Build Business Credit Fast: Proven Strategies for Success

Building business credit fast can seem daunting. But it’s essential for growth.

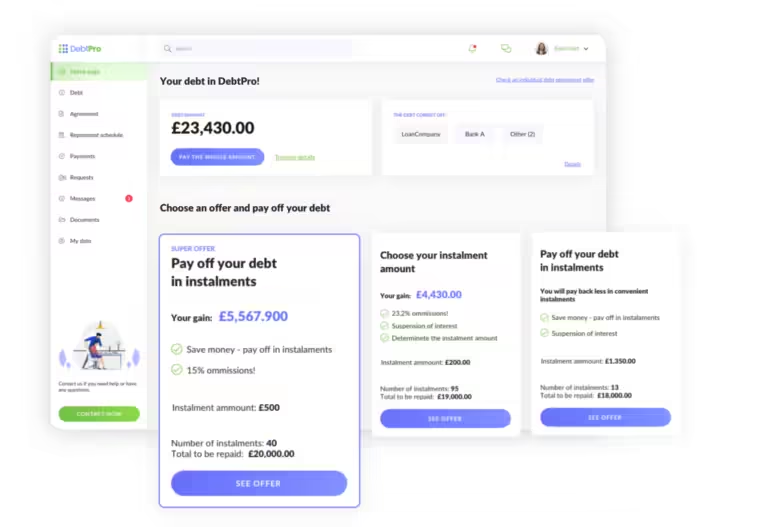

Establishing solid business credit quickly can unlock better financing options and improve cash flow. Small businesses often face challenges in securing credit due to limited history. But with the right strategies, you can build credit effectively. One powerful tool to consider is the Flex Financial Platform. Flex integrates banking, credit, and expense management into one seamless app. This helps streamline financial operations and enhance your credit profile. With features like net-60 terms, 0% interest for 60 days, and high APY on deposits, Flex offers valuable benefits. Start leveraging these tools now to accelerate your business credit-building journey. Ready to build your business credit fast? Learn more about Flex here.

Introduction To Building Business Credit

Building business credit is essential for any business aiming to grow and prosper. It opens up opportunities for better financing options, favorable terms, and a more robust financial foundation. This section will introduce you to the basics of business credit, its importance, and how it differs from personal credit.

Understanding Business Credit

Business credit refers to the creditworthiness of a business entity. It works similarly to personal credit but is tied to the business’s financial activities. A strong business credit score can help secure loans, leases, and better terms on business insurance.

Key aspects of business credit include:

- Business credit reports from bureaus like Dun & Bradstreet, Experian, and Equifax.

- Trade credit ratings based on payment history with suppliers.

- Public records, such as bankruptcies or liens.

Importance Of Business Credit

Business credit is vital for several reasons:

- Access to Financing: Easier approval for loans and lines of credit.

- Better Terms: Lower interest rates and better payment terms.

- Business Growth: Opportunities to expand operations and invest in new projects.

- Vendor Relationships: Improved credit terms with suppliers and vendors.

Building strong business credit can significantly impact your business’s financial health and growth potential.

How Business Credit Differs From Personal Credit

While both business and personal credit assess creditworthiness, they differ in several ways:

| Aspect | Business Credit | Personal Credit |

|---|---|---|

| Ownership | Tied to the business entity | Tied to the individual |

| Reporting Agencies | Dun & Bradstreet, Experian, Equifax | Experian, Equifax, TransUnion |

| Impact | Affects business financing and vendor terms | Affects personal loans, credit cards, mortgages |

| Factors | Payment history, public records, trade credit | Payment history, credit utilization, credit age |

Understanding these differences is crucial for managing both personal and business finances effectively.

For businesses looking to streamline financial management, the Flex Financial Platform offers an all-in-one solution. Flex integrates banking services, credit card management, and advanced security features into a single, user-friendly app. With features like net-60 terms on purchases and up to 2.99% APY on cash deposits, Flex helps businesses grow and manage expenses efficiently.

Key Steps To Establish Business Credit

Building business credit is essential for the financial health and growth of your business. By taking the right steps early, you can secure better financing options and improve your business reputation. Below are the crucial steps to establish business credit effectively.

Registering Your Business Entity

The first step to establish business credit is to register your business entity. This means selecting the right structure, such as a Limited Liability Company (LLC) or Corporation. Registering your business officially separates your personal and business finances, a vital step for building business credit.

| Business Structure | Benefits |

|---|---|

| LLC | Limited personal liability, flexibility in management, pass-through taxation |

| Corporation | Limited liability, ability to raise capital, perpetual existence |

Obtaining An Employer Identification Number (ein)

Next, you need to obtain an Employer Identification Number (EIN) from the IRS. This number is essential for tax purposes and is required to open a business bank account. An EIN also helps to establish a business credit profile.

- Visit the IRS website.

- Fill out the EIN application form.

- Receive your EIN immediately upon completion.

Opening A Business Bank Account

Opening a business bank account is another crucial step. This account will be used for all business transactions, further separating your personal and business finances. It is important to choose a bank that offers business-friendly features.

Flex Financial Platform offers banking services designed to simplify payments and manage expenses. With Flex, you can earn up to 2.99% APY on cash deposits and benefit from features like free ACH/wire payments and robust expense management.

To open a business bank account:

- Gather your business documents.

- Complete the application process.

- Deposit the minimum required amount.

Following these steps will set the foundation for establishing a strong business credit profile. With the right tools and practices, your business will be well-positioned for financial success.

Strategies To Build Business Credit Quickly

Building business credit fast requires strategic planning and diligent execution. By following specific tactics, you can enhance your business’s credit profile swiftly. Here are some effective strategies to consider:

Using Business Credit Cards Effectively

Business credit cards are powerful tools. They help manage expenses and build credit. Choose a card like the Flex Financial Platform credit card. It offers Net-60 terms and 0% interest for 60 days if the balance is paid within the grace period. Here’s how to use them effectively:

- Pay on Time: Always pay your credit card bills on time. Late payments negatively affect your credit score.

- Keep Utilization Low: Aim to use less than 30% of your credit limit. High utilization can hurt your credit score.

- Track Expenses: Use the Flex platform to manage and track expenses efficiently. This helps you stay within budget and avoid overspending.

Establishing Trade Lines With Vendors

Trade lines with vendors help in building business credit. Establish relationships with vendors who report to credit bureaus. Here’s how to go about it:

- Select Vendors: Choose vendors who report to business credit bureaus.

- Negotiate Terms: Work out favorable payment terms. Flex Financial Platform offers simplified banking and payments which can streamline this process.

- Make Timely Payments: Pay your vendors on time. This positively impacts your credit score.

Maintaining A Positive Payment History

A positive payment history is crucial for a good credit score. Here are some tips to maintain it:

- Automate Payments: Use Flex’s automated payment features to ensure timely payments. This reduces the risk of missing due dates.

- Monitor Transactions: Regularly check your transactions through the Flex app. This helps in identifying and addressing any discrepancies promptly.

- Keep Records: Maintain records of all payments. This can help resolve disputes if they arise.

By following these strategies, you can build business credit quickly and effectively, ensuring your business’s financial health and growth.

Leveraging Business Credit Monitoring Tools

Building business credit fast requires smart strategies. One effective strategy is leveraging business credit monitoring tools. These tools keep you informed about your credit status, helping you make timely decisions.

Top Business Credit Monitoring Services

Several services stand out for their reliability and features:

- Dun & Bradstreet: Offers comprehensive credit reports and monitoring.

- Experian Business: Provides detailed credit scores and alerts.

- Equifax Business: Features in-depth credit insights and monitoring.

These services help track your credit score changes and notify you of any issues. They offer detailed reports and alerts, making them essential for businesses.

Benefits Of Regular Credit Monitoring

Regular credit monitoring offers several benefits:

- Early Detection of Fraud: Monitoring tools can alert you to suspicious activities.

- Better Financial Decisions: Up-to-date information helps in making informed choices.

- Improved Credit Scores: Regular checks ensure you address issues promptly, improving your score.

These benefits contribute to maintaining a healthy business credit profile.

How To Use Monitoring Tools To Improve Credit

Using credit monitoring tools effectively involves a few key steps:

- Set Up Alerts: Configure alerts for any changes in your credit report.

- Review Reports Regularly: Go through the detailed reports to identify any discrepancies.

- Address Issues Promptly: Resolve any errors or issues as soon as they appear.

By following these steps, you can leverage monitoring tools to boost your business credit score.

For an integrated approach to managing business finances, consider using the Flex Financial Platform. It offers banking services, credit card features, and robust security measures, making financial management seamless and efficient.

Common Pitfalls To Avoid When Building Business Credit

Building business credit is crucial for a company’s growth. Avoiding common pitfalls can help you establish a strong credit profile. Understanding these pitfalls ensures that your business remains financially healthy and credible to lenders.

Overextending Credit Lines

One of the major mistakes is overextending credit lines. Using too much available credit can negatively impact your credit score. It’s important to keep your credit utilization ratio below 30%. This shows lenders that you manage credit responsibly.

Flex Financial Platform offers credit limits that grow with your business. This feature can help manage your credit lines effectively. But, ensure you use the credit wisely to avoid overextending.

Ignoring Payment Deadlines

Timely payments are crucial for building good business credit. Late payments can severely damage your credit score. They can also incur late fees and higher interest rates. Use tools like Flex’s robust expense management features to stay on top of your payments.

Flex’s credit card offers 0% interest for 60 days if the balance is paid within the grace period. This can be a great way to manage your payments without incurring extra costs.

Mixing Personal And Business Finances

Mixing personal and business finances is a common mistake. It can complicate accounting and tax filings. It also makes it difficult to build a distinct business credit profile. Always keep your personal and business finances separate.

Flex Financial Platform simplifies banking, payments, and expense management. This helps ensure that your business transactions are clearly separated from personal ones. Using features like individual employee cards can also help maintain clear financial boundaries.

Pros And Cons Of Rapid Business Credit Building

Building business credit quickly can be a double-edged sword. While it can provide immediate financial benefits, it also comes with its set of challenges. Understanding the pros and cons is crucial for making informed decisions.

Advantages Of Fast Credit Building

- Immediate Access to Funds: Rapid credit building allows businesses to access necessary funds quickly. This can be vital for addressing urgent financial needs.

- Improved Cash Flow: With quick credit, businesses can manage cash flow more efficiently, ensuring operations run smoothly without financial hiccups.

- Opportunity for Growth: Fast access to credit can support expansion plans, allowing businesses to seize opportunities as they arise.

- Enhanced Credit Profile: Building credit rapidly can help in establishing a strong credit profile, leading to better credit terms in the future.

Potential Risks And Disadvantages

Despite the benefits, there are potential downsides to consider:

- High-Interest Rates: Rapidly building credit might come with higher interest rates, increasing the overall cost of borrowing.

- Increased Debt: Fast credit building can lead to taking on more debt than the business can handle, risking financial stability.

- Credit Score Impact: Rapid accumulation of credit can negatively impact the business credit score if not managed responsibly.

- Short-Term Focus: Prioritizing rapid credit building may lead to short-term decision-making, compromising long-term financial health.

Balancing Speed With Stability

Finding the right balance between fast credit building and maintaining financial stability is key:

- Assess Needs Carefully: Evaluate your business needs and determine if rapid credit is essential.

- Monitor Credit Usage: Keep track of credit usage and ensure it aligns with your business’s financial capacity.

- Maintain Payment Discipline: Pay off balances promptly to avoid high-interest costs and protect your credit score.

- Leverage Financial Tools: Use platforms like Flex Financial Platform to manage expenses, streamline payments, and monitor cash flow effectively.

Balancing speed with stability ensures sustainable growth and long-term success.

Ideal Scenarios For Building Business Credit Quickly

Building business credit fast can be a game-changer for various scenarios. It provides businesses with the financial backing needed to grow, expand, and secure significant opportunities. Here are some ideal scenarios where building business credit quickly is essential.

Startups And New Businesses

Startups often need to establish credit quickly to fund initial operations and growth. Having a good business credit score can help secure favorable terms and lines of credit. This is crucial for covering early expenses and scaling the business efficiently.

- Access to favorable credit terms.

- Fund initial operations and growth.

- Cover early expenses efficiently.

| Benefits | Details |

|---|---|

| Favorable Credit Terms | Helps secure lines of credit |

| Efficient Expense Management | Cover early expenses with ease |

Businesses Looking To Expand

Expanding businesses need quick access to credit to seize growth opportunities. With a solid business credit profile, companies can secure loans and credit lines to finance expansion plans. This includes opening new locations, purchasing equipment, or hiring staff.

- Secure loans for expansion.

- Open new locations.

- Purchase equipment or hire staff.

Companies Seeking Large Contracts Or Loans

For companies aiming to secure large contracts or loans, a strong business credit score is vital. This builds trust with lenders and partners, demonstrating financial responsibility and reliability. It can also lead to better terms and lower interest rates, which are essential for managing large-scale projects.

- Build trust with lenders and partners.

- Secure better terms and lower interest rates.

- Manage large-scale projects effectively.

Using the Flex Financial Platform can accelerate the process. Its features like Net-60 terms and 0% interest for 60 days can significantly improve cash flow. This is especially beneficial for startups, expanding businesses, and those seeking large contracts.

Frequently Asked Questions

How Can I Build Business Credit Quickly?

To build business credit quickly, start by registering your business legally. Open a business bank account and get a business credit card. Pay all bills on time.

What Are The Benefits Of Business Credit?

Business credit helps secure loans, better interest rates, and vendor terms. It separates personal and business finances, protecting personal credit scores.

Can New Businesses Get Business Credit?

Yes, new businesses can get business credit. Start by registering your business, opening a bank account, and applying for a business credit card.

How Does Business Credit Impact Loan Approval?

Good business credit improves loan approval chances. It shows lenders your business is reliable and financially responsible, leading to better terms.

Conclusion

Building business credit fast is achievable with the right tools. Consider using Flex, a comprehensive financial platform that integrates banking, credit, and security features. Flex simplifies financial management and offers high-interest rates on deposits. With expense management tools and flexible credit terms, it supports business growth. Explore Flex for a more efficient financial strategy. Learn more about Flex here.