Easy Credit Repair Process: Your Step-by-Step Guide to Success

Are you struggling with a low credit score? Fixing your credit doesn’t have to be hard.

The easy credit repair process is here to help. Repairing your credit can feel daunting, but it doesn’t have to be. With a straightforward plan, you can improve your credit score step by step. Understanding the basics of credit repair and knowing what actions to take can make a big difference. Whether it’s disputing errors on your credit report, paying down debt, or managing your finances better, each step brings you closer to financial freedom. Ready to learn more? Let’s dive into the easy steps that can help you repair your credit and regain control of your financial future. For business owners seeking accessible funding, consider the Revenued Business Card Visa® Commercial Card. It offers a unique, flexible solution to your financial needs.

Introduction To Easy Credit Repair

Repairing credit can feel overwhelming, but it doesn’t have to be. Understanding the basics can make the process simpler and more effective. Let’s dive into the essentials of easy credit repair.

Understanding The Importance Of Good Credit

Good credit is essential for many financial opportunities. It affects your ability to secure loans, credit cards, and even housing. A higher credit score means better interest rates and terms.

Businesses, like those using the Revenued Business Card Visa® Commercial Card, benefit significantly from good credit. It allows for more flexible financing options and better terms. The Revenued card provides unique revenue-based financing, which can be crucial for maintaining a healthy cash flow.

Why Credit Repair Is Necessary

Credit repair is crucial if your credit score is low. Poor credit can limit your financial opportunities and make borrowing more expensive. Repairing credit involves identifying and fixing errors on your credit report, paying down debts, and improving your credit habits.

For businesses, a strong credit profile can enhance access to tools like the Revenued Business Card. This card offers instant access to funds, which can be vital for business operations. A better credit score can also lead to higher spending limits and more favorable terms.

| Benefits of Good Credit | Impact on Businesses |

|---|---|

| Lower interest rates | More affordable financing options |

| Better loan terms | Higher spending limits |

| Increased credit card approvals | Access to tools like the Revenued Business Card |

Repairing credit can be a straightforward process with the right approach. Focus on understanding your credit report, disputing errors, and making timely payments. With persistence, you can improve your credit score and unlock better financial opportunities.

Assessing Your Credit Situation

Understanding your credit situation is the first step towards easy credit repair. By taking the time to evaluate your credit, you can identify areas that need improvement and create a strategy to enhance your credit score. This section will guide you through obtaining your credit reports, identifying errors and inaccuracies, and understanding your credit score.

Obtaining Your Credit Reports

To assess your credit situation, you need to obtain your credit reports. You can request a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. It’s recommended to get reports from all three as they may contain different information.

- Visit the website Annual Credit Report.

- Fill out the required information to request your reports.

- Download and save copies of your credit reports for review.

Identifying Errors And Inaccuracies

Once you have your credit reports, review them carefully for any errors or inaccuracies. Common errors include incorrect personal information, accounts that do not belong to you, and erroneous payment histories. Identifying these mistakes is crucial as they can negatively impact your credit score.

- Check your personal information for accuracy.

- Review each account listed to ensure it belongs to you.

- Verify that payment histories and balances are correct.

If you find any errors, you can dispute them with the credit bureau. Most bureaus allow you to file disputes online, making the process straightforward and efficient.

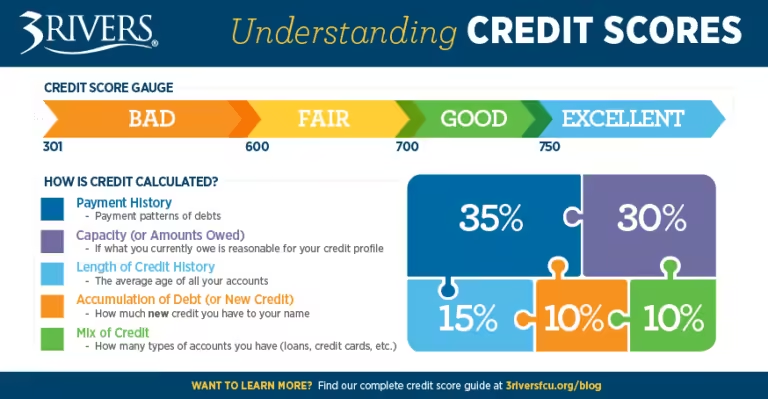

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness. It’s calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Understanding your credit score helps you know where you stand and what needs improvement.

| Factor | Percentage |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Types of Credit Used | 10% |

Regularly monitoring your credit score can help you stay on track and make informed decisions about your financial health. Many online services offer free credit score monitoring, allowing you to keep an eye on your progress.

By thoroughly assessing your credit situation, you can take the necessary steps to repair and improve your credit, leading to better financial opportunities in the future.

Disputing Errors On Your Credit Report

Errors on your credit report can lower your credit score. This makes it harder to get loans or credit cards. Fixing these errors is crucial. Here’s how you can dispute errors on your credit report.

How To Write A Dispute Letter

Writing a clear and concise dispute letter is key. Follow these steps:

- Start with your personal information. Include your full name, address, and contact details.

- Mention the credit reporting agency. State the name of the agency where the error appears.

- Identify the error. Clearly state what the error is and why it is incorrect.

- Provide supporting documents. Attach copies of any documents that support your claim.

- Request correction. Ask the agency to correct the error or remove it.

- Sign and date the letter. This adds authenticity to your dispute.

Following Up On Your Dispute

After sending your dispute letter, follow up. Here’s how:

- Wait for a response. Credit agencies have 30 days to investigate your dispute.

- Check your mail. Look out for updates or requests for more information.

- Review the results. After the investigation, you’ll receive the results in writing.

If the error is corrected, your credit report will be updated.

What To Do If Your Dispute Is Rejected

Sometimes, disputes are rejected. Here’s what you can do:

- Request the reason. Ask why your dispute was rejected.

- Provide additional evidence. Send more documents that support your claim.

- Contact the creditor. Try resolving the error directly with the creditor.

- Seek help. Consider hiring a credit repair company for assistance.

If all else fails, you can add a statement to your credit report explaining the dispute.

Addressing Negative Items On Your Credit Report

Negative items on your credit report can impact your credit score. Addressing these items is crucial for credit repair. Here’s how you can deal with late payments, collections, and charge-offs.

Strategies For Dealing With Late Payments

Late payments can significantly affect your credit score. Here are some strategies to address them:

- Request a goodwill adjustment: Contact your creditor and request them to remove the late payment from your report.

- Set up automatic payments: This helps avoid missing future payments.

- Pay off overdue balances: Clear any overdue balances as soon as possible.

How To Handle Collections And Charge-offs

Collections and charge-offs can be daunting, but they can be managed. Follow these steps:

- Verify the debt: Ensure the debt is accurate and belongs to you.

- Negotiate a payment plan: Work with the creditor to set up a manageable payment plan.

- Request a pay-for-delete agreement: Ask if the creditor will remove the item from your report upon payment.

The Role Of Debt Settlement

Debt settlement can help resolve debts for less than the owed amount. Here’s how it works:

| Step | Description |

|---|---|

| 1. Assess your debts | List all debts and prioritize them based on interest rates and amounts. |

| 2. Contact creditors | Negotiate with creditors to settle the debt for a lower amount. |

| 3. Get agreement in writing | Ensure the settlement agreement is documented and signed by both parties. |

Debt settlement might impact your credit score, but it can provide a fresh start.

Building And Maintaining Good Credit

Good credit is essential for financial stability and growth. It influences your ability to secure loans, credit cards, and even affects job opportunities. By building and maintaining good credit, you ensure financial flexibility and security.

Establishing A Positive Payment History

One of the most critical aspects of good credit is a positive payment history. Always pay your bills on time. Late payments can significantly impact your credit score. Use reminders or automatic payments to stay on track. If you have missed a payment, pay it as soon as possible. The longer a late payment goes unpaid, the more it can hurt your credit.

| Payment Type | Impact on Credit |

|---|---|

| On-time Payments | Positive |

| Late Payments | Negative |

| Missed Payments | Very Negative |

Managing Credit Utilization

Credit utilization is the ratio of your current debt to your credit limit. Keeping this ratio low is crucial. Aim to use less than 30% of your available credit. High credit utilization can negatively affect your credit score.

- Monitor your credit limits and balances regularly.

- Consider requesting a higher credit limit if you can manage it responsibly.

- Pay down debt to lower your credit utilization rate.

The Importance Of Diversifying Your Credit Mix

Diversifying your credit mix means having different types of credit accounts. This can include credit cards, loans, and mortgages. A diverse credit mix demonstrates that you can manage various types of credit responsibly. It can positively impact your credit score.

- Installment credit (e.g., car loans, mortgages)

- Revolving credit (e.g., credit cards)

- Service credit (e.g., utility bills)

By maintaining a healthy mix, you show lenders that you can handle multiple credit types. This can improve your creditworthiness.

Using Credit Repair Services

Repairing credit can be a complex and time-consuming process. For many, using credit repair services can simplify this journey. These services offer professional assistance to improve your credit score. They handle disputes with credit bureaus and creditors on your behalf. This can save you time and effort.

When To Consider Professional Help

Not everyone needs professional help with credit repair. However, there are certain situations where it’s beneficial. For example, if you have multiple negative items on your credit report, such as late payments or collections, it might be wise to seek help. Also, if you lack the time or knowledge to address credit issues on your own, a professional can be useful.

How To Choose A Reputable Credit Repair Company

Choosing a reputable credit repair company is crucial. Here are some tips to help:

- Check the company’s credentials and reviews.

- Ensure they are compliant with the Credit Repair Organizations Act (CROA).

- Avoid companies that ask for payment upfront.

- Look for transparency in their services and fees.

- Seek recommendations from trusted sources.

Reputable companies will provide a clear outline of their services. They will also offer a contract that details your rights and their obligations.

Understanding The Costs And Benefits Of Credit Repair Services

Credit repair services come with costs, but they also offer significant benefits. Here’s a breakdown:

| Costs | Benefits |

|---|---|

| Monthly fees or per-item charges | Professional handling of disputes |

| Potential setup fees | Time-saving and convenience |

| Varies by company and service | Improved credit score |

While the costs can add up, the benefits often outweigh them. A higher credit score can lead to better loan terms and interest rates. This can save you money in the long run.

Pros And Cons Of Diy Credit Repair Vs. Professional Services

Repairing your credit can be a daunting task. You can choose to handle it yourself or hire a professional. Each approach has its own advantages and drawbacks. Below, we will explore the pros and cons of DIY credit repair compared to professional services.

The Benefits Of Diy Credit Repair

- Cost-Effective: DIY credit repair saves you money. You avoid paying fees to a credit repair company.

- Control: You have full control over the process. You decide which errors to dispute and how to manage your credit.

- Learning Experience: You gain valuable knowledge about credit and personal finance. This can help you make better financial decisions in the future.

The Drawbacks Of Diy Credit Repair

- Time-Consuming: DIY credit repair requires a significant time investment. You need to research, gather documentation, and follow up on disputes.

- Complexity: The process can be complex and confusing. Understanding credit laws and regulations is essential for effective credit repair.

- Limited Expertise: You may lack the expertise to handle complicated cases. Professional services often have more experience dealing with credit issues.

Advantages Of Professional Credit Repair Services

- Expertise: Professional services have extensive knowledge and experience in credit repair. They know how to navigate the system effectively.

- Efficiency: They can often resolve issues faster than you can on your own. Their specialized tools and resources streamline the process.

- Less Stress: Hiring a professional reduces your stress. They handle the paperwork and negotiations on your behalf.

Potential Downsides Of Hiring A Credit Repair Company

- Cost: Professional credit repair services can be expensive. Fees vary, and you may end up paying hundreds or even thousands of dollars.

- Scams: There are many fraudulent credit repair companies. It is crucial to research and choose a reputable service.

- Dependence: Relying too much on professionals might prevent you from learning valuable credit management skills.

Specific Recommendations For Different Scenarios

Credit repair can seem daunting, but it helps to have specific strategies for different situations. Whether you have minor credit issues or major credit challenges, tailored approaches can make the process easier and more effective.

Credit Repair For Individuals With Minor Credit Issues

If you have minor credit issues, such as a few late payments or a high credit utilization ratio, focus on these steps:

- Pay Bills on Time: Ensure all future payments are on time to build a positive payment history.

- Reduce Credit Utilization: Aim to keep your credit utilization below 30%. This can be done by paying down debt or requesting a credit limit increase.

- Dispute Errors: Regularly check your credit report for errors and dispute any inaccuracies with the credit bureaus.

- Use a Secured Credit Card: Consider using a secured credit card to build or rebuild your credit score.

Strategies For Those With Major Credit Challenges

For those facing major credit challenges, such as bankruptcy or multiple defaults, a more comprehensive approach is required:

- Seek Professional Help: Consider working with a credit counseling agency to create a debt management plan.

- Negotiate with Creditors: Contact your creditors to negotiate a settlement or payment plan.

- Consider Debt Consolidation: Look into debt consolidation loans to combine multiple debts into a single, manageable payment.

- Rebuild Credit: Start rebuilding your credit by using secured credit cards or becoming an authorized user on someone else’s account.

Tailored Approaches For Different Financial Situations

Different financial situations require tailored approaches to credit repair:

| Situation | Recommendation |

|---|---|

| Stable Income | Create a budget to prioritize debt repayment and avoid new debt. |

| Irregular Income | Use the Revenued Business Card Visa® Commercial Card for flexible funding based on revenue. |

| Recent Job Loss | Focus on essential expenses and communicate with creditors to arrange deferred payments. |

| High Medical Bills | Negotiate with medical providers for lower payments or interest-free payment plans. |

Using these specific recommendations can help you address your unique credit repair needs effectively.

Conclusion: Your Path To Credit Repair Success

Embarking on the journey to repair your credit can feel overwhelming. But with the right steps and strategies, you can achieve credit repair success. Let’s recap the essential steps, discuss long-term strategies, and offer final tips to keep you on track.

Recap Of Key Steps In The Credit Repair Process

To repair your credit, follow these key steps:

- Check Your Credit Report: Obtain a copy of your credit report from the major credit bureaus.

- Identify Errors: Carefully review your report for any inaccuracies or fraudulent activities.

- Dispute Inaccuracies: Report any errors to the credit bureaus and provide supporting documents.

- Pay Down Debts: Focus on paying off high-interest debts and reduce your credit card balances.

- Build Positive Credit History: Make timely payments and consider using secured credit cards to rebuild credit.

Long-term Strategies For Maintaining Good Credit

Maintaining good credit requires ongoing effort. Implement these long-term strategies:

- Monitor Your Credit Regularly: Regularly check your credit report to stay aware of your credit standing.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit limit.

- Pay Bills on Time: Consistently pay all your bills by the due date to avoid late fees and negative marks.

- Avoid Unnecessary Credit Inquiries: Limit the number of new credit applications to prevent hard inquiries.

- Manage Debt Responsibly: Create a budget and stick to it to manage your debts effectively.

Encouragement And Final Tips For Staying On Track

Stay motivated on your credit repair journey with these final tips:

- Set Realistic Goals: Break down your credit repair goals into smaller, manageable tasks.

- Seek Support: Consider working with a credit counselor or financial advisor for guidance.

- Stay Disciplined: Stick to your budget and avoid impulsive financial decisions.

- Celebrate Milestones: Reward yourself for achieving significant credit repair milestones.

- Stay Informed: Educate yourself about credit and personal finance to make informed decisions.

Repairing your credit takes time and commitment, but with dedication, you can achieve your financial goals. Remember, each step you take brings you closer to a healthier credit score and financial stability.

Frequently Asked Questions

What Is The First Step In Credit Repair?

The first step in credit repair is to obtain your credit reports. Review them for errors or inaccuracies.

How Long Does Credit Repair Take?

Credit repair typically takes between three to six months. The duration depends on the number of errors and your efforts.

Can I Repair My Credit Myself?

Yes, you can repair your credit yourself. Start by disputing errors with credit bureaus and paying off debts.

Does Paying Off Debt Improve Credit Score?

Yes, paying off debt improves your credit score. Reducing your debt-to-income ratio positively impacts your creditworthiness.

Conclusion

Repairing your credit can feel daunting, but it is manageable. Take small steps and stay consistent. Remember, you don’t have to do it alone. Tools like the Revenued Business Card can help you manage finances better. It provides flexible funding options and personalized support. Check out the Revenued Business Card for more details. Improving your credit is a journey worth taking. Stick to the process, and you’ll see positive changes.