How To Fix Credit Score: Proven Tips for Quick Improvement

A good credit score opens many financial doors. But what if your score needs improvement?

Fixing your credit score can seem overwhelming, but it’s achievable with the right steps and dedication. A low credit score can impact your ability to secure loans, get favorable interest rates, and even affect job prospects. Understanding the factors that influence your credit score and learning how to address them is crucial. In this guide, we’ll explore practical steps to boost your credit score. Whether it’s addressing past debts or managing new credit wisely, you’ll find actionable tips that can make a significant difference. Ready to take control of your financial future? Let’s dive into the ways you can improve your credit score and pave the way for better financial health. Need help consolidating your debts? Check out Mitigately for effective debt management solutions.

Understanding Credit Scores

Credit scores play a crucial role in financial health. Knowing how they work helps in improving and maintaining a good score. Let’s break down the basics.

What Is A Credit Score?

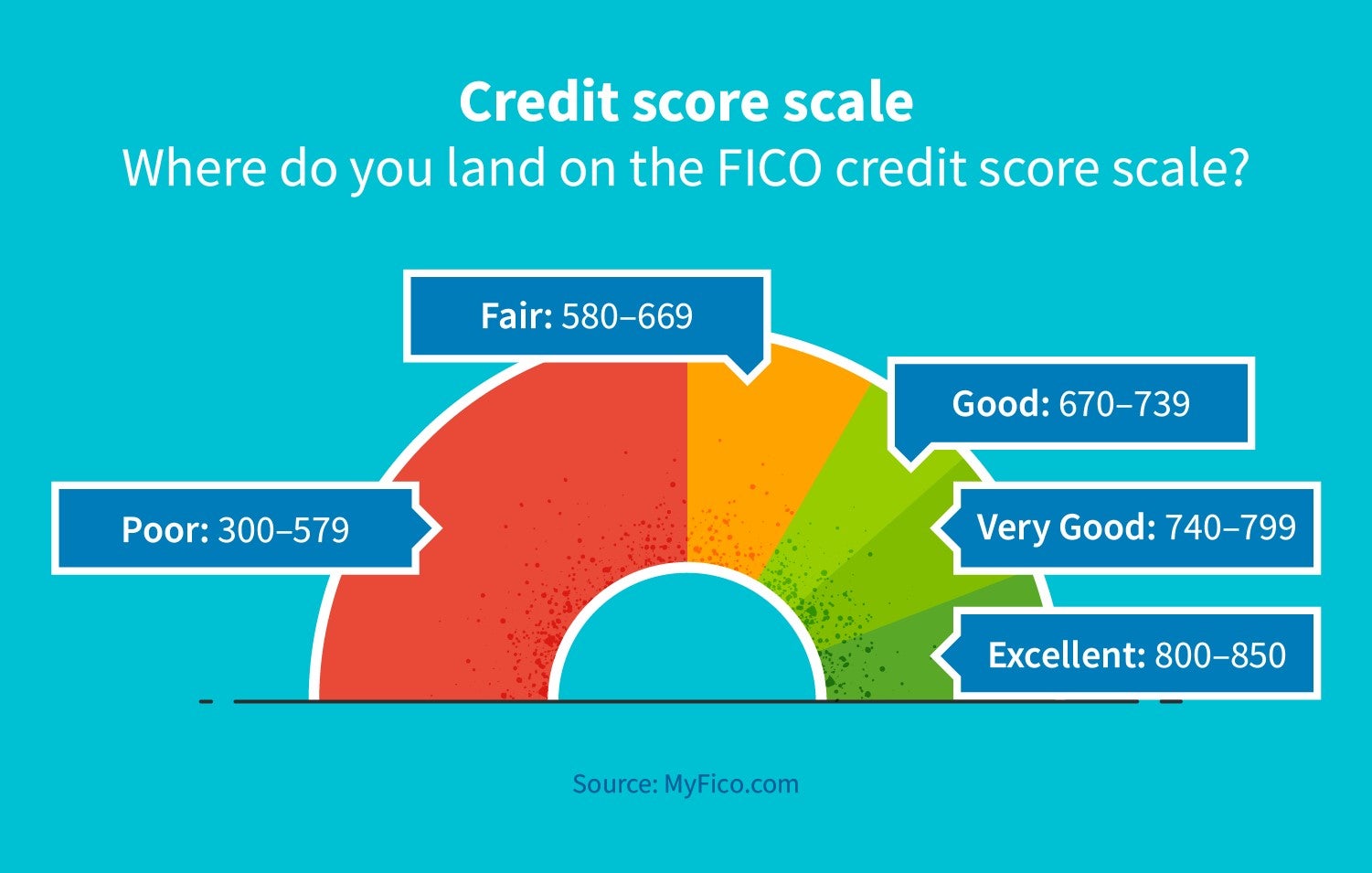

A credit score is a three-digit number that represents your creditworthiness. Lenders use it to decide if they should lend you money or approve you for a credit card. The score ranges from 300 to 850. A higher score means better credit.

How Credit Scores Are Calculated

Credit scores are calculated using several factors:

| Factor | Percentage |

|---|---|

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

Payment history has the largest impact. Always pay your bills on time. Amounts owed is next, so keep balances low. Length of credit history matters too. The longer, the better. New credit and credit mix also play a role but to a lesser extent.

Importance Of A Good Credit Score

A good credit score is vital. It can lead to:

- Lower interest rates on loans and credit cards.

- Higher credit limits.

- Better approval chances for rental applications.

- Favorable terms on insurance premiums.

With a higher score, you save money and have more financial flexibility.

Common Factors Affecting Credit Scores

Understanding the factors that affect your credit score is crucial. These elements play a significant role in determining your creditworthiness. By knowing these factors, you can take steps to improve your credit score.

Payment History

Payment history is the most significant factor affecting your credit score. It shows how reliably you pay your debts. Late payments, missed payments, and defaults negatively impact your score. Regular, on-time payments improve it.

Credit Utilization Rate

Your credit utilization rate is the ratio of your credit card balances to your credit limits. It is important to keep this rate below 30%. High credit utilization indicates a high dependency on credit, which can lower your score.

Length Of Credit History

The length of your credit history includes the age of your oldest credit account, the age of your newest account, and the average age of all your accounts. A longer credit history generally boosts your credit score.

Types Of Credit

Having a mix of different types of credit accounts can positively affect your credit score. This includes credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. A diverse credit portfolio demonstrates your ability to manage various credit types responsibly.

Recent Credit Inquiries

Recent credit inquiries refer to the number of times lenders have checked your credit report. These inquiries occur when you apply for new credit. Multiple inquiries in a short period can lower your score. Limit new credit applications to maintain a healthy credit score.

Proven Tips To Improve Your Credit Score Quickly

Improving your credit score quickly is possible with the right strategies. Focusing on key areas can make a significant difference. Here are some proven tips to boost your credit score in a short time.

Paying Bills On Time

Paying your bills on time is the most effective way to improve your credit score. Payment history accounts for 35% of your credit score. Even one late payment can negatively impact your score.

- Set up automatic payments to avoid missing due dates.

- Use reminders or calendar alerts for upcoming bills.

- Pay at least the minimum amount due each month.

Reducing Credit Card Balances

High credit card balances can hurt your credit score. Aim to keep your credit utilization ratio below 30%. This ratio is the amount of credit you’re using compared to your total credit limit.

| Current Balance | Credit Limit | Utilization Ratio |

|---|---|---|

| $1,000 | $5,000 | 20% |

- Pay down high balances as quickly as possible.

- Spread out your balances across multiple cards.

- Request a credit limit increase to lower your utilization ratio.

Avoiding New Credit Applications

Applying for new credit can temporarily lower your credit score. Each application results in a hard inquiry on your credit report, which can stay on your record for up to two years.

- Limit new credit applications to essential needs only.

- Space out applications to minimize impact on your score.

Keeping Old Accounts Open

Long credit history can positively affect your credit score. Closing old accounts can shorten your credit history and reduce your available credit.

- Keep older accounts open to maintain a longer credit history.

- Use old accounts occasionally to keep them active.

Disputing Credit Report Errors

Errors on your credit report can lower your credit score. Regularly check your credit report for inaccuracies. Dispute any errors you find.

- Request your free credit report from the major credit bureaus.

- Review the report for incorrect information.

- File a dispute with the credit bureau to correct errors.

Correcting errors can quickly improve your credit score.

Long-term Strategies For Maintaining A Good Credit Score

Maintaining a good credit score is a continuous effort. It requires disciplined financial habits and strategic planning. Here are some long-term strategies to ensure your credit score remains in good standing.

Establishing An Emergency Fund

An emergency fund is essential. It acts as a financial cushion for unexpected expenses. Aim to save at least three to six months’ worth of living expenses. This fund helps avoid using credit cards for emergencies, thus protecting your credit score.

Regularly Monitoring Your Credit Report

Regularly check your credit report. Look for inaccuracies and report them immediately. You can request a free credit report annually from major credit bureaus. Keeping an eye on your credit report helps you stay aware of your financial health.

Using Credit Wisely

Use credit cards responsibly. Keep your credit utilization ratio below 30%. Pay off your balance in full each month. Avoid opening too many new accounts at once. Responsible credit use positively impacts your credit score.

Seeking Professional Help

Consider professional help if managing debt becomes overwhelming. Services like Mitigately can assist. They offer debt consolidation services to combine multiple payments into one. This approach simplifies debt management and potentially saves you money.

Mitigately features include:

- Consolidation of Payments: Combine multiple debts into a single payment.

- Speed: Match with a debt solution in 6½ minutes using AI-powered agents.

- Savings: Potential to save an average of 35% through debt consolidation.

- Debt Repayment Calculator: Tool to calculate potential savings and compare monthly payments.

Benefits of using Mitigately include:

- Free Service: No charge until your accounts settle.

- Efficiency: Quick and secure matching with a debt solution.

- Significant Savings: Potential to save thousands and reduce debt faster.

- User-Friendly Process: Simple enrollment process and ongoing support.

By following these strategies, you can maintain a good credit score and achieve financial stability. Remember, consistency is key.

Tools And Resources To Help Manage And Improve Your Credit Score

Improving your credit score can feel daunting, but many tools and resources are available to help. By leveraging these tools, you can gain control over your financial health and work towards a better credit score. Below are some valuable resources:

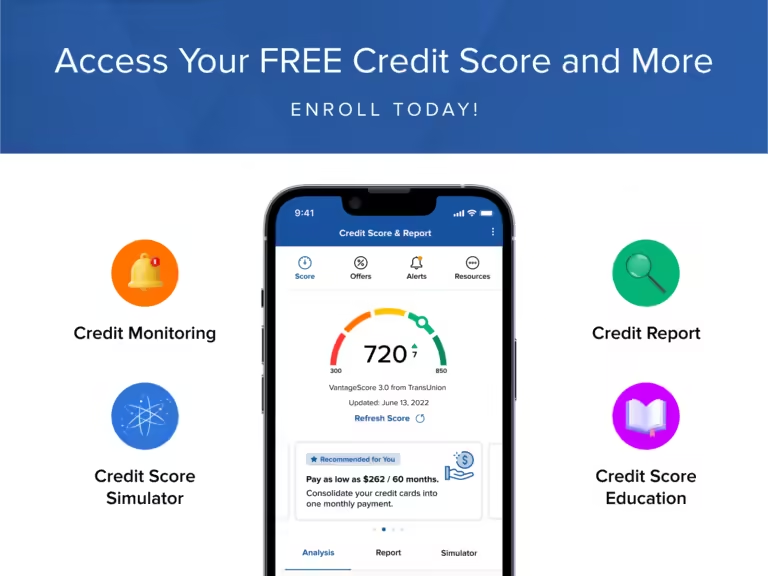

Credit Monitoring Services

Credit monitoring services keep track of your credit report and alert you to any changes. This can help you spot inaccuracies or signs of identity theft quickly. Some popular credit monitoring services include:

- Experian: Offers free credit monitoring and identity theft protection.

- TransUnion: Provides comprehensive credit monitoring and alerts.

- Equifax: Monitors your credit reports and provides score tracking.

These services can give you peace of mind by ensuring you stay informed about your credit status. They often offer additional features such as credit score simulators and personalized recommendations.

Credit Counseling Agencies

Credit counseling agencies offer professional advice and support to help manage debt and improve credit scores. They can assist with creating a budget, developing a debt repayment plan, and negotiating with creditors. Some reputable credit counseling agencies include:

- National Foundation for Credit Counseling (NFCC): Provides certified credit counselors and various financial services.

- Financial Counseling Association of America (FCAA): Offers credit and debt counseling services nationwide.

These agencies can provide you with tailored advice and support, making it easier to manage your finances and improve your credit score over time.

Financial Education Resources

Understanding how credit works is essential for managing and improving your score. Financial education resources can provide valuable insights and tips. Some useful resources include:

- MyCreditGuide from American Express: Offers a free credit score and educational materials.

- Credit Karma: Provides free credit scores, reports, and financial advice.

These resources can help you understand credit basics, identify areas for improvement, and make informed financial decisions. By educating yourself, you can take control of your credit and work towards a better score.

Common Mistakes To Avoid When Trying To Improve Your Credit Score

Improving your credit score can be a challenging task. Many people make common mistakes that can hinder their progress. Understanding these mistakes can help you avoid them and achieve a better credit score more efficiently.

Closing Old Credit Accounts

Closing old credit accounts can negatively impact your credit score. These accounts contribute to your credit history and increase your available credit. When you close them, you reduce your credit history length and available credit, which can lower your score.

Maxing Out Credit Cards

Maxing out credit cards can be detrimental to your credit score. High credit card balances increase your credit utilization ratio. It’s best to keep your balances below 30% of your credit limit to maintain a healthy score.

Ignoring Your Credit Report

Ignoring your credit report is a critical mistake. Regularly reviewing your credit report helps you catch errors and fraudulent activity. Dispute any inaccuracies to ensure your credit score reflects accurate information.

Applying For Too Much Credit At Once

Applying for too much credit at once can hurt your credit score. Each credit application results in a hard inquiry, which can lower your score. Space out your credit applications to avoid a negative impact.

For more information on debt consolidation, consider using Mitigately. This service can help you consolidate multiple payments into one, save on what you owe, and become debt-free faster.

Conclusion: Taking Control Of Your Financial Health

Taking control of your financial health is crucial for long-term stability. A healthy credit score opens doors to better financial opportunities. This journey involves understanding, planning, and executing strategies effectively.

Summarizing Key Points

Throughout this blog, we have discussed several important steps to improve your credit score:

- Reviewing your credit report regularly to identify and correct errors.

- Paying bills on time to build a positive payment history.

- Reducing debt and managing credit utilization effectively.

- Avoiding unnecessary credit inquiries and applying for new credit sparingly.

- Using tools like Mitigately to consolidate debts and simplify payments.

These steps, when followed consistently, can help improve your credit score significantly.

Encouraging Consistent Financial Habits

Building good financial habits is key to maintaining a healthy credit score. Here are some habits to adopt:

- Set up automatic payments to ensure bills are paid on time.

- Create a monthly budget to track expenses and stay within your means.

- Regularly review your credit report for any discrepancies or errors.

- Use credit cards responsibly and avoid maxing them out.

- Seek professional advice or use services like Mitigately for debt management.

Consistency in these habits will lead to better financial health over time.

Setting Realistic Credit Goals

Setting realistic credit goals can help you stay focused and motivated. Consider the following:

| Short-Term Goals | Long-Term Goals |

|---|---|

| Pay off high-interest debt first. | Increase your credit score by 50 points within a year. |

| Reduce credit card balances below 30% of the limit. | Maintain a credit utilization rate under 20%. |

| Review and correct credit report errors. | Qualify for a mortgage or car loan with favorable terms. |

Setting and achieving these goals can guide you to a better credit future.

Using services like Mitigately can significantly help in managing and reducing debt. With its AI-powered agents, Mitigately can match you with a debt solution in just 6½ minutes. This user-friendly service can help you save thousands and achieve financial freedom faster.

Frequently Asked Questions

How Can I Improve My Credit Score Quickly?

Improving your credit score quickly involves paying bills on time, reducing credit card balances, and disputing any errors on your credit report.

What Affects My Credit Score The Most?

Payment history has the most significant impact on your credit score. Other factors include credit utilization, length of credit history, new credit inquiries, and credit mix.

How Long Does It Take To Fix A Credit Score?

Fixing a credit score can take several months to a year. The exact time depends on the severity of the issues and how quickly you address them.

Can Paying Off Debt Improve My Credit Score?

Yes, paying off debt can improve your credit score. It reduces your credit utilization ratio and shows responsible credit management.

Conclusion

Improving your credit score takes time and dedication. Follow the steps outlined here. Make timely payments, reduce debt, and monitor your credit report. Each small effort contributes to a healthier score. Need help managing debt? Consider using Mitigately. They offer a free service to consolidate payments, save money, and speed up debt repayment. Stay committed, and you’ll see positive changes in your credit score. Remember, patience and consistency are key. Your financial future looks brighter with each step you take. Keep pushing forward!