Quick Credit Card Approval: Get Instant Approval Today!

Quick Credit Card Approval In today’s fast-paced world, waiting for credit card approval can be frustrating. Many seek quick and easy solutions to streamline this process.

If you’re looking to manage corporate spending efficiently, Wallester offers an ideal solution. Wallester provides a platform for managing corporate expenses with free virtual cards. It features instant issuance, an open API, and real-time tracking. This white-label solution allows businesses to launch branded card programs quickly and seamlessly. With Wallester, you can issue up to 300 free virtual cards without hidden fees. The platform offers high financial security standards and continuous fraud monitoring, ensuring your transactions are safe. Manage your company’s spending with ease and control, knowing Wallester has you covered. Explore more about Wallester here.

Introduction To Quick Credit Card Approval

In today’s fast-paced world, waiting weeks for credit card approval is inconvenient. Quick credit card approval is a game-changer, offering immediate access to funds. This process is fast, efficient, and highly beneficial for individuals and businesses. Let’s delve into the key aspects of quick credit card approval.

What Is Quick Credit Card Approval?

Quick credit card approval refers to the rapid processing and approval of credit card applications. With platforms like Wallester, users can get immediate access to virtual and physical cards. This process eliminates the traditional waiting period, providing users with instant financial solutions.

Quick approval leverages advanced technology and open API integration. It ensures that applicants receive their cards quickly. Companies like Wallester offer a seamless process, allowing applicants to complete verification, issue cards, and access funds within minutes.

The Importance Of Instant Approval

Instant approval is crucial for several reasons:

- Time-Saving: It saves applicants from lengthy approval processes.

- Immediate Access to Funds: Users can access their credit line right away, essential for urgent financial needs.

- Convenience: Instant approval provides a hassle-free experience, reducing stress and uncertainty.

- Enhanced Financial Management: Platforms like Wallester offer real-time tracking and expense management, improving financial control.

Wallester’s instant approval process combines efficiency and security, adhering to strict financial regulations and standards. This ensures that users receive quick and reliable financial solutions.

Key Features Of Quick Credit Card Approval

Getting a credit card quickly is essential for many. Understanding the key features can help you decide the best option. Below, we explore the main aspects of quick credit card approval.

Fast Application Process

Applying for a credit card should not be time-consuming. Wallester Business Expense Cards offer a streamlined application process. You can complete the application in minutes. This efficiency ensures you spend less time waiting and more time managing your finances.

Instant Credit Decision

Waiting for a credit decision can be stressful. With Wallester, you receive an instant credit decision. This immediate feedback helps you know your status without delay. Quick decisions mean you can start using your card right away if approved.

Minimal Documentation Required

Submitting extensive documentation can be a hassle. Wallester minimizes this requirement. Basic information is often all you need. This simplicity makes the approval process faster and more convenient.

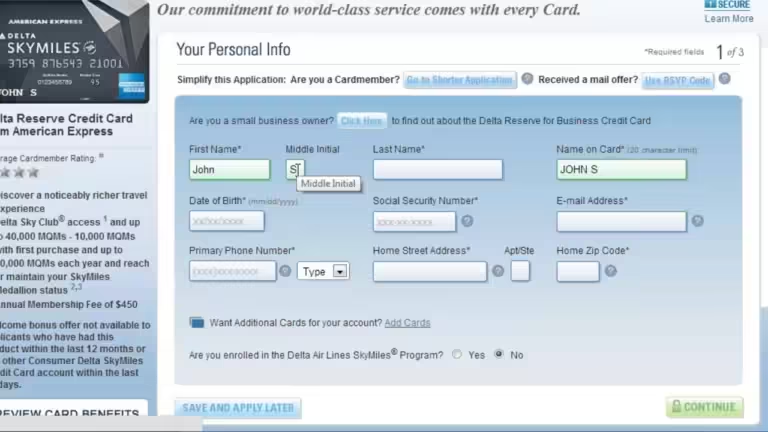

Online Application Accessibility

Applying for a credit card should be easy and accessible. Wallester allows you to apply online. You can complete the application from anywhere. Online accessibility ensures you don’t have to visit a bank, saving time and effort.

These key features make Wallester Business Expense Cards an excellent choice for those seeking quick credit card approval. With a fast application process, instant decisions, minimal documentation, and online accessibility, managing your finances becomes simpler and more efficient.

How Quick Credit Card Approval Benefits You

Quick credit card approval offers numerous advantages for both individuals and businesses. This process can transform how you manage your finances, giving you faster access to credit and more flexibility in spending. Below, we explore the key benefits of quick credit card approval.

Immediate Access To Credit

One of the most significant benefits of quick credit card approval is immediate access to credit. With traditional methods, you might wait days or weeks for approval. Quick approval processes, like those offered by Wallester, eliminate this wait time. You can start using your credit card right away for essential purchases or unexpected expenses.

Convenience And Time-saving

Quick credit card approval processes save you a lot of time. Filling out lengthy applications and waiting for responses can be frustrating. With a streamlined approval system, you get a decision in minutes. This means you can focus more on what matters to you, rather than dealing with paperwork.

Improved Financial Flexibility

Having a credit card with quick approval can enhance your financial flexibility. You can manage your expenses better and take advantage of opportunities as they arise. For example, Wallester’s platform allows for real-time tracking and setting spending limits, giving you more control over your finances.

In addition, Wallester provides the option to issue free virtual cards, making it easier to manage corporate spending without hidden fees. This feature is particularly useful for businesses looking for cost-efficient solutions.

| Feature | Benefit |

|---|---|

| Free Virtual Cards | No hidden fees, easy management |

| Real-Time Tracking | Monitor transactions instantly |

| Open API Integration | Seamless integration with systems |

| Security Compliance | Adheres to financial regulations |

Overall, quick credit card approval provides a host of benefits that can significantly improve your financial situation, whether for personal use or business purposes.

Pricing And Affordability

Understanding the pricing and affordability of credit cards is crucial. It helps you make informed decisions. Here, we explore the various aspects of Wallester’s Business Expense Cards pricing.

Annual Fees

Wallester Business Expense Cards offer a major advantage with no annual fees. This makes it a cost-effective solution for businesses. Many traditional credit cards come with high annual fees, but Wallester stands out with its free offering.

Interest Rates

Interest rates can significantly impact your expenses. Wallester’s Business Expense Cards are designed to be affordable. They provide competitive rates, making them a suitable choice for managing corporate spending. Always check the specific rates when signing up.

Hidden Charges

Hidden charges can be a major concern for many users. With Wallester, there are no hidden fees. This transparency ensures you know exactly what you’re paying for. It’s a clear and straightforward pricing model, ideal for businesses looking to manage costs effectively.

| Feature | Details |

|---|---|

| Annual Fees | No annual fees |

| Interest Rates | Competitive rates |

| Hidden Charges | No hidden fees |

Wallester’s transparent pricing ensures cost efficiency. It’s tailored for businesses needing an affordable and reliable expense management solution.

Pros And Cons Based On Real-world Usage

When considering quick credit card approval, it is essential to understand both the advantages and disadvantages. Real-world usage provides valuable insights into how these cards perform in everyday financial scenarios.

Advantages

Quick credit card approval offers several benefits that can enhance your financial flexibility and convenience:

- Immediate Access to Credit: Get instant access to funds for urgent expenses.

- Convenience: Apply online and receive approval without lengthy paperwork.

- Build Credit History: Start building or improving your credit score quickly.

- Promotional Offers: Enjoy introductory rates and bonuses offered by many issuers.

- Flexibility: Choose from various cards tailored to different needs, such as rewards or low-interest rates.

Disadvantages

Despite the advantages, there are some drawbacks to quick credit card approval:

- Higher Interest Rates: Quick approval cards may come with higher APRs.

- Fees: Potential hidden fees for balance transfers or cash advances.

- Credit Score Impact: Frequent applications can negatively affect your credit score.

- Limited Rewards: Some cards may offer fewer rewards compared to traditional options.

Understanding these pros and cons will help you make an informed decision when applying for a quick approval credit card.

Specific Recommendations For Ideal Users

Quick credit card approval can be a game-changer for many. But who benefits the most? Let’s explore the ideal candidates for fast credit card approval and the best scenarios for applying.

Who Should Apply?

Quick credit card approval is perfect for those who need immediate access to funds. Here are some specific groups who should consider applying:

- Freelancers: Need to separate business and personal expenses quickly.

- Small Business Owners: Require a fast solution to manage company spending.

- Travel Enthusiasts: Often need immediate funds for travel bookings.

- Students: Seeking a quick and easy way to manage daily expenses.

Best Scenarios For Quick Credit Card Approval

There are certain scenarios where quick credit card approval can be particularly beneficial:

| Scenario | Why It’s Ideal |

|---|---|

| Emergency Situations | Immediate access to funds can be life-saving in emergencies. |

| Last-Minute Business Trips | Quick funds ensure you can cover travel and accommodation costs. |

| Seasonal Sales | Take advantage of limited-time offers with instant credit access. |

| New Business Ventures | Quickly set up expense management systems for your startup. |

For those seeking a robust solution, Wallester Business Expense Cards offer a range of benefits:

- 300 free virtual cards with no hidden fees.

- Real-time tracking for effective expense management.

- White-label card issuing for quick brand setup.

- Open API integration for seamless system incorporation.

Wallester’s platform is available in multiple countries, including the EEA, UK, Switzerland, Ireland, USA, and Australia. This flexibility makes it an ideal choice for businesses and individuals alike.

Frequently Asked Questions

How Can I Get Quick Credit Card Approval?

To get quick approval, ensure your credit score is good. Complete the application accurately. Provide all required documents promptly. Choose a card that matches your credit profile.

What Factors Affect Quick Credit Card Approval?

Key factors include your credit score, income level, and existing debt. An accurate application and proper documentation are crucial. Your employment history also plays a role.

Is Instant Credit Card Approval Possible?

Yes, many issuers offer instant approval. You receive a decision within minutes. Ensure your credit profile meets their criteria for the best chance.

Which Credit Cards Offer Quick Approval?

Many issuers offer quick approval cards. Examples include Capital One, Discover, and American Express. Research and choose the card that fits your needs.

Conclusion

Secure quick credit card approval to ease your financial needs. Explore Wallester’s free virtual cards for efficient corporate spending management. Enjoy features like real-time tracking and seamless API integration. Manage expenses effortlessly with no hidden fees. Ready to simplify your business finances? Visit Wallester Business Expense Cards here.