Rebuild Credit History: Proven Strategies for Fast Improvement

Rebuilding your credit history can feel overwhelming. Yet, it’s essential for financial health.

A good credit history opens doors to loans, mortgages, and better interest rates. If your credit has taken a hit, don’t worry. There are effective strategies to rebuild it. By understanding the key steps and implementing them, you can gradually improve your credit score. This process requires patience, discipline, and some knowledge. Whether you’ve faced financial setbacks or just want to boost your credit, this guide will help. Let’s explore practical tips to rebuild your credit history and regain financial stability. Visit Revenued to discover tools that support your business credit needs.

Introduction To Rebuilding Credit History

Rebuilding credit history can seem like a daunting task, but it is essential for achieving financial stability. Whether you have faced financial hardships or are new to credit, understanding how to improve your credit score is crucial. This guide will provide valuable insights and practical strategies to help you rebuild your credit history effectively.

Understanding The Importance Of A Good Credit Score

A good credit score opens many doors. It can help you secure loans, get better interest rates, and even find a job. Lenders, landlords, and employers often check credit scores to evaluate financial responsibility. Maintaining a healthy credit score is not just about borrowing money; it’s about building trust and proving reliability.

Common Reasons For Poor Credit History

Several factors can lead to a poor credit history. These include:

- Late or missed payments

- High credit card balances

- Defaults on loans

- Bankruptcy filings

- Frequent credit inquiries

Understanding these reasons can help you avoid common pitfalls and take proactive steps toward improving your credit score.

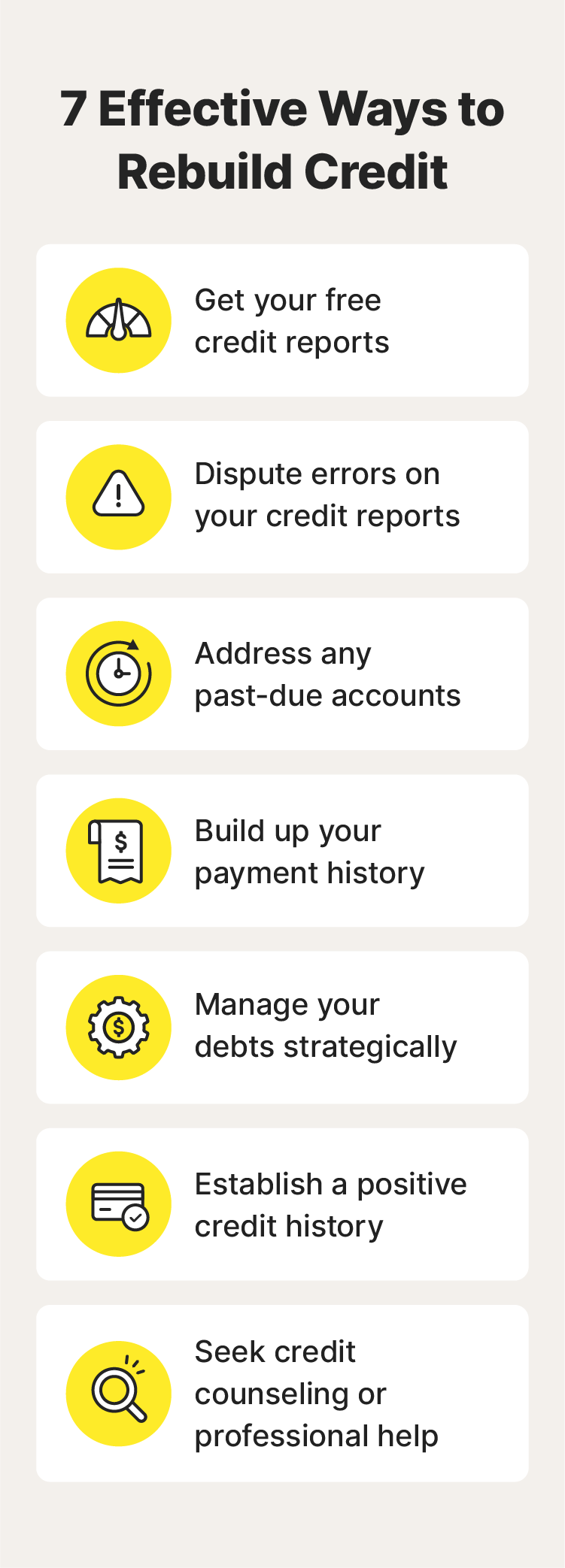

Overview Of The Article’s Strategies

This article covers various strategies to rebuild your credit history. These strategies include:

- Paying bills on time

- Reducing outstanding debt

- Reviewing your credit report for errors

- Using secured credit cards

- Keeping old accounts open

By following these steps, you can gradually improve your credit score and regain financial freedom.

For business owners, consider using financial tools like the Revenued Business Card Visa® Commercial Card. This card offers:

| Main Features | Benefits |

|---|---|

| Revenue-Based Financing | Immediate Access to Funds |

| Flex Line | Flexible Use of Capital |

| Mobile Access | Control Over Finances |

| Spending Limits | Higher Approval Rates |

| Dedicated Support | Real-Time Assistance |

Visit Revenued to learn more about how this card can support your business growth.

Assessing Your Current Credit Situation

Understanding your current credit situation is the first step to rebuilding your credit history. Start by evaluating where you stand. This process involves obtaining your credit report, identifying negative items, and evaluating your credit score. Each of these steps provides valuable insights into your credit health.

Obtaining Your Credit Report

The first step in assessing your credit situation is to obtain your credit report. You can request a free copy from each of the three major credit bureaus: Equifax, Experian, and TransUnion. This report details your credit history, including open accounts, payment history, and any derogatory marks.

To get your credit report, visit AnnualCreditReport.com. You are entitled to one free report from each bureau every 12 months. Reviewing your credit report helps you understand what lenders see when evaluating your creditworthiness.

Identifying Negative Items

Once you have your credit report, the next step is to identify any negative items. These can include late payments, collections, charge-offs, bankruptcies, and high credit card balances. Negative items can significantly impact your credit score.

Make a list of these negative items, noting the date and amount of each. This will help you determine which items need immediate attention. Disputing inaccuracies and settling outstanding debts can help improve your credit report.

Evaluating Your Credit Score

Evaluating your credit score is crucial in assessing your credit situation. Your credit score ranges from 300 to 850, with higher scores indicating better credit health. You can check your score through various online services or your bank.

A credit score above 700 is considered good, while a score below 600 might need improvement. Knowing your score helps you understand your creditworthiness and what steps you need to take to improve it.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Use this information to set realistic goals for improving your credit score. Regularly monitoring your credit score helps track your progress and identify areas for improvement.

Proven Strategies For Improving Your Credit Score

Improving your credit score can open doors to better financial opportunities. Whether you are looking to purchase a home, secure a loan, or get a credit card, a higher credit score can make a significant difference. Here are some proven strategies to help you rebuild your credit history and improve your credit score.

Paying Bills On Time

One of the most effective ways to improve your credit score is to pay your bills on time. Late payments can have a negative impact on your credit report.

- Set up reminders or automatic payments to ensure timely payments.

- Focus on paying at least the minimum amount due on each bill.

Consistently paying your bills on time demonstrates financial responsibility and can gradually improve your credit score.

Reducing Outstanding Debt

High amounts of outstanding debt can hurt your credit score. Work towards reducing your debt to improve your credit standing.

- Create a budget to manage your expenses and prioritize paying off debts.

- Focus on paying down high-interest debts first.

- Avoid taking on new debt while paying off existing balances.

Reducing your outstanding debt can lower your credit utilization ratio, which positively affects your credit score.

Using A Secured Credit Card

A secured credit card can be a valuable tool in rebuilding credit. These cards require a security deposit, which acts as your credit limit.

| Advantages | Disadvantages |

|---|---|

| Helps establish or rebuild credit | Requires a security deposit |

| Reports to credit bureaus | Limited credit limit |

Using a secured credit card responsibly by making small purchases and paying off the balance in full each month can help improve your credit score over time.

Becoming An Authorized User On Another Account

Another strategy to improve your credit score is to become an authorized user on someone else’s credit account. This can be a family member or a trusted friend.

- You get the benefit of their good credit history.

- Ensure the primary account holder has a positive payment history.

Being an authorized user can help you build credit without the need for your own credit account.

Correcting Errors On Your Credit Report

Errors on your credit report can negatively impact your credit score. Correcting these errors is crucial to rebuilding your credit history. Here’s how you can identify inaccuracies, dispute errors, and follow up on disputes.

Identifying Inaccuracies

First, obtain a copy of your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. Look for common errors such as:

- Incorrect Personal Information: Wrong name, address, or Social Security number.

- Account Errors: Accounts that do not belong to you.

- Incorrect Account Status: Closed accounts listed as open, or incorrect balances.

- Duplicate Accounts: Same debt listed multiple times.

- Outdated Information: Old debts that should have been removed.

Disputing Errors

Once you’ve identified inaccuracies, it’s time to dispute them. Follow these steps:

- Gather Evidence: Collect documents that support your claim, such as bank statements or payment records.

- Write a Dispute Letter: Clearly explain the error and provide copies of your evidence. Be concise and polite.

- Contact the Credit Bureau: Send your dispute letter to the credit bureau that provided the erroneous report. You can also dispute errors online via the bureau’s website.

Here’s a sample dispute letter format:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, Zip Code]

[Date]

Subject: Dispute of Inaccurate Information

To Whom It May Concern,

I am writing to dispute the following information on my credit report. The item(s) I am disputing are highlighted below:

[List the inaccurate information]

I have attached copies of [your supporting documents] that prove the inaccuracy. Please investigate this matter and correct the information on my credit report.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Following Up On Disputes

After submitting your dispute, follow up to ensure the error is corrected. Here’s how:

- Track Your Dispute: Credit bureaus typically have 30 days to investigate. Mark your calendar to check on the status.

- Review the Response: The bureau will send you a report of their findings. Verify that the error has been corrected.

- Persist if Necessary: If the error is not corrected, you can dispute it again or contact the creditor directly.

Correcting errors on your credit report is a key step in rebuilding your credit history. Stay vigilant and proactive to ensure your credit report accurately reflects your financial behavior.

Building Positive Credit History

Building a positive credit history is essential for securing loans, getting favorable interest rates, and overall financial health. Here are some effective strategies to build a strong credit profile.

Opening A New Credit Account Responsibly

Opening a new credit account can help improve your credit score, but it must be done responsibly. Consider the Revenued Business Card Visa® Commercial Card if you run a business. This card offers revenue-based financing, which is different from traditional credit cards and loans. The application process is quick, and you can access funds within 24 hours.

To open a new account responsibly, follow these tips:

- Research and choose a card that suits your needs.

- Read the terms and conditions carefully.

- Ensure you can manage and repay the credit.

Maintaining A Low Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you are using compared to your total credit limit. Keeping this ratio low is crucial for a healthy credit score. Aim to use less than 30% of your available credit.

Here are some ways to maintain a low credit utilization ratio:

- Pay off your balances in full each month.

- Ask for a credit limit increase, but avoid increasing your spending.

- Keep unused credit accounts open to benefit from their credit limits.

Diversifying Your Credit Mix

A diverse credit mix shows lenders that you can manage different types of credit responsibly. Having a combination of credit cards, installment loans, and retail accounts can positively impact your credit score.

Consider the following to diversify your credit mix:

- Add a business credit card like the Revenued Business Card Visa® Commercial Card to your profile.

- Take out a small personal loan if needed.

- Consider a mortgage or auto loan if it fits your financial situation.

Remember, the key is to manage each type of credit responsibly and ensure timely payments.

Monitoring Your Credit Progress

Rebuilding your credit history is a journey that requires consistent monitoring. Keeping track of your progress can help you make informed decisions and adjust your strategies effectively. Below are some key methods to ensure you stay on top of your credit improvement process.

Regularly Checking Your Credit Report

It is essential to regularly check your credit report to understand your financial standing. You can access your credit report from major bureaus such as Equifax, Experian, and TransUnion.

- Verify Accuracy: Ensure all information is correct.

- Identify Errors: Spot and dispute any inaccuracies.

- Track Changes: Notice how your actions impact your score.

Regular checks can help you identify areas for improvement and take corrective actions promptly.

Using Credit Monitoring Services

Consider using credit monitoring services to get real-time updates on your credit status. These services offer several benefits:

| Benefit | Description |

|---|---|

| Instant Alerts | Get notified of any significant changes to your credit report. |

| Protection | Monitor for potential identity theft and fraud activities. |

| Convenience | Access your credit information anytime through mobile apps. |

These services can be crucial in maintaining a healthy credit profile.

Adjusting Strategies Based On Progress

As you monitor your credit, it’s important to adjust your strategies based on the progress you observe. Here are some steps to consider:

- Evaluate Results: Look at which actions have positively impacted your score.

- Set New Goals: Establish new objectives to continue improving.

- Seek Advice: Consult with financial advisors if needed.

Adapting your approach ensures that you remain on the right track towards rebuilding your credit history.

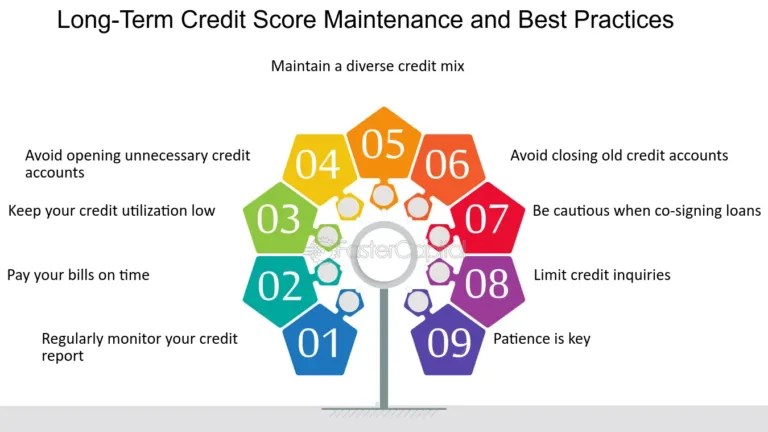

Conclusion: Maintaining A Healthy Credit Score

Maintaining a healthy credit score is a continuous effort. Good credit habits lead to long-term financial health. Here are some key strategies to ensure your credit score stays in great shape.

Long-term Habits For Credit Health

Developing long-term habits is essential for maintaining a healthy credit score. Consider these tips:

- Pay Bills on Time: Consistently paying your bills on time is crucial.

- Monitor Credit Utilization: Keep your credit utilization ratio below 30%.

- Check Credit Reports: Regularly review your credit reports for errors.

- Limit New Credit Requests: Avoid frequent hard inquiries on your credit.

- Manage Existing Debt: Pay down existing debt to improve your score.

Final Tips For Sustained Improvement

For sustained credit improvement, follow these additional tips:

- Automate Payments: Set up automatic payments to avoid missed due dates.

- Build an Emergency Fund: An emergency fund helps prevent late payments during unexpected events.

- Seek Professional Advice: Consider professional credit counseling for personalized advice.

- Use Credit Wisely: Only charge what you can afford to pay off each month.

Resources For Ongoing Support

Utilize resources to support your credit journey:

| Resource | Description |

|---|---|

| Revenued Business Card Visa® Commercial Card | Provides flexible working capital and dedicated support. |

| Credit Counseling Services | Offers professional advice on managing debt and improving credit. |

| Credit Monitoring Tools | Helps track your credit score and report regularly. |

By integrating these habits and utilizing available resources, you can maintain a healthy credit score and ensure your financial well-being.

Frequently Asked Questions

How Can I Start Rebuilding My Credit?

Start by reviewing your credit report for errors. Pay off outstanding debts and make timely payments. Consider a secured credit card.

How Long Does It Take To Rebuild Credit?

Rebuilding credit typically takes 3 to 6 months of consistent, responsible financial behavior. However, significant improvements can take up to a year.

Does Paying Off Debt Improve Credit Score?

Yes, paying off debt can improve your credit score. It lowers your credit utilization ratio and demonstrates responsible financial behavior.

Can A Secured Credit Card Help Rebuild Credit?

Yes, a secured credit card can help rebuild credit. It requires a deposit and reports your payment history to credit bureaus.

Conclusion

Rebuilding your credit history takes time and effort, but it is achievable. Start with small, consistent steps. Pay bills on time and keep balances low. Consider tools like the Revenued Business Card Visa® Commercial Card to manage finances and improve your credit score. This card offers flexible funding and easy management through a mobile app. Remember, persistence is key. Stay focused on your financial goals. With dedication and the right tools, you can rebuild your credit history successfully.