Top Credit Card Tips: Maximize Rewards and Minimize Debt

Managing credit wisely is crucial for financial health. With the right strategies, you can boost your credit score and save money.

In today’s financial landscape, credit cards play a significant role. They offer convenience and can help build your credit score if used responsibly. But without proper knowledge, they can lead to debt and financial stress. This blog post will provide you with essential tips to manage your credit card effectively. By following these tips, you can improve your credit score, make smarter financial decisions, and avoid common pitfalls. Whether you’re new to credit cards or looking to improve your credit management skills, these tips will guide you toward better financial stability. For a tool designed to help improve your credit score, check out the Ava Credit Builder from Ava Finance. Visit their website here: Ava Finance.

Introduction To Maximizing Credit Card Rewards And Minimizing Debt

Credit cards can be powerful tools for managing finances. They offer rewards and benefits but can also lead to debt if not managed properly. This guide will help you understand how to maximize credit card rewards while minimizing debt.

Understanding The Importance Of Credit Card Management

Proper credit card management is crucial for maintaining a healthy credit score. A good credit score can save you money on loans and insurance premiums.

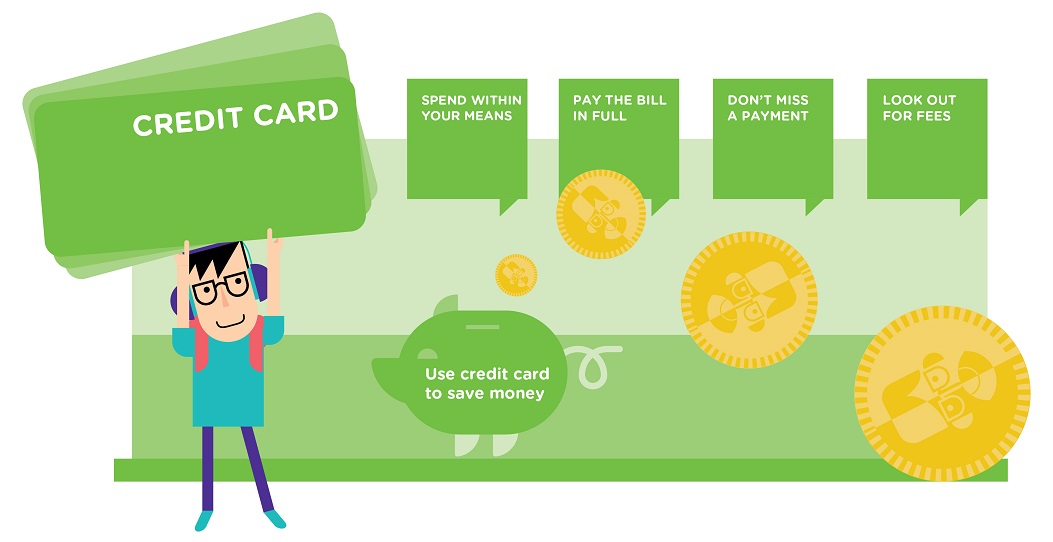

Here are some key aspects of credit card management:

- Pay bills on time: Timely payments prevent late fees and interest charges.

- Keep balances low: High balances can negatively impact your credit score.

- Monitor spending: Keeping track of your expenses helps avoid overspending.

How Rewards Programs Can Benefit You

Credit card rewards programs offer various benefits. Understanding how to utilize them can enhance your financial well-being.

Common types of rewards include:

- Cashback: Earn a percentage of your spending back in cash.

- Points: Accumulate points to redeem for travel, merchandise, or gift cards.

- Miles: Collect miles to use for flights and travel-related expenses.

Maximizing rewards involves:

- Choosing the right card for your spending habits.

- Using the card for regular expenses.

- Paying off the balance monthly to avoid interest charges.

Consider products like the Ava Credit Builder to enhance your credit profile while benefiting from rewards. Ava offers a Credit Builder Mastercard and a Save & Build Credit account, reporting payments to all three major credit bureaus quickly.

Visit Ava’s official website for more information and to get started.

Choosing The Right Credit Card

Choosing the right credit card can significantly impact your financial health. With numerous options available, it’s essential to understand the types of credit cards and their benefits, and the factors to consider when selecting one. Ava Finance offers tools like the Ava Credit Builder Mastercard to help improve your credit profile efficiently.

Types Of Credit Cards And Their Benefits

Credit cards come in various types, each offering distinct advantages. Here are some common types:

| Type of Credit Card | Benefits |

|---|---|

| Rewards Credit Cards | Earn points, cashback, or miles on purchases. |

| Balance Transfer Credit Cards | Transfer high-interest debt to a lower interest rate card. |

| Secured Credit Cards | Require a security deposit; ideal for building or rebuilding credit. |

| Credit Builder Cards | Designed to improve credit scores by reporting activity to credit bureaus. |

The Ava Credit Builder Mastercard falls under the credit builder category. It reports payments to all three major credit bureaus within 24 hours, helping users improve their credit scores quickly.

Factors To Consider When Selecting A Credit Card

When selecting a credit card, consider the following factors:

- Annual Fees: Some cards charge an annual fee; weigh the benefits against the cost.

- Interest Rates: Look for cards with lower interest rates to save money on balances.

- Rewards Programs: Choose a card with rewards that match your spending habits.

- Credit Limit: Ensure the card offers a sufficient credit limit for your needs.

- Credit Reporting: Check if the card reports to all three major credit bureaus.

The Ava Credit Builder Mastercard has no credit check, interest, or late fees, making it an attractive option for those seeking to build or rebuild their credit. Its fast reporting feature ensures timely updates to credit bureaus, which can lead to quicker credit score improvements.

By understanding the different types of credit cards and considering key factors, you can make an informed decision that aligns with your financial goals. Ava Finance offers tools and resources to help you on your journey to better credit.

Maximizing Credit Card Rewards

Maximizing credit card rewards can lead to significant savings. By understanding how different reward structures work and employing strategic spending, you can make the most out of your credit cards. Below, we delve into key strategies to help you maximize your rewards.

Understanding Different Reward Structures

Different credit cards offer various reward structures. Some provide cashback, while others offer points or travel miles. It’s crucial to choose a card that aligns with your spending habits. Here’s a quick comparison:

| Reward Type | Description |

|---|---|

| Cashback | Earn a percentage of your spending back as cash. |

| Points | Earn points for each dollar spent, redeemable for various rewards. |

| Travel Miles | Earn miles for travel expenses, useful for frequent travelers. |

Strategies To Earn More Rewards

To earn more rewards, consider these strategies:

- Use the right card: Match your card to your spending categories.

- Pay off balances: Avoid interest charges by paying balances in full.

- Take advantage of sign-up bonuses: Meet the spending requirements for sign-up bonuses.

Using Bonus Categories To Your Advantage

Many credit cards offer bonus rewards for specific spending categories. These can include:

- Groceries

- Dining

- Travel

- Gas

To maximize rewards, use a card that offers higher points or cashback for the categories where you spend the most.

For example, the Ava Credit Builder Mastercard helps improve your credit profile while allowing you to pay everyday bills and earn rewards. This card reports to all three major credit bureaus within 24 hours, ensuring quick credit improvement.

Ava also offers a Save & Build Account. Make monthly payments, and get the money back after 12 or 24 months, further boosting your credit score.

By understanding reward structures, employing smart strategies, and leveraging bonus categories, you can maximize your credit card rewards effectively.

Minimizing And Managing Credit Card Debt

Credit card debt can be overwhelming if not managed properly. Here are some essential tips to help you minimize and manage your credit card debt effectively. By following these strategies, you can take control of your finances and work towards financial stability.

Tips For Avoiding Credit Card Debt

- Create a Budget: Track your income and expenses to avoid overspending.

- Use Credit Wisely: Only charge what you can pay off each month.

- Emergency Fund: Save for unexpected expenses to avoid using credit cards.

- Avoid Cash Advances: High fees and interest rates make them costly.

- Regular Monitoring: Check your statements for any errors or unauthorized charges.

Effective Strategies For Paying Down Debt

Paying down credit card debt requires a systematic approach. Here are some effective strategies:

- Pay More Than the Minimum: This reduces the principal balance faster.

- Debt Snowball Method: Pay off smallest debts first to gain momentum.

- Debt Avalanche Method: Focus on highest interest rate debts first to save on interest.

- Automate Payments: Set up automatic payments to ensure consistency.

- Extra Income: Use any additional income to pay off debt quicker.

Balance Transfers And Debt Consolidation Options

Consider balance transfers and debt consolidation to manage your credit card debt more effectively:

| Option | Benefits | Considerations |

|---|---|---|

| Balance Transfer | Lower interest rates, consolidate multiple debts | Transfer fees, introductory rate period |

| Debt Consolidation Loan | Single monthly payment, potentially lower interest rates | Loan fees, qualification criteria |

Using tools like Ava Credit Builder can also assist in improving your credit score. Ava offers a Credit Builder Mastercard and a Save & Build Account, reporting to all three major credit bureaus. This helps users see quick improvements in their credit profiles.

For more information or to get started, visit Ava’s official website.

Smart Credit Card Usage Practices

Using a credit card wisely can help you build a strong credit profile. With Ava Finance’s Credit Builder Mastercard, you can improve your credit score quickly. Here are some smart practices for using your credit card effectively.

The Importance Of Paying Your Balance In Full

Always pay your balance in full each month. This practice prevents interest charges and helps you maintain a healthy credit score. Ava Finance reports your payments to all three credit bureaus within 24 hours, ensuring your timely payments are recognized.

Monitoring Your Credit Card Statements Regularly

Check your credit card statements regularly. This helps you catch any errors or fraudulent charges early. Ava Finance employs 256-bit encryption to keep your data safe. Monitoring your statements is an essential step in managing your finances.

Understanding And Managing Credit Card Fees

Know the fees associated with your credit card. The Ava Credit Builder Mastercard has no interest or late fees, making it easier to manage. Understanding your card’s fee structure helps you avoid unnecessary expenses and keeps you informed.

Protecting Your Credit Score

Your credit score is a vital financial tool. Protecting it should be a top priority. A healthy credit score opens doors to better loan rates, lower insurance premiums, and more. Here are some tips and tricks to keep your credit score in good shape.

How Credit Card Usage Affects Your Credit Score

Credit card usage has a significant impact on your credit score. Here’s how:

- Payment History: Timely payments are crucial. They make up 35% of your credit score.

- Credit Utilization: Using less than 30% of your credit limit shows responsible usage.

- Credit Age: Older accounts are better. They indicate a longer credit history.

- New Credit: Opening many new accounts in a short period can lower your score.

- Credit Mix: A variety of credit types (credit cards, loans) can improve your score.

Tips For Maintaining A Healthy Credit Score

Maintaining a healthy credit score is essential. Here are some actionable tips:

- Pay Bills On Time: Set reminders or automate payments to avoid late fees.

- Keep Balances Low: Aim to use less than 30% of your available credit.

- Monitor Your Credit Report: Regularly check for errors and report them.

- Limit New Credit Applications: Only apply for new credit when necessary.

- Use a Credit Builder Card: Ava Credit Builder Mastercard is a good option.

Common Credit Card Mistakes To Avoid

Even small mistakes can harm your credit score. Avoid these common pitfalls:

| Mistake | Impact |

|---|---|

| Missing Payments | Late payments hurt your score. They stay on your report for seven years. |

| High Credit Utilization | Using too much of your credit limit can lower your score. |

| Ignoring Your Credit Report | Errors can go unnoticed, affecting your score negatively. |

| Closing Old Accounts | Reduces your credit age and available credit. |

| Applying for Too Much Credit | Multiple inquiries can lower your score. |

By understanding how credit card usage affects your credit score, maintaining healthy habits, and avoiding common mistakes, you can protect and improve your credit score effectively. Ava Credit Builder can be a valuable tool in this process, offering features designed to help you build and maintain a strong credit profile.

Frequently Asked Questions

What Are The Best Ways To Use Credit Cards?

Use credit cards responsibly. Pay the full balance monthly. Monitor your spending. Avoid unnecessary fees. Utilize rewards and benefits.

How Can I Improve My Credit Score?

Pay your bills on time. Keep credit utilization low. Avoid opening many new accounts quickly. Check your credit report.

What Should I Avoid With Credit Cards?

Avoid maxing out your card. Don’t miss payments. Steer clear of cash advances. Avoid only paying the minimum.

How Do Credit Card Rewards Work?

Credit card rewards include points, miles, or cashback. Earn rewards through purchases. Redeem them for travel, statement credits, or merchandise.

Conclusion

Building good credit takes time and effort. Follow these tips for success. Manage your credit cards wisely to boost your financial health. Consider using tools like Ava Credit Builder. Improve your credit profile quickly and efficiently. Ava offers a Credit Builder Mastercard and Save & Build Credit account. Learn more about Ava here. Better credit can lead to financial savings. Start today and see positive changes soon.