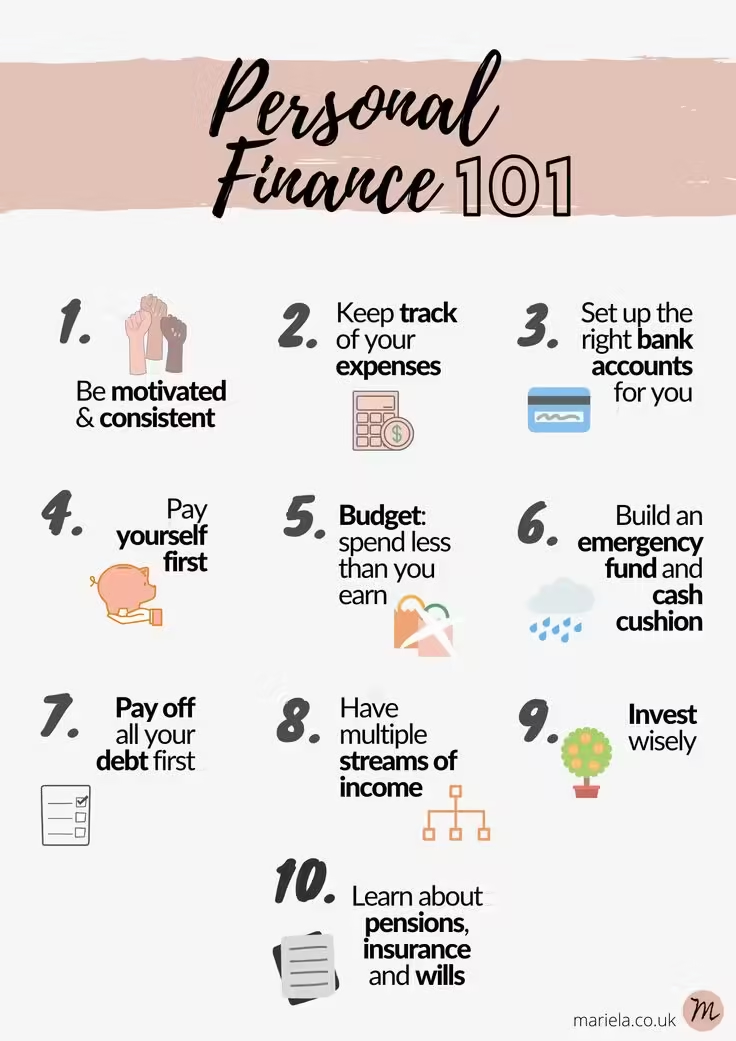

Personal Finance Tips: Boost Your Savings and Wealth

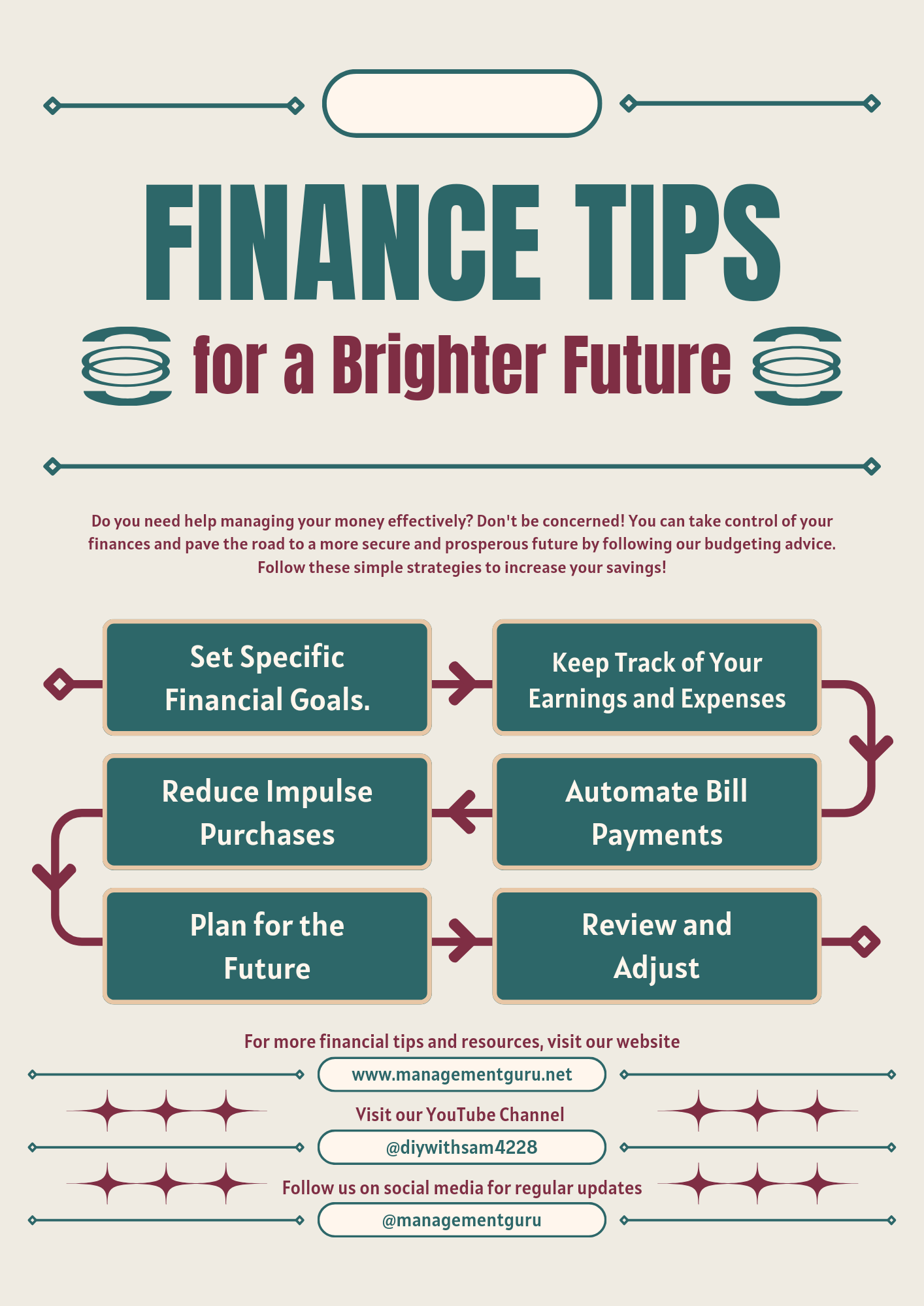

Managing personal finances can feel overwhelming, but it doesn’t have to be. With the right tips, anyone can take control of their financial future.

Financial stability is crucial for peace of mind and long-term success. From budgeting smarter to reducing debt, small changes can have a big impact. In this blog post, we’ll explore essential personal finance tips to help you achieve financial wellness. Whether you’re just starting out or looking to refine your strategy, these tips will guide you towards better financial habits. For those struggling with debt, services like Mitigately offer streamlined solutions. Mitigately simplifies debt management by consolidating payments and using AI to find the best debt relief options. Ready to take charge of your finances? Let’s dive into the essential tips that can make a difference. For more information on debt management, visit Mitigately.

Introduction To Personal Finance

Personal finance is about managing your money to achieve financial stability. It covers budgeting, saving, investing, and handling debt. Understanding personal finance helps you make informed decisions about your money. This guide will introduce you to the basics and importance of managing your finances.

Understanding Personal Finance

Personal finance involves a range of activities:

- Budgeting: Tracking your income and expenses to control spending.

- Saving: Setting aside money for future needs and emergencies.

- Investing: Growing your wealth through investments like stocks and bonds.

- Debt Management: Reducing and consolidating debts for financial freedom.

Each of these activities plays a crucial role in ensuring your financial health. Effective management of these areas leads to a more secure and stress-free financial life.

Importance Of Managing Finances

Managing your finances is essential for several reasons:

- Financial Security: Proper management ensures you have funds for emergencies and future needs.

- Reduced Stress: Knowing your financial situation reduces anxiety and stress.

- Debt Reduction: Effective management helps in reducing and consolidating debt, as offered by services like Mitigately.

- Improved Lifestyle: With better financial control, you can enjoy a more comfortable lifestyle.

Using services like Mitigately can simplify debt management. Mitigately consolidates multiple payments into one, speeds up debt reduction, and saves you money. This service is free until accounts are settled, emphasizing customer satisfaction and financial stability.

| Feature | Benefit |

|---|---|

| Consolidation | Simplifies payments into one |

| Faster Debt-Free Process | Reduces debt quicker than traditional methods |

| AI-Powered Matching | Finds best debt solutions in minutes |

Understanding and managing your finances is crucial. It leads to financial freedom, reduced stress, and a better quality of life. Start today to secure your future.

Setting Financial Goals

Setting financial goals is crucial for achieving financial stability and independence. Whether you aim to pay off debt, save for a vacation, or plan for retirement, having clear goals provides direction and motivation. This section will guide you through the process of setting effective financial goals.

Short-term Vs Long-term Goals

Understanding the difference between short-term and long-term goals is essential. Short-term goals are usually achieved within a year. Examples include paying off a small debt or saving for a vacation.

On the other hand, long-term goals take more time and planning. These goals might include buying a house, saving for retirement, or your child’s education. Both types of goals are important for a balanced financial plan.

Smart Goals Framework

Using the SMART goals framework can make your financial goals more achievable. SMART stands for:

- Specific: Clearly define your goal. For example, “Save $1,000 for emergency fund.”

- Measurable: Track your progress. Use a savings tracker to see your progress.

- Achievable: Ensure your goal is realistic. Don’t aim to save $10,000 in a month if your income doesn’t support it.

- Relevant: Your goal should align with your overall financial plan. For instance, if you have high debt, prioritize debt repayment.

- Time-bound: Set a deadline. “Save $1,000 within six months” gives you a clear end date.

For those dealing with debt, consider using a service like Mitigately. Mitigately helps manage and reduce debt efficiently, offering a faster path to becoming debt-free. Their AI-powered agent matches you with the best debt solutions quickly, and their services are free until your accounts are settled. This can simplify your financial goals and help you achieve them sooner.

Budgeting Basics

Effective budgeting is crucial for managing personal finances. It allows you to control your spending, save money, and reduce debt. Here are some essential tips for creating and maintaining a budget.

Creating A Budget

Start by listing all your sources of income. This includes salary, freelance work, and any other revenue streams. Next, categorize your expenses. Common categories include housing, utilities, groceries, transportation, and entertainment. Use a spreadsheet or a budgeting app to organize this information.

- Income: Salary, freelance work, side gigs

- Fixed Expenses: Rent/mortgage, utilities, insurance

- Variable Expenses: Groceries, transportation, entertainment

Allocate a specific amount of money to each category. Ensure your total expenses do not exceed your total income. Aim to include a portion for savings and debt repayment.

Tracking Your Expenses

Keep track of your spending to ensure you stick to your budget. You can do this manually by writing down each expense or using a budgeting app. Review your expenses weekly to see where your money is going.

A table can help categorize and monitor your expenses effectively:

| Category | Budgeted Amount | Actual Spending |

|---|---|---|

| Housing | $1000 | $950 |

| Groceries | $300 | $320 |

| Transportation | $150 | $140 |

Regular tracking helps identify areas where you may be overspending. This ensures you stay within your limits.

Adjusting Your Budget

Your budget is not set in stone. Life changes, and so should your budget. If you notice you are overspending in one category, adjust other categories to balance your budget.

- Review your budget monthly.

- Make adjustments based on your spending patterns.

- Consider seasonal expenses and plan accordingly.

Use these budgeting basics to take control of your finances. It sets a strong foundation for financial stability and success.

Saving Strategies

Effective saving strategies can be the cornerstone of sound personal finance. Whether you’re preparing for unexpected expenses or aiming to grow your wealth, a structured approach to saving money is crucial. Here are some practical tips to help you save more effectively.

Emergency Fund

An emergency fund is a crucial safety net that covers unexpected expenses. These can include medical bills, car repairs, or sudden job loss. Aim to save at least three to six months’ worth of living expenses.

- Start small. Even a few dollars each week can add up over time.

- Keep this fund in a separate account to avoid using it for non-emergencies.

- Review and adjust your goal as your financial situation changes.

High-yield Savings Accounts

A high-yield savings account can help your money grow faster compared to a standard savings account. These accounts offer higher interest rates, which means more earnings on your savings.

| Feature | Standard Savings Account | High-Yield Savings Account |

|---|---|---|

| Interest Rate | 0.01% – 0.05% | 1.00% – 2.00% |

| Accessibility | High | High |

| Minimum Balance | Varies | Varies |

Consider transferring funds to a high-yield account to maximize your interest earnings. Research different banks and their offerings to find the best rate.

Automating Your Savings

Automating your savings can make saving money effortless. Set up automatic transfers from your checking account to your savings account. This ensures you save regularly without having to think about it.

- Determine a fixed amount to transfer each month.

- Set up the transfer through your bank’s online portal.

- Monitor your savings to ensure the transfers are happening as planned.

Automation helps you stay disciplined and reduces the temptation to spend the money instead of saving it.

Investing For Wealth Growth

Investing is a key strategy for growing your wealth. By putting your money to work, you can achieve financial goals faster. This section explores various investment options that can help you build wealth over time.

Understanding Investment Options

To grow your wealth, understand the different investment options available:

- Stocks: Buying shares of companies.

- Bonds: Lending money to companies or governments.

- Mutual Funds: Pooled investments managed by professionals.

- Real Estate: Investing in property for rental income or appreciation.

Each option has its own risks and rewards. Choose based on your financial goals and risk tolerance.

Stock Market Basics

The stock market can be a great place to invest. Here are some basics:

- Stocks: Represent ownership in a company.

- Dividends: Payments made by companies to shareholders.

- Capital Gains: Profits from selling stocks at a higher price.

Investing in stocks can offer high returns, but it also comes with risks. It’s important to research and understand the market before investing.

Real Estate Investment

Real estate can be a valuable addition to your investment portfolio. Here are some ways to invest in real estate:

- Rental Properties: Buy property to rent out for monthly income.

- Real Estate Investment Trusts (REITs): Invest in property portfolios managed by professionals.

- Flipping Houses: Buy, renovate, and sell for a profit.

Real estate investment can provide steady income and potential appreciation over time.

Diversification

Diversification is key to managing investment risk. Here are some tips:

- Spread Investments: Don’t put all your money in one asset.

- Mix Asset Types: Combine stocks, bonds, and real estate.

- Geographic Diversification: Invest in different regions.

Diversification can help protect your investments from market volatility. It ensures you have a balanced portfolio, reducing overall risk.

Managing Debt

Managing debt is crucial for maintaining financial health. It helps in reducing stress and securing a stable financial future. With proper strategies, you can take control of your debt and work towards financial freedom.

Types Of Debt

Understanding different types of debt is the first step in managing it effectively. Debt usually falls into two categories:

- Secured Debt: This is backed by collateral, such as a mortgage or car loan.

- Unsecured Debt: This includes credit cards, medical bills, and personal loans without collateral.

Debt Repayment Strategies

Several strategies can help manage and repay debt efficiently:

- Debt Snowball: Focus on paying off the smallest debt first while making minimum payments on others. This builds momentum.

- Debt Avalanche: Pay off the debt with the highest interest rate first. This saves money on interest over time.

- Debt Consolidation: Combine multiple debts into one payment. This simplifies management and potentially lowers interest rates.

Debt Consolidation

Mitigately is a valuable tool for debt consolidation. It simplifies debt management by consolidating multiple payments into one. Below are the benefits of using Mitigately:

- Simplified debt management with a single payment.

- Faster debt-free process.

- Potential savings of thousands of dollars.

- AI-powered matching to debt solutions in approximately 6½ minutes.

- No upfront fees; pay only after accounts are settled.

- High customer satisfaction with a 4.9-star rating from 400+ reviews.

Here is a simple process of how Mitigately works:

| Step | Description |

|---|---|

| Submit Details | Enter information securely to the AI-powered agent. |

| Get Matched | Receive the best debt consolidation or relief option. |

| Follow Through | Implement the plan while Mitigately handles creditors. |

| Financial Freedom | Enjoy reduced debt and financial stability. |

Using Mitigately can lead to significant cost savings and faster debt reduction, ensuring a smoother path to financial freedom.

Retirement Planning

Planning for retirement is a crucial aspect of personal finance. It ensures financial stability and comfort in your golden years. Starting early and being informed about various retirement options can make a significant difference. Let’s delve into some essential tips for effective retirement planning.

Importance Of Early Planning

Early retirement planning is vital. The earlier you start, the more time your investments have to grow. This allows for compound interest to work in your favor, potentially leading to a larger nest egg.

Consider these benefits of early planning:

- More time to save and invest

- Opportunity to take advantage of compound interest

- Reduced financial stress in later years

Retirement Accounts (401k, Ira)

Retirement accounts such as 401k and IRA are essential tools for saving. They offer tax advantages that can help your savings grow faster.

| Account Type | Benefits |

|---|---|

| 401k | Employer matching contributions, tax-deferred growth |

| IRA | Tax-free growth in Roth IRA, tax-deferred growth in Traditional IRA |

It’s important to contribute regularly to these accounts. Aim to maximize employer contributions and consider both Traditional and Roth options to diversify tax benefits.

Social Security Benefits

Social Security benefits are a significant part of retirement income for many. Understanding how they work can help you plan better.

Key points to know about Social Security:

- Eligibility depends on your work history and earnings

- Benefits increase if you delay retirement past the full retirement age

- Spousal and survivor benefits are available

Plan to supplement Social Security with other retirement savings. This ensures a more comfortable and secure retirement.

Tax Planning

Effective tax planning is crucial for managing your personal finances. It helps you minimize tax liabilities and maximize potential savings. By understanding tax brackets, deductions, credits, and utilizing tax-advantaged accounts, you can keep more of your hard-earned money.

Understanding Tax Brackets

The tax system in most countries is progressive. This means higher earnings are taxed at higher rates. Knowing your tax bracket helps you plan and predict your tax liability. For instance, if you earn $50,000 annually, you might fall into the 22% bracket.

| Income Range | Tax Rate |

|---|---|

| $0 – $9,950 | 10% |

| $9,951 – $40,525 | 12% |

| $40,526 – $86,375 | 22% |

By staying informed about tax brackets, you can make strategic financial decisions.

Tax Deductions And Credits

Tax deductions and credits can significantly reduce your tax bill. Deductions lower your taxable income, while credits reduce the tax you owe directly.

Common tax deductions include:

- Mortgage interest

- Student loan interest

- Charitable contributions

Some valuable tax credits are:

- Child Tax Credit

- Earned Income Tax Credit

- Education credits like the Lifetime Learning Credit

Utilize these deductions and credits to reduce your tax burden.

Tax-advantaged Accounts

Tax-advantaged accounts offer tax benefits that can help you save more effectively. These include 401(k), IRA, and Health Savings Accounts (HSA).

Benefits of these accounts:

- Contributions to a 401(k) or IRA are often tax-deductible.

- Earnings in these accounts grow tax-free or tax-deferred.

- HSAs provide tax-free withdrawals for qualified medical expenses.

Maximizing contributions to these accounts can lead to significant long-term savings.

For more insights on managing debt and financial stability, visit Mitigately. They offer a streamlined process to manage and reduce debt efficiently.

Insurance And Risk Management

Managing personal finances involves more than saving and investing. Insurance and risk management are crucial parts. They protect your assets and provide peace of mind. Understanding different types of insurance and how to choose the right coverage can safeguard your financial future.

Types Of Insurance

Various insurance types cater to different needs. Here are some common ones:

- Health Insurance: Covers medical expenses and treatments.

- Life Insurance: Provides financial support to your family after your death.

- Auto Insurance: Covers damages and liabilities from car accidents.

- Homeowners/Renters Insurance: Protects your home or rented property from damages.

- Disability Insurance: Replaces income if you cannot work due to illness or injury.

Choosing The Right Coverage

Selecting the right insurance coverage is essential for effective risk management. Consider the following steps:

- Assess Your Needs: Determine which types of insurance are necessary for your situation.

- Compare Policies: Look at different insurance providers and their offerings.

- Understand Terms: Read the policy details, including coverage limits and exclusions.

- Check Costs: Evaluate the premiums and any additional costs.

- Consult a Professional: Seek advice from an insurance agent or financial advisor.

Risk Management Techniques

Risk management involves identifying, assessing, and mitigating risks. Here are some effective techniques:

- Diversification: Spread your investments across various asset types to minimize risk.

- Emergency Fund: Maintain a fund to cover unexpected expenses.

- Regular Reviews: Periodically review and adjust your insurance policies.

- Loss Prevention: Implement measures to reduce the likelihood of losses, such as installing security systems.

- Debt Management: Use services like Mitigately to consolidate and reduce debt, ensuring financial stability.

Incorporating these tips into your personal finance strategy can enhance your financial security and peace of mind.

Financial Tools And Resources

Managing personal finances can be challenging. Using the right tools and resources helps simplify the process. Below are some essential financial tools and resources for effective money management.

Personal Finance Software

Personal finance software helps track expenses, budget, and save money. Popular options include Mint and YNAB (You Need A Budget). These tools provide insights into spending habits and help set financial goals.

- Mint: Free budgeting software with account synchronization and spending analysis.

- YNAB: Paid service offering detailed budgeting and goal-setting features.

These tools offer both mobile and desktop applications, making them accessible and convenient.

Financial Advisors

Financial advisors offer personalized advice based on individual financial situations. They help with investments, retirement planning, and debt management.

Using services like Mitigately can also be beneficial. Mitigately provides debt consolidation and relief services. It uses an AI-powered agent to find the best debt solutions.

| Service | Benefits |

|---|---|

| Mitigately |

|

Mitigately simplifies debt management and ensures financial stability.

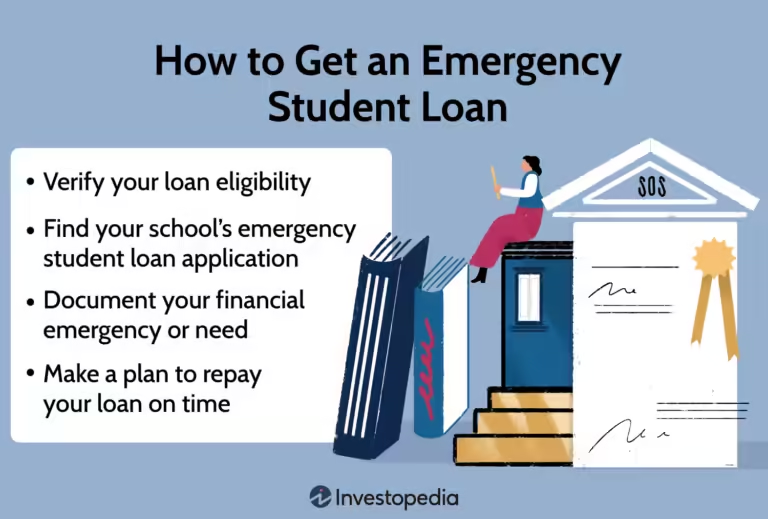

Educational Resources

Educational resources provide valuable knowledge on personal finance. Websites, blogs, and online courses offer insights into budgeting, saving, and investing.

Some useful resources include:

- Investopedia: Extensive articles on financial terms and concepts.

- Khan Academy: Free courses on personal finance and economics.

- Financial Blogs: Blogs like The Simple Dollar and NerdWallet offer practical advice and tips.

Using these resources helps improve financial literacy and make informed decisions.

Conclusion: Building A Secure Financial Future

Achieving a secure financial future requires careful planning and smart decision-making. Implementing effective personal finance strategies can lead to financial stability and peace of mind. Here, we recap key tips and outline next steps for ongoing financial success.

Recap Of Key Tips

- Budgeting: Track your income and expenses to identify areas for savings.

- Emergency Fund: Save at least three to six months’ worth of expenses.

- Debt Management: Use services like Mitigately to consolidate and reduce debt.

- Investing: Start investing early to benefit from compound interest.

- Insurance: Protect yourself with adequate health, life, and property insurance.

- Retirement Planning: Contribute regularly to retirement accounts to ensure a comfortable future.

Next Steps For Financial Success

- Review Your Budget: Regularly update and review your budget to stay on track.

- Use Tools Wisely: Leverage tools like Mitigately for debt consolidation and management.

- Automate Savings: Set up automatic transfers to your savings and investment accounts.

- Monitor Credit: Check your credit score and report regularly to identify and fix issues.

- Continue Learning: Stay informed about personal finance through books, courses, and online resources.

By following these steps, you can build a secure financial future. Remember, financial stability is a journey, not a destination. Stay committed and keep learning.

Frequently Asked Questions

What Are Essential Personal Finance Tips?

Start by creating a budget. Track your expenses and income. Save at least 20% of your earnings. Avoid unnecessary debt.

How Can I Save Money Effectively?

Automate your savings. Set specific financial goals. Cut down on non-essential expenses. Use budgeting apps to stay on track.

Why Is An Emergency Fund Important?

An emergency fund covers unexpected expenses. It prevents debt accumulation. Aim for 3-6 months of living expenses. It provides financial security.

How To Manage Debt Wisely?

Prioritize high-interest debt first. Make consistent payments. Avoid accumulating more debt. Consider debt consolidation if needed.

Conclusion

Personal finance management is crucial for a secure future. Use these tips to improve your financial health. For those dealing with debt, Mitigately can help. It consolidates payments and reduces debt efficiently. With Mitigately’s AI-powered agent, find the best debt solutions quickly. Save time and money with this service. Learn more about Mitigately by visiting their website. Take control of your finances today. Simplify, save, and secure your future.