Small Business Payment Solutions: Streamline Your Transactions Today

Managing payments can be a challenge for small business owners. You need solutions that are efficient and reliable.

Understanding the best small business payment solutions can make a big difference. The right tools help you streamline transactions and manage cash flow better. One such solution is Melio Payments. This platform is designed to simplify how you make and receive payments. Melio offers a variety of features that cater specifically to small business needs. You can pay bills online, schedule payments, and track transactions in real time. Melio also integrates with popular accounting software like QuickBooks. This makes financial management easier and more efficient. Ready to learn more? Check out Melio here.

Introduction To Small Business Payment Solutions

Small businesses often face challenges when it comes to managing payments. Efficient payment solutions are crucial for smooth operations. Melio Payments is a digital platform designed to enhance the payment process for businesses.

Understanding The Need For Efficient Payment Solutions

Small businesses need efficient payment solutions to stay competitive. Without them, managing cash flow becomes difficult. Late payments can lead to financial strain. It’s essential to have a system that simplifies payments. Melio Payments offers such a solution.

Melio Payments allows businesses to pay bills online. It also offers multiple payment methods. This flexibility is vital for meeting various business needs. The platform integrates with popular accounting software like QuickBooks. This integration helps streamline financial management.

How Streamlined Transactions Benefit Small Businesses

Streamlined transactions save time. Businesses can focus on growth instead of managing payments. Melio Payments enables scheduled payments. This feature ensures timely transactions. It also helps avoid late fees.

Tracking payments in real-time is another benefit. It provides better financial control. Businesses can monitor their expenses and cash flow more effectively. Melio Payments’ tracking feature offers this convenience.

Additionally, the platform supports vendor payments. Businesses can pay vendors via bank transfer or credit card. Even if vendors only accept checks, Melio Payments covers it. This flexibility is invaluable for maintaining good vendor relationships.

Below is a table summarizing the main features and benefits of Melio Payments:

| Feature | Description |

|---|---|

| Bill Payments | Easily pay bills online with flexibility in payment methods. |

| Vendor Payments | Pay vendors via bank transfer or credit card, even if they only accept checks. |

| Scheduled Payments | Schedule payments to ensure timely transactions. |

| Payment Tracking | Track all payments in real-time for better financial management. |

| Integration | Seamlessly integrates with popular accounting software like QuickBooks. |

Melio Payments offers a free plan with basic features. For advanced features, there is a premium plan available. More details on pricing can be found on their website.

Key Features Of Modern Payment Solutions

Modern payment solutions are essential for small businesses. They offer convenience, flexibility, and security. Below are key features that make modern payment solutions indispensable for businesses.

Mobile Payment Integration: Flexibility On The Go

Mobile payment integration allows businesses to accept payments anywhere. This feature provides flexibility, especially for businesses on the move. Melio Payments supports various mobile payment methods. This ensures you can handle transactions efficiently outside the traditional store setting.

Point Of Sale (pos) Systems: Enhancing In-store Experience

POS systems enhance the in-store experience. They streamline transactions and improve customer satisfaction. Melio Payments integrates seamlessly with POS systems. This ensures smooth and fast transactions. It also helps in tracking sales and inventory in real-time.

Online Payment Gateways: Secure And Convenient E-commerce Transactions

Online payment gateways are crucial for e-commerce businesses. They provide secure and convenient transactions. Melio Payments offers robust online payment solutions. These solutions protect sensitive data and ensure smooth online transactions. They also integrate with popular e-commerce platforms for enhanced functionality.

Recurring Billing: Simplifying Subscription Management

Recurring billing is essential for subscription-based businesses. It automates the billing process, saving time and effort. Melio Payments simplifies subscription management with its recurring billing feature. This ensures timely payments and reduces administrative tasks.

Multi-currency Support: Expanding Global Reach

Multi-currency support is crucial for businesses with international customers. It allows businesses to accept payments in different currencies. Melio Payments offers multi-currency support. This helps businesses expand their global reach and cater to a broader audience.

| Feature | Description |

|---|---|

| Mobile Payment Integration | Accept payments anywhere, providing flexibility for mobile businesses. |

| POS Systems | Enhance in-store transactions and customer satisfaction. |

| Online Payment Gateways | Ensure secure and convenient e-commerce transactions. |

| Recurring Billing | Automate subscription management for timely payments. |

| Multi-Currency Support | Expand global reach by accepting multiple currencies. |

Melio Payments is a comprehensive solution for modern businesses. It integrates essential features that streamline and enhance payment processes.

Pricing And Affordability Breakdown

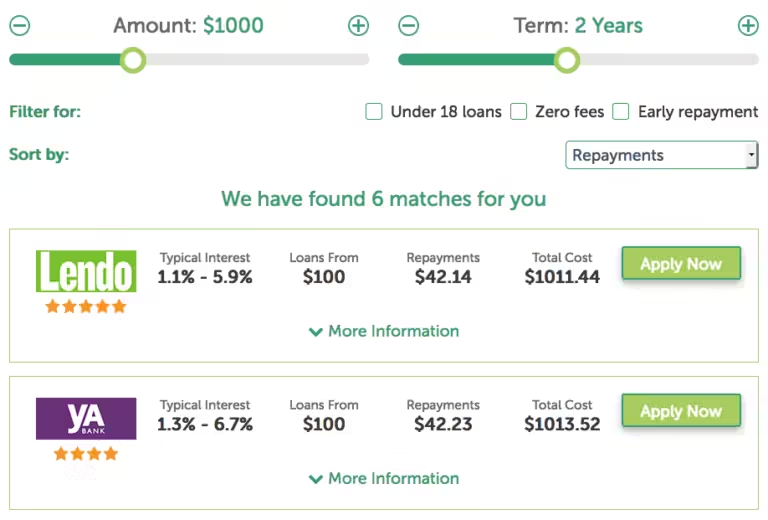

Finding the right payment solution for your small business involves understanding the costs. Each provider offers different pricing structures and fees. Let’s dive into these details to help you make an informed decision.

Comparing Different Payment Solution Providers

Each payment solution provider has unique offerings. Here’s a comparison of some popular ones:

| Provider | Free Plan | Premium Plan | Key Features |

|---|---|---|---|

| Melio Payments | Yes | Yes | Bill Payments, Vendor Payments, Scheduled Payments, Payment Tracking, Integration with QuickBooks |

| Provider B | Yes | Yes | Feature 1, Feature 2, Feature 3 |

| Provider C | No | Yes | Feature 1, Feature 2, Feature 3 |

Understanding Transaction Fees And Monthly Costs

Transaction fees and monthly costs can vary greatly. Here’s what to consider:

- Transaction Fees: These are fees charged per transaction. Melio Payments offers flexible payment methods which might have different fees.

- Monthly Costs: Some providers offer free plans with basic features, while premium plans offer advanced features at a monthly fee.

For example, Melio Payments has a free plan with essential features and a premium plan for advanced needs. Check their website for the latest pricing details.

Finding The Best Value For Your Business Needs

To find the best value, consider the following:

- Analyze Your Needs: Identify the features that are most important for your business.

- Compare Costs: Look at both transaction fees and monthly costs to find a balance that suits your budget.

- Consider Integration: Choose a solution that integrates with your existing systems, like Melio’s integration with QuickBooks.

- Check Flexibility: Make sure the provider offers flexible payment options and scheduling.

Melio Payments stands out with its convenience, flexibility, and efficiency, making it a valuable option for many small businesses.

Pros And Cons Of Popular Payment Solutions

Choosing the right payment solution is crucial for any small business. Each payment option has its unique advantages and drawbacks. Understanding these can help businesses make informed decisions. Let’s dive into the pros and cons of popular payment solutions, focusing on user experience, security features, and integration capabilities.

Evaluating User Experience And Customer Support

User experience plays a significant role in the effectiveness of a payment solution. Melio Payments offers a streamlined user interface, making it easy for businesses to manage transactions. The platform allows users to pay bills online, schedule payments, and track transactions in real-time.

Customer support is equally important. Melio provides robust support, ensuring users can resolve issues quickly. The availability of customer support can make or break the user experience. When evaluating a payment solution, consider the quality and accessibility of customer support services.

Weighing Security Features Against Convenience

Security is paramount in any payment solution. Melio Payments ensures secure transactions through encrypted data and compliance with industry standards. This protects sensitive information from potential threats.

While security is essential, convenience should not be overlooked. Melio offers flexible payment options, including bank transfers and credit card payments. This flexibility can simplify the payment process and improve financial management. Balancing security with convenience is key to choosing the right payment solution.

Assessing Integration Capabilities With Existing Systems

Integration capabilities are crucial for seamless business operations. Melio Payments integrates smoothly with popular accounting software like QuickBooks. This feature can save time and reduce errors in financial management.

Assessing how well a payment solution integrates with your existing systems can significantly impact efficiency. Look for solutions that offer easy integration to streamline your workflow and improve productivity.

Here’s a brief comparison table summarizing the key points:

| Feature | Melio Payments |

|---|---|

| User Experience | Streamlined interface, easy bill payments, real-time tracking |

| Customer Support | Robust and accessible support services |

| Security | Encrypted data, industry-standard compliance |

| Convenience | Flexible payment options, efficient scheduling |

| Integration | Seamless integration with QuickBooks |

By understanding the pros and cons of payment solutions like Melio Payments, businesses can choose the best option for their needs. Consider user experience, security features, and integration capabilities when making your decision.

Recommendations For Ideal Users And Scenarios

Choosing the right payment solution is crucial for small businesses. The ideal solution varies based on the type of business you run. Below, we break down the best options for retail, e-commerce, and service-based industries.

Best Solutions For Retail Businesses

Retail businesses need fast and reliable payment methods. Melio Payments offers a flexible and convenient solution for paying vendors and managing bills. Retailers can use Melio to:

- Pay suppliers via bank transfer or credit card.

- Schedule payments to avoid late fees.

- Track all transactions in real-time.

This ensures a smooth supply chain and better cash flow management, essential for any retail business.

Top Choices For E-commerce Platforms

E-commerce businesses require seamless integration with their online platforms. Melio Payments integrates with popular accounting software like QuickBooks. This integration helps e-commerce businesses:

- Automate payment processes.

- Manage cash flow efficiently.

- Track expenses and payments in real-time.

These features save time and reduce the risk of errors, making Melio a top choice for online sellers.

Ideal Payment Solutions For Service-based Industries

Service-based industries often deal with varied payment schedules and methods. Melio Payments offers the flexibility needed for these businesses. Service providers can:

- Schedule payments to align with project milestones.

- Pay vendors even if they prefer checks.

- Streamline their financial workflows.

This flexibility and efficiency make Melio ideal for managing the financial aspects of service-based businesses.

Conclusion: Streamlining Your Transactions For Growth

Choosing the right payment solution can greatly impact your small business. Efficient payment processing saves time, reduces errors, and enhances customer satisfaction. Melio Payments offers a robust platform designed to streamline your transactions and support business growth.

Recap Of Key Benefits And Features

Melio Payments provides a range of benefits and features tailored to small business needs:

| Feature | Benefit |

|---|---|

| Bill Payments | Pay bills online with ease and flexibility. |

| Vendor Payments | Pay vendors via bank transfer or credit card, even if they only accept checks. |

| Scheduled Payments | Ensure timely transactions by scheduling payments. |

| Payment Tracking | Track all payments in real-time for better financial management. |

| Integration | Seamlessly integrates with popular accounting software like QuickBooks. |

- Convenience: Streamlines the payment process, saving time and effort.

- Flexibility: Offers multiple payment options to suit various business needs.

- Efficiency: Automates payment scheduling and tracking to improve financial workflows.

- Cost Management: Helps manage cash flow and expenses effectively.

Final Thoughts On Choosing The Right Payment Solution

Selecting the right payment solution involves understanding your business requirements and evaluating features and benefits. Melio Payments offers a free plan with essential features and a premium plan for advanced needs, making it suitable for various business sizes and types.

Consider Melio Payments for its ease of use, flexibility, and efficiency. This can help streamline your transactions and support your business growth. For more details, visit the official Melio Payments website.

Frequently Asked Questions

What Are Small Business Payment Solutions?

Small business payment solutions are services that help businesses process transactions. They include credit card processing, mobile payments, and online payment gateways.

How Do Payment Solutions Benefit Small Businesses?

Payment solutions streamline transactions, reduce manual errors, and improve cash flow. They also enhance customer satisfaction by offering multiple payment options.

Which Payment Solution Is Best For Small Businesses?

The best payment solution depends on your business needs. Consider options like PayPal, Square, and Stripe for their ease of use and features.

Are Mobile Payment Solutions Secure?

Yes, mobile payment solutions are secure. They use encryption and tokenization to protect sensitive information, ensuring safe transactions.

Conclusion

Choosing the right payment solution is crucial for small businesses. Melio Payments offers a streamlined, flexible, and efficient way to handle transactions. Its features like bill payments, vendor payments, and payment tracking make financial management easier. With seamless integration with QuickBooks, Melio simplifies your workflow. Explore more about Melio Payments by visiting their website here. Make smart payment decisions to boost your business success.