Effective Credit Management: Boost Your Financial Health Today

Effective credit management is crucial for financial stability. It involves smart strategies to maintain and improve credit scores.

Understanding how to manage credit effectively can transform your financial health. Credit scores impact loan approvals, interest rates, and even job prospects. A high score opens doors to better opportunities. But how do you achieve and maintain a good score? The process isn’t always straightforward. Programs like Boost Your Score can help. They offer tools like credit builder loans and secured credit cards. These tools aid in building positive credit histories. Regular updates on your FICO score keep you informed. Consistent, on-time payments improve your credit score. This, in turn, enhances your financial freedom. Ready to dive deeper? Let’s explore effective credit management strategies.

Introduction To Effective Credit Management

Effective credit management is crucial for maintaining and improving your financial health. It involves managing your credit accounts, making timely payments, and monitoring your credit score. This section will cover the basics of credit management and its importance.

Understanding Credit Management

Credit management involves the strategies and processes used to maintain and improve your credit score. It includes managing existing credit lines, ensuring timely repayments, and keeping track of your credit history. Consistent and responsible credit management can lead to a positive credit history and access to better financial opportunities.

One effective tool for credit management is the Boost Your Score program. This program offers a Credit Builder Loan and a Secured Credit Card to help improve your credit score. Regular payments towards these credit products are reported as positive credit history, which can significantly enhance your creditworthiness.

Importance Of Credit Management For Financial Health

Proper credit management is essential for maintaining good financial health. A good credit score can make it easier to get loans, mortgages, and even jobs. It shows lenders and other entities that you are responsible with your finances.

Here are some key benefits of effective credit management:

- Improved Credit Score: Regular, on-time payments can enhance your credit score.

- Financial Discipline: Encourages consistent payments without immediate access to borrowed funds.

- Access to Credit: Provides a secured credit card, offering another method to build credit.

- Money Retention: Payments made are yours to keep, minus interest, fees, and any outstanding balances.

For example, the Boost Your Score program offers various plans to suit different financial needs:

| Plan | Monthly Cost | Total Payment | Get Back | Est. APR | Est. Interest Rate | Loan Amount |

|---|---|---|---|---|---|---|

| Mini Boost | $30 | $360 | $300 | 34.82% | 35.56% | $300 |

| Boost | $64 | $768 | $650 | 31.76% | 32.41% | $650 |

| Mega Boost | $82 | $984 | $850 | 27.76% | 28.31% | $850 |

The right credit management plan can help you achieve a higher credit score, providing more financial opportunities in the future.

Key Features Of Effective Credit Management

Effective credit management is essential for maintaining a healthy financial life. It involves keeping track of your credit activities, budgeting wisely, ensuring timely payments, managing debts efficiently, and building a strong credit score. Below are the key features that contribute to effective credit management.

Regular credit monitoring helps you stay informed about your credit status. It allows you to detect and address any inaccuracies or fraudulent activities promptly. By using services like Boost Your Score, you can receive free monthly FICO score updates, giving you a clear picture of your credit health.

Developing a budget is crucial for managing your finances. It helps you allocate your income towards essential expenses and savings, ensuring you have enough to cover your monthly bills. Utilize tools and resources to create a budget that suits your financial goals and stick to it diligently.

Timely bill payments are vital for maintaining a good credit score. Late payments can negatively impact your credit history. Services like Boost Your Score offer automated payments to ensure you never miss a due date. This feature can significantly enhance your payment history, a major factor in creditworthiness.

Managing debt wisely involves understanding your debt obligations and making payments on time. It’s important to avoid accumulating high-interest debt. Consider options like a credit builder loan to improve your credit score while managing your debt efficiently.

Building and maintaining a good credit score requires consistency and financial discipline. Regular, on-time payments and responsible credit usage are key. With Boost Your Score, you can access a secured credit card after making four loan payments, providing another method to build positive credit history.

| Product | Monthly Cost | Total Payment | Get Back | Loan Amount |

|---|---|---|---|---|

| Mini Boost | $30 for 12 months | $360 | $300 | $300 |

| Boost | $64 for 12 months | $768 | $650 | $650 |

| Mega Boost (Best Value) | $82 for 12 months | $984 | $850 | $850 |

Effective credit management is a continuous process. By focusing on these key features, you can take control of your financial future and build a strong credit profile.

Regular Credit Monitoring

Effective credit management hinges on regular credit monitoring. Keeping a close watch on your credit report helps you stay informed about your financial health. This practice can alert you to potential issues, allowing for prompt action.

Tools For Monitoring Your Credit

Several tools can assist in monitoring your credit. These tools provide insights into your credit score and report, helping you understand your financial standing.

- Credit Monitoring Services: Services like Boost Your Score offer free monthly FICO score updates.

- Credit Report Access: You can access your credit report from major bureaus annually at no cost.

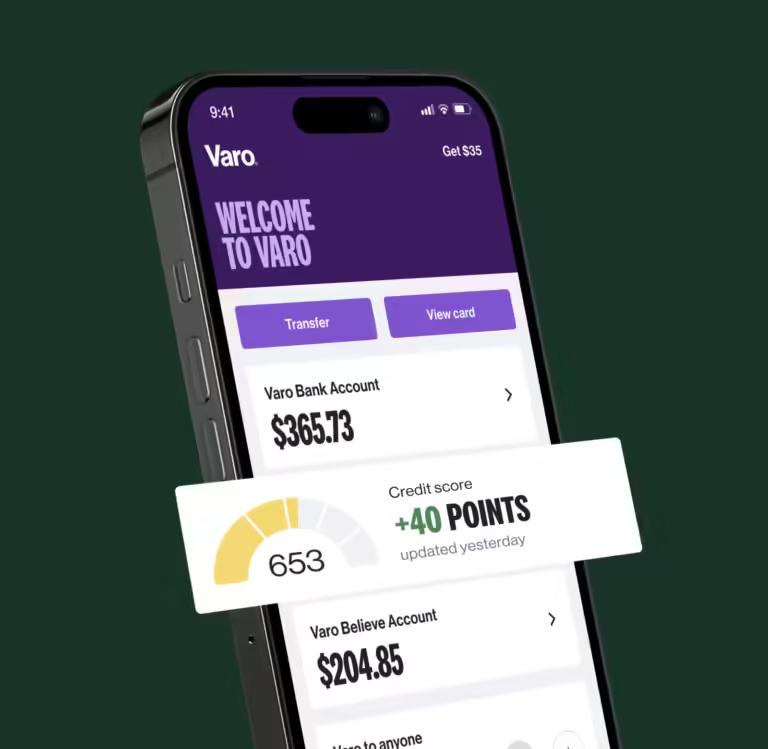

- Mobile Apps: Many banks and financial institutions offer apps for real-time credit score monitoring.

Using these tools, you can track changes in your credit report and quickly address any discrepancies.

Benefits Of Regular Credit Checks

Regular credit checks offer several benefits. They help maintain a healthy credit profile and safeguard against fraud.

- Early Detection of Errors: Regular checks help identify errors or inaccuracies in your report.

- Fraud Prevention: Monitoring can spot unauthorized activities, protecting you from identity theft.

- Financial Planning: Understanding your credit score aids in better financial planning and decision-making.

By keeping a close eye on your credit, you ensure your financial stability and readiness for future financial needs.

Boost Your Score: A Tool For Credit Monitoring

Boost Your Score provides an excellent solution for those seeking to monitor and improve their credit. The program offers several features designed to build and maintain a positive credit history.

Main Features:

- Credit Builder Loan: Payments are held in a deposit account until the loan is paid off.

- Secured Credit Card: Available after the fourth loan payment, linked to the credit builder loan.

- Positive Credit Reporting: Payments are reported as positive credit history.

- Automated Payments: Easy setup for automatic monthly payments.

- Free Monthly FICO Score Updates: Regular updates on your credit score.

Benefits:

- Improved Credit Score: Regular, on-time payments can enhance your credit score.

- Financial Discipline: Encourages consistent payments without immediate access to borrowed funds.

- Access to Credit: Provides a secured credit card after four payments.

- Money Retention: Payments made are yours to keep, minus interest, fees, and any outstanding balances.

For more details, visit Boost Your Score.

Pricing Details

| Package | Monthly Cost | Total Payment | Get Back | Est. APR | Est. Interest Rate | Loan Amount |

|---|---|---|---|---|---|---|

| Mini Boost | $30 for 12 months | $360 | $300 | 34.82% | 35.56% | $300 |

| Boost | $64 for 12 months | $768 | $650 | 31.76% | 32.41% | $650 |

| Mega Boost (Best Value) | $82 for 12 months | $984 | $850 | 27.76% | 28.31% | $850 |

Refund Policy: Upon completion, participants receive the total amount saved, minus any interest, fees, and outstanding balances.

For more information, contact Boost Your Score at 1 (800) 259-1270 or easy@boostyourscore.com.

Developing A Budget

Managing credit effectively starts with developing a budget. A budget helps you track your spending and ensures you allocate funds towards paying off debts. This can be crucial for improving your credit score using tools like Boost Your Score.

Steps To Create An Effective Budget

Follow these steps to create an effective budget:

- List Your Income: Record all sources of income, including salary, freelance work, and any other earnings.

- Track Your Expenses: Categorize your expenses into fixed (rent, bills) and variable (entertainment, dining out).

- Set Financial Goals: Determine your short-term and long-term financial goals, like saving for a vacation or paying off a loan.

- Create a Spending Plan: Allocate your income towards expenses, savings, and debt repayment. Ensure you prioritize high-interest debts.

- Monitor and Adjust: Regularly review your budget and adjust it as needed to stay on track with your financial goals.

How Budgeting Helps In Credit Management

Budgeting plays a vital role in credit management:

- Ensures Timely Payments: By allocating funds for debt repayment, you reduce the risk of missed or late payments.

- Improves Credit Score: Consistent, on-time payments positively impact your credit score. This is especially important for programs like Boost Your Score.

- Controls Spending: A budget helps you avoid overspending, ensuring you have enough funds to cover your financial obligations.

- Reduces Financial Stress: Knowing where your money goes can reduce anxiety and help you make informed financial decisions.

For example, using Boost Your Score, you can set up automated payments to ensure your credit builder loan payments are always on time. This can significantly improve your credit score over time.

| Plan | Monthly Cost | Total Payment | Get Back | Est. APR | Loan Amount |

|---|---|---|---|---|---|

| Mini Boost | $30 | $360 | $300 | 34.82% | $300 |

| Boost | $64 | $768 | $650 | 31.76% | $650 |

| Mega Boost | $82 | $984 | $850 | 27.76% | $850 |

Developing a budget can be the first step towards better credit management and financial stability. Using tools like Boost Your Score can further aid in achieving your financial goals.

Timely Bill Payments

Ensuring timely bill payments is crucial for effective credit management. Paying bills on time helps maintain a healthy credit score and prevents penalties or extra fees. Late payments can significantly impact your financial standing and creditworthiness. This section will explore strategies for ensuring on-time payments and the impact of late payments on your credit score.

Strategies For Ensuring On-time Payments

To avoid missing payments, consider the following strategies:

- Set Up Automated Payments: Many services, like Boost Your Score, offer automated payments. This ensures bills are paid on time without manual intervention.

- Create Reminders: Use calendar alerts or reminder apps to notify you of upcoming payment dates.

- Consolidate Bills: If possible, consolidate bills to reduce the number of payments you need to track.

- Budget Wisely: Allocate funds for bills first, then manage other expenses. This ensures you always have enough to cover your payments.

Impact Of Late Payments On Credit Score

Late payments can have a significant negative effect on your credit score. Here’s how:

| Duration of Late Payment | Impact on Credit Score |

|---|---|

| 30 Days Late | Minor impact, but still noticeable |

| 60 Days Late | Moderate impact, harder to recover |

| 90+ Days Late | Severe impact, long-term damage |

Late payments are reported to credit bureaus, reducing your credit score. This can affect your ability to secure loans, get favorable interest rates, and can even impact job opportunities.

Using tools like Boost Your Score can help manage and ensure timely payments, improving your credit score over time. Regular, on-time payments and access to a secured credit card after four payments, offer a structured path to better credit.

Managing Debt Wisely

Effective debt management is crucial for maintaining good financial health. Understanding different types of debt and their impact is the first step. Let’s explore how to handle various debts, repayment strategies, and options like consolidation and refinancing.

Different Types Of Debt And How To Handle Them

Debt comes in many forms, each requiring a unique approach. Here are some common types and tips for managing them:

- Credit Card Debt: High-interest rates make this a priority. Pay more than the minimum to reduce the balance faster.

- Student Loans: Often have lower interest rates. Consider income-driven repayment plans if you’re struggling.

- Mortgage: Typically, your largest debt. Refinance if you can get a lower interest rate.

- Auto Loans: Ensure you’re not underwater on the loan. Pay off as soon as possible to avoid negative equity.

Debt Repayment Strategies

Choosing the right repayment strategy can save money and stress. Here are some popular methods:

- Debt Snowball: Pay off the smallest debt first. Gain momentum as you clear each balance.

- Debt Avalanche: Focus on the debt with the highest interest rate. Save on interest over time.

- Automated Payments: Set up automatic payments to ensure you never miss a due date.

Consolidation And Refinancing Options

Consolidating or refinancing can simplify your finances. Here’s how:

| Option | Pros | Cons |

|---|---|---|

| Debt Consolidation | Single monthly payment, possibly lower interest rate | May extend repayment period, potential fees |

| Refinancing | Lower interest rate, reduced monthly payments | May incur closing costs, impact credit score temporarily |

Programs like Boost Your Score offer structured plans to improve credit. Through consistent payments and positive credit reporting, you can achieve better financial stability.

Building And Maintaining A Good Credit Score

Maintaining a good credit score is essential for financial stability. It helps in securing loans, lower interest rates, and favorable terms. Here’s how you can build and maintain a good credit score effectively.

Factors Affecting Your Credit Score

- Payment History: Timely payments improve your score.

- Credit Utilization: Keeping balances low on credit cards.

- Credit Age: Longer credit history benefits your score.

- New Credit: Frequent applications can lower your score.

- Credit Mix: A variety of credit types is favorable.

Tips For Improving Your Credit Score

- Pay Your Bills on Time: Late payments negatively impact your score.

- Reduce Debt: Lowering outstanding balances can boost your score.

- Use Credit Builder Programs: Consider programs like Boost Your Score to build positive credit history.

- Check Credit Reports: Regularly review your credit reports for errors.

- Limit New Credit Applications: Apply for new credit only when necessary.

Common Mistakes To Avoid

- Missing Payments: Even one missed payment can lower your score.

- Maxing Out Credit Cards: High balances negatively affect your score.

- Closing Old Accounts: Keep old accounts open to maintain credit history length.

- Ignoring Credit Report Errors: Dispute inaccuracies to avoid negative impacts.

- Applying for Too Much Credit: Each application can slightly reduce your score.

Using Boost Your Score can significantly help in managing and improving your credit score. Their credit builder loan, secured credit card, and positive credit reporting are effective tools to build a solid credit foundation.

For more details, visit Boost Your Score.

Pricing And Affordability Of Credit Management Tools

Credit management tools come in various pricing models. Some are free, while others require a subscription or one-time payment. Understanding the pricing and affordability of these tools can help you make an informed decision.

Free Vs. Paid Credit Management Tools

There are both free and paid options for credit management tools. Free tools often provide basic features such as:

- Credit score tracking

- Basic financial advice

- Limited credit report access

Paid tools, on the other hand, offer advanced features. These include:

- Detailed credit reports

- Credit score simulators

- Personalized financial advice

- Access to secured credit cards

For example, Boost Your Score is a paid program. It offers a credit builder loan, positive credit reporting, and free monthly FICO score updates. The program also provides a secured credit card after making four loan payments.

Cost-benefit Analysis Of Different Tools

Evaluating the cost and benefits of credit management tools is essential. Let’s compare the different plans offered by Boost Your Score:

| Plan | Monthly Cost | Total Payment | Amount Returned | Estimated APR | Estimated Interest Rate | Loan Amount |

|---|---|---|---|---|---|---|

| Mini Boost | $30 | $360 | $300 | 34.82% | 35.56% | $300 |

| Boost | $64 | $768 | $650 | 31.76% | 32.41% | $650 |

| Mega Boost | $82 | $984 | $850 | 27.76% | 28.31% | $850 |

The Mini Boost plan has a lower monthly cost but higher interest rates. The Mega Boost offers the best value with lower interest rates and higher returns. These details help in understanding which plan fits your budget and needs best.

Additionally, Boost Your Score’s benefits include:

- Improved credit score through positive reporting

- Financial discipline through structured payments

- Access to a secured credit card

- Retention of money paid, minus fees and interest

Assessing these factors ensures you choose a tool that balances cost and benefits effectively.

Pros And Cons Of Effective Credit Management

Effective credit management is crucial for maintaining financial stability. Understanding the advantages and potential drawbacks can help you make informed decisions about your credit.

Advantages Of Proper Credit Management

- Improved Credit Score: Regular, on-time payments enhance your credit score. This is important because payment history is a significant factor in creditworthiness.

- Access to Better Credit Options: A higher credit score can lead to better loan and credit card offers. This includes lower interest rates and higher credit limits.

- Financial Discipline: Credit management encourages consistent payments. This helps build financial discipline, reducing the likelihood of debt accumulation.

- Positive Credit Reporting: Tools like Boost Your Score report payments as positive credit history, which can benefit your credit score over time.

- Automated Payments: Setting up automated payments ensures you never miss a due date. This helps maintain a good payment history.

- Access to Secured Credit Cards: Programs like Boost Your Score offer secured credit cards after a few successful payments. This provides another method to build credit.

- Money Retention: Payments made are yours to keep, minus interest, fees, and any outstanding balances.

Challenges And Potential Drawbacks

- High APR and Interest Rates: Credit builder loans can have high APR and interest rates. For example, Boost Your Score’s Mini Boost has an estimated APR of 34.82%.

- Commitment to Monthly Payments: Effective credit management requires a commitment to making monthly payments. Missing payments can harm your credit score.

- Initial Access to Funds: With programs like Boost Your Score, you don’t have immediate access to borrowed funds. Payments are held in a deposit account until the loan is paid off.

- Fees and Balances: Upon completion, participants receive the amount saved, minus any interest, fees, and outstanding balances. This reduces the total money you get back.

- Potential for Overextension: Access to higher credit limits can lead to overextending yourself financially. This can result in debt if not managed properly.

- Regular Monitoring Needed: Maintaining good credit requires regular monitoring of your credit score and report. This helps ensure accuracy and identify potential issues early.

Understanding the pros and cons of effective credit management is essential. It helps you leverage the benefits while being mindful of the challenges.

Specific Recommendations For Ideal Users

Effective credit management is essential for anyone who wishes to maintain a healthy financial life. With the Boost Your Score program, individuals can take significant steps towards improving their credit scores. Here are specific recommendations for those who can benefit most from effective credit management and scenarios where credit management is crucial.

Who Can Benefit Most From Effective Credit Management

Effective credit management is not only for those with poor credit scores. It is equally beneficial for individuals looking to build or maintain good credit. Here are some ideal users:

- Young Adults: They can start building their credit history early with a secured credit card.

- Students: They can manage their finances better and prepare for future credit needs.

- First-Time Borrowers: They can establish a positive credit history through regular, on-time payments.

- Individuals with Bad Credit: They can improve their credit scores by making consistent payments.

- People with No Credit History: They can start building their credit with the credit builder loan.

Scenarios Where Credit Management Is Crucial

Certain life situations demand effective credit management to achieve financial goals. Here are some scenarios:

- Buying a Home: A good credit score can help secure a mortgage with favorable terms.

- Starting a Business: Good credit can make it easier to get business loans or lines of credit.

- Purchasing a Car: Effective credit management can lead to better auto loan rates.

- Applying for a Job: Some employers check credit history as part of their hiring process.

- Renting an Apartment: Landlords may prefer tenants with good credit scores.

Boost Your Score offers tools like the credit builder loan and secured credit card to help users in these scenarios. The program promotes financial discipline by encouraging consistent payments and providing free monthly FICO score updates.

| Plan | Monthly Cost | Total Payment | Amount Returned | Estimated APR |

|---|---|---|---|---|

| Mini Boost | $30 | $360 | $300 | 34.82% |

| Boost | $64 | $768 | $650 | 31.76% |

| Mega Boost | $82 | $984 | $850 | 27.76% |

For more information, visit Boost Your Score or contact their support team at 1 (800) 259-1270 or via email at easy@boostyourscore.com.

Frequently Asked Questions

What Is Credit Management?

Credit management involves overseeing and controlling credit extended to customers. It ensures timely payments and minimizes bad debts. Efficient credit management improves cash flow and financial stability.

Why Is Credit Management Important?

Credit management is crucial for maintaining liquidity. It reduces the risk of bad debts and improves cash flow. Proper management also enhances customer relationships and creditworthiness.

How Can Businesses Improve Credit Management?

Businesses can improve credit management by setting clear credit policies. Regularly reviewing customer creditworthiness and implementing automated systems also help. Training staff on credit management practices is essential.

What Are Common Credit Management Strategies?

Common strategies include credit scoring, setting credit limits, and regular monitoring. Offering early payment discounts and maintaining good customer relationships are also effective.

Conclusion

Effective credit management is vital for financial well-being. Consistent, on-time payments boost your credit score. Consider using tools like Boost Your Score to improve your credit history. It offers a credit builder loan and a secured credit card. These can help build a positive credit history. Automated payments make the process easier. For more details, visit Boost Your Score. With discipline and the right tools, you can achieve better credit health. Start your journey to a stronger credit score today.