0% Interest Business Credit Card: Unlock Limitless Savings

In today’s competitive market, businesses need smart financial tools. A 0% interest business credit card can be a game-changer.

Imagine a credit card that offers 0% interest for 60 days on all your business purchases. This can help you manage expenses and improve cash flow effectively. The Flex Financial Platform [Flex] offers just that. It combines simplified banking with a powerful credit card solution. With Flex, you get net-60 terms, no interest for 60 days if you pay within the grace period, and growing credit limits. Plus, it ensures high security with multi-factor authentication and robust encryption. By using Flex, your business can streamline expenses, issue team cards easily, and even earn up to 2.99% APY on idle cash.

Introduction To 0% Interest Business Credit Cards

Running a business often requires balancing expenses and cash flow. A 0% interest business credit card can be a valuable tool. It allows businesses to manage their finances without the burden of immediate interest charges. This can be especially beneficial for startups and small businesses looking to grow.

Understanding 0% Interest Business Credit Cards

Business credit cards with 0% interest offer a grace period where no interest is charged on purchases. For instance, the Flex Financial Platform provides 0% interest for the first 60 days. This means that if the balance is paid within this period, no interest is incurred.

Here are some key features of the Flex Credit Card:

- Net-60 Terms: Purchases have a 60-day repayment period.

- Credit Limits: Limits increase as your business grows.

- Expense Management: Easily manage all business expenses.

- Security: Multi-Factor Authentication (MFA) and robust encryption.

Purpose And Benefits For Businesses

The primary purpose of a 0% interest business credit card is to improve cash flow. Here’s how it benefits businesses:

| Benefit | Description |

|---|---|

| Increased Cash Flow | Flexible credit terms and 0% interest for 60 days enhance cash flow. |

| Expense Management | Manage expenses and receipts efficiently with Flex Banking. |

| Team Efficiency | Issue cards to team members at no extra cost, improving efficiency. |

| High Security | FDIC & SIPC insurance, automated fraud monitoring, and robust encryption. |

| High APY | Earn up to 2.99% APY on idle cash, maximizing profit potential. |

Using a 0% interest business credit card like the Flex Credit Card can streamline financial management. It offers a range of features that support growth and efficiency in business operations.

Key Features Of 0% Interest Business Credit Cards

0% Interest Business Credit Cards offer several attractive features for businesses. These cards help manage finances efficiently. They come with various benefits that are designed to support business growth and streamline expenses.

Introductory 0% Apr Period

One of the most significant features is the introductory 0% APR period. This allows businesses to make purchases without paying interest for a specific time. For instance, with the Flex Credit Card, you get 0% interest for 60 days. This period can be crucial for managing cash flow and making large purchases without immediate financial pressure.

Rewards And Cashback Programs

Many 0% Interest Business Credit Cards offer rewards and cashback programs. These programs provide incentives for using the card, such as earning points or cashback on purchases. Although specific details on the Flex Credit Card’s rewards program are not provided, such features typically help businesses save money and earn rewards on everyday expenses.

Credit Limit And Flexibility

A key benefit of these cards is the flexibility in credit limits. The Flex Credit Card, for example, offers credit limits that grow with your business. This flexibility ensures that as your business expands, your credit limit adjusts accordingly. This feature supports your business’s evolving financial needs and helps manage larger expenses over time.

Additional Perks And Benefits

0% Interest Business Credit Cards often come with additional perks and benefits. The Flex Credit Card includes features like:

- Net-60 terms on all purchases, giving you two months to pay without interest.

- Expense management tools to track and manage spending easily.

- Individual employee cards at no extra cost, enhancing team efficiency.

- High security measures such as multi-factor authentication and robust encryption.

These benefits, combined with the 0% interest feature, make these cards a valuable tool for any business looking to optimize its financial management.

Pricing And Affordability

Understanding the pricing and affordability of the Flex Financial Platform is essential for businesses. The platform offers various features designed to enhance financial management, but it’s crucial to know the costs involved. Let’s break down the fees and charges, compare them with other business credit cards, and explore the long-term financial implications.

Breakdown Of Fees And Charges

The Flex Credit Card offers a 0% interest rate for the first 60 days. This means if you pay off the balance within this period, you avoid interest charges. After 60 days, interest accrues if the balance remains unpaid.

| Fee Type | Cost |

|---|---|

| Interest Rate (First 60 Days) | 0% |

| Interest Rate (After 60 Days) | Varies (based on terms) |

| ACH/Wire Payments | Free |

| Employee Card Issuance | Free |

Comparison With Other Business Credit Cards

When comparing Flex with other business credit cards, several factors stand out. Most business credit cards charge interest from the day of purchase. Flex offers a 60-day interest-free period.

- Flex Credit Card: 0% interest for 60 days, free ACH/Wire payments, free employee card issuance.

- Traditional Business Credit Cards: Immediate interest charges, fees for wire transfers, costs for issuing additional employee cards.

Long-term Financial Implications

Using the Flex Credit Card can have significant long-term financial benefits. The 60-day 0% interest period helps businesses manage cash flow more effectively. This can lead to better financial planning and reduced operational costs.

Additionally, the ability to issue employee cards at no extra cost and free ACH/Wire payments can save businesses money over time. The interest earned on cash deposits (up to 2.99% APY) further enhances the financial benefits.

In summary, the Flex Financial Platform’s pricing and affordability make it a competitive option for businesses seeking to optimize their financial management.

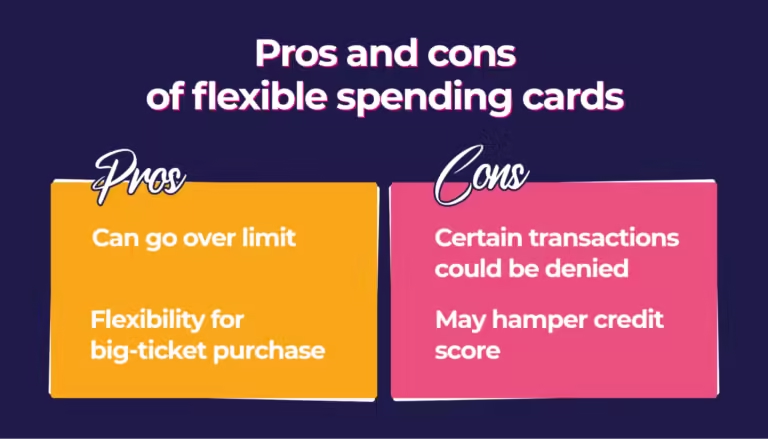

Pros And Cons Of 0% Interest Business Credit Cards

Choosing the right business credit card can significantly impact your company’s financial health. One popular option is the 0% interest business credit card. This type of card offers a grace period with no interest, which can be highly beneficial for managing cash flow and expenses. Below, we explore the pros and cons of 0% interest business credit cards.

Advantages For Business Owners

0% interest business credit cards offer multiple benefits that can help business owners manage their finances more effectively:

- Improved Cash Flow: With no interest for a specified period, businesses can better manage their cash flow. This allows for more flexibility in paying off expenses without incurring additional charges.

- Expense Management: These cards often come with tools to help manage expenses. For example, Flex offers expense management features that simplify tracking and categorizing business expenses.

- Team Efficiency: Issuing individual employee cards at no extra cost can streamline spending and improve team efficiency.

- High Security: Features like Multi-Factor Authentication (MFA) and robust encryption enhance financial security.

Potential Drawbacks And Considerations

While there are many advantages, there are also potential drawbacks and considerations to keep in mind:

- Limited Time Frame: The 0% interest is usually limited to an introductory period. For Flex, this is 60 days. After this period, interest rates apply if the balance is not paid in full.

- Credit Limits: Credit limits may initially be lower but can grow with your business. This might restrict spending in the early stages.

- Interest Accrual: If the balance is not paid within the grace period, interest will accrue, potentially leading to higher costs.

- Terms and Conditions: It’s important to review the terms and conditions thoroughly to understand all fees and requirements.

Real-world Usage Experiences

Many business owners find 0% interest business credit cards beneficial for their operations. Here are some real-world usage experiences:

- Startups: Startups often benefit from the initial 0% interest period as it allows them to invest in growth without immediate financial pressure.

- Small Businesses: Small businesses use these cards to manage cash flow during off-peak seasons, ensuring they can cover expenses without incurring interest.

- Established Companies: Even established companies use these cards to optimize cash flow and take advantage of expense management tools.

For more detailed information about the Flex Financial Platform and its offerings, visit Flex Financial Platform.

Who Should Consider A 0% Interest Business Credit Card?

A 0% interest business credit card can be a valuable tool for various businesses. It offers the flexibility to manage cash flow, make purchases, and handle expenses without immediate interest costs. But is it right for your business? Let’s explore who should consider this financial tool.

Ideal Businesses And Scenarios

Some businesses can benefit greatly from a 0% interest business credit card. Here are a few scenarios:

- Startups: New businesses often need to make significant initial investments. A 0% interest card can help spread these costs over time.

- Seasonal Businesses: Companies with fluctuating cash flow can use these cards to manage expenses during off-peak seasons.

- Expanding Businesses: Businesses looking to grow can use the extra cash flow to invest in new opportunities.

These cards are also ideal for businesses that want to improve cash flow and manage expenses more efficiently.

Specific Recommendations Based On Business Needs

Depending on your business needs, specific features of the Flex Financial Platform can be beneficial:

| Business Need | Recommended Feature |

|---|---|

| Manage Initial Investments | 0% Interest for 60 Days: Spread out initial costs without interest. |

| Handle Seasonal Cash Flow | Net-60 Terms: Delay payments to align with revenue cycles. |

| Improve Expense Management | Expense Management: Easily track and manage all business expenses. |

| Issue Employee Cards | Individual Employee Cards: Provide team members with their own cards. |

For businesses seeking to maximize idle cash, Flex Banking offers an APY of up to 2.99%, ensuring that your cash reserves are working for you. The ability to issue team cards and manage expenses seamlessly further adds to the platform’s value.

In addition, Flex’s high-security measures, such as Multi-Factor Authentication (MFA) and robust encryption, ensure that your financial data remains secure.

Frequently Asked Questions

What Is A 0% Interest Business Credit Card?

A 0% interest business credit card offers no interest on purchases or balance transfers for a limited period. This can help manage expenses and improve cash flow.

How Long Does The 0% Interest Period Last?

The 0% interest period typically lasts between 6 to 18 months. The exact duration depends on the card issuer’s terms and conditions.

Are There Any Fees With 0% Interest Cards?

Yes, there can be fees such as annual fees, balance transfer fees, or late payment fees. Always read the card’s terms carefully.

Can I Transfer Balances To A 0% Interest Card?

Yes, many 0% interest business credit cards allow balance transfers. This can help consolidate debt and reduce interest payments.

Conclusion

Choosing a 0% interest business credit card like Flex can boost your business. It offers flexible terms and high security. Manage expenses and cash flow with ease. Flex provides great features like free ACH/Wire payments and team cards. Improve your business efficiency today. Learn more about Flex Financial Platform by visiting their website. Make smart financial choices for your business growth. Explore Flex now.