Credit Repair Assistance: Boost Your Financial Health Today

Struggling with bad credit can feel overwhelming. You might think there’s no way out.

But what if you had expert help to guide you through the process? Credit repair assistance can make a significant difference in your financial life. It’s about more than just improving your credit score. It’s about regaining control, reducing stress, and opening doors to better opportunities. Whether you have unpaid debts or errors on your credit report, professional credit repair services like Mitigately can help. They use smart AI technology to find the best debt solutions for you in just minutes. This free service consolidates your debts into one manageable payment, helping you pay off what you owe faster and save money. Ready to take the first step towards financial freedom? Learn how Mitigately can help you today. Click here to get started.

Introduction To Credit Repair Assistance

Credit repair assistance helps individuals improve their credit scores. This is crucial for financial stability. Mitigately offers services that can aid in this process. They focus on debt consolidation and relief.

Understanding Credit Scores

Your credit score is a number that represents your creditworthiness. It ranges from 300 to 850. Higher scores indicate better credit history. Lenders use this score to decide on loan approvals.

Several factors impact your credit score:

- Payment history

- Credit utilization

- Length of credit history

- Types of credit accounts

- Recent credit inquiries

The Importance Of A Good Credit Score

A good credit score opens doors to better financial opportunities. It allows you to qualify for lower interest rates on loans and credit cards. You can save money in the long term. It also makes renting a home easier.

Employers may check your credit score when you apply for a job. A good score reflects financial responsibility. This can be beneficial in your career.

How Credit Repair Assistance Works

Credit repair assistance involves identifying and correcting errors on your credit report. Mitigately provides these services through their AI-powered platform. Here’s how it works:

- Getting Started: Submit your details securely online.

- Your Perfect Plan: The AI agent matches you with the best debt solution.

- The Follow Through: Mitigately negotiates with creditors on your behalf.

- You Made it Happen: Pay less than what you originally owed and regain financial freedom.

Mitigately’s service is free until your accounts are settled. They consolidate multiple payments into one. This simplifies debt repayment and helps you save money.

Key Features Of Credit Repair Assistance Services

Mitigately offers comprehensive credit repair assistance services. These services help users manage their debts and improve their credit scores effectively. Let’s explore the key features:

Comprehensive Credit Report Analysis

Mitigately provides a detailed credit report analysis to identify errors and inaccuracies. They review your credit report line by line. This helps in understanding the factors affecting your credit score. The analysis includes:

- Identifying incorrect personal information

- Detecting duplicate accounts

- Spotting inaccurate late payments

- Finding unauthorized hard inquiries

Dispute Resolution With Credit Bureaus

Mitigately handles dispute resolution with major credit bureaus. They contact the bureaus on your behalf. This ensures that erroneous entries are corrected. The dispute process includes:

- Preparing and submitting dispute letters

- Following up with credit bureaus

- Ensuring timely resolution

Personalized Credit Improvement Plans

Mitigately designs personalized credit improvement plans based on your financial situation. These plans are tailored to your needs, ensuring effective improvement of your credit score. The plan includes:

- Debt consolidation options

- Debt repayment schedules

- Strategies to reduce credit utilization

- Advice on managing new credit

Credit Monitoring Services

Mitigately offers continuous credit monitoring services to keep track of your credit score. This helps in identifying any sudden changes or suspicious activities. The monitoring services include:

- Regular credit score updates

- Alerts for new credit inquiries

- Notifications of changes in account statuses

With Mitigately’s credit repair assistance, you can achieve financial freedom. Their structured approach ensures that you can improve your credit score efficiently and effectively.

For more information, visit Mitigately.

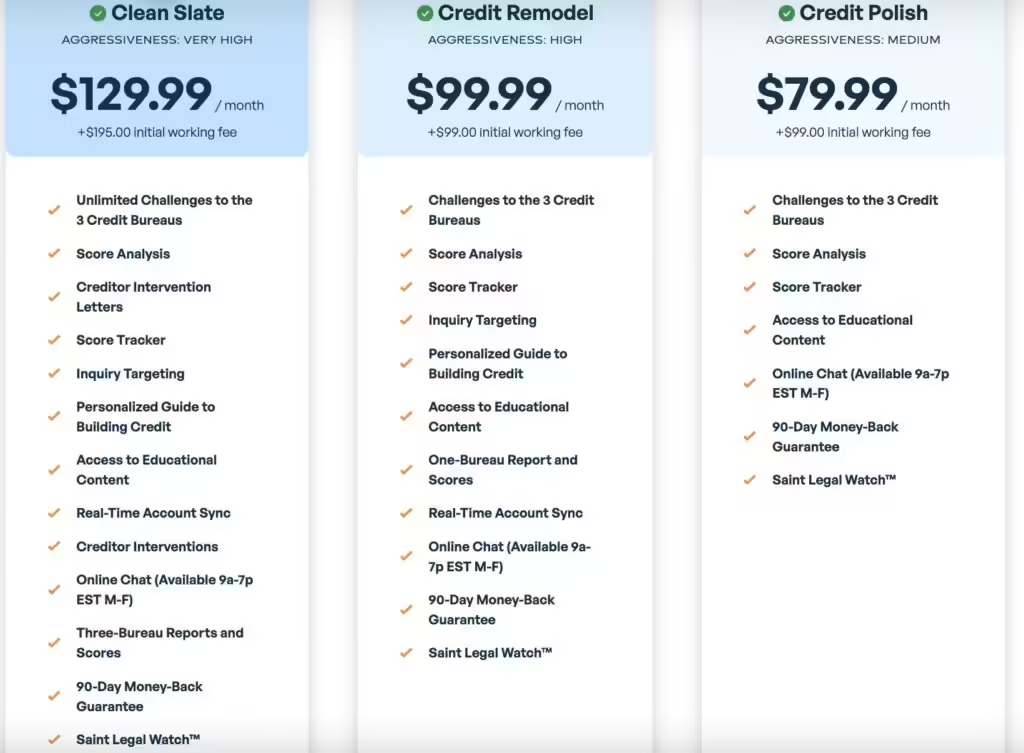

Pricing And Affordability

Understanding the cost of credit repair assistance is crucial. Mitigately offers various pricing tiers tailored to different needs. Let’s dive into the specifics of each plan.

Different Pricing Tiers Explained

Mitigately provides a simple and transparent pricing structure. The service fee is set at $0 until your accounts are settled. This ensures that users only pay once they see results, making it a risk-free option for many.

What’s Included In Each Pricing Plan

Each pricing plan with Mitigately includes a range of beneficial features:

- AI-Powered Matching: Matches users to debt solutions within an average of 6½ minutes.

- Debt Consolidation: Combines multiple payments into one streamlined payment.

- Debt Repayment Calculator: Estimate savings and compare monthly payments.

- High Ratings: Rated 4.9 stars from over 400 reviews.

This comprehensive approach ensures that users receive tailored, effective debt management solutions.

Comparing Cost Vs. Value

When evaluating cost versus value, Mitigately stands out. Users typically save an average of 35% through debt consolidation. The service’s ease of use and high ratings further enhance its value.

Mitigately’s pricing plan offers unmatched affordability and effectiveness in debt management. The service provides excellent value without upfront costs, ensuring financial relief and satisfaction.

Pros And Cons Of Credit Repair Assistance

Credit repair assistance can be a valuable resource for individuals looking to improve their credit scores. It involves professional services that help correct errors on credit reports and negotiate with creditors. But like any service, it has its advantages and potential drawbacks. Here’s a closer look at the pros and cons of credit repair assistance.

Advantages Of Professional Credit Repair

- Expertise: Credit repair professionals have extensive knowledge of credit laws and regulations.

- Time-Saving: They handle all the paperwork and negotiations, saving you time.

- Improved Credit Score: With their help, you can see significant improvements in your credit score.

- Legal Protection: They ensure that your rights are protected throughout the process.

- Customized Plans: Services like Mitigately offer personalized debt solutions tailored to your financial situation.

Potential Drawbacks And Risks

- Cost: While some services charge fees, Mitigately offers a free service until your accounts are settled.

- Scams: Be wary of fraudulent companies that promise unrealistic results.

- Limited Results: Credit repair can’t remove accurate negative information from your credit report.

Real-world Usage Experiences

- D. Murg: “Mitigately delivered and I paid less than half of what I owed.”

- J. Fischer: “Qualified for the Fresh Start Loan Program and now debt-free.”

- M. Sellers: “Debt relief cut my debt into less than half.”

- E. Proctor: “Saved thousands and my credit was like new after a few months.”

Mitigately, with its AI-powered matching, has received high ratings from users who have benefited from faster debt repayment and significant cost savings.

Recommendations For Ideal Users

Credit repair assistance can be a lifesaver for many. It helps improve credit scores, manage debts, and provides financial relief. Mitigately, a trusted name in debt consolidation and relief, offers specialized services for those in need.

Who Can Benefit Most From Credit Repair Assistance

Individuals with poor credit scores can benefit greatly from credit repair assistance. Those struggling with multiple debt payments, or those who have been denied loans due to poor credit history, will find these services invaluable. Mitigately offers a unique AI-powered matching system, making it easier to find suitable debt solutions quickly.

- People with multiple debts

- Individuals denied loans

- Those seeking faster debt repayment

Specific Scenarios Where Credit Repair Is Beneficial

There are specific situations where credit repair can make a significant impact. For instance, if you are planning to buy a home, having a good credit score is crucial. Mitigately can help consolidate your debts and improve your credit score efficiently.

| Scenario | Benefit |

|---|---|

| Buying a Home | Improved credit score for better loan rates |

| Applying for a Car Loan | Higher chances of approval |

| Starting a Business | Better financial credibility |

Success Stories And Case Studies

Many users have shared their success stories after using Mitigately. These testimonials highlight the real-world impact of effective debt management and credit repair.

D. Murg: “Mitigately delivered and I paid less than half of what I owed.”

J. Fischer: “Qualified for the Fresh Start Loan Program and now debt-free.”

M. Sellers: “Debt relief cut my debt into less than half.”

E. Proctor: “Saved thousands and my credit was like new after a few months.”

Conclusion: Boosting Your Financial Health

Taking control of your finances can seem daunting. With the right tools and support, it becomes manageable. Credit repair assistance, like Mitigately, offers a path to better financial health. Understanding its benefits, taking the first step, and staying committed will help you achieve your goals.

Summarizing The Benefits

Mitigately provides several benefits:

- Faster Debt Repayment: Pay off debts quicker than traditional methods.

- Cost Savings: Save an average of 35% through debt consolidation.

- Ease of Use: Handle everything online with no phone calls or waiting.

- Financial Freedom: Follow a structured plan to achieve financial independence.

These benefits are designed to make your journey to better credit smoother and more efficient.

Taking The First Step Towards Better Credit

Starting your journey with Mitigately involves a few simple steps:

- Getting Started: Submit your details securely through the AI-powered agent.

- Your Perfect Plan: Receive a tailored debt consolidation or relief plan.

- The Follow Through: Follow the plan while Mitigately handles negotiations with creditors.

- You Made it Happen: Pay a fraction of what was originally owed and enjoy financial freedom.

These steps are straightforward. Each is designed to bring you closer to a debt-free life.

Final Thoughts And Encouragement

Credit repair assistance offers a lifeline to those struggling with debt. Mitigately stands out with its AI-powered matching, ease of use, and significant cost savings. Starting the journey can be the hardest part. But with the right support, reaching financial freedom is possible.

Remember, the path to better credit is a step-by-step process. Stay committed to your plan. Celebrate each milestone. Your financial health will improve, and you will achieve the peace of mind you deserve.

Frequently Asked Questions

What Is Credit Repair Assistance?

Credit repair assistance helps improve your credit score. Professionals guide you through disputing errors on your credit report.

How Does Credit Repair Work?

Credit repair involves reviewing your credit report. Experts identify errors and dispute inaccuracies with credit bureaus.

Is Credit Repair Assistance Effective?

Yes, credit repair assistance can be effective. It helps remove inaccuracies from your credit report, improving your score.

How Long Does Credit Repair Take?

Credit repair typically takes three to six months. The duration depends on the complexity of your credit issues.

Conclusion

Achieving financial freedom is possible with the right support. Mitigately offers a reliable solution for debt management. By consolidating multiple payments, you can reduce financial stress. Their AI-powered matching ensures quick and effective debt solutions. Save time and money while managing your debts efficiently. Visit Mitigately to start your journey to financial independence today. Secure your future by taking control of your debts now. Make informed decisions and enjoy a debt-free life.