

| Transaction Fees | $0.10 – $0.50/transaction | Free |

| Hidden Costs | Common | None |

Wallester stands out with its transparent pricing and lack of hidden costs. This can lead to significant savings over time.

Value For Money: Long-term Benefits

Investing in personalized financial solutions can offer substantial long-term benefits. These include cost-efficiency, convenience, and enhanced security.

- Cost-Efficiency: Free business expense cards save money.

- Convenience: Easy setup and real-time expense management.

- Security: Continuous fraud monitoring and compliance with financial regulations.

Using Wallester’s platform ensures efficient and secure financial management. This is ideal for businesses of all sizes and industries.

Pros And Cons Of Personalized Financial Solutions

Personalized financial solutions have become increasingly popular. They offer tailored approaches to managing finances. However, like any service, they come with both benefits and drawbacks. It’s essential to weigh these before making a decision.

Advantages Of Personalized Approaches

Tailored Strategies: Personalized financial solutions provide strategies that fit your specific needs. This ensures that your financial plans are aligned with your goals.

Efficiency: With tailored solutions, you can manage your finances more efficiently. For instance, Wallester Business Solutions offers 300 free virtual cards with no hidden fees, making corporate spending management seamless.

Customization: Personalized services like Wallester’s white-label card issuing allow businesses to launch branded card programs. This enhances brand recognition and customer loyalty.

Real-Time Tracking: With advanced features such as real-time tracking, you can monitor your financial activities instantly. This helps in making informed decisions.

Potential Drawbacks To Consider

Cost: While some services may be free, others can be expensive. It’s important to understand the pricing structure. Wallester, for example, offers free business expense cards but earns from partnerships.

Complexity: Personalized financial solutions can sometimes be complex to set up. They require a deep understanding of your financial landscape.

Dependency: Relying too much on personalized solutions may reduce your ability to manage finances independently. It’s crucial to balance personalization with self-sufficiency.

Balancing Personalization With Flexibility

Scalability: Choose solutions that can grow with your business. Wallester’s platform is suitable for various sizes and industries, ensuring scalability.

Compliance: Ensure that your personalized solutions comply with regulations. Wallester adheres to PCI DSS requirements and offers continuous fraud monitoring.

Convenience: Opt for services that offer ease of use. Wallester provides easy setup and real-time expense management, making it convenient for businesses.

Security: Security should be a top priority. Wallester’s compliance with KYC and AML regulations ensures high financial security standards.

By understanding the pros and cons of personalized financial solutions, you can make informed decisions. Choose solutions that offer the right balance between personalization and flexibility.

Specific Recommendations For Ideal Users

Understanding who can benefit the most from personalized financial solutions can help you determine if Wallester Business Solutions is the right fit for your needs. Below, we break down ideal users, scenarios where personalized solutions excel, and tips to maximize benefits.

Who Can Benefit The Most?

Small to Medium-Sized Enterprises (SMEs): These businesses often require efficient expense management. Wallester offers 300 free virtual cards with no hidden fees, making it cost-effective for SMEs.

Large Corporations: With the need for scalable solutions and real-time tracking, large corporations can manage vast corporate spending efficiently.

Startups: Quick setup and instant issuance of branded cards help startups manage finances without delays.

| User Type | Benefit |

|---|---|

| SMEs | Cost-effective and efficient expense management |

| Large Corporations | Scalable solutions with real-time tracking |

| Startups | Quick setup and instant card issuance |

Scenarios Where Personalized Solutions Shine

High Volume Transactions: If your business processes many transactions, Wallester’s real-time tracking and continuous fraud monitoring ensure security.

Global Operations: Businesses operating in multiple regions benefit from compliance with KYC and AML regulations, ensuring smooth operations across borders.

Branded Card Programs: Companies looking to enhance brand visibility can launch branded card programs seamlessly with Wallester’s white-label card issuing feature.

Tips For Maximizing The Benefits

- Utilize Free Virtual Cards: Make use of the 300 free virtual cards to manage expenses without additional costs.

- Integrate with Open API: Seamlessly integrate Wallester’s features into your existing systems using the open API.

- Monitor Real-Time Data: Take advantage of real-time tracking to keep an eye on expenses and prevent fraud.

- Leverage Digital Wallets: Use card tokenization for Apple Pay and Google Pay to simplify transactions.

By following these tips, businesses can maximize the benefits offered by Wallester’s personalized financial solutions, ensuring efficient and secure financial management.

Conclusion: Unlocking Your Financial Freedom

In this blog, we’ve explored the benefits of personalized financial solutions through Wallester. Now, let’s summarize the key points and guide you on how to start your journey towards financial freedom.

Recap Of Key Points

- Wallester Business Solutions offers customized financial services for corporate clients.

- Business Expense Cards: 300 free virtual cards with no hidden fees.

- White-Label Card Issuing: Instant issuance of branded cards with open API integration.

- Advanced Features: Real-time tracking, compliance with KYC/AML, and 3D Secure protection.

- Benefits: Cost-efficiency, customization, security, convenience, and scalability.

Steps To Get Started With Personalized Financial Solutions

- Visit the Wallester Website: Go to wallester.com to learn more.

- Sign Up: Create an account and top up your balance.

- Issue Cards: Set up virtual or physical cards for your business needs.

- Monitor Expenses: Use real-time tracking to manage corporate spending efficiently.

Final Thoughts On Achieving Financial Freedom

Unlocking financial freedom involves making informed decisions and utilizing the right tools. Wallester provides a platform designed to enhance financial management and security. By leveraging their services, you can efficiently manage corporate expenses and launch branded card programs with ease. Embrace these solutions to gain more control over your finances and achieve the financial freedom you desire.

Frequently Asked Questions

What Are Personalized Financial Solutions?

Personalized financial solutions are customized financial strategies tailored to individual needs. They consider your income, goals, risk tolerance, and preferences to create a unique plan.

How Can Personalized Financial Solutions Benefit Me?

Personalized financial solutions can help you achieve your financial goals efficiently. They offer tailored advice and strategies, maximizing your financial potential and minimizing risks.

Who Needs Personalized Financial Solutions?

Anyone looking to optimize their financial planning can benefit from personalized financial solutions. They are ideal for individuals with unique financial goals or complex financial situations.

Are Personalized Financial Solutions Expensive?

The cost of personalized financial solutions varies. Many financial advisors offer different pricing models to fit various budgets, making them accessible to a wide range of people.

Conclusion

Personalized financial solutions like Wallester can transform your business finance management. Their business expense cards offer efficient spending control. Launching branded card programs is simple with Wallester’s open API. Real-time tracking and fraud monitoring ensure security. These solutions fit businesses of any size. Discover how Wallester can streamline your financial operations by visiting their website.