Effective Credit Repair Strategies: Boost Your Credit Score Fast

Improving your credit score can seem daunting. But effective strategies can make this process easier and more manageable.

Credit repair isn’t just about fixing your score; it’s about creating financial freedom and peace of mind. Whether you’re dealing with errors on your credit report or struggling with debt, knowing the right steps can make a huge difference. This guide will walk you through practical and effective strategies to repair your credit. By following these methods, you can take control of your financial future and enjoy the benefits of a better credit score. For those looking for professional help, consider using services like Mitigately. This AI-powered service can help consolidate debts and provide relief, making the journey to financial freedom smoother. Learn more at Mitigately. Let’s explore these strategies together and set you on the path to financial health.

Introduction To Credit Repair

Credit repair involves improving your credit score by identifying and disputing errors on your credit report. Mitigately, a leading AI-powered debt consolidation and relief service, can help streamline this process, ensuring you become debt-free faster.

Understanding Credit Scores

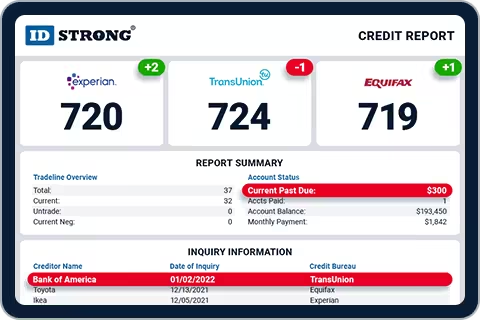

A credit score is a numerical representation of your creditworthiness. It is based on your credit history, including the number of open accounts, total levels of debt, and repayment history.

Credit scores typically range from 300 to 850. Higher scores indicate better creditworthiness. Mitigately can assist by consolidating your debts, which may improve your credit score.

The Importance Of A Good Credit Score

A good credit score can provide several benefits:

- Lower interest rates on loans and credit cards

- Better chances of loan and credit approval

- Increased negotiating power

- Higher credit limits

- Better insurance rates

With Mitigately, users can save an average of 35% through debt consolidation, improving their financial health and credit score. This service is free until accounts are settled, providing a risk-free way to manage debt.

Key Strategies For Effective Credit Repair

Repairing your credit can seem daunting, but with the right strategies, it is achievable. Here are some key strategies for effective credit repair that will help you take control of your financial future.

Start by obtaining your credit report from major credit bureaus. Check for inaccuracies and outdated information. Identify any errors that might be affecting your credit score.

| Step | Action |

|---|---|

| 1 | Get your credit report from Equifax, Experian, and TransUnion. |

| 2 | Review each section for incorrect or outdated information. |

| 3 | Note any inaccuracies for disputing. |

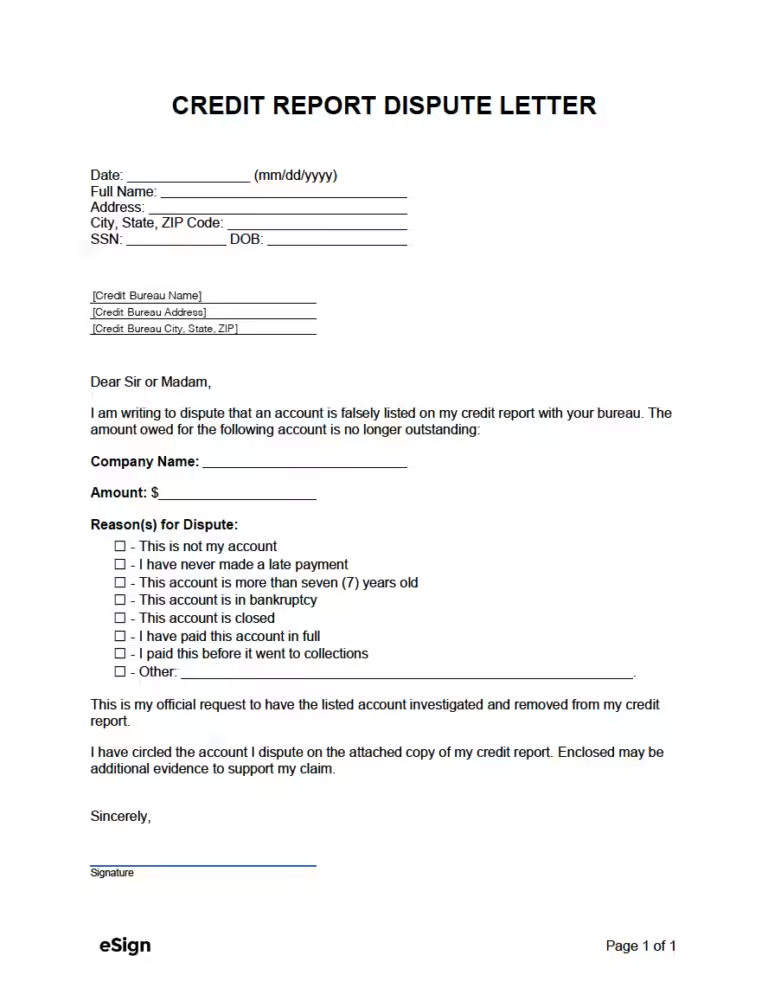

If you find errors, you need to dispute them with the credit bureau. This involves writing a dispute letter and providing evidence to support your claim.

- Write a detailed dispute letter.

- Include copies of documents that support your case.

- Send the letter to the credit bureau via certified mail.

High debt levels can negatively impact your credit score. Focus on paying down debt to improve your credit utilization ratio. Consider using a debt consolidation service like Mitigately to manage multiple debts more effectively.

- Make a list of all your debts.

- Determine a payment plan.

- Consider debt consolidation options.

Using credit wisely is crucial for maintaining a good credit score. Avoid maxing out credit cards and try to keep your credit utilization rate below 30%.

Here are some tips:

- Pay your bills on time.

- Keep balances low on credit cards.

- Only open new credit accounts when necessary.

Building a positive credit history is essential for long-term credit health. Use new credit responsibly and make regular payments to demonstrate financial responsibility.

Consider these actions:

- Become an authorized user on a family member’s account.

- Apply for a secured credit card.

- Take out a small loan and pay it back on time.

By following these strategies, you can effectively repair your credit and secure a better financial future. Consider using tools like Mitigately for debt consolidation and relief to simplify the process and save money.

Reviewing Your Credit Report

Effective credit repair begins with a thorough review of your credit report. This crucial step helps identify errors and areas needing improvement. By understanding your credit report, you can take actionable steps to enhance your credit score.

How To Obtain Your Credit Report

To get started, you need access to your credit report. Here’s how you can obtain it:

- Visit AnnualCreditReport.com, the only authorized source for free credit reports.

- Request your report from the three major credit bureaus: Experian, Equifax, and TransUnion.

- You are entitled to one free report from each bureau every 12 months.

Once you have your report, you can begin analyzing the details.

What To Look For In Your Report

When reviewing your credit report, focus on the following key areas:

| Section | Details to Check |

|---|---|

| Personal Information | Ensure your name, address, and social security number are correct. |

| Credit Accounts | Verify all accounts listed are yours and their statuses are accurate. |

| Credit Inquiries | Check for any unauthorized or unfamiliar inquiries. |

| Public Records | Look for any bankruptcies, liens, or judgments that may impact your score. |

| Errors and Discrepancies | Identify any errors or discrepancies that could hurt your credit. |

If you find any inaccuracies, dispute them with the respective credit bureau. This can help improve your credit score quickly.

Remember, a regular review of your credit report is essential for maintaining good credit health. Tools like Mitigately can assist in managing and consolidating debt, further aiding in your journey to financial freedom.

Disputing Inaccuracies

Disputing inaccuracies on your credit report is a crucial step in credit repair. By addressing errors, you can potentially improve your credit score. Here, we will discuss how to identify errors, file disputes, and follow up on your disputes effectively.

Identifying Errors

To start, you need to thoroughly review your credit report. Look for discrepancies such as:

- Incorrect personal information

- Accounts that aren’t yours

- Duplicate accounts

- Incorrect account statuses

- Inaccurate balances or credit limits

- Outdated information

It is important to check all three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau may have different information on file.

How To File A Dispute

Once you have identified the errors, you need to file a dispute. Here is a step-by-step guide:

- Gather supporting documents: This includes any statements, identification, and proof of the errors.

- Write a dispute letter: Clearly state the inaccuracies and include copies of supporting documents.

- Submit your dispute: You can do this online through the credit bureau’s website or by mail.

- Keep copies: Always keep copies of your dispute letter and supporting documents for your records.

Each credit bureau has its own process for filing disputes. Make sure to follow their specific guidelines to ensure your dispute is processed smoothly.

Follow-up On Disputes

After filing a dispute, it’s important to follow up. Here’s how you can do that:

- Track your dispute: Most credit bureaus provide a way to track the status of your dispute online.

- Wait for a response: Credit bureaus typically have 30 days to investigate and respond.

- Review the results: Once you receive a response, carefully review the results to ensure the corrections were made.

- Dispute again if necessary: If the bureau did not correct the error, you may need to dispute again with additional evidence.

Effective follow-up ensures that your credit report reflects accurate information, which is essential for maintaining a good credit score.

Paying Down Debt

Paying down debt is a crucial step toward improving your credit score. By reducing your debt, you can increase your credit utilization ratio, which is a significant factor in determining your credit score. It also alleviates financial stress and frees up funds for savings or other expenses. Below are some effective strategies to help you pay down debt.

Prioritizing High-interest Debt

High-interest debts can quickly spiral out of control, making it essential to prioritize them. Focus on paying these off first to reduce the amount of interest you accrue over time.

- Identify High-Interest Debts: List all your debts along with their interest rates.

- Allocate Extra Payments: Direct any extra money toward the debt with the highest interest rate.

- Maintain Minimum Payments: Keep making minimum payments on other debts to avoid late fees.

Debt Snowball Vs. Debt Avalanche Methods

Two popular methods for paying down debt are the Debt Snowball and Debt Avalanche methods. Each has its own benefits and can be effective depending on your financial situation and personal preference.

| Method | Approach | Benefits |

|---|---|---|

| Debt Snowball | Pay off the smallest debts first. | Quick wins boost motivation. |

| Debt Avalanche | Pay off the highest interest debts first. | Save money on interest over time. |

Both methods can be effective, but it’s important to choose the one that aligns with your goals. The Debt Snowball method can provide quick psychological wins, while the Debt Avalanche method can save you more money in the long run.

Consider using tools such as Mitigately’s Debt Repayment Calculator to estimate potential savings and compare monthly payments. This AI-powered service can help consolidate multiple debts into a single payment, making the process more manageable and potentially saving you thousands on what you owe.

Using Credit Wisely

Effectively managing your credit is key to improving and maintaining a healthy credit score. By using credit wisely, you can avoid pitfalls that may lead to debt accumulation and financial stress. Below are some strategies to help you use your credit responsibly.

Keeping Credit Utilization Low

Credit utilization refers to the ratio of your credit card balances to your credit limits. Keeping this ratio low is crucial for a good credit score. Aim to use no more than 30% of your available credit. For example, if your credit limit is $10,000, try to keep your balance below $3,000.

Using a table can help monitor your credit utilization:

| Credit Card | Credit Limit | Current Balance | Utilization (%) |

|---|---|---|---|

| Card 1 | $5,000 | $1,000 | 20% |

| Card 2 | $3,000 | $900 | 30% |

Avoiding New Debt

One of the best ways to use credit wisely is to avoid accumulating new debt. Think carefully before taking out new loans or credit cards. Ask yourself if you really need the new credit or if it can wait.

Consider the following points to avoid new debt:

- Only apply for credit when necessary.

- Focus on paying off existing debts first.

- Use cash or debit cards for purchases whenever possible.

Smart Use Of Credit Cards

Credit cards can be useful tools if used responsibly. Here are some tips for smart use of credit cards:

- Pay your balance in full each month to avoid interest charges.

- Set up automatic payments to ensure you never miss a due date.

- Use credit cards for planned purchases only, not for impulsive buying.

Additionally, consider utilizing Mitigately’s services to consolidate debt. Mitigately offers AI-powered debt consolidation and relief services to help you manage your finances better. With Mitigately, you can consolidate multiple payments into one and save thousands on what you owe.

For more information, visit Mitigately.

Building Positive Credit History

Building a positive credit history is crucial for improving your credit score. This section will guide you through effective strategies to establish and maintain a strong credit profile. By following these steps, you can enhance your creditworthiness and achieve financial stability.

Timely Bill Payments

Paying bills on time is one of the most effective ways to build positive credit history. Late payments can significantly harm your credit score. Set reminders or automate your payments to ensure you never miss a due date.

- Set up automatic payments for recurring bills.

- Use calendar alerts to remind you of upcoming due dates.

- Monitor your account balances regularly to avoid overdrafts.

Consistent timely payments demonstrate responsibility and reliability to creditors.

Secured Credit Cards

Secured credit cards are excellent tools for building or rebuilding credit. These cards require a security deposit, which serves as your credit limit. Using a secured credit card responsibly can boost your credit score over time.

| Feature | Benefit |

|---|---|

| Security Deposit | Sets your credit limit and minimizes risk for issuers |

| Regular Reporting | Payments reported to credit bureaus |

| Credit Building | Improve credit score with responsible use |

Ensure you use only a small portion of your credit limit and pay the balance in full every month.

Authorized User Accounts

Becoming an authorized user on someone else’s credit card account can help you build credit. The primary account holder’s positive payment history can reflect on your credit report, boosting your credit score.

- Ask a trusted friend or family member to add you as an authorized user.

- Ensure the primary account holder has a good credit history.

- Monitor the account activity regularly.

This strategy allows you to benefit from the primary account holder’s good credit habits without being liable for the debt.

Professional Credit Repair Services

Struggling with bad credit can be stressful. Sometimes, professional help is necessary. Professional credit repair services offer expertise in improving credit scores. They work with creditors and credit bureaus to correct errors and negotiate better terms. This can save you money and time.

When To Consider Professional Help

There are times when seeking professional credit repair services is a good idea:

- Your credit report has multiple errors.

- You have tried DIY methods without success.

- Facing difficulties in understanding credit reports.

- Need faster results to secure a loan or mortgage.

Professional services can navigate complex credit laws. They also have established relationships with creditors and credit bureaus. This can lead to quicker and more effective results.

Choosing A Reputable Credit Repair Service

Not all credit repair services are created equal. It is important to choose a reputable one. Here are some tips:

- Research: Check reviews and ratings online. Look for services with high satisfaction rates.

- Transparency: Ensure they explain their process clearly. Ask about their methods and expected outcomes.

- Cost: Be wary of upfront fees. Most reputable services charge only after they have delivered results.

- Accreditation: Look for services accredited by organizations like the Better Business Bureau.

One example of a reputable service is Mitigately. They offer AI-powered debt consolidation and relief services. Mitigately helps users consolidate multiple payments into one. Their AI-powered agent matches users to suitable debt solutions quickly. This service is free until accounts are settled. They have a high satisfaction rate of 4.9 stars from over 400 reviews.

Choosing a reputable service can make a significant difference in your credit repair journey. It is worth taking the time to find the right one.

Pros And Cons Of Diy Credit Repair

Repairing your credit on your own can seem like a daunting task. Yet, it offers both significant benefits and challenges. Understanding the pros and cons of DIY credit repair can help you decide if it’s the right approach for you.

Advantages Of Diy Credit Repair

Cost Savings: One of the main advantages of DIY credit repair is that it can save you money. You avoid paying fees to credit repair companies, making it a cost-effective option.

Control Over Process: DIY credit repair gives you full control over the process. You can monitor your credit reports, dispute inaccuracies, and track your progress.

Educational Experience: Repairing your own credit can be an educational experience. You learn about credit scoring, how to manage debt, and how to avoid future credit issues.

Flexible Pace: You can work at your own pace. Whether you want to address issues quickly or spread out the process, the choice is yours.

Challenges Of Diy Credit Repair

Time-Consuming: DIY credit repair can be time-consuming. It involves understanding credit reports, contacting creditors, and following up on disputes, which can be overwhelming.

Complexity: The process can be complex. Understanding credit laws, knowing how to dispute errors, and negotiating with creditors require knowledge and patience.

Risk of Errors: There is a risk of making errors. Incorrectly disputing items or mishandling communications with creditors can worsen your credit situation.

Emotional Stress: Managing your own credit repair can be stressful. Dealing with creditors and financial issues can take an emotional toll.

If DIY credit repair seems overwhelming, consider using a service like Mitigately. Mitigately offers an AI-powered debt consolidation and relief service that could save you both time and money.

Ideal Users For Credit Repair Strategies

Credit repair strategies provide a vital lifeline for those with poor credit scores. These strategies help improve credit scores and secure better financial opportunities. Mitigately, an AI-powered debt consolidation and relief service, offers effective solutions to those facing credit challenges.

Who Should Use Credit Repair Strategies?

Credit repair strategies are essential for individuals with low credit scores. These people may struggle to secure loans, credit cards, or favorable interest rates. Mitigately can help:

- People with a credit score below 600.

- Individuals facing high-interest debts.

- Those denied credit due to poor credit history.

Mitigately’s AI-powered agent quickly matches users to suitable debt solutions. This process typically takes just 6½ minutes. The service is free until accounts are settled, making it accessible to all.

Scenarios Where Credit Repair Is Most Beneficial

There are specific scenarios where credit repair strategies can be most beneficial. Mitigately’s services can help in the following situations:

- High-Interest Debt: Consolidating high-interest debts into a single, manageable payment can save users an average of 35%.

- Multiple Debts: Combining several debts into one payment simplifies the repayment process.

- Credit Denial: Improving credit scores to secure loans or credit cards.

Mitigately not only helps consolidate debts but also offers relief programs to significantly reduce the amount owed. Users can save thousands on what they owe and become debt-free faster.

For example, customer reviews highlight the effectiveness of Mitigately’s services:

| Customer | Experience |

|---|---|

| D. Murg | Paid less than half of what was owed. |

| J. Fischer | Became debt-free in 5 minutes through the Fresh Start Loan Program. |

| M. Sellers | Mitigately’s debt relief cut debt into less than half. |

| E. Proctor | Saved thousands and improved credit after a few months. |

These testimonials showcase the potential benefits of using Mitigately for credit repair. The service’s high satisfaction rate, with a rating of 4.9 stars from over 400 reviews, emphasizes its effectiveness.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves improving your credit score by disputing errors and negotiating with creditors. It helps in removing inaccurate or outdated information from your credit report.

How Can I Fix My Credit Score Quickly?

Pay off outstanding debts, dispute errors on your credit report, and avoid new credit inquiries. Consistently making on-time payments also helps.

Do Credit Repair Companies Work?

Credit repair companies can assist in removing errors from your credit report. However, you can often do these tasks yourself without extra costs.

How Long Does Credit Repair Take?

Credit repair can take a few months to a year, depending on your credit issues. Consistent efforts yield better results.

Conclusion

Effective credit repair strategies can make a big difference. They can improve your credit score and financial health. Take small steps daily for better results. Use tools like Mitigately to manage debt and consolidate payments. Their AI-powered service can save you time and money. Check out Mitigately for more information. Start your journey to financial freedom today.