Credit Card Consolidation: Simplify Your Debt and Save Money

Credit card debt can feel overwhelming. Credit card consolidation might be the solution.

Managing multiple credit card payments can be stressful. Credit card consolidation simplifies your financial life by combining all your credit card balances into one single payment. This helps you save on interest rates and can improve your credit score over time. It’s a strategy that offers not only ease of management but also potential financial relief. In this guide, we’ll explore what credit card consolidation involves, how it works, and its benefits. With the right approach, you can regain control of your finances and reduce the burden of debt. Ready to learn more about how to streamline your credit card payments? Let’s dive in! Discover how Wallester can help you manage corporate spending with ease. Visit their website here.

Introduction To Credit Card Consolidation

Credit card consolidation can help manage multiple debts. This process combines multiple credit card balances into one, simplifying payments and reducing interest rates.

What Is Credit Card Consolidation?

Credit card consolidation means combining several credit card debts into a single loan. This new loan typically has a lower interest rate. It simplifies the monthly payment process.

This can be done through various methods. Common options include balance transfer cards, personal loans, or home equity loans.

Purpose And Benefits Of Consolidation

The main purpose of credit card consolidation is to reduce financial stress. It helps you manage your debt more easily.

- Lower Interest Rates: Consolidation loans usually offer lower interest rates.

- Single Monthly Payment: One payment is easier to manage than several.

- Improved Credit Score: Timely payments can boost your credit score.

Consolidation offers multiple benefits. It simplifies your finances and can help you save money over time.

Key Features Of Credit Card Consolidation

Credit card consolidation combines multiple credit card debts into one manageable payment. This process offers several benefits that can ease your financial burden and help you regain control of your finances.

Lower Interest Rates

One of the primary features of credit card consolidation is the potential for lower interest rates. By consolidating your debt, you may qualify for a lower interest rate compared to the high rates typically associated with credit cards. This can save you a significant amount of money in the long run.

Single Monthly Payment

Managing multiple credit card payments can be overwhelming. Credit card consolidation simplifies this by combining all your debts into a single monthly payment. This makes it easier to keep track of due dates and ensures you never miss a payment, reducing the risk of additional fees and penalties.

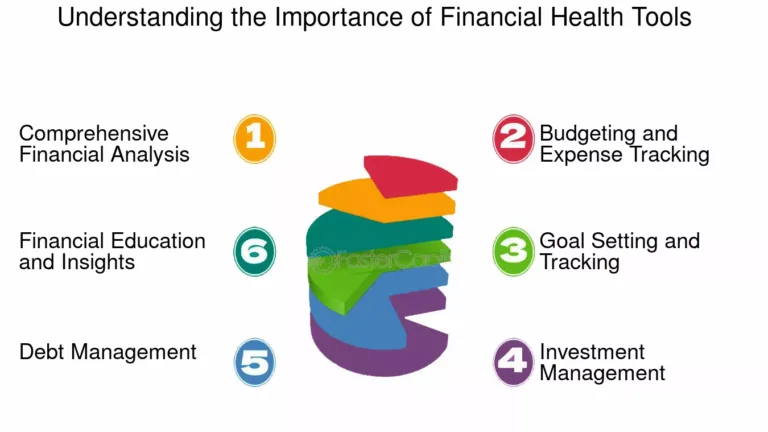

Debt Management Plans

Debt management plans offer structured ways to pay off your credit card debt. These plans often include financial counseling and personalized repayment schedules. This helps you stay on track and achieve your debt-free goals more efficiently.

How Credit Card Consolidation Works

Credit card consolidation is a strategy to manage multiple credit card debts. It merges them into a single, manageable payment. This process can reduce interest rates and simplify your finances.

Types Of Consolidation Methods

There are several methods to consolidate credit card debt. Here are the most common ones:

- Balance Transfer Credit Cards: Transfer your existing credit card balances to a new card with a lower interest rate.

- Debt Consolidation Loans: Take out a personal loan to pay off your credit card debts. This loan usually has a lower interest rate.

- Home Equity Loans: Use the equity in your home to secure a loan for paying off your credit card debts.

- Debt Management Plans: Work with a credit counseling agency to create a plan to repay your debts over time.

Steps To Consolidate Your Credit Card Debt

Follow these steps to consolidate your credit card debt:

- Assess Your Debt: Calculate the total amount of your credit card debt.

- Research Consolidation Options: Compare different consolidation methods to find the best fit for your situation.

- Check Your Credit Score: Ensure your credit score is in good standing to qualify for better rates.

- Apply for a Consolidation Method: Complete the application process for your chosen method.

- Pay Off Your Credit Cards: Use the consolidation funds to pay off your existing credit card debts.

- Make Regular Payments: Ensure you make timely payments on your new consolidation loan or credit card.

By consolidating your credit card debt, you can simplify your finances and potentially save money on interest. Consider your options carefully to choose the best method for your needs.

Pricing And Affordability Of Credit Card Consolidation

Credit card consolidation can help you manage debt. Understanding the pricing and affordability is crucial. Different methods come with varying costs and potential savings. Let’s break down these aspects for better clarity.

Cost Of Different Consolidation Methods

There are several methods for credit card consolidation. Each has its own costs:

- Balance Transfer Cards: These often come with a 0% introductory APR. However, they may have a transfer fee of 3-5%.

- Personal Loans: Interest rates vary based on your credit score. They range from 5% to 36% APR.

- Home Equity Loans: These loans use your home as collateral. Interest rates are usually lower than personal loans but involve significant risk.

- Debt Management Plans: These plans are usually free or have a small setup fee. Monthly fees may apply.

Choosing the right method depends on your financial situation. Always compare the costs before deciding.

Potential Savings And Financial Impact

Consolidating credit card debt can lead to significant savings. The potential savings depend on the method chosen and your current interest rates. Here’s how each method can impact your finances:

| Method | Potential Savings | Financial Impact |

|---|---|---|

| Balance Transfer Cards | Save on interest during the 0% APR period | Pay off debt faster with lower interest |

| Personal Loans | Lower interest rates than credit cards | Fixed monthly payments make budgeting easier |

| Home Equity Loans | Even lower interest rates | Risk of losing your home if payments are missed |

| Debt Management Plans | Reduced interest rates through negotiation | May impact your credit score initially |

Carefully evaluate the potential savings and financial impact. This will help you make an informed decision.

Pros And Cons Of Credit Card Consolidation

Credit card consolidation can be a useful strategy for managing debt. It involves combining multiple credit card balances into one, often with a lower interest rate. This approach offers many benefits but also comes with some risks. Let’s explore the advantages and potential drawbacks of credit card consolidation.

Advantages Of Consolidation

- Lower Interest Rates: Combining debts often results in a lower overall interest rate.

- Simplified Payments: Manage only one monthly payment instead of multiple.

- Improved Credit Score: Consistently making payments on time can boost your credit score.

- Reduced Stress: Fewer payments to track means less financial stress.

Potential Drawbacks And Risks

- Fees and Costs: Some consolidation loans come with fees that can add up.

- Longer Repayment Terms: Extending the repayment period can mean paying more in interest over time.

- Risk of Accruing More Debt: Without discipline, you might start using your credit cards again, increasing debt.

Ideal Users And Scenarios For Credit Card Consolidation

Credit card consolidation can be an effective financial strategy for many people. It simplifies debt management and can reduce interest rates. But, who are the ideal users? And in what scenarios does it work best? Let’s explore.

Who Should Consider Consolidation?

Individuals with multiple high-interest credit cards should consider credit card consolidation. It allows combining all debts into a single payment. This can lower the overall interest rate and make managing debt easier.

People struggling to make minimum payments each month can benefit too. Consolidation offers a way to reduce monthly payments by extending the repayment period. This makes it easier to stay on top of finances.

Credit card holders with good credit scores are ideal candidates. They can often qualify for lower interest rates on consolidation loans. This reduces the total amount paid over time.

Best Situations For Using Consolidation

There are specific scenarios where credit card consolidation can be particularly useful. Let’s look at some of them:

- High-Interest Debt: If you have multiple credit cards with high interest rates, consolidating can save money. It helps by securing a lower interest rate.

- Single Monthly Payment: Consolidation simplifies debt repayment. It combines multiple payments into one. This reduces the stress of managing several due dates.

- Improved Credit Score: Consistently making payments on a consolidation loan can improve your credit score. This can be a benefit for future financial needs.

- Temporary Financial Hardship: During times of financial struggle, reducing monthly payments through consolidation can be a relief. It helps keep your finances in order.

Wallester offers a range of financial products that can aid in managing business expenses and launching branded Visa cards. Their solutions provide features like real-time tracking, instant card issuance, and robust security measures. For businesses looking to streamline their spending or issue their own cards, Wallester’s platform could be the perfect fit.

Find out more about Wallester’s offerings and how they can benefit your business: Wallester.

Conclusion And Final Recommendations

Credit card consolidation is a strategic move to manage multiple debts effectively. With the right approach, it can reduce financial stress and improve credit scores.

Summary Of Key Points

- Credit card consolidation can simplify your debt management.

- It typically involves combining multiple credit card balances into one new loan.

- Key benefits include lower interest rates and a single monthly payment.

- Debt consolidation can potentially improve your credit score over time.

- It’s important to choose the right method, such as a balance transfer card or a personal loan.

Final Tips For Successful Debt Consolidation

- Assess your financial situation: Know your total debt, interest rates, and monthly payments.

- Research consolidation options: Compare balance transfer cards, personal loans, and debt management plans.

- Create a budget: Ensure you can afford the new consolidated payment each month.

- Avoid new debt: Focus on paying off your consolidated debt without accumulating more.

- Monitor your progress: Regularly check your credit score and track your payment progress.

- Seek professional advice: Consult with a financial advisor if you need help choosing the best consolidation option.

For businesses, platforms like Wallester offer comprehensive solutions to manage corporate spending through virtual business expense cards and white-label card issuing programs. These tools can assist in controlling expenses and monitoring transactions in real-time, ultimately supporting better financial management.

Frequently Asked Questions

What Is Credit Card Consolidation?

Credit card consolidation combines multiple credit card balances into one loan. This simplifies payments and may reduce interest rates.

How Does Credit Card Consolidation Work?

Credit card consolidation works by taking out a new loan. Use it to pay off all your existing credit card debts.

What Are The Benefits Of Consolidating Credit Cards?

Consolidating credit cards simplifies payments. It may lower your interest rates and improve your credit score over time.

Is Credit Card Consolidation Bad For My Credit?

Credit card consolidation can help your credit score. By making timely payments, your credit score may improve over time.

Conclusion

Credit card consolidation can simplify your financial life. It helps reduce stress. Consider using platforms like Wallester for managing expenses. With Wallester’s business expense cards, you get control and efficiency. Simplify your finances today. Make informed decisions for a better financial future.