Financial Freedom Through Credit: Unlock Your Wealth Potential

Credit can be a powerful tool for achieving financial freedom. Properly managed, it can help you build wealth and secure your future.

Understanding how to leverage credit effectively is key to financial success. Many people view credit as a burden, but it can actually be an asset when used wisely. Credit can help you start or grow a business, invest in opportunities, and improve your financial standing. Platforms like Funding Societies offer various credit options tailored for small and medium enterprises (SMEs). With quick approvals and flexible financing solutions, they provide the necessary support for business growth. Whether you are a business owner looking to expand or an investor seeking new opportunities, Funding Societies can be a valuable partner in your journey towards financial freedom. For more details, visit Funding Societies and explore their offerings.

Introduction To Financial Freedom Through Credit

Achieving financial freedom is a goal many people strive for. Credit can play a significant role in this journey. By understanding how to use credit wisely, individuals and businesses can unlock opportunities for growth and stability.

Understanding Financial Freedom

Financial freedom means having enough income to cover living expenses without relying on a traditional job. It allows for greater control over your time and financial decisions. Here are a few key aspects:

- Income: Generating multiple streams of income.

- Savings: Building an emergency fund and retirement savings.

- Investments: Growing wealth through various investment options.

- Debt Management: Reducing and managing debt efficiently.

Role Of Credit In Achieving Financial Freedom

Credit is a powerful tool in the pursuit of financial freedom. It helps individuals and businesses access funds when they need them most. Here’s how:

| Type of Credit | Purpose | Benefits |

|---|---|---|

| Credit Cards | Everyday expenses, rewards, and building credit history | Convenience, rewards, and credit score improvement |

| Personal Loans | Consolidating debt, major purchases | Fixed interest rates, structured repayments |

| Business Loans | Expanding business, managing cash flow | Supporting growth, covering operational costs |

Using credit wisely involves understanding your needs and selecting the right type of credit. Here are some options provided by Funding Societies:

- Micro Loan: Fast approval within 24 hours. Ideal for urgent small business needs.

- Term Loan: Larger financing for working capital and business expansion.

- Investment Options: Short investment tenors with periodic repayments. Minimum investment: S$20. Average return (2020): 7.28%.

Funding Societies supports SMEs with quick and easy access to necessary funding. This can aid in overcoming the SME financing gap and support growth. Investors also benefit from diversifying their portfolios and earning returns.

Key Features Of Credit For Wealth Building

Understanding the key features of credit can significantly aid in wealth building. Utilizing credit effectively can open doors to various financial opportunities. Let’s delve into some important aspects of credit that can help you build wealth.

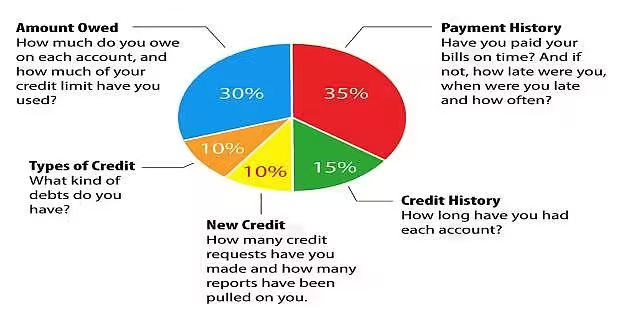

Credit Scores And Their Impact On Your Financial Life

Your credit score is a vital part of your financial profile. It affects your ability to get loans, mortgages, and other forms of credit. A higher credit score often leads to better interest rates and loan terms. Here’s how credit scores impact your financial life:

| Credit Score Range | Impact |

|---|---|

| Excellent (750-850) | Best loan terms and interest rates |

| Good (700-749) | Good loan terms and interest rates |

| Fair (650-699) | Higher interest rates |

| Poor (600-649) | Limited loan options |

| Bad (300-599) | Very high interest rates |

The Power Of Low-interest Credit Cards

Low-interest credit cards can be powerful tools for managing debt and financing purchases. They typically offer:

- Lower interest rates compared to standard credit cards.

- Balance transfer options to consolidate debt.

- Reward programs for cashback, points, or travel miles.

Using these cards wisely can help you save money on interest and even earn rewards.

Leveraging Credit For Investment Opportunities

Credit can also be used to invest in opportunities that may provide significant returns. For instance, Funding Societies offers:

- Micro Loans for urgent financing with fast approval.

- Term Loans for business expansion and working capital.

- Short-term investments with periodic repayments.

Investing wisely can lead to potential returns and wealth accumulation. However, it’s important to evaluate risks and ensure you can manage repayments.

Building Credit Responsibly

Building credit responsibly is crucial for long-term financial health. Here are some tips:

- Pay your bills on time to maintain a good payment history.

- Keep your credit utilization low, ideally below 30% of your credit limit.

- Avoid opening too many new credit accounts at once.

- Regularly check your credit report for errors and discrepancies.

Responsible credit use not only improves your credit score but also opens up better financial opportunities in the future.

Pricing And Affordability Of Credit Options

Understanding the pricing and affordability of credit options is crucial for achieving financial freedom. Funding Societies offers various credit products tailored to meet different financial needs. This section explores important aspects such as interest rates, fees, rewards programs, and loan terms.

Comparing Interest Rates And Fees

Interest rates and fees can significantly impact the cost of credit. Funding Societies provides competitive rates to make credit more affordable:

- Micro Loan: Fast approval within 24 hours, ideal for urgent needs.

- Term Loan: Suitable for working capital and business expansion, offering larger amounts.

When comparing credit options, consider the following:

| Credit Option | Interest Rate | Fees |

|---|---|---|

| Micro Loan | Varies | Minimal processing fees |

| Term Loan | Competitive rates | Standard processing fees |

Evaluating Credit Card Rewards Programs

Credit card rewards programs offer benefits that can enhance the value of using credit. Funding Societies offers credit products with potential rewards:

- Cashback: Earn a percentage of your spending back as cash.

- Points: Accumulate points for every dollar spent, redeemable for various rewards.

- Travel Miles: Earn miles for travel expenses.

Evaluate the rewards programs based on:

- The type of rewards that align with your spending habits.

- The ease of redeeming rewards.

- Any associated fees or interest rates that may offset the benefits.

Understanding Loan Terms And Conditions

Comprehending loan terms and conditions helps you make informed decisions. Funding Societies offers transparent terms for their credit products:

- Loan Amount: Varies based on credit option and business needs.

- Repayment Period: Micro loans have short tenors; term loans offer longer periods.

- Interest Rate: Clearly stated in the loan agreement.

Key terms to understand:

- Repayment Schedule: Monthly or periodic repayments.

- Prepayment Penalties: Charges for early repayment, if any.

- Default Consequences: Penalties or actions for missed payments.

Ensure you review all terms before committing to a loan to avoid surprises and ensure the credit option fits your financial plan.

Pros And Cons Of Using Credit For Financial Freedom

Credit can be a powerful tool in achieving financial freedom. It offers both opportunities and challenges. Understanding these pros and cons helps in making informed decisions. Here, we explore the advantages and disadvantages of using credit for financial freedom and how to balance its use with financial discipline.

Advantages: Flexibility And Immediate Access To Funds

One of the main advantages of using credit is the flexibility it provides. Credit cards and loans can help cover unexpected expenses. This can be especially useful for small businesses needing urgent financing.

Another benefit is the immediate access to funds. Products like the Micro Loan from Funding Societies offer fast approval within 24 hours. This quick access to funds can help businesses manage cash flow and seize growth opportunities without delay.

| Feature | Benefit |

|---|---|

| Micro Loan | Fast approval within 24 hours |

| Term Loan | Funds tailored for business needs |

Disadvantages: Risk Of Debt And Financial Mismanagement

Despite its benefits, using credit carries risks. One major disadvantage is the risk of debt. Borrowing money means you have to repay it, often with interest. This can lead to a cycle of debt if not managed properly.

Another concern is financial mismanagement. Without careful planning, it’s easy to overspend and accumulate more debt than you can handle. This can harm your financial health and limit your ability to achieve financial freedom.

- High interest rates on credit cards

- Potential for accumulating unmanageable debt

Balancing Credit Use With Financial Discipline

To benefit from credit while avoiding its pitfalls, it’s important to balance its use with financial discipline. Here are some tips:

- Set a budget and stick to it

- Use credit for necessary expenses only

- Pay off your balance in full each month

- Monitor your credit score regularly

By following these tips, you can use credit as a tool to achieve financial freedom without falling into debt.

Specific Recommendations For Ideal Users

Credit can be a powerful tool for achieving financial freedom. Whether you are a young professional, an entrepreneur, or an individual planning a major purchase, Funding Societies offers tailored solutions to meet your needs. Below are specific recommendations for various ideal users.

Young Professionals Looking To Build Credit

Young professionals just starting out can benefit greatly from establishing good credit early. Funding Societies offers micro loans that are perfect for those needing quick and easy access to funds. These loans come with:

- Fast approval within 24 hours.

- Small amounts suitable for early career professionals.

Building credit responsibly can open doors to larger loans and better interest rates in the future. Using short-term financing options can help you manage your finances without accumulating long-term debt.

Entrepreneurs Seeking Capital For Business Ventures

Entrepreneurs often need capital to start or expand their businesses. Funding Societies provides various financing options designed to meet these needs:

| Loan Type | Purpose | Benefits |

|---|---|---|

| Micro Loan | Urgent financing | Fast approval within 24 hours |

| Term Loan | Working capital, business expansion | Larger amounts, tailored for specific needs |

These financing options allow entrepreneurs to secure the necessary funds to grow their businesses, while also building their credit profile.

Individuals Planning Major Purchases Or Investments

Individuals planning significant expenditures or investments can benefit from the investment options provided by Funding Societies. Key features include:

- Short investment tenors (1 – 12 months).

- Periodic repayments.

- Minimum investment as low as S$20.

These features make it easier to diversify your investment portfolio and earn attractive returns. For example, in Singapore, the average investment return in 2020 was 7.28%.

By leveraging these options, you can plan for major purchases or investments without compromising your financial stability.

Conclusion: Unlock Your Wealth Potential With Credit

Credit can be a powerful tool in achieving financial freedom. Using credit wisely opens up many opportunities for personal and business growth. Funding Societies, Southeast Asia’s largest SME digital financing and debt investment platform, offers various financing options to meet different needs.

Recap Of Benefits And Strategies

- Access to Quick Financing: Funding Societies provides fast approval for micro loans, ideal for small businesses needing urgent funds.

- Diverse Investment Options: Investors can benefit from short investment tenors and periodic repayments with average returns of 7.28% in Singapore.

- Support for Business Growth: Term loans tailored for working capital, business expansion, and more, help businesses grow efficiently.

- Diversification: Investors can diversify their portfolios and earn returns by supporting local SMEs.

Final Tips For Responsible Credit Use

- Understand Your Needs: Assess your financial needs before applying for any loan. Choose the loan type that best fits your requirements.

- Read Terms Carefully: Ensure you understand the terms and conditions of the credit agreement. This includes interest rates, repayment schedules, and any potential fees.

- Make Timely Payments: Always make your repayments on time. This helps maintain a good credit score and avoids additional fees.

- Monitor Your Credit: Regularly check your credit status. Monitoring helps you stay aware of your financial health and make informed decisions.

- Use Credit Wisely: Only borrow what you can repay. Avoid over-borrowing to maintain a healthy financial balance.

For more information on financing and investment options, visit the Funding Societies website.

Frequently Asked Questions

What Is Financial Freedom?

Financial freedom means having enough savings, investments, and cash to afford the lifestyle you want. It allows you to make life decisions without being overly stressed about financial constraints.

How Can Credit Help Achieve Financial Freedom?

Using credit wisely can build a strong credit score. This can help secure lower interest rates on loans and mortgages, ultimately saving money and aiding financial freedom.

What Are The Benefits Of A High Credit Score?

A high credit score can lead to lower interest rates, better loan terms, and higher credit limits. This helps in achieving financial freedom more efficiently.

How To Improve Your Credit Score?

Pay bills on time, reduce outstanding debt, and avoid opening many new accounts. Regularly check your credit report for errors and rectify them.

Conclusion

Achieving financial freedom through credit is possible with smart choices. Funding Societies offers effective solutions for SMEs and investors. Small businesses can secure quick financing. Investors can diversify portfolios and earn steady returns. Start your journey towards financial growth today. Visit Funding Societies for more details.