Credit Card For Startups: Maximize Your Business Growth

Starting a business comes with many challenges. Managing finances shouldn’t be one of them.

A credit card designed for startups can help streamline expenses and manage cash flow efficiently. By providing financial flexibility, these cards can be a crucial tool for budding entrepreneurs. Flex, a financial platform, offers such a solution tailored for startups. Flex integrates banking, payments, and expense management into one seamless platform. With features like net-60 on all purchases and 0% interest for 60 days, Flex can support your business growth and provide the financial security you need. Discover more about how Flex can assist your startup by visiting their site here. Understanding the right financial tools for your startup can make a significant difference in your business journey.

Introduction To Credit Cards For Startups

Startups can benefit from credit cards by managing expenses and building credit history. These cards offer rewards and flexible payment options, aiding cash flow management.

Starting a new business requires strategic financial planning. One essential tool that can help is a credit card specifically designed for startups. These credit cards offer numerous benefits to new businesses, providing the much-needed financial support to fuel growth and manage expenses efficiently.Understanding The Importance Of Credit Cards For Startups

Credit cards for startups, like the Flex Credit Card, provide significant financial flexibility. They allow startups to make purchases and manage cash flow effectively. Here are some key reasons why they are important:- Immediate Access to Funds: Startups often face cash flow challenges. Credit cards provide instant access to funds.

- Expense Management: With tools for tracking and managing expenses, startups can maintain financial discipline.

- Building Credit: Using a business credit card responsibly helps build the company’s credit history.

- Rewards and Perks: Many business credit cards offer rewards, cash backs, and other perks that can be reinvested into the business.

How Credit Cards Can Fuel Business Growth

Credit cards can significantly contribute to a startup’s growth. The Flex Credit Card offers several features that make it an excellent choice for new businesses:| Feature | Benefit |

|---|---|

| Net-60 on All Purchases | Gives startups 60 days to pay off purchases without interest, easing cash flow management. |

| 0% Interest for 60 Days | Helps startups save on interest costs if the balance is paid within the grace period. |

| Growing Credit Limits | Credit limits increase with business growth, offering more financial flexibility as the startup expands. |

| Expense Management | Individual employee cards at no extra cost and real-time expense tracking simplify financial management. |

Key Features Of Credit Cards For Startups

Startups need financial tools that offer flexibility and support business growth. Credit cards tailored for startups, like the Flex Credit Card, provide numerous features to help manage expenses and improve cash flow. Here are some key features to consider:

High Credit Limits: Enabling Significant Purchases

One of the main advantages of startup credit cards is the high credit limits. This feature allows businesses to make significant purchases necessary for growth. With the Flex Credit Card, the credit limit grows with your business, ensuring you have the funds you need as your company expands.

Rewards And Cashbacks: Maximizing Financial Benefits

Many startup credit cards offer rewards and cashbacks on purchases. These financial benefits can add up quickly, providing extra funds that can be reinvested into the business. The Flex Credit Card also offers various incentives, making every purchase more rewarding.

Expense Management Tools: Keeping Track Of Business Spending

Effective expense management is crucial for startups. Credit cards like the Flex Credit Card come with tools that simplify tracking and categorizing business expenses. Flex also provides individual employee cards at no extra cost, making it easier to monitor and control spending across your team.

Low Or No Annual Fees: Cost-effective Solutions For Startups

Startup budgets are often tight, so finding cost-effective financial solutions is essential. Many credit cards for startups offer low or no annual fees. The Flex Credit Card has no annual fee, making it an affordable option for young businesses.

In summary, credit cards designed for startups, such as the Flex Credit Card, provide high credit limits, rewards, expense management tools, and low or no annual fees. These features help startups manage their finances effectively and support their growth journey.

Pricing And Affordability

Understanding the pricing and affordability of credit cards for startups is crucial. The right card can offer essential benefits without breaking the bank. Let’s explore the key aspects you need to consider.

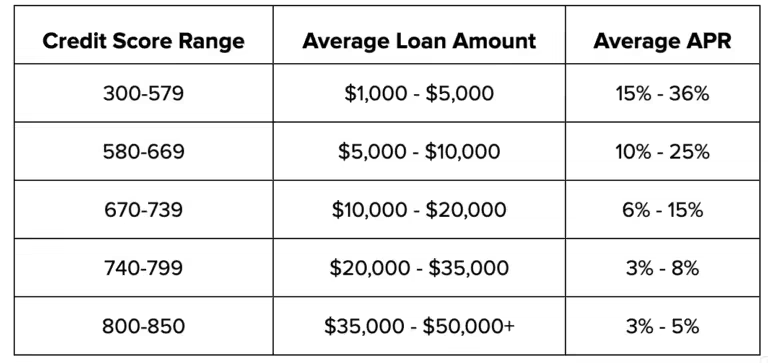

Interest Rates And Apr: What To Expect

Interest rates and APR (Annual Percentage Rate) are critical factors. Flex Credit Card offers a 0% interest for the first 60 days if the balance is paid within the grace period. This can provide significant savings for startups managing cash flow. Beyond the grace period, interest accrues if the balance is not cleared.

Annual Fees: Comparing Different Options

Annual fees can vary widely among credit cards. It’s essential to compare different options to find the most cost-effective solution. Flex Credit Card simplifies this with no extra cost for issuing individual employee cards, making it an attractive option for startups looking to minimize expenses.

Hidden Charges: What To Watch Out For

Hidden charges can quickly add up and impact your budget. Flex Credit Card is transparent with its pricing, ensuring no unexpected fees for using team cards or managing expenses. Always read the terms and conditions to avoid unpleasant surprises.

| Feature | Details |

|---|---|

| Interest Rate | 0% for 60 days if paid within grace period |

| APY | Up to 2.99% on cash on hand |

| Annual Fees | No extra cost for issuing team cards |

| Hidden Charges | Transparent pricing, no unexpected fees |

In summary, Flex Credit Card offers competitive rates and clear pricing, making it a cost-effective choice for startups.

Pros And Cons Of Using Credit Cards For Startups

Using credit cards can be a double-edged sword for startups. While they offer several benefits, they also come with certain risks. Understanding the pros and cons can help business owners make informed decisions.

Advantages: Boosting Cash Flow And Earning Rewards

Credit cards like the Flex Credit Card can significantly boost a startup’s cash flow. With features such as Net-60 on all purchases and 0% interest for 60 days if paid within the grace period, businesses can manage their finances more effectively.

Additionally, startups can earn rewards and benefits. The Flex Finance Super App offers up to 2.99% APY on cash on hand, helping businesses maximize their idle cash.

| Advantages | Details |

|---|---|

| Boosting Cash Flow | Net-60 on all purchases, 0% interest for 60 days |

| Earning Rewards | Up to 2.99% APY on cash on hand |

Disadvantages: Risks Of Debt And High-interest Rates

Credit cards also carry risks. If the balance is not paid within the grace period, interest rates can be high. This can lead to debt accumulation, which can be detrimental to a startup’s financial health.

It’s important to manage spending and ensure timely payments. The Flex Credit Card has a 60-day interest-free period, but if not managed well, the interest can accrue and increase costs.

In summary, while credit cards provide cash flow and rewards, they require careful management to avoid debt and high-interest rates.

| Disadvantages | Details |

|---|---|

| Risk of Debt | Potential debt accumulation if not managed properly |

| High-Interest Rates | Interest accrues if balance not paid within the grace period |

Specific Recommendations For Ideal Users Or Scenarios

The ideal credit card for a startup can vary based on the nature of the business. Here are some specific recommendations for tech startups, e-commerce businesses, and service-based startups.

Best Credit Cards For Tech Startups

Tech startups often require a credit card that offers flexibility and robust security features. The Flex Credit Card is an excellent choice due to its 0% interest for 60 days and net-60 terms on all purchases. This provides ample time to manage cash flow without accruing interest. Additionally, the card’s growing credit limits align with the startup’s growth, making it easier to scale operations.

- Expense Management: Issue individual employee cards at no extra cost.

- Security: Proactive protection, phishing deterrence, and device verification.

- High Yield: Earn up to 2.99% APY on cash on hand.

Top Choices For E-commerce Businesses

E-commerce businesses benefit from a credit card that supports frequent transactions and offers rewards. The Flex Finance Super App is particularly suitable as it integrates various back-office functions, including banking and payments, into a single platform. This streamlines operations and enhances efficiency.

| Feature | Benefit |

|---|---|

| Flex Banking | Simplified payments and expense management. |

| 0% Interest for 60 Days | Improves cash flow management. |

| Free ACH/Wire Payments | Reduces transaction costs. |

Ideal Credit Cards For Service-based Startups

Service-based startups need a credit card that facilitates easy tracking of expenses and offers robust security features. The Flex Credit Card stands out with its comprehensive expense management tools and advanced security measures. This card helps in keeping track of expenditures with real-time expense tracking and individual employee cards.

- Expense Tracking: Real-time tracking of all expenses.

- Security: Robust encryption, Multi-Factor Authentication, and automated fraud monitoring.

- FDIC Insurance: Up to $3M through Thread Bank, and up to $75M through ADM.

Frequently Asked Questions

What Is A Credit Card For Startups?

A credit card for startups is designed for new businesses. It helps manage expenses and build business credit.

Why Do Startups Need Credit Cards?

Startups need credit cards for managing cash flow. They also help in tracking expenses and improving credit scores.

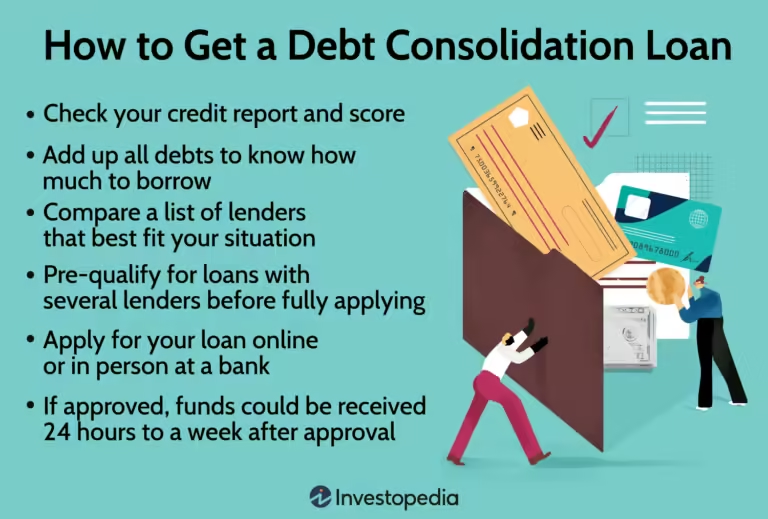

How To Choose A Startup Credit Card?

Choose a startup credit card by comparing interest rates, rewards, and credit limits. Look for one that suits your business needs.

Can Startups Get Credit Cards With No Credit History?

Yes, many credit card issuers offer cards specifically for startups. These are designed for businesses with no credit history.

Conclusion

Choosing the right credit card can propel your startup forward. Flex Finance Super App offers excellent features and benefits for businesses. With seamless banking, generous credit terms, and robust security, Flex supports your growth. Explore Flex to simplify your financial management and accelerate your business. Discover more about Flex here.