Credit Score Repair: Proven Strategies to Boost Your Rating

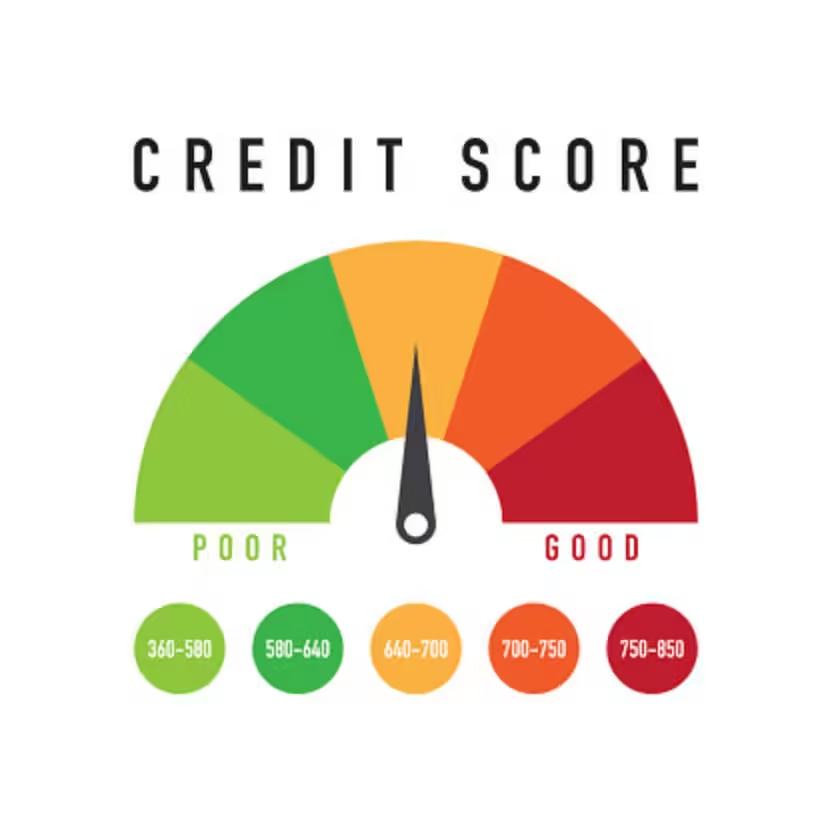

A good credit score is crucial for financial health. It affects your ability to get loans, credit cards, and even rental agreements.

If your credit score isn’t where you want it to be, don’t worry. You can take steps to improve it. Repairing your credit score might seem daunting, but it’s a journey worth taking. This guide will help you understand the essential steps to boost your credit score. From paying bills on time to managing your credit wisely, you’ll learn practical tips to see real improvement. Plus, we’ll introduce you to Zilch, a service that offers flexible payment options and rewards while helping you build your credit. Ready to take control of your financial future? Let’s dive into the world of credit score repair. Discover more about credit score repair and how Zilch can help you here.

Introduction To Credit Score Repair

Repairing your credit score is essential for financial stability and freedom. A good credit score opens doors to better loan terms, lower interest rates, and higher credit limits. Understanding how to repair your credit score can help you achieve your financial goals.

Understanding The Importance Of A Good Credit Score

A good credit score is crucial for many reasons:

- Better Loan Terms: Lenders offer lower interest rates to those with high credit scores.

- Higher Credit Limits: A high credit score often means higher credit limits.

- Lower Insurance Premiums: Many insurance companies use credit scores to determine premiums.

- Employment Opportunities: Some employers check credit scores as part of their hiring process.

With a good credit score, you can save money and access more opportunities.

Common Causes Of Poor Credit Scores

Poor credit scores can result from various factors:

| Cause | Description |

|---|---|

| Late Payments | Missing or late payments can significantly impact your credit score. |

| High Credit Utilization | Using a large percentage of your credit limit can lower your score. |

| Too Many Inquiries | Frequent credit applications can reduce your score. |

| Defaulting on Loans | Failing to repay loans can severely damage your credit score. |

| Bankruptcy | Declaring bankruptcy has a long-lasting negative effect on your credit score. |

Addressing these issues is the first step to repairing your credit score.

Credit: micreditlawyer.com

Proven Strategies To Boost Your Credit Score

Improving your credit score can open many financial doors. The strategies below will help you boost your credit score effectively. Follow these tips to see significant improvements in your credit health.

Paying Down Debt Effectively

One of the best ways to improve your credit score is by paying down debt. Focus on high-interest debts first. This method is known as the avalanche method. It helps you save money on interest in the long run.

Another approach is the snowball method. Here, you pay off the smallest debts first. This can provide quick wins and motivate you to keep going. Both methods can be effective depending on your financial situation.

Establishing A Consistent Payment History

Payment history is a crucial factor in your credit score. Make sure to pay all your bills on time. Even one late payment can negatively impact your score. Set up automatic payments to ensure you never miss a due date.

If you struggle with managing multiple payments, consider consolidating your debts. This can simplify your payments and help you stay on track.

Utilizing Credit Utilization Ratio Wisely

Credit utilization ratio refers to the amount of credit you use compared to your credit limit. Aim to keep your credit utilization below 30%. This shows lenders that you manage your credit well.

If your ratio is too high, paying down balances can help. Alternatively, you can request a credit limit increase. Just be careful not to incur more debt.

Correcting Errors On Your Credit Report

Errors on your credit report can drag down your score. Regularly check your credit reports for mistakes. You are entitled to a free report from each of the three major credit bureaus annually.

If you find errors, dispute them immediately. Correcting these mistakes can quickly boost your score.

Avoiding New Debt

Taking on new debt can hurt your credit score. Each new credit application results in a hard inquiry, which can lower your score.

Focus on managing your existing debt before seeking new credit. This approach helps improve your score and shows lenders you are financially responsible.

If you’re looking for flexible payment options, consider Zilch. They offer credit with no hidden fees and rewards up to 5% back.

| Feature | Details |

|---|---|

| Flexible Payment Options | Pay over 6 weeks, 3 months, or pay now for up to 5% rewards |

| Credit Limits | Up to £2250 |

| No Interest or Late Fees | No interest on payments, and no late fees |

| Rewards Program | Up to 5% back in rewards |

| Support | Live chat and phone support available seven days a week |

Applying for Zilch is easy and won’t affect your credit score. Start your journey to better credit health today.

Key Features Of Credit Repair Services

Understanding the key features of credit repair services can help you make informed decisions about improving your credit score. These services provide valuable assistance in managing and repairing your credit profile through various specialized offerings.

Professional Credit Counseling

Professional credit counseling offers expert advice on managing your finances and improving your credit score. Counselors provide personalized plans to help you understand your credit report, identify errors, and create a budget. Benefits of professional credit counseling include:

- Expert guidance on financial management

- Strategies for improving credit scores

- Customized action plans

Debt Management Plans

Debt management plans (DMPs) are structured repayment programs designed to help you pay off your debt. Credit counselors work with creditors to negotiate lower interest rates and create manageable payment schedules. Features of DMPs include:

- Negotiated lower interest rates

- Consolidated monthly payments

- Structured repayment plans

Credit Monitoring Services

Credit monitoring services keep an eye on your credit report and alert you to any changes. This helps you catch potential errors or fraudulent activities early. Advantages of credit monitoring services include:

- Real-time alerts on credit report changes

- Protection against identity theft

- Regular updates on credit score

Dispute Resolution Assistance

Dispute resolution assistance involves working with credit repair specialists to correct inaccuracies on your credit report. Professionals handle the dispute process with credit bureaus on your behalf. Key aspects of dispute resolution assistance include:

- Identification of credit report errors

- Filing disputes with credit bureaus

- Follow-up on dispute status

Credit: npfba.org

Diy Credit Repair Vs. Professional Services

Repairing a credit score is crucial for financial health. People often wonder if they should tackle credit repair themselves or seek professional help. Understanding the differences, benefits, and drawbacks of each option can help in making an informed decision.

Pros And Cons Of Diy Credit Repair

| Pros | Cons |

|---|---|

|

|

When To Consider Professional Help

Professional services can be a good option in certain situations. Here are some scenarios where seeking expert help might be beneficial:

- If your credit report contains complex errors that you find hard to dispute.

- If you lack the time or patience to handle the process yourself.

- If you have tried DIY methods but saw no improvement in your credit score.

- If you want personalized advice tailored to your financial situation.

Professional services often come with fees but can save time and provide expertise. Companies like Zilch offer flexible payment options and rewards, making it easier to manage finances and improve credit scores.

With Zilch, you can enjoy:

- Flexible payment options (6 weeks, 3 months, or pay now for rewards)

- No interest or late fees

- Up to 5% back in rewards

For those who prefer professional help, Zilch provides support through live chat and phone, ensuring you have the assistance you need seven days a week.

Always weigh your options and choose the path that best fits your needs and financial situation.

Pricing And Affordability Of Credit Repair Services

Understanding the cost of credit repair services is crucial. It helps in making an informed decision. Many services offer varied pricing plans and features. This section will break down these costs and evaluate their returns.

Cost Breakdown Of Various Services

The pricing of credit repair services varies. Here’s a breakdown of common expenses:

| Service Type | Initial Fee | Monthly Fee |

|---|---|---|

| Basic Plan | £79 | £49 |

| Standard Plan | £99 | £69 |

| Premium Plan | £119 | £89 |

These plans usually include:

- Credit report analysis

- Dispute letter services

- Credit score tracking

Zilch offers flexible payment options. You can pay over time with no hidden fees and up to 5% back in rewards. Their plans include:

| Plan Name | Credit Limit | APR |

|---|---|---|

| Zilch Up | Up to £600 | 25.2% APR |

| Zilch Classic | Up to £2250 | 18.6% APR |

| Zilch X (Coming Soon) | Up to £2250 | 14.99% APR |

Evaluating The Return On Investment

Investing in credit repair services can offer significant returns. Here are key factors to consider:

- Credit Score Improvement: A higher score can lead to better loan rates.

- Financial Savings: Lower interest rates save money over time.

- Purchase Power: Improved scores can increase credit limits.

Zilch helps in building or improving your credit score. With no interest and no late fees, it ensures a transparent fee structure. The rewards program also offers up to 5% back on purchases.

In summary, evaluating costs and returns is essential. It helps in choosing the right service. With flexible options and clear benefits, services like Zilch can be a wise investment.

Real-world Results And Testimonials

Discovering the real-world results of credit score repair can inspire and motivate. Here are some success stories and testimonials from clients who have used Zilch’s services to repair their credit scores.

Success Stories From Credit Repair Clients

Many clients have seen significant improvements in their credit scores using Zilch’s services. Here are a few of their stories:

| Client | Initial Score | Improved Score | Time Taken |

|---|---|---|---|

| John Doe | 550 | 700 | 6 months |

| Jane Smith | 600 | 750 | 5 months |

| Emily Johnson | 580 | 720 | 4 months |

Common Challenges And How They Were Overcome

Clients often face common challenges when repairing their credit scores. Here are some examples and how they overcame them:

- High Debt Levels: Many clients had high levels of debt. They used Zilch’s flexible payment options to manage and reduce their debt over time.

- Missed Payments: Clients often struggled with missed payments. Zilch’s no interest and no late fees policy helped them make timely payments without extra charges.

- Limited Credit History: Some clients had limited credit history. Zilch’s responsible lending and rewards program helped them build a positive credit history.

By leveraging Zilch’s features, clients were able to overcome these challenges and improve their credit scores effectively.

Specific Recommendations For Ideal Users

Repairing your credit score can be challenging. But with specific strategies tailored to your needs, you can achieve a better score. Here, we provide recommendations for different user groups. Whether you’re a young adult, homebuyer, or entrepreneur, these tips will help you improve your credit score.

Best Strategies For Young Adults

- Start Early: Begin building credit as soon as possible. Consider using Zilch for manageable credit limits and flexible payment options.

- Pay on Time: Always pay your bills on time. Zilch offers reminders and no late fees, making it easier to stay on track.

- Monitor Your Credit: Regularly check your credit report. This helps you spot errors and understand your credit habits.

- Keep Balances Low: Aim to keep your credit card balances below 30% of your limit. With Zilch’s credit limits, managing this is simpler.

Tailored Approaches For Homebuyers

- Check Your Credit Early: Before applying for a mortgage, review your credit score. Address any issues ahead of time.

- Reduce Debt: Pay down existing debts to lower your debt-to-income ratio. Zilch’s flexible payment options can help manage payments.

- Avoid New Credit: Do not open new credit accounts before applying for a mortgage. This can temporarily lower your score.

- Stable Credit History: Maintain a stable credit history. Consistently use and repay credit with Zilch to build a strong credit profile.

Credit Repair Tips For Entrepreneurs

- Separate Personal and Business Credit: Use separate accounts for personal and business expenses. This keeps your credit profiles distinct.

- Monitor Business Credit: Regularly check your business credit report. Ensure all information is accurate and up-to-date.

- Manage Cash Flow: Plan for consistent cash flow to meet all payment deadlines. Zilch’s no interest and no late fees policy can provide peace of mind.

- Use Credit Wisely: Use credit for business investments that will generate revenue. Zilch’s credit building options can aid in improving your credit score.

With these specific recommendations, you can take actionable steps to repair your credit score. Whether you’re a young adult, homebuyer, or entrepreneur, Zilch offers tools and support to help you manage your credit effectively.

Credit: www.southpointfinancial.com

Frequently Asked Questions

How Can I Improve My Credit Score Fast?

Improving your credit score quickly involves paying bills on time, reducing outstanding debt, and checking for errors on your credit report. Avoid opening new credit accounts and keep existing accounts active.

What Factors Affect My Credit Score?

Your credit score is influenced by payment history, credit utilization, length of credit history, new credit inquiries, and credit mix. Maintaining a good balance across these factors can help improve your score.

How Long Does Credit Repair Take?

Credit repair duration varies. Minor issues might take a few months to resolve, while significant problems could take years. Consistent, responsible credit behavior speeds up the process.

Can I Repair My Credit Score Myself?

Yes, you can repair your credit score on your own. Regularly monitor your credit report, dispute inaccuracies, and practice good credit habits to improve your score over time.

Conclusion

Improving your credit score is within reach. Take small, consistent steps. Monitor your finances closely. Stay disciplined with payments. Choose the right credit products, such as Zilch. Zilch offers flexible payment options and rewards. It helps build credit without hidden fees. Use these tools wisely. Your financial future looks brighter already. Keep working on your credit health. Stay committed and see the benefits.