Competitive Credit Card Offers: Unlock the Best Deals Today

In today’s fast-paced financial world, finding the right credit card can be a game-changer for your personal finance. Competitive credit card offers provide a range of benefits, from rewards to credit-building opportunities.

Navigating the myriad of options available can be overwhelming. Whether you’re looking to build your credit score, enjoy cash back rewards, or simply find a card that suits your spending habits, understanding the top offers is crucial. A great option to consider is the Zable Credit Card, which not only helps in credit building but also offers features like virtual cards for immediate spending, rent reporting, and spend tracking. These benefits can significantly impact your financial health and help you manage your expenses more efficiently. Keep reading to learn more about the best competitive credit card offers available today. Discover more about Zable UK and how it can help you on your financial journey.

Introduction To Competitive Credit Card Offers

Finding the right credit card can be tricky. With so many options, it’s hard to know which one is best. This guide will help you understand competitive credit card offers and why choosing the right one matters.

Understanding Credit Card Offers

Credit card offers can vary greatly. It’s important to know what each offer includes. Here are some key points to consider:

- Interest Rates: Look for the Annual Percentage Rate (APR). Zable offers a representative APR of 48.9% (variable).

- Approval Odds: Some cards use your banking history to boost approval odds. Zable boosts approval odds by up to 35%.

- Features: Check if the card has extra features. Zable provides virtual cards for immediate spending via Apple Pay or Google Pay.

Why Choosing The Right Credit Card Matters

Choosing the right credit card can help you manage your finances better. Here are some reasons why it matters:

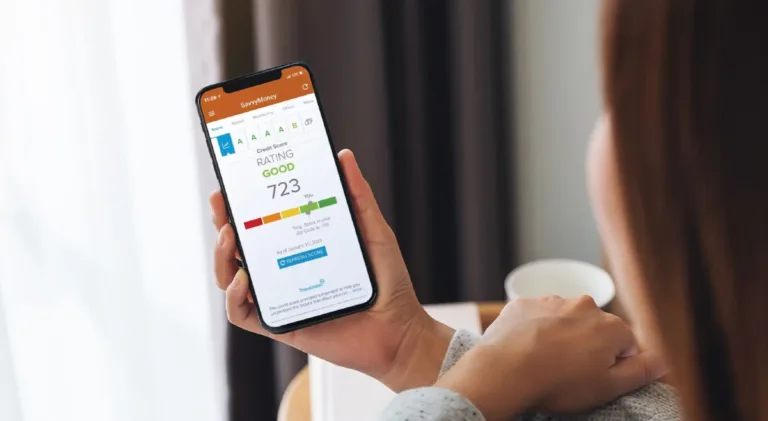

- Credit Building: A good card helps improve your credit score. Zable helps build credit through timely payments and credit management.

- Instant Access: Some cards offer instant access to funds. Zable allows eligible users to use virtual cards immediately.

- Easy Management: A user-friendly app can make a difference. Zable offers an app to easily manage your finances.

Understanding these factors can help you choose the best credit card for your needs. For more information, visit Zable UK.

Key Features Of Competitive Credit Card Offers

Understanding the key features of competitive credit card offers can help you make an informed decision. Various aspects such as interest rates, rewards programs, and sign-up bonuses play a crucial role in choosing the right credit card. This section will discuss these features in detail, making it easier for you to compare and decide.

Interest Rates And Apr

Interest rates and Annual Percentage Rates (APR) are essential factors to consider. Lower interest rates mean you pay less for borrowing money. Competitive offers often have lower APRs compared to standard cards. For instance, the Zable credit card has a representative APR of 48.9% (variable), which is a significant consideration.

Rewards Programs And Cashback

Rewards programs and cashback offers add value to your spending. Many competitive credit cards offer rewards points for purchases, which can be redeemed for various benefits. Cashback offers provide a percentage of your spending back to you, saving you money over time. Evaluate the rewards and cashback options to maximize your benefits.

Sign-up Bonuses And Promotions

Sign-up bonuses and promotions are attractive features of competitive credit cards. These bonuses might include extra rewards points, cashback, or other incentives. For example, some cards offer virtual cards for immediate use, which can be appealing. Look for cards with substantial sign-up bonuses to get the most value.

Balance Transfer Options

Balance transfer options allow you to move existing debt from one card to another, often at a lower interest rate. This can help you save on interest payments and pay off debt faster. Competitive credit cards may offer low or zero interest rates on balance transfers for a promotional period, making it a cost-effective option.

Annual Fees And Hidden Charges

Annual fees and hidden charges can significantly impact the value of a credit card. Some competitive credit cards have no annual fees, which can save you money. Always read the fine print to understand any additional charges that may apply. Being aware of these fees helps you choose a card that offers the best overall value.

| Feature | Description |

|---|---|

| Interest Rates and APR | Lower interest rates and APRs reduce borrowing costs. |

| Rewards Programs and Cashback | Earn rewards points and cashback on purchases. |

| Sign-Up Bonuses and Promotions | Substantial bonuses and promotions add extra value. |

| Balance Transfer Options | Move debt to a lower interest card to save money. |

| Annual Fees and Hidden Charges | Look for cards with no annual fees and minimal hidden charges. |

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit card offers is crucial. This section will help you navigate interest rates, annual fees, and potential costs and savings.

Comparison Of Interest Rates

Zable Credit Cards offer a representative APR of 48.9% (variable). This rate influences how much interest you pay on outstanding balances.

| Credit Card | Interest Rate (variable) | Representative APR |

|---|---|---|

| Zable Credit Card | 48.9% | 48.9% |

For personal loans, Zable offers a representative APR of 32.5%. This rate applies to loans processed in less than an hour, with flexible amounts from £1,000 to £25,000.

Annual Fees Overview

Annual fees can impact the overall cost of maintaining a credit card. Fortunately, Zable Credit Cards do not charge annual fees. This means you can focus on other financial aspects without worrying about yearly costs.

- No Annual Fees: Enjoy the benefit of using Zable Credit Cards without additional yearly charges.

Potential Costs And Savings

Let’s break down the potential costs and savings associated with Zable’s credit cards and loans.

- Credit Card Borrowing Example: Assume a borrowing of £1200 at an interest rate of 48.9% (variable) p.a.

- Representative APR: 48.9% (variable)

- Personal Loan Borrowing Example: Assume a borrowing of £7,500 over 36 months at 32.5% APR representative.

- Total repayable amount: £11,237.40

- Interest rate: 27.0% p.a. (fixed) with total fees of £440.00

By choosing Zable Credit Cards, you can access features like rent reporting and spend tracking. These features help you build your credit score and manage finances effectively, potentially saving money in the long run.

In summary, comparing interest rates, understanding the absence of annual fees, and evaluating potential costs and savings are key steps to making informed financial decisions.

Pros And Cons Of Different Credit Card Offers

Choosing the right credit card can be challenging. Each offer has distinct advantages and drawbacks. Understanding the pros and cons can help you make a better decision. Let’s explore the different aspects of credit card offers.

Advantages Of Low-interest Cards

Low-interest credit cards are great for saving money on interest charges. They are especially beneficial if you tend to carry a balance. Here are some key advantages:

- Lower Interest Costs: Save on interest payments, making it easier to pay off balances.

- More Affordable Borrowing: Low-interest rates mean borrowing costs are lower for large purchases.

- Debt Management: Easier to manage and reduce debt over time.

Downsides Of High Annual Fees

High annual fees can be a significant drawback for many credit card users. They can add up quickly, especially if you have multiple cards. Consider these downsides:

- Increased Costs: High fees can outweigh the benefits offered by the card.

- Budget Impact: Annual fees can strain your budget, especially if not managed well.

- Limited Value: If you don’t use the card frequently, the high fee may not be worth it.

Benefits Of Reward Programs

Credit cards with reward programs can offer significant perks. These benefits can enhance your spending experience:

- Cashback Rewards: Earn cashback on purchases, which can be used to offset future spending.

- Travel Points: Accumulate points for travel, leading to free flights or hotel stays.

- Exclusive Offers: Access to special deals and discounts not available to non-cardholders.

Limitations Of Balance Transfer Offers

Balance transfer offers can help consolidate debt, but they come with limitations. Understanding these can help you make a better decision:

- Transfer Fees: Balance transfers often include fees, which can reduce savings.

- Promotional Periods: Low or zero interest rates are typically for a limited time.

- Credit Score Impact: Multiple transfers can impact your credit score.

Specific Recommendations For Ideal Users

Finding the perfect credit card can be challenging. Zable offers a variety of credit cards, making it easier to find the right match. Here are some specific recommendations for different types of users.

Best Cards For Frequent Travelers

For frequent travelers, finding a credit card with travel rewards is essential. These cards offer benefits like airline miles, hotel points, and travel insurance. Zable Credit Cards come with a virtual card for immediate spending via Apple Pay or Google Pay. This can be useful for travelers who need quick access to funds.

| Card | Benefits | APR |

|---|---|---|

| Zable Travel Card | Airline miles, hotel points, travel insurance | 48.9% (variable) |

Top Picks For Cashback Enthusiasts

If you enjoy earning cashback on your purchases, certain credit cards are designed for you. Zable offers cards that help you monitor spending and earn cashback. This can help you save money on everyday expenses.

- Zable Cashback Card

- Offers cashback on groceries, dining, and fuel

- Representative APR of 48.9% (variable)

Ideal Choices For Low-interest Seekers

Low-interest credit cards are great for those who may carry a balance. Zable provides cards with competitive interest rates to help you manage your finances better. The Representative APR is 48.9% (variable), making it a good choice for low-interest seekers.

Best Options For Balance Transfers

If you have an existing credit card debt, a balance transfer card can help you save on interest. Zable’s balance transfer cards offer a competitive interest rate. This can help you pay down debt faster.

| Card | Balance Transfer Fee | APR |

|---|---|---|

| Zable Balance Transfer Card | 3% of the amount transferred | 48.9% (variable) |

Conclusion: Unlocking The Best Credit Card Deals

Finding the ideal credit card can transform your financial health. With many options available, it is essential to understand what each offer entails. This section will summarize the key points and provide final tips to help you make an informed decision.

Summary Of Key Points

When evaluating credit card offers, consider the following:

- Approval Odds: Some cards, like Zable Credit Cards, use banking history to boost approval odds by up to 35%.

- Instant Access: Virtual cards are available for immediate spending via Apple Pay or Google Pay.

- APR: Zable’s credit card has a representative APR of 48.9% (variable).

- Credit Monitoring: Access to your Equifax credit score and track all accounts in one place.

- Rent Reporting: Report rent payments to build your credit history.

- Spend Tracking: Monitor your spending across all accounts with a user-friendly app.

- Loan Processing: Personal loans are processed in less than an hour, with flexible amounts and terms.

Final Tips For Selecting The Right Card

Choosing the right credit card involves careful consideration:

- Evaluate Your Needs: Determine if you need a credit card to build credit, access instant funds, or monitor spending.

- Compare APRs: Look for cards with competitive APRs. Zable offers a variable APR of 48.9% for its credit card.

- Check Additional Features: Features like rent reporting, spend tracking, and credit monitoring can add significant value.

- Review Customer Support: Ensure the provider offers robust customer support. Zable provides support via online chat, email, and phone.

- Read Reviews: Check reviews on platforms like Trustpilot to gauge customer satisfaction. Zable has over 123,000 reviews.

By following these tips, you can unlock the best credit card deals suited to your financial situation.

Frequently Asked Questions

What Are Competitive Credit Card Offers?

Competitive credit card offers provide attractive benefits like low interest rates, cashback, rewards, and sign-up bonuses. These offers are designed to attract new customers and retain existing ones.

How Can I Compare Credit Card Offers?

Compare credit card offers by evaluating interest rates, annual fees, rewards programs, and additional perks. Use comparison websites and read customer reviews for better insights.

Which Credit Card Offers The Best Rewards?

The best rewards credit card depends on your spending habits. Some cards offer cashback, while others provide travel points or retail discounts.

Are There Credit Cards With No Annual Fee?

Yes, many credit cards come with no annual fee. These cards often offer basic rewards or cashback without additional costs.

Conclusion

Choosing the right credit card can be challenging. Zable UK offers flexible options. They help build or improve your credit score. With features like spend tracking and rent reporting, managing finances is easy. Quick approval times and a user-friendly app make Zable a convenient choice. For more details, visit their website today. Make an informed decision and enhance your financial health with Zable UK.