Credit Management Solutions: Boost Your Financial Health Today

Effective credit management is crucial for maintaining financial health. It ensures you stay on top of your debts and avoid financial pitfalls.

In this blog post, we explore “Credit Management Solutions” to help you find the best way to manage and reduce your debt. Managing credit can be overwhelming. With so many options, finding the right solution can be daunting. That’s where Mitigately comes in. Mitigately offers a comprehensive approach to debt management, powered by AI for quick and efficient solutions. It consolidates multiple debt payments into one, making it easier to become debt-free faster. With the potential to save up to 35% on what you owe, Mitigately’s services are designed to simplify your financial life. Discover how you can secure your financial future by visiting Mitigately.

Introduction To Credit Management Solutions

Managing credit effectively is crucial for maintaining financial health. Credit management solutions like Mitigately provide tools and services to help individuals handle their debts efficiently. Understanding these solutions can lead to faster debt repayment and significant savings.

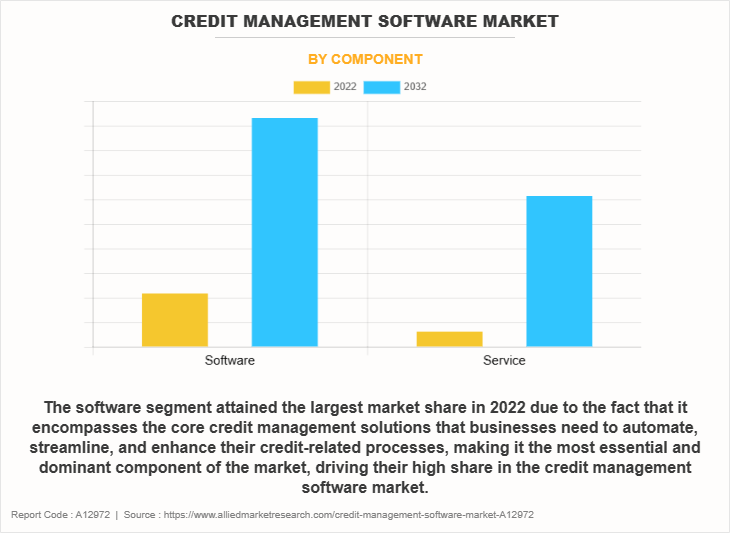

What Are Credit Management Solutions?

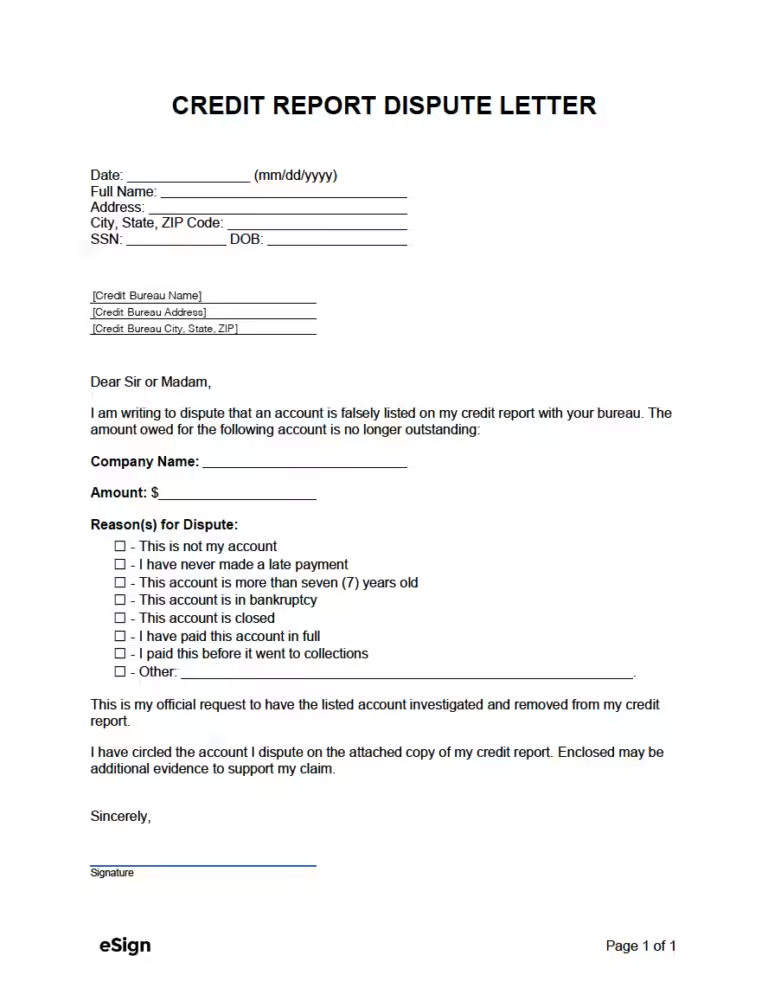

Credit management solutions are services designed to help individuals manage their debt. These solutions can include debt consolidation, debt relief programs, and tools for monitoring and improving credit scores. For example, Mitigately offers an AI-powered debt consolidation service, which combines multiple debt payments into one manageable payment.

Mitigately matches users to appropriate debt solutions quickly, with an average matching time of just 6½ minutes. This efficient process helps users find the best debt relief options tailored to their specific needs.

Importance Of Effective Credit Management

Effective credit management is essential for several reasons:

- Faster Debt Repayment: Services like Mitigately help users become debt-free faster than traditional methods.

- Cost Savings: Users can save up to 35% on their debts, potentially saving thousands of dollars.

- Ease of Use: The quick and easy enrollment process eliminates the need for lengthy phone calls.

- Privacy Protection: Mitigately ensures that personal data is secure with 256-bit encryption.

- High Ratings: The service is highly rated, with an average rating of 4.9 stars from over 400 reviews.

By using credit management solutions like Mitigately, individuals can achieve financial freedom and improve their overall credit health.

Key Features Of Credit Management Solutions

Credit management solutions like Mitigately offer powerful tools and features to help individuals manage their credit efficiently. These solutions not only focus on consolidating debt but also provide comprehensive monitoring, automated reminders, personalized advice, and simulation tools. Let’s explore some key features:

Comprehensive Credit Monitoring

Mitigately provides comprehensive credit monitoring to keep track of your credit status. This feature allows you to monitor any changes in your credit report, ensuring you stay informed about your financial health. By keeping an eye on your credit, you can quickly identify and address any discrepancies or potential issues.

Automated Payment Reminders

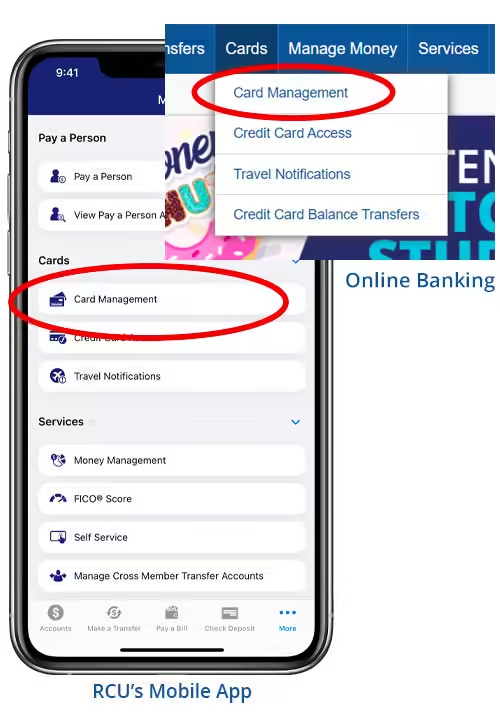

With automated payment reminders, Mitigately ensures you never miss a payment. These reminders help you stay on top of your financial obligations, reducing the risk of late fees and negative impacts on your credit score. Timely payments are crucial for maintaining a good credit score, and this feature makes it easier to manage them.

Personalized Financial Advice

Mitigately offers personalized financial advice tailored to your unique situation. The AI-powered agent analyzes your financial data to provide recommendations that help you manage debt and improve your credit score. This personalized approach ensures you receive advice that is relevant and actionable.

Credit Score Simulation Tools

Mitigately includes credit score simulation tools that allow you to see how different financial actions might affect your credit score. Whether you are considering taking out a new loan, paying off a debt, or making other financial decisions, these tools can help you understand the potential impact on your credit score.

| Feature | Description |

|---|---|

| Comprehensive Credit Monitoring | Monitor credit status and changes in your credit report. |

| Automated Payment Reminders | Receive reminders to avoid late fees and maintain your credit score. |

| Personalized Financial Advice | Get tailored advice to manage debt and improve your credit score. |

| Credit Score Simulation Tools | See how different financial actions affect your credit score. |

Pricing And Affordability Of Credit Management Solutions

Understanding the pricing and affordability of credit management solutions is crucial. It ensures you get the best value for your money while managing your debts efficiently. Mitigately offers various plans and features, making it accessible and cost-effective for users.

Subscription Plans Overview

Mitigately provides a flexible pricing model to cater to different financial needs. Below is an overview of their subscription plans:

| Plan | Features | Cost |

|---|---|---|

| Basic | AI-Powered Matching, Debt Consolidation | Free until accounts settle |

| Premium | All Basic features, Fresh Start Loan Program, High Savings | Free until accounts settle |

Free Vs. Paid Features

Mitigately’s service is free until your accounts settle. This makes it accessible to everyone. Here’s a breakdown of what you get with the free and paid plans:

- Free Features:

- AI-Powered Matching

- Debt Consolidation

- Secure Process

- Paid Features:

- Debt Relief Programs

- Fresh Start Loan Program

- High Savings

Value For Money Analysis

Mitigately provides exceptional value for money. Here’s why:

- Faster Debt Repayment: Users become debt-free faster than traditional methods.

- Cost Savings: Save up to 35% on debts.

- Ease of Use: Quick enrollment process without lengthy phone calls.

- Privacy Protection: 256-bit encryption ensures personal data is secure.

- High Ratings: Rated 4.9 stars from over 400 reviews.

Given these benefits, Mitigately stands out as an affordable and effective credit management solution.

Pros And Cons Of Using Credit Management Solutions

Credit management solutions like Mitigately offer various benefits and drawbacks. Understanding these can help you decide if these tools meet your financial needs.

Advantages Of Credit Management Tools

Mitigately provides several advantages:

- AI-Powered Matching: Matches users to debt solutions in 6½ minutes.

- Debt Consolidation: Combines multiple payments into one.

- Debt Relief Programs: Includes options like the Fresh Start Loan Program.

- Secure Process: Ensures personal data protection with 256-bit encryption.

- High Savings: Users can save up to 35% on debts.

- Faster Debt Repayment: Helps users become debt-free quicker.

- Ease of Use: Quick enrollment without lengthy phone calls.

Potential Drawbacks And Limitations

Despite its benefits, Mitigately has some drawbacks:

- No Explicit Refund Policies: No clear refund or return policy.

- Not All Debts Covered: Some debts may not be eligible for consolidation.

- Impact on Credit Score: Consolidation might affect credit scores initially.

Comparing the advantages and drawbacks can help in making an informed decision about using credit management solutions like Mitigately.

Recommendations For Ideal Users

Mitigately offers a range of credit management solutions that cater to different financial needs. Understanding who benefits the most from these services helps users make informed decisions. This section highlights the ideal users and scenarios where Mitigately shines.

Who Can Benefit The Most?

Individuals with Multiple Debts: Those juggling multiple debt payments can find relief in consolidating their debts into a single payment.

People Seeking Faster Debt Repayment: If you aim to become debt-free quickly, Mitigately’s efficient processes and programs can help achieve that goal.

Users Looking for Cost Savings: Mitigately users can save up to 35% on their debts, making it a cost-effective solution.

Privacy-Conscious Individuals: The service ensures personal data security with 256-bit encryption, providing peace of mind.

Scenarios Where Credit Management Solutions Shine

- Consolidation of Multiple Payments: If you manage several credit card debts, Mitigately’s debt consolidation can streamline your payments into one.

- Debt Relief Programs: Programs like the Fresh Start Loan Program offer tailored solutions for significant debt reduction.

- Quick Matching: The AI-powered agent matches users to debt solutions in an average of 6½ minutes, providing prompt assistance.

- High Savings Potential: Users can save thousands on what they owe, making financial recovery more feasible.

Mitigately’s solutions are designed to cater to a wide range of financial situations. Whether you need to consolidate debts or find debt relief programs, Mitigately offers the tools and support necessary for financial freedom.

Conclusion: Boost Your Financial Health Today

Taking control of your finances can seem overwhelming. With Mitigately, you can simplify this process and make smart financial decisions. Let’s recap the benefits and leave you with some final thoughts to encourage you on your journey.

Summary Of Benefits

Mitigately offers a range of benefits that can help you manage your debt effectively:

- AI-Powered Matching: Find a debt solution in just 6½ minutes.

- Debt Consolidation: Combine multiple payments into one.

- Debt Relief Programs: Access various programs, including the Fresh Start Loan Program.

- High Savings: Save up to 35% on your debts.

- Privacy Protection: 256-bit encryption safeguards your personal data.

- Ease of Use: Quick enrollment without lengthy phone calls.

- High Ratings: Rated 4.9 stars by over 400 users.

Final Thoughts And Encouragement

Mitigately empowers you to tackle your debt with confidence. The secure and efficient process ensures that your financial health is prioritized. Users like D. Murg and J. Fischer have achieved significant savings and financial freedom.

The journey to becoming debt-free starts with a single step. Take advantage of Mitigately’s free service until your accounts settle. Begin by securely inputting your information and let the AI agent match you with the best debt solution. Achieve financial freedom and boost your credit score with Mitigately.

Are you ready to boost your financial health today? Visit Mitigately and take the first step towards a debt-free life.

Frequently Asked Questions

What Are Credit Management Solutions?

Credit management solutions help businesses manage and streamline their credit processes. They aid in assessing creditworthiness, reducing risk, and ensuring timely payments.

Why Is Credit Management Important?

Credit management is crucial for maintaining cash flow. It minimizes the risk of bad debts and helps in making informed credit decisions.

How Do Credit Management Solutions Work?

Credit management solutions automate credit assessments and monitor payments. They provide real-time analytics, helping businesses make accurate credit decisions and reduce financial risks.

What Features Do Credit Management Solutions Offer?

Credit management solutions offer features like credit scoring, risk assessment, automated invoicing, and real-time monitoring. These features enhance efficiency and reduce manual errors.

Conclusion

Effective credit management is essential for financial stability. Mitigately offers a reliable solution. It helps consolidate multiple payments into one. This simplifies debt repayment and saves money. The AI-powered service ensures efficient matching. Users can expect faster debt relief. Interested in learning more? Check out Mitigately here. Start your journey to financial freedom today.