Financial Product Reviews: Unbiased Insights for Smart Decisions

Are you looking to improve your financial health? Understanding different financial products can be challenging.

In our detailed financial product reviews, we simplify this process by breaking down various options, helping you make informed decisions. Financial products like credit cards and savings accounts play a crucial role in managing your finances. Choosing the right products can save you money and improve your credit score. In this blog, we will review Ava Finance’s Ava Credit Builder, a tool designed to build credit quickly and efficiently. Ava Credit Builder is known for its user-friendly approach, no interest fees, and high success rate. Read on to find out how Ava can help you enhance your credit profile and achieve financial stability. For more details, visit the Ava website.

Introduction To Financial Product Reviews

Financial product reviews are critical in today’s economy. They help consumers make informed choices. Understanding the value and features of products like credit cards is essential. These reviews offer insights that can influence financial decisions significantly.

Purpose Of Financial Product Reviews

The main purpose is to provide a detailed analysis of financial products. This includes their benefits, drawbacks, and unique features. For example, the Ava Credit Builder helps users build their credit profile quickly. It does this without requiring a credit check, and it reports to all three major credit bureaus.

Reviews also compare different products. This comparison can highlight which product is best suited for specific needs. For instance, the Ava Credit Builder has no interest or late fees, making it a compelling choice for users looking to improve their credit scores.

Importance Of Unbiased Insights For Smart Decisions

Unbiased insights are crucial. They ensure that the information provided is accurate and trustworthy. Reviews that are free from promotional bias help consumers make smart decisions. For Ava Finance, unbiased reviews would emphasize its high ratings and the quick credit score improvement seen by 74% of its members.

Additionally, these insights cover both the pros and cons of a product. This helps in setting realistic expectations. Ava’s money-back guarantee after the completion of a term is an example of a beneficial feature that unbiased reviews would highlight.

| Feature | Description |

|---|---|

| No Credit Check | Start building credit without a credit check |

| No Interest or Late Fees | Avoid extra costs with no interest or late fees |

| Reports to All Bureaus | Equifax, Experian, and TransUnion receive updates within 24 hours |

| High Ratings | Rated 4.9 stars from over 13,000 reviews on the App Store |

In conclusion, unbiased financial product reviews are essential. They provide valuable insights that empower consumers to make well-informed financial decisions.

Key Features Of Financial Products

Understanding the key features of financial products is essential for making informed decisions. Ava Finance offers various features designed to help users build their credit profiles efficiently and securely.

Diverse Range Of Financial Products

Ava Finance provides a variety of financial products, including the Ava Credit Builder Mastercard and the Save & Build Credit Account. These products help users improve their credit scores quickly and effectively. Ava reports to all three major credit bureaus, ensuring that your credit history reflects your responsible financial behavior.

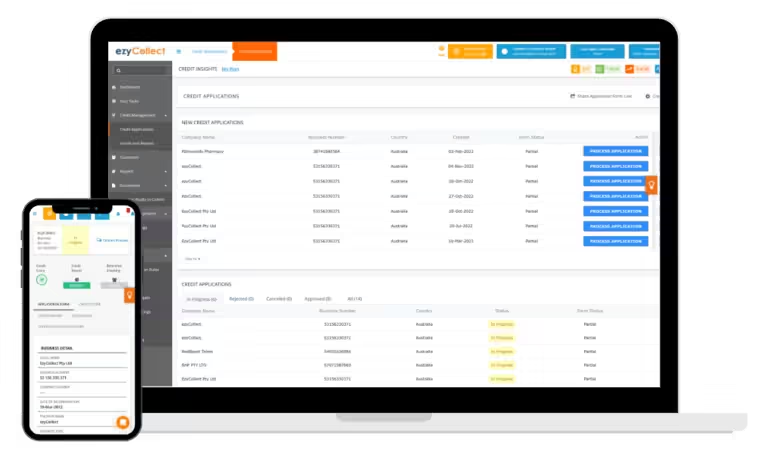

User-friendly Interfaces

The Ava Finance platform is designed with the user in mind. The interface is intuitive and easy to navigate, making it simple for users to manage their accounts. Signing up is straightforward, and linking a bank account is hassle-free. The user-friendly design ensures that even those new to credit building can easily understand and use the platform.

Comprehensive Reporting Tools

Ava Finance offers robust reporting tools that provide users with detailed insights into their credit-building progress. Ava reports to Equifax, Experian, and TransUnion within 24 hours of each payment. This immediate reporting helps users see the impact of their financial activities on their credit scores in real-time. Additionally, Ava addresses four of the five major factors that credit bureaus consider in determining scores.

Security And Data Protection

Security is a top priority for Ava Finance. The platform uses 256-bit encryption to keep personal information safe. Ava does not sell user data or save banking logins, ensuring that your financial information remains secure. Ava partners with trusted financial institutions, such as Evolve Bank & Trust and Patriot Bank, to provide secure services.

For more details on Ava Finance and its products, visit their official website.

Pricing And Affordability

Understanding the pricing and affordability of financial products is crucial. Ava Finance offers a range of features designed to improve your credit score. Let’s explore its pricing structure, subscription plans, and the value it provides.

Subscription Plans And Costs

Ava Finance does not explicitly state the cost of its services. It includes the use of the Ava Credit Builder Mastercard and the Save & Build Credit account. These services are bundled into a membership plan, which users need to subscribe to.

Free Vs. Paid Features

Ava offers a unique blend of features without additional costs. There are no credit checks, interest rates, or late fees. All members get access to the Ava Credit Builder Mastercard and the Save & Build Credit account. Ava reports your payments to all three credit bureaus, which is a valuable feature for credit building.

Value For Money

Ava Finance provides significant value for its members.

- 74% of members see a credit score improvement in less than 7 days.

- Potential annual savings of $2,700 on car, mortgage, and credit card payments with a 100-point credit score increase.

- Members get all their money back after completing a 12 or 24-month term in the Save & Build Credit account.

Pros And Cons Of Financial Products

Understanding the pros and cons of financial products is essential for making informed decisions. Each product has its unique features, benefits, and limitations. In this section, we will explore the advantages, common drawbacks, and user feedback for financial products like Ava Credit Builder.

Advantages Based On Real-world Usage

The Ava Credit Builder offers several key advantages:

- No Credit Check: Get started without affecting your credit score.

- No Interest or Late Fees: Avoid extra charges with no interest rates or late fees.

- Quick Credit Score Improvement: 74% of members see improvements in less than 7 days.

- Reports to All Three Credit Bureaus: Equifax, Experian, and TransUnion receive updates within 24 hours.

- High Ratings: Rated 4.9 stars from over 13,000 reviews on the App Store.

- Security: Uses 256-bit encryption to keep your information safe.

Common Drawbacks And Limitations

While Ava Credit Builder has many benefits, it also has some limitations:

- Membership Costs: Costs are not explicitly stated and could be a concern.

- Refund Terms: Specific terms regarding refunds upon cancellation are not detailed.

- Bank Account Link: Requires linking a bank account for setup.

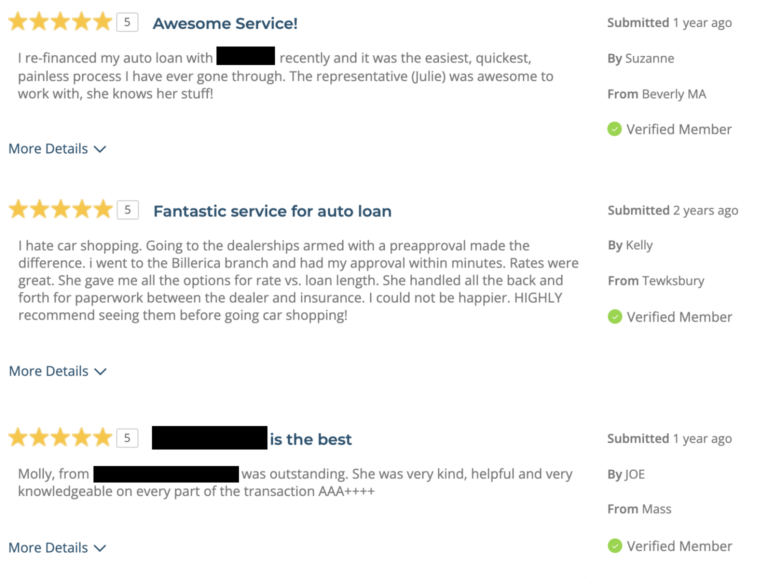

User Feedback And Testimonials

User feedback is overwhelmingly positive for Ava Credit Builder. Here are a few testimonials:

“My credit score improved by 50 points in just a week! Ava is a lifesaver.” – John D.

“The no interest and no late fees feature is fantastic. Highly recommend Ava.” – Maria S.

“Ava’s reporting to all three bureaus is a game changer. My credit score has never been better.” – Alex P.

For more details, visit the Ava website.

Ideal Users And Scenarios

The Ava Credit Builder is designed to help individuals improve their credit profiles quickly and effectively. This section explores who will benefit most from Ava’s financial products, the best use cases, and recommendations based on specific needs.

Who Will Benefit Most From Financial Products

Ava Finance is ideal for individuals who need to build or repair their credit scores. Here are some key groups who will benefit the most:

- Young Adults: Those starting their financial journey and looking to establish a credit history.

- Credit Repair Seekers: Individuals with poor or no credit history aiming to improve their scores.

- Immigrants: Newcomers to the country needing to build a credit profile.

- Budget-Conscious Users: People who want to avoid credit checks, interest, and late fees.

Best Use Cases And Scenarios

Using the Ava Credit Builder Mastercard helps in various scenarios:

| Scenario | How Ava Helps |

|---|---|

| Paying Everyday Bills | Use the Ava card to manage routine expenses and build credit simultaneously. |

| Quick Credit Improvement | 74% of users see a score boost in less than 7 days. |

| Preparing for Major Purchases | Improve your credit score to secure better rates on car, mortgage, and credit card payments. |

Recommendations Based On Specific Needs

Based on different financial needs, Ava offers tailored recommendations:

- For Quick Credit Improvement: Use the Ava Credit Builder Mastercard and make timely payments to see fast results.

- For Long-Term Savings: Utilize the Save & Build Credit account to save money and enhance your credit over 12 or 24 months.

- For Maximum Security: Rely on Ava’s 256-bit encryption to keep your personal data safe.

To learn more about how Ava can meet your financial needs, visit the Ava website.

Frequently Asked Questions

What Is A Financial Product Review?

A financial product review evaluates a financial product’s features, benefits, and drawbacks. It helps consumers make informed decisions.

Why Are Financial Product Reviews Important?

Financial product reviews provide unbiased insights. They help consumers compare options and choose the best financial products for their needs.

How To Find Reliable Financial Product Reviews?

Look for reviews from reputable sources. Check for detailed analysis, user feedback, and expert opinions to ensure reliability.

Can Financial Product Reviews Save Money?

Yes, they can. Reviews highlight cost-effective options and potential drawbacks, helping consumers avoid costly mistakes.

Conclusion

Choosing the right financial product can be challenging. Ava Credit Builder offers a straightforward solution. Build your credit without credit checks or late fees. Improve your credit score quickly and efficiently. Many users have seen improvements within a week. Interested in learning more? Visit Ava Finance for more details. Explore how Ava can help you achieve better financial health.