0% Apr Credit Card For Small Business: Boost Your Cash Flow

Managing expenses is crucial for small businesses. A 0% APR credit card can help.

This financial tool offers interest-free periods, easing cash flow. Flex offers a comprehensive financial platform for small businesses. Its 0% APR credit card is a standout feature, providing interest-free purchases for the first 60 days. Flex integrates banking, payments, and expense management into one easy-to-use app. With dynamic credit limits and no impact on credit scores, it’s designed to grow with your business. This card can simplify your financial management and enhance your cash flow. Explore more about Flex and see how it can benefit your small business by visiting their official website: Flex.

Introduction To 0% Apr Credit Cards For Small Businesses

Small businesses often face cash flow challenges. One effective solution is a 0% APR credit card. These cards offer a way to manage expenses without immediate interest charges, easing financial pressure.

What Is A 0% Apr Credit Card?

A 0% APR credit card allows you to make purchases without paying interest for a set period. This introductory period can range from a few months to over a year. For small businesses, this means you can invest in growth without worrying about accruing interest on your purchases.

The Importance Of Cash Flow In Small Businesses

Cash flow is the lifeblood of any small business. It ensures you can pay employees, manage inventory, and cover day-to-day expenses. A 0% APR credit card helps maintain healthy cash flow by offering interest-free credit for a limited time.

| Feature | Flex Credit Card |

|---|---|

| Interest Rate | 0% for the first 60 days |

| Credit Terms | Net-60 terms on all purchases |

| Credit Impact | Does not affect credit score upon application |

| Employee Cards | Individual cards at no extra cost |

Using a 0% APR credit card like Flex can significantly ease the cash flow burden. The Flex card offers net-60 terms on all purchases, providing ample time to pay off the balance. With no interest for the first 60 days, businesses can invest in growth initiatives without the immediate financial strain.

Flex also offers dynamic credit limits that grow with your business. This means as your business expands, your credit capacity increases. This scalability is crucial for small businesses aiming for long-term growth.

Additionally, Flex provides robust security features. These include multi-factor authentication, industry-standard encryption, and proactive phishing protection. Ensuring your financial data remains secure is vital for any business.

In summary, a 0% APR credit card like Flex can be a valuable tool for small businesses. It supports cash flow management, offers flexible credit terms, and provides robust security features. By integrating such a card into your financial strategy, you can focus on growing your business without the immediate worry of interest charges.

Key Features Of 0% Apr Credit Cards

Flex Credit Card offers unique advantages for small businesses. Understanding its key features can help you leverage these benefits effectively. Below are the core aspects that make Flex an excellent choice.

Interest-free Period: How Long Does It Last?

One of the standout features of the Flex Credit Card is its 0% interest for the first 60 days. This interest-free period provides businesses with a window to manage cash flow without incurring additional costs. It enables you to make significant purchases and plan repayments without the burden of interest.

Balance Transfer Options: Consolidate Your Debt

Flex Credit Card also supports balance transfer options. This allows you to consolidate existing debts into one manageable payment. By transferring balances from high-interest credit cards to Flex, you can take advantage of the 0% APR period to pay down your debt more efficiently.

Rewards And Cashback Programs: Maximize Your Spending

The Flex platform integrates rewards and cashback programs to help you maximize your spending. While making purchases, you can earn valuable rewards that can be reinvested in your business. This feature not only helps save money but also incentivizes spending in a way that benefits your business.

Credit Limit: Ensuring Adequate Financial Flexibility

Flex offers dynamic credit limits that grow with your business. This ensures you have the financial flexibility to meet your business needs. Whether it’s handling unexpected expenses or investing in growth opportunities, having a scalable credit limit provides the necessary support.

The Flex Credit Card also offers individual employee cards at no extra cost. This feature allows you to manage team expenses more effectively, track spending, and ensure proper allocation of resources. It simplifies expense management by integrating all financial functions into one platform.

In addition, Flex does not impact your credit score upon application, providing peace of mind while applying for credit.

| Feature | Details |

|---|---|

| Interest-Free Period | 0% interest for the first 60 days |

| Balance Transfer | Supports debt consolidation |

| Rewards and Cashback | Incentivizes spending with rewards |

| Credit Limit | Dynamic limits that grow with your business |

| Employee Cards | Individual cards at no extra cost |

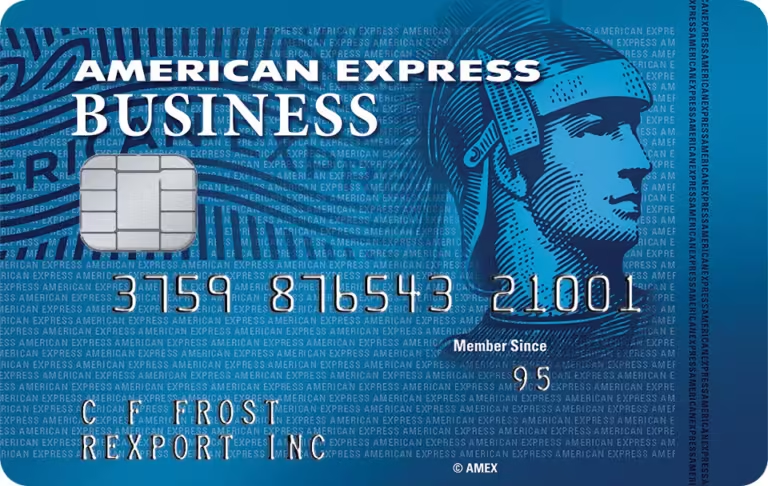

Pricing And Affordability

Understanding the pricing and affordability of a 0% APR credit card is crucial for small businesses. Flex offers a range of features designed to support business growth while keeping costs manageable. Let’s delve into the specifics of annual fees, hidden charges, and how to compare different providers to get the best deal.

Annual Fees: Are They Worth It?

Many business credit cards come with annual fees. These fees can be a worthwhile investment, given the right benefits. With Flex, businesses enjoy a 0% interest for the first 60 days. This allows companies to make purchases without immediate financial strain. Furthermore, Flex provides individual employee cards at no extra cost. This feature can save businesses a significant amount of money in the long run.

When evaluating the worth of annual fees, consider the net-60 terms on all purchases offered by Flex. This means businesses have two months to repay without accruing interest. Such terms can enhance cash flow management, making annual fees a justified expense. The potential to earn up to 2.99% APY on cash deposits further adds value, offsetting any fees paid.

Hidden Charges: What To Look Out For

Hidden charges can erode the benefits of a business credit card. Flex is transparent with its fees, ensuring businesses understand what they are paying for. One key area to watch is the interest that accrues if the balance is not paid within the 60-day grace period. Flex’s dynamic credit limits grow with the business, providing flexibility without unexpected costs.

Other potential hidden charges include fees for ACH/wire payments. Flex offers these services for free, which is a significant advantage over other providers. By integrating multiple financial functions into a single platform, Flex reduces the risk of hidden charges. This integration streamlines expense management, making it easier for businesses to track costs.

Comparing Different Providers: Getting The Best Deal

Comparing different credit card providers can be overwhelming. To get the best deal, consider the unique benefits offered by each provider. Flex stands out with its combination of 0% interest for the first 60 days, dynamic credit limits, and no impact on credit score upon application.

Use the table below to compare key features of Flex with typical business credit cards:

| Feature | Flex | Typical Business Credit Card |

|---|---|---|

| Interest Rate | 0% for 60 days | Varies, often above 15% |

| Annual Fees | Varies, often justified by benefits | Varies, not always justified |

| Employee Cards | Free | Often charged |

| Hidden Charges | Minimal, transparent | Can be significant |

| Credit Score Impact | None upon application | Possible impact |

By comparing these features, businesses can make an informed decision. Flex’s integrated financial platform and robust security measures make it an attractive option. The potential to earn up to 2.99% APY on idle cash further enhances its appeal. For small businesses looking for a cost-effective credit card solution, Flex offers a compelling package.

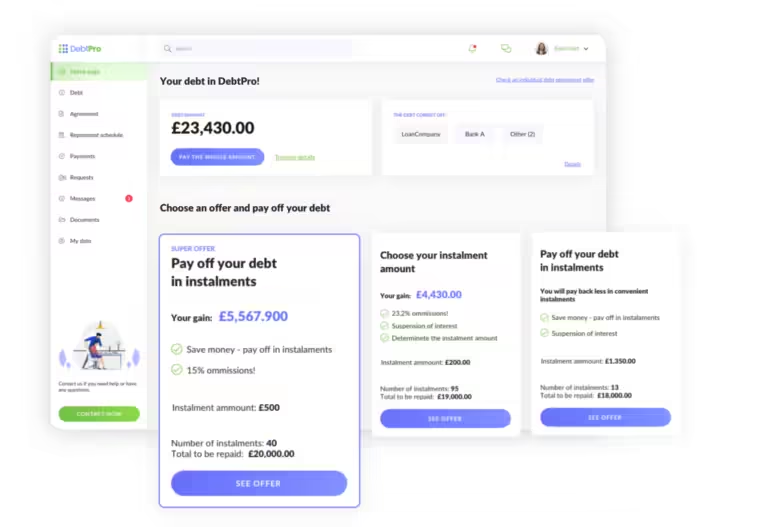

Pros And Cons Of 0% Apr Credit Cards

0% APR credit cards can be a great tool for small businesses. They offer benefits but also come with some drawbacks. Understanding both is essential for making an informed decision.

Advantages: How It Benefits Your Business

The main advantage of a 0% APR credit card is the interest-free period. For example, the Flex Credit Card offers 0% interest for the first 60 days. This can help businesses manage cash flow effectively and make essential purchases without immediate financial pressure.

- Cash Flow Management: With 0% APR, businesses can make purchases and pay them off over time without incurring interest.

- Expense Management: Flex’s digital platform simplifies expense tracking and receipt capture, helping businesses stay organized.

- Employee Cards at No Extra Cost: Flex offers individual employee cards, helping manage team expenses efficiently.

- Credit Growth: Flex’s dynamic credit limits grow with your business, providing more flexibility as your needs change.

- High Yield on Cash Deposits: Earn up to 2.99% APY on cash deposits, making idle cash work for you.

Disadvantages: Potential Drawbacks To Consider

While there are many benefits, there are also some potential drawbacks to consider:

- Limited Interest-Free Period: The 0% APR is only available for the first 60 days. After that, interest will accrue if the balance is not paid off.

- Potential for Debt: If not managed carefully, businesses can accumulate debt during the interest-free period, leading to financial strain once the period ends.

- Terms and Conditions: It’s crucial to understand the terms and conditions, as failing to meet them can result in higher costs.

By weighing the pros and cons, businesses can decide if a 0% APR credit card like the Flex Credit Card is the right financial tool for their needs.

Specific Recommendations For Ideal Users Or Scenarios

The Flex credit card offers numerous benefits for small businesses. The 0% APR for 60 days and other features make it a valuable tool. Here are specific scenarios where the Flex card can be especially beneficial.

Startups: Establishing A Financial Foundation

Startups often need to manage cash flow while building their foundation. The Flex credit card is perfect for new businesses.

- 0% interest for 60 days: Helps manage early expenses without immediate interest.

- Dynamic credit limits: Grows with your business needs.

- Individual employee cards: No extra cost, ideal for managing team expenses.

These features make the Flex card a smart choice for startups looking to establish a stable financial base.

Seasonal Businesses: Managing Seasonal Cash Flow

Seasonal businesses face unique cash flow challenges. The Flex credit card can help manage these seasonal fluctuations efficiently.

- Net-60 terms: Buy now, pay later, matching income cycles.

- Expense management: Simplified banking and expense tracking tools.

- High yield on cash deposits: Earn up to 2.99% APY on cash on hand.

This flexibility ensures that seasonal businesses can optimize their cash flow throughout the year.

Businesses With High Initial Expenses: Easing Financial Pressure

Businesses with significant upfront costs need financial tools to ease the burden. The Flex card offers several advantages.

- 0% APR for 60 days: Manage large initial expenses without interest.

- High credit limits: Scalable to meet substantial financial needs.

- Integrated platform: Simplifies financial management with a single, easy-to-use app.

These benefits help businesses with high initial expenses reduce financial stress and focus on growth.

Frequently Asked Questions

What Is A 0% Apr Credit Card?

A 0% APR credit card offers no interest on purchases for a promotional period. This helps businesses manage cash flow.

How Can A 0% Apr Card Benefit My Small Business?

A 0% APR card can save on interest costs. This allows for better cash management and investment in growth.

Are There Any Fees With 0% Apr Credit Cards?

Some 0% APR credit cards may have annual fees. Always read the terms and conditions to understand all fees involved.

How Long Does The 0% Apr Period Last?

The 0% APR period typically lasts between 6 to 18 months. Check the specific card’s terms for exact duration.

Conclusion

Choosing a 0% APR credit card like Flex can benefit small businesses. It offers interest-free purchases for the first 60 days. This helps with cash flow management and reduces financial stress. Flex also provides dynamic credit limits and robust security features. For more details, check out their website.