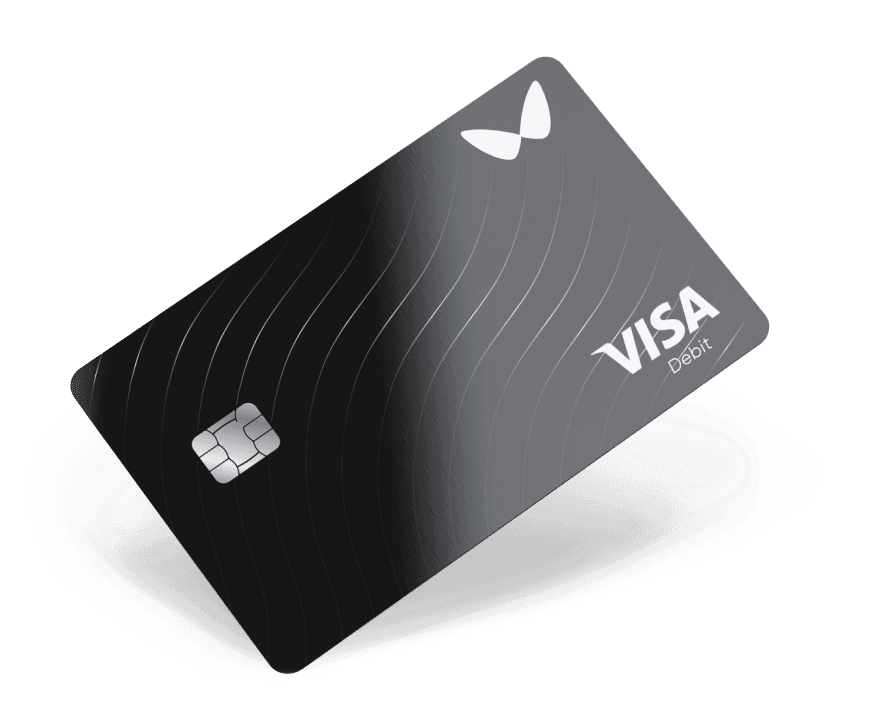

Wallester Credit Cards: Unlock Premium Benefits Today

Credit cards are essential tools for managing personal and business finances. Wallester credit cards offer unique features tailored for efficient expense management.

Whether you’re a small business owner or managing a large corporation, Wallester Business Expense Cards provide a seamless solution. With 300 free virtual cards and no hidden fees, you can easily control and track corporate spending. Wallester cards offer real-time expense tracking, instant issuance, and enhanced security features. This ensures your financial operations are smooth and compliant with regulations. Interested in learning more? Visit Wallester for detailed information and to get started with your own Wallester credit cards today. Ready to streamline your business expenses? Get started with Wallester now!

Introduction To Wallester Credit Cards

Wallester Credit Cards offer a seamless, efficient, and secure solution for managing personal and corporate expenses. With features like instant card issuance, real-time expense tracking, and robust security measures, Wallester Credit Cards cater to a wide range of needs and preferences.

Overview Of Wallester Credit Cards

Wallester Credit Cards come with a variety of features designed to simplify financial management. Here are some key aspects:

- 300 Free Virtual Cards: Issue up to 300 virtual cards for free, ensuring flexibility and ease of use.

- No Hidden Fees: Transparent pricing with no hidden costs.

- Real-Time Expense Tracking: Monitor spending as it happens.

- Instant Issuance: Get both physical and virtual cards instantly.

- Open API Integration: Seamless integration with existing systems.

- Compliance: Adheres to KYC and AML regulations.

- Card Tokenization: Securely use cards with digital wallets.

- 3D Secure Protection: Enhanced security for online payments.

- Continuous Fraud Monitoring: Stay protected against fraudulent activities.

Purpose And Target Audience

Wallester Credit Cards are designed for both personal and business users, offering tailored solutions to meet diverse financial needs. Here’s how different audiences benefit:

| Audience | Benefits |

|---|---|

| Businesses |

|

| Personal Users |

|

Wallester Credit Cards are ideal for anyone seeking a secure, efficient, and flexible financial solution.

Key Features Of Wallester Credit Cards

Wallester Credit Cards offer a range of features designed for both security and convenience. These cards are perfect for managing personal and business expenses. Let’s explore the key features that set Wallester Credit Cards apart.

Advanced Security Features

Security is a top priority for Wallester. Each card comes with 3D Secure protection for online payments, ensuring your transactions are safe. Additionally, there is continuous fraud monitoring to detect and prevent unauthorized activities. Card tokenization allows secure use in digital wallets, providing an extra layer of security for your transactions.

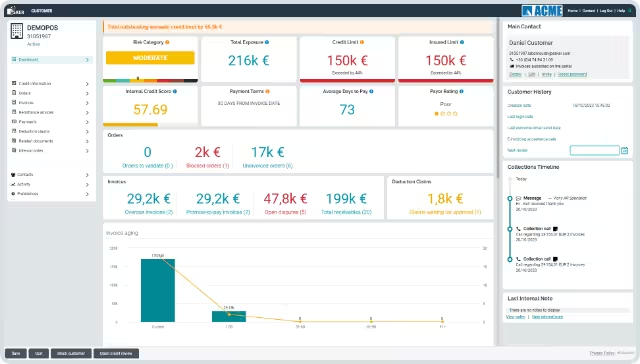

Customizable Spending Limits

Wallester Credit Cards offer the ability to set customizable spending limits. This feature is particularly useful for businesses that need to manage employee expenses. You can create individual spending limits for each card, helping to control and monitor expenses in real time.

Reward Programs And Cashback Offers

Enjoy the benefits of reward programs and cashback offers with Wallester Credit Cards. These programs are designed to provide you with incentives for your spending. Whether you are a business or an individual, these rewards can add significant value to your financial activities.

Global Acceptance And Usage

Wallester Credit Cards are globally accepted, making them ideal for international travel and business. You can use your card in various countries without worrying about acceptance issues. This ensures convenience and flexibility wherever you are.

In conclusion, Wallester Credit Cards combine advanced security, customizable spending limits, attractive reward programs, and global acceptance to provide a comprehensive financial solution.

Pricing And Affordability

Wallester credit cards offer a cost-effective solution for businesses looking to manage corporate expenses. The pricing structure is designed to cater to various needs without burdening users with hidden fees. Let’s dive into the specifics of the pricing and affordability of Wallester credit cards.

Annual Fees And Charges

One of the standout features of Wallester credit cards is the absence of hidden fees. Users can enjoy up to 300 free virtual cards, making it an excellent choice for businesses of all sizes. The annual fees are virtually non-existent, which significantly reduces the overall cost of managing corporate expenses.

| Card Type | Annual Fee |

|---|---|

| Virtual Cards | Free |

| Physical Cards | Contact Wallester for details |

Interest Rates And Apr

The interest rates and APR for Wallester credit cards are competitive in the market. While specific rates are not detailed in the provided information, businesses can expect favorable terms due to Wallester’s partnerships with Visa and other financial institutions. For precise rates, it is advisable to contact Wallester directly.

- Competitive interest rates

- Favorable APR

- Partnerships with Visa and other institutions

Comparison With Competitors

Wallester credit cards stand out in the market due to their transparent pricing and lack of hidden fees. Unlike many competitors, Wallester offers 300 free virtual cards, which is a significant advantage for businesses. Additionally, the real-time expense tracking and instant issuance of cards add value that many other providers do not offer.

| Feature | Wallester | Competitors |

|---|---|---|

| Annual Fees | Free for virtual cards | Varies, often high |

| Hidden Fees | None | Common |

| Real-time Tracking | Yes | Not always available |

| Instant Issuance | Yes | Limited |

In summary, Wallester credit cards provide a highly affordable and transparent solution for businesses. The absence of hidden fees, competitive interest rates, and unique features like instant card issuance and real-time expense tracking make Wallester a strong contender in the credit card market.

Pros And Cons Of Wallester Credit Cards

Wallester Credit Cards come with a variety of features that cater to both businesses and individuals. While they offer many benefits, there are also some drawbacks to consider. Let’s explore the pros and cons based on user reviews and common limitations.

Advantages Based On User Reviews

- 300 Free Virtual Cards: Users appreciate the ability to issue up to 300 virtual cards without any hidden fees.

- Real-Time Expense Tracking: The real-time tracking of expenses helps businesses manage their finances more efficiently.

- Instant Issuance: Both physical and virtual cards are issued instantly, providing immediate access to funds.

- Open API Integration: Seamless integration with existing systems through an open API is highly valued by users.

- Enhanced Security: Features like 3D Secure protection and continuous fraud monitoring ensure secure transactions.

- Compliance with Regulations: Wallester complies with KYC and AML regulations, adding a layer of trust for users.

- No Hidden Fees: Transparent pricing with no hidden fees is a significant advantage for cost-conscious businesses.

Common Drawbacks And Limitations

- Limited Geographic Availability: Wallester services are limited to specific regions, including the EEA, UK, Switzerland, Ireland, Australia, and the USA.

- No Explicit Refund Policies: The lack of clearly stated refund or return policies can be a concern for potential users.

- Complex Integration: While the open API is a plus, some users find the initial integration process complex and time-consuming.

- Customer Support: Some users have reported slow response times from customer support, which can be frustrating.

Overall, Wallester Credit Cards offer many benefits, especially for businesses looking for efficient expense management and enhanced security. However, potential users should be aware of the geographic limitations and ensure they understand the terms and conditions related to refunds and customer support.

Ideal Users And Scenarios For Wallester Credit Cards

Wallester Credit Cards cater to a diverse range of users and scenarios. Their features and benefits make them suitable for various personal and business needs. Whether you need to manage corporate expenses or launch a branded card program, Wallester offers a solution tailored to your requirements.

Best Use Cases

Wallester Credit Cards are perfect for managing corporate expenses efficiently. With 300 free virtual cards, businesses can allocate spending limits and track expenses in real-time. This makes it easier to control budgets and reduce financial risks.

Another great use case is launching a white-label card program. Wallester’s white-label solution allows companies to issue branded cards quickly. The open API and instant issuance features simplify integration and speed up market entry. This is ideal for businesses looking to enhance their brand presence and offer customized financial services.

Who Should Get A Wallester Credit Card?

Business owners looking to streamline their expense management will find Wallester Credit Cards valuable. The cards offer real-time expense tracking and no hidden fees, making financial management straightforward and cost-effective.

Companies aiming to launch their own branded card programs should also consider Wallester. The white-label solution provides features like 3D Secure protection and continuous fraud monitoring, ensuring high security and compliance.

Finally, corporations in the European Economic Area (EEA), the UK, Ireland, Switzerland, Australia, and the USA can benefit from Wallester’s services. The wide operational reach ensures that businesses in these regions can leverage Wallester’s robust financial solutions.

Frequently Asked Questions

What Are Wallester Credit Cards?

Wallester credit cards are innovative financial tools that offer flexible credit solutions. They are designed for both personal and business use.

How Do Wallester Credit Cards Work?

Wallester credit cards work by providing a credit limit for purchases. Users repay the borrowed amount monthly.

Are Wallester Credit Cards Secure?

Yes, Wallester credit cards feature advanced security measures. They include fraud detection, encryption, and secure transactions.

Can I Use Wallester Credit Cards Internationally?

Yes, Wallester credit cards are accepted worldwide. You can make purchases internationally without issues.

Conclusion

Experience seamless corporate spending with Wallester Business Expense Cards. Enjoy 300 free virtual cards with no hidden fees. Track expenses in real-time and issue cards instantly. Wallester ensures high security and compliance for all transactions. Ready to simplify your business finance? Discover more about Wallester here.