Wallester Benefits: Unlocking Financial Efficiency and Growth

Managing corporate expenses can be a headache. Wallester simplifies this process.

Wallester provides business expense cards and a white-label card issuing program. Companies can easily manage spending with 300 free virtual cards. The white-label program lets businesses create branded card programs quickly. With no hidden fees and real-time tracking, Wallester offers transparency and control. In this post, we’ll explore the benefits of Wallester. You’ll see how it can help streamline your financial operations. Whether you’re a small business or a large corporation, Wallester has solutions that fit your needs. Ready to learn more about how Wallester can benefit your business? Let’s dive in. Learn more about Wallester.

Introduction To Wallester

Welcome to the world of Wallester! Let’s explore how Wallester can help manage your corporate spending effectively and efficiently. This platform offers solutions like Business Expense Cards and White-Label Card Issuing, enhancing financial efficiency and growth for businesses.

Overview Of Wallester And Its Purpose

Wallester provides a comprehensive solution for managing corporate spending. The platform offers 300 free virtual cards, ensuring no hidden fees and easy corporate spending management. The White-Label Card Issuing program allows businesses to launch branded card programs seamlessly.

| Main Features | Details |

|---|---|

| Business Expense Cards |

|

| White-Label Card Issuing |

|

Why Financial Efficiency And Growth Matter

Financial efficiency and growth are crucial for any business. Wallester helps by simplifying corporate expense management with no hidden costs and easy setup. The White-Label Card Issuing program ensures quick market entry and easy integration with branded Visa cards. This helps businesses to focus on growth while maintaining financial control.

Benefits for Business Expense Cards:

- Simplified corporate expense management

- No hidden costs

- Easy setup and control

Benefits for White-Label Card Issuing:

- Quick market entry

- Easy integration

- Branded Visa cards

Wallester’s compliance with PCI DSS requirements and Estonian financial regulations ensures trust and security. Services are available in the EEA, UK, Ireland, Switzerland, Australia, and the USA. Features like client portals, mobile wallets, KYC/AML compliance, card tokenization, 3D Secure protection, and continuous fraud monitoring provide additional peace of mind.

Getting started with Wallester is simple:

- Sign up and top up your account.

- Issue and set corporate cards.

- Control expenses in real time.

For more details, visit Wallester’s website or contact their support.

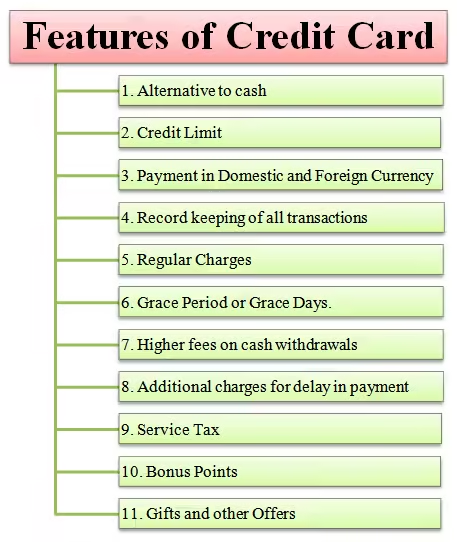

Key Features Of Wallester

Wallester offers unique features that enhance how businesses manage their finances. These features provide a comprehensive solution for corporate spending, customizable card solutions, and advanced security measures.

Wallester simplifies corporate expense management with real-time tracking. Businesses can monitor and control expenses instantly, ensuring transparency and efficiency. The system allows for immediate updates on spending, reducing the risk of overspending.

- Instant tracking of expenses

- Transparent and efficient management

- Reduces risk of overspending

Wallester provides customizable card solutions through its White-Label Card Issuing program. Businesses can create branded Visa cards with ease. This flexibility allows for a personalized approach to corporate finance management.

| Feature | Benefit |

|---|---|

| White-Label Card Issuing | Branded Visa cards |

| Instant Issuance | Quick market entry |

| Open API | Easy integration |

Wallester ensures the safety of financial transactions with advanced security measures. The system complies with PCI DSS requirements and includes features like card tokenization and 3D Secure protection. Continuous fraud monitoring adds an extra layer of security.

- PCI DSS compliant

- Card tokenization

- 3D Secure protection

- Continuous fraud monitoring

Wallester offers comprehensive reporting tools that provide detailed insights into corporate spending. These tools help in making informed financial decisions, ensuring better budgeting and planning. The client portal and mobile wallets add convenience and accessibility.

- Detailed spending insights

- Better budgeting and planning

- Client portal and mobile wallets

Real-time Expense Management

Managing expenses can be a daunting task for businesses and individuals. Wallester provides a solution with its real-time expense management feature. This tool simplifies tracking and controlling spending, offering a seamless and efficient experience.

How It Works

Wallester’s real-time expense management leverages instant issuance and open API. These features ensure that users can issue cards quickly and track expenses in real time.

Users can start by signing up and topping up their account. Once the account is set up, they can issue corporate cards and control expenses immediately. The platform supports the issuance of 300 free virtual cards without hidden fees, making it a cost-effective solution.

Benefits For Businesses And Individuals

For businesses, Wallester offers simplified corporate expense management. The platform allows businesses to manage expenses easily, with no hidden costs and straightforward control mechanisms.

Individuals also benefit from real-time tracking and management. They can monitor their spending, ensuring they stay within their budget and avoid unnecessary expenses. The platform’s user-friendly interface makes it accessible for everyone.

Solving Common Financial Challenges

Wallester addresses several common financial challenges:

- Hidden Fees: Wallester ensures transparency with no hidden costs.

- Expense Tracking: Real-time tracking helps users stay on top of their spending.

- Quick Market Entry: The white-label card issuing feature allows businesses to launch branded cards quickly.

Moreover, Wallester’s continuous fraud monitoring and 3D Secure protection enhance security, making it a reliable choice for managing expenses.

Wallester complies with PCI DSS requirements and operates under Estonian financial regulations, providing additional trust and security for its users.

In summary, Wallester’s real-time expense management feature offers a practical and efficient way to manage corporate and personal spending, addressing key financial challenges and providing robust security measures.

Customizable Card Solutions

Wallester offers customizable card solutions tailored to meet various business needs. These solutions empower businesses with flexibility and control. Let’s explore the benefits of these solutions.

Personalized Financial Tools

Wallester’s customizable card solutions provide businesses with personalized financial tools. Companies can issue up to 300 free virtual cards, enabling streamlined corporate spending management. These cards come with no hidden fees, ensuring transparency.

Businesses can easily set up and control these cards, making it simple to manage expenses. Additionally, Wallester’s White-Label Card Issuing program allows businesses to launch branded card programs. This enhances brand recognition and provides a unique customer experience.

Adapting To Different Business Needs

The customizable card solutions offered by Wallester are designed to adapt to different business needs. With features like instant issuance and an open API, businesses can quickly integrate these solutions into their existing systems. Real-time tracking ensures that all transactions are monitored continuously, enhancing financial oversight.

Wallester’s solutions are also compliant with PCI DSS requirements and operate under Estonian financial regulations. This ensures that businesses are meeting necessary compliance standards while benefiting from a reliable and secure card issuing platform.

Enhancing User Experience

Wallester focuses on enhancing user experience through its customizable card solutions. The platform offers client portals and mobile wallets that provide users with easy access to their financial tools. Features like card tokenization and 3D Secure protection ensure that transactions are safe and secure.

Additionally, Wallester’s continuous fraud monitoring helps protect users from fraudulent activities. This comprehensive approach to security and user experience makes Wallester an ideal choice for businesses looking to offer personalized and secure financial solutions.

| Feature | Benefit |

|---|---|

| 300 Free Virtual Cards | No hidden fees, easy expense management |

| White-Label Card Issuing | Quick market entry, branded Visa cards |

| Instant Issuance | Quick setup and integration |

| Real-time Tracking | Enhanced financial oversight |

| Client Portals & Mobile Wallets | Improved user access and experience |

| 3D Secure Protection | Enhanced transaction security |

Advanced Security Measures

Wallester is committed to ensuring the highest level of security for its users. The advanced security measures implemented are designed to protect financial data and prevent fraud, making it a trustworthy choice for businesses.

Protecting Financial Data

With Wallester, your financial data is secure. The platform complies with PCI DSS requirements and operates under Estonian financial regulations. This ensures that your data is handled in accordance with the highest security standards.

Additionally, Wallester uses card tokenization and 3D Secure protection to safeguard transactions. This means that sensitive information is encrypted, reducing the risk of data breaches.

Fraud Prevention Technologies

Fraud prevention is a top priority for Wallester. The platform features continuous fraud monitoring to detect and prevent suspicious activities in real-time.

Wallester also complies with KYC/AML regulations, ensuring that all users are verified and legitimate. This reduces the risk of fraudulent accounts and transactions.

Why Security Is Crucial

Security is crucial in the financial sector. A breach can result in significant losses and damage to reputation. Wallester’s robust security measures protect users from these risks.

By using Wallester, businesses can manage their expenses with peace of mind, knowing their financial data is secure. This allows them to focus on growth rather than worrying about security threats.

Comprehensive Reporting Tools

Wallester’s Comprehensive Reporting Tools offer businesses the ability to manage and analyze their financial data effectively. These tools provide detailed financial insights, streamline financial analysis, and improve decision-making processes. Let’s explore how Wallester’s reporting tools can benefit your business.

Detailed Financial Insights

Wallester provides detailed financial insights that help businesses understand their spending patterns. With these insights, businesses can:

- Track expenses in real-time

- Identify spending trends

- Analyze cost-saving opportunities

These insights are crucial for managing corporate spending efficiently. The platform’s real-time tracking feature ensures that businesses always have up-to-date information.

Streamlining Financial Analysis

Wallester’s reporting tools streamline financial analysis by offering easy-to-use dashboards and customizable reports. Businesses can:

- Generate reports with a few clicks

- Customize data views to suit their needs

- Integrate with other financial software

This simplifies the analysis process, saving time and reducing errors. The open API makes it easy to integrate Wallester’s tools with existing systems, enhancing overall efficiency.

Improving Decision-making Processes

With comprehensive and precise data, Wallester helps businesses improve their decision-making processes. The platform provides:

- Actionable insights based on real-time data

- Visual reports for better understanding

- Tools for forecasting and budgeting

These features enable businesses to make informed decisions quickly. This leads to better financial management and optimized spending.

Wallester’s Comprehensive Reporting Tools are designed to help businesses manage their finances more effectively. By providing detailed insights, streamlining analysis, and improving decision-making, Wallester ensures that businesses can control their expenses and maximize their resources.

Pricing And Affordability

Wallester offers a competitive edge in the market with its affordable pricing and transparent cost structure. Whether you’re a small business or a large corporation, Wallester ensures that managing expenses is both cost-effective and straightforward.

Cost Breakdown

The Wallester Business solution is free, supported through partnerships with Visa. This means no hidden fees or unexpected charges for businesses. Here is a quick breakdown of the costs:

- 300 free virtual cards: Provided at no extra cost.

- No hidden fees: Transparent pricing ensures no surprise expenses.

Comparison With Competitors

When compared to other card issuing services, Wallester stands out for its affordability and ease of use. Here’s a comparison:

| Feature | Wallester | Competitors |

|---|---|---|

| Virtual Cards | 300 free | Limited or paid |

| Hidden Fees | None | Possible |

| Integration | Easy | Varies |

Value For Money

Wallester provides excellent value for money with its extensive features and transparent pricing. Businesses benefit from:

- Simplified expense management: Easily track and control corporate spending.

- Quick market entry: Launch branded Visa cards swiftly.

- Real-time tracking: Monitor expenses as they happen.

With no hidden costs and a straightforward setup, Wallester offers a cost-effective solution for managing business expenses and issuing branded cards.

Pros And Cons Of Wallester

Wallester offers unique solutions for managing corporate spending and issuing branded cards. Understanding its pros and cons helps in making an informed decision.

Advantages Based On Real-world Usage

Wallester provides several advantages that have been proven in real-world scenarios:

- 300 Free Virtual Cards: Businesses receive 300 free virtual cards, reducing initial costs.

- No Hidden Fees: Transparent pricing with no hidden charges.

- Easy Corporate Spending Management: Simplifies tracking and controlling expenses.

- Instant Issuance: Quick and efficient issuance of cards.

- Open API: Facilitates seamless integration with existing systems.

- Real-Time Tracking: Enables real-time monitoring of transactions.

These features make Wallester an attractive option for businesses aiming to streamline their financial operations.

Potential Drawbacks And Limitations

Despite its numerous benefits, Wallester has some limitations:

- Geographical Restrictions: Services are limited to the EEA, UK, Ireland, Switzerland, Australia, and the USA.

- Refund Policies: No clear refund or return policies mentioned.

- Launch Time: White-Label program launch time can range from 4 to 8 weeks, which may be long for some businesses.

While these drawbacks are notable, they do not overshadow the comprehensive benefits Wallester offers.

Ideal Users And Scenarios

Wallester offers a range of solutions tailored for businesses that need effective expense management and those looking to launch their branded card programs. It simplifies corporate spending and provides an easy entry into the financial market with its White-Label Card Issuing service.

Best Use Cases For Wallester

Wallester is ideal for several business scenarios. Here are some best use cases:

- Small to Medium Enterprises (SMEs): Manage employee expenses with 300 free virtual cards, ensuring transparency and control.

- Startups: Quick market entry with minimal setup costs using the White-Label Card Issuing service.

- Financial Institutions: Launch branded Visa cards seamlessly with open API integration and real-time tracking.

- International Businesses: Operate in multiple regions, including the EEA, UK, USA, and more, complying with local financial regulations.

Target Audience Recommendations

Wallester is designed for specific target audiences. Here are the main recommendations:

| Target Audience | Recommendations |

|---|---|

| Business Owners | Use Wallester for transparent, fee-free corporate expense management. |

| Financial Managers | Leverage real-time tracking and open API for seamless integration. |

| HR Departments | Issue virtual cards quickly to manage employee expenses efficiently. |

| Fintech Startups | Launch branded card programs swiftly, entering the market in 4-8 weeks. |

By focusing on these audiences, Wallester ensures its solutions meet the specific needs of each segment, enhancing operational efficiency and financial control.

Frequently Asked Questions

What Are The Main Benefits Of Wallester?

Wallester offers a range of benefits including financial flexibility, advanced security features, and seamless integration with existing systems. It provides real-time transaction monitoring and robust fraud protection, enhancing user confidence and security.

How Does Wallester Improve Financial Management?

Wallester simplifies financial management with its user-friendly interface and comprehensive analytics tools. It allows businesses to track expenses, manage budgets, and generate detailed financial reports effortlessly.

Is Wallester Secure For Transactions?

Yes, Wallester ensures high-level security with encrypted transactions and multi-factor authentication. Its advanced fraud detection systems safeguard your financial data, providing peace of mind for users.

Can Wallester Integrate With Other Systems?

Wallester seamlessly integrates with various financial systems and platforms. This integration enables streamlined workflows and improved efficiency, making it easier for businesses to manage their financial operations.

Conclusion

Wallester offers practical solutions for corporate expense management and card issuance. Businesses benefit from 300 free virtual cards, no hidden fees, and easy setup. The White-Label program provides quick market entry and branded Visa cards. Wallester’s services ensure simplified expense control and seamless integration. Explore more about Wallester’s offerings and take your business management to the next level. Visit Wallester for further details.