Credit Repair Myths: Debunking Common Misconceptions

Credit repair is a common topic. Many myths surround it, causing confusion.

Understanding credit repair myths is essential. False beliefs can mislead you and harm your financial health. Some people think fixing credit is a quick process; others believe it’s impossible without professional help. These myths often prevent individuals from taking the right steps. In this blog post, we will uncover the truth behind these myths. Our goal is to provide clear, accurate information to help you improve your credit score. If you want to learn more about managing your credit and finances, visit Freecash. Together, let’s debunk these myths and guide you toward better financial health.

Introduction To Credit Repair Myths

Many people believe in myths about credit repair. These myths often lead to confusion and mistakes. It’s important to know the truth. This section will help you understand the common misconceptions about credit repair.

Understanding The Importance Of Credit Repair

Credit repair is crucial for financial health. A good credit score can help you get loans and credit cards. It also affects interest rates. A high score means lower interest rates. This saves you money.

Credit repair can help fix errors on your credit report. Errors can lower your score. Fixing them can improve it. This is why credit repair is important.

Why Misconceptions About Credit Repair Exist

There are many misconceptions about credit repair. One reason is a lack of knowledge. People often get wrong information from unreliable sources. Friends, family, or online forums may spread myths.

Another reason is the complexity of credit reports. Credit reports have many details. Understanding them can be hard. This can lead to misunderstandings.

Some businesses also spread myths. They do this to sell their services. They may promise quick fixes. These are usually false promises. It’s important to know the truth about credit repair.

Myth 1: Only Professionals Can Repair Your Credit

Many believe that only professionals can fix credit issues. This myth can lead to unnecessary expenses and stress. The truth is, you can repair your credit by yourself with the right information and effort.

The Role Of Professional Credit Repair Services

Professional credit repair services offer expertise in handling credit disputes and negotiating with creditors. They have experience and tools to address complex credit issues. These services can be beneficial if you lack the time or confidence to handle your credit repair.

Benefits of professional services:

- Knowledge of credit laws and regulations

- Experience in dealing with credit bureaus

- Ability to handle multiple disputes efficiently

Though professionals can be helpful, their services often come with fees. Understanding the pros and cons can help you decide if professional help is necessary.

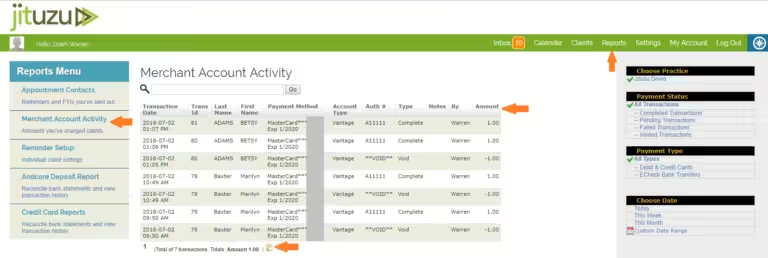

Diy Credit Repair: Steps You Can Take Yourself

Many people successfully repair their credit without professional help. Here are some steps to take:

- Get Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus.

- Review for Errors: Check your reports for any mistakes or inaccuracies.

- Dispute Errors: If you find errors, file a dispute with the credit bureau.

- Pay Down Debt: Focus on paying down high-interest debts first.

- Make Payments on Time: Ensure all your bills are paid on time to build positive credit history.

- Limit New Credit Applications: Avoid applying for new credit while repairing your credit.

These steps can help you improve your credit score over time. Consistency and patience are key.

Evaluating When Professional Help Is Necessary

Sometimes, professional help may be necessary. Consider professional services if you:

- Feel overwhelmed with the process

- Have multiple and complex disputes

- Face legal issues related to your credit

Assess your situation and decide if professional help is worth the investment. Remember, you have the power to fix your credit, whether you choose to do it yourself or seek expert help.

Myth 2: Closing Old Accounts Will Improve Your Credit Score

Many people believe that closing old credit accounts will boost their credit score. This is a common misconception. In reality, closing old accounts can hurt your credit score.

The Impact Of Account Age On Credit Score

Your credit score is influenced by the age of your accounts. Credit scoring models, such as FICO, consider the age of your oldest account and the average age of all your accounts. Older accounts with a positive history can enhance your credit score.

When you close an old account, you reduce the average age of your accounts. This can negatively impact your credit score. Keeping old accounts open can show a long history of responsible credit use.

How Closing Accounts Can Actually Hurt Your Credit

Closing an old account reduces your available credit. This can increase your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A higher credit utilization ratio can lower your credit score.

For example:

| Total Credit Available | Credit Used | Credit Utilization |

|---|---|---|

| $10,000 | $2,000 | 20% |

| $5,000 (after closing an account) | $2,000 | 40% |

As shown in the table, closing an account can double your credit utilization ratio. This can significantly impact your credit score.

Alternative Strategies For Improving Your Credit Score

Instead of closing old accounts, consider these strategies:

- Pay your bills on time. Payment history is a major factor in credit scoring.

- Keep your credit utilization low. Try to use less than 30% of your available credit.

- Maintain a mix of credit types. Having different types of credit, like credit cards and loans, can benefit your score.

- Monitor your credit report. Check for errors and dispute any inaccuracies.

Following these strategies can help improve your credit score without the negative effects of closing old accounts.

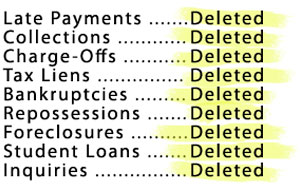

Myth 3: Paying Off Debts Erases Bad Credit History

Many believe that paying off debts will wipe their bad credit history clean. This is a common misconception. While paying off debts is crucial, it doesn’t instantly remove negative marks from your credit report.

Understanding How Debt Repayment Affects Credit Reports

Paying off debts is essential, but it doesn’t erase past mistakes. Credit reports show a history of financial behavior. This includes both positive and negative information. Paying off a debt shows responsibility. Yet, the history of late payments or defaults remains visible.

The Length Of Time Negative Information Stays On Your Credit Report

Negative information doesn’t disappear immediately. Different types of negative information remain for varying periods.

| Type of Negative Information | Duration on Credit Report |

|---|---|

| Late Payments | 7 years |

| Bankruptcies | Up to 10 years |

| Foreclosures | 7 years |

Steps To Rebuild Credit After Repaying Debts

Rebuilding credit takes time and effort. Here are actionable steps:

- Pay bills on time: Consistent, on-time payments boost your credit score.

- Keep balances low: Maintain low balances on credit cards and other revolving credit.

- Monitor your credit report: Regularly check for errors and dispute inaccuracies.

- Limit new credit applications: Too many applications can hurt your score.

- Build a positive history: Use secured credit cards or small loans to show responsible behavior.

Remember, credit repair is a journey. Being informed and proactive can help improve your credit health over time.

Myth 4: Checking Your Own Credit Report Lowers Your Score

Many people believe that checking their own credit report can hurt their credit score. This myth causes unnecessary worry and stops people from monitoring their credit. In reality, checking your own credit report does not lower your score.

Difference Between Soft And Hard Inquiries

Understanding the difference between soft and hard inquiries is key. A soft inquiry occurs when you check your own credit or a company checks it for a background check. Soft inquiries do not affect your credit score.

A hard inquiry happens when a lender checks your credit for a loan or credit card application. Hard inquiries can lower your credit score by a few points.

Knowing the difference helps you make informed decisions about your credit.

Why Regularly Checking Your Credit Is Important

Regularly checking your credit report is crucial. It helps you catch errors and detect identity theft early. Errors on your credit report can lower your score.

Correcting these mistakes can improve your credit. Monitoring your credit also helps you understand your financial health better. You can see where you need to improve and track your progress.

How To Monitor Your Credit Without Affecting Your Score

There are several ways to monitor your credit without affecting your score. You can use free services like Freecash to check your credit report.

Many credit card companies also offer free credit score monitoring. You can also get a free credit report from each of the three major credit bureaus once a year at annualcreditreport.com.

Regular monitoring helps you stay on top of your credit without any negative impact.

Myth 5: You Only Have One Credit Score

Many believe that they have only one credit score. This is a common misconception. In reality, you have multiple credit scores. These scores are generated by different credit bureaus and scoring models. Understanding this can help you better manage your credit.

Understanding Different Credit Scoring Models

Several credit scoring models exist. The most popular ones include:

- FICO Score: The Fair Isaac Corporation creates this score. It is widely used by lenders.

- VantageScore: This is another common model, developed by the three major credit bureaus.

Each model uses a different algorithm. This means your score can vary between models.

Why Your Credit Score May Vary Between Agencies

Three main credit bureaus generate credit scores:

- Equifax

- Experian

- TransUnion

Each bureau collects different data. They may not have the same information about your credit history. This can lead to different scores.

Tips For Maintaining A Consistent Credit Score Across Models

To keep your credit score consistent, follow these tips:

- Pay bills on time: Late payments can lower your score.

- Keep credit card balances low: High balances can hurt your score.

- Check your credit reports: Ensure they are accurate. Dispute errors if you find any.

- Avoid opening many new accounts: This can lower your average account age.

By following these tips, you can maintain a healthy credit score.

Myth 6: Credit Repair Takes Years

Many believe that credit repair is a long, drawn-out process. Credit repair does not have to take years. With the right steps, you can see improvements quickly. Let’s debunk this myth and explore ways to speed up the process.

Factors That Influence The Speed Of Credit Repair

Several factors affect how fast you can repair your credit. Understanding these can help you create a better plan.

| Factor | Impact |

|---|---|

| Current Credit Score | Lower scores can take longer to improve. |

| Type of Negative Marks | Some marks, like bankruptcies, take years to remove. |

| Payment History | Consistent, on-time payments speed up repair. |

| Debt Levels | High debt can slow down credit repair. |

| Credit Utilization | Keeping utilization low boosts your score faster. |

Quick Tips To Start Improving Your Credit Score Today

Here are some simple steps to start improving your credit score:

- Pay Bills on Time: Late payments harm your score.

- Reduce Credit Card Balances: Lower balances help your utilization rate.

- Check Your Credit Report: Dispute any inaccuracies.

- Avoid New Debt: New credit inquiries can lower your score.

- Use a Secured Credit Card: This can help build credit if used responsibly.

Realistic Timelines For Credit Repair

Understanding realistic timelines can help you manage expectations.

- 30-60 Days: Small errors on your credit report can be corrected.

- 3-6 Months: Consistent, on-time payments begin to show positive changes.

- 6-12 Months: Significant improvements with reduced debt and on-time payments.

- 1-2 Years: Major negative marks may take longer to improve.

Credit repair does not have to take years. By taking the right steps, you can see improvements in a shorter time.

Conclusion: The Truth About Credit Repair

Many people believe in myths about credit repair. These myths can harm your financial health. Let’s explore the truth about credit repair. We will recap some debunked myths, discuss empowering yourself with accurate information, and share resources for ongoing credit improvement.

Recap Of Debunked Myths

Myth 1: Paying off all debts instantly improves credit score. This is not true. Credit history takes time to reflect changes.

Myth 2: Closing old accounts boosts credit score. This can lower your score by reducing your credit history length.

Myth 3: Using a credit repair agency is the only way to fix credit. You can repair your credit yourself with the right knowledge.

Empowering Yourself With Accurate Credit Information

Understanding your credit report is the first step. Get a free copy from annualcreditreport.com. Review it for errors. Dispute any inaccuracies you find.

Learn about the factors affecting your credit score. Payment history, credit utilization, and length of credit history are key factors. Make payments on time and keep your credit usage low.

Stay informed. Use reputable sources like the Federal Trade Commission (FTC) for accurate credit information.

Resources For Ongoing Credit Improvement

Here are some resources to help you improve your credit:

- Annual Credit Report: Get your free credit report every 12 months.

- MyFICO: Access your FICO scores and credit reports.

- Credit Counseling Services: Seek help from non-profit organizations.

- Financial Education Programs: Enroll in courses to understand personal finance better.

Remember, improving your credit takes time. Be patient and stay informed. Use the available resources to guide you.

Frequently Asked Questions

What Is Credit Repair?

Credit repair is the process of fixing your poor credit score. It involves disputing errors on credit reports. You can do it yourself or hire a service.

Are Credit Repair Services Effective?

Credit repair services can be effective if they dispute legitimate errors. However, they can’t remove accurate negative information. It’s important to choose a reputable service.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. Start by checking your credit report for errors. Dispute any inaccuracies with the credit bureaus.

How Long Does Credit Repair Take?

Credit repair can take several months. It depends on the number of errors and your diligence. Patience and persistence are key.

Conclusion

Debunking credit repair myths helps you manage your credit better. Misunderstanding these myths can harm your financial health. Stay informed and make smart credit decisions. Seeking help? Check out Freecash for useful resources. Knowledge empowers you to take control of your credit. Remember, good credit habits lead to financial success.