Easy Credit Card Approval: Tips to Boost Your Chances Fast

Getting approved for a credit card can seem tough. But it doesn’t have to be.

Imagine a world where obtaining a credit card is straightforward and stress-free. This is now possible with options designed for easy credit card approval. Whether you have a low credit score or are new to credit, there are solutions tailored for you. One such solution is Zable UK, which offers credit cards and personal loans to help you manage your finances better. With features like spend tracking, free credit score monitoring, and instant virtual cards, Zable makes the process smooth and beneficial. Keep reading to discover how you can improve your chances of getting a credit card with ease and start building a better financial future. Apply for a Zable Credit Card today and take the first step towards financial freedom.

Introduction To Easy Credit Card Approval

Applying for a credit card can often seem daunting, especially with uncertain approval processes. Zable UK offers an accessible and straightforward way to get a credit card or personal loan. They provide helpful tools and insights to make the application process smooth and stress-free. Here’s a closer look at how you can benefit from easy credit card approval.

Understanding Credit Card Approval Processes

The approval process for credit cards can be complex. Lenders evaluate your credit history, income, and financial behavior. Zable simplifies this by using your banking history. This increases your chances of approval by up to 35%. Plus, their eligibility checks do not impact your credit score.

| Steps | Description |

|---|---|

| 1. Application Submission | Submit your application through the Zable app. |

| 2. Eligibility Check | Check your eligibility without affecting your credit score. |

| 3. Banking History Review | Zable reviews your banking history for better approval chances. |

| 4. Quick Decision | Receive a quick decision, often within minutes. |

| 5. Virtual Card Access | Use your virtual card instantly with Apple Pay or Google Pay. |

Why Quick Approval Matters

Quick approval for credit cards or loans can be crucial. It helps in managing urgent financial needs effectively. Zable ensures most personal loans are disbursed in less than an hour. This speed is beneficial in emergencies or when unexpected expenses arise.

Here are some key benefits of quick approval:

- Immediate Access: Use the virtual card instantly for online purchases.

- Financial Flexibility: Handle unforeseen expenses without delays.

- Improved Credit Score: Start building or improving your credit score sooner.

- Convenience: Quick and easy application process through the Zable app.

With Zable, the focus is on providing fast, efficient, and user-friendly financial solutions. Whether you need a credit card or a personal loan, Zable makes the process hassle-free. Download the Zable app to start your application today and experience the ease of quick credit card approval.

Key Factors That Influence Credit Card Approval

Understanding the factors that influence credit card approval is crucial. Knowing these can help improve your chances of getting a credit card. Here are some key aspects that issuers consider when reviewing applications.

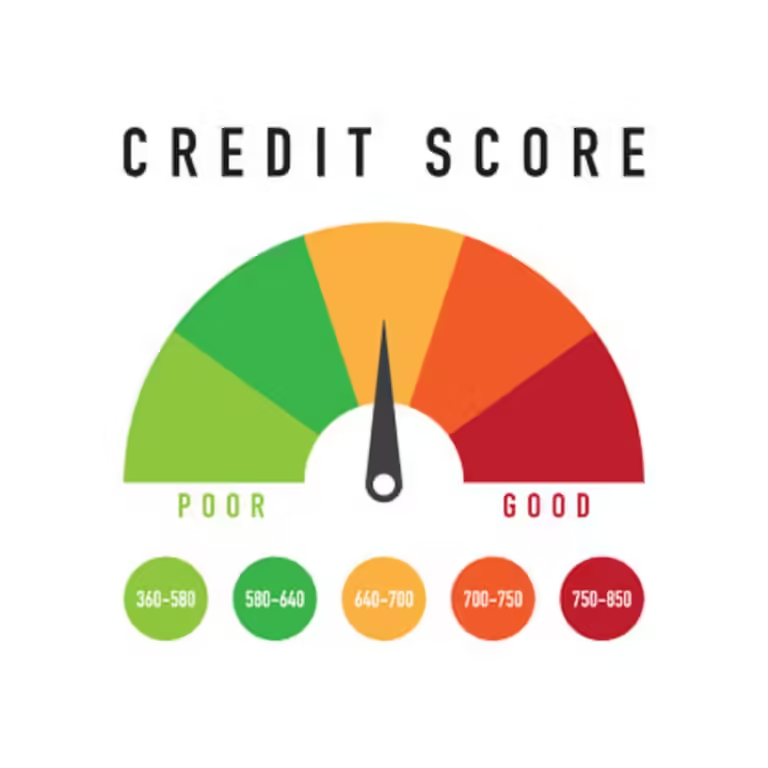

Credit Score: The Primary Determinant

One of the most important factors is your credit score. Lenders use this to assess your creditworthiness. A higher score indicates a lower risk to lenders. Generally, a score above 700 is considered good. Zable offers credit cards that can help improve your score over time.

Check your credit score regularly. Zable provides free access to your Equifax credit score through their app. This can help you stay informed and make necessary adjustments to improve your rating.

Income Level And Employment Status

Your income level and employment status play a significant role. Lenders want to ensure you have a stable income to repay the credit. Provide accurate and up-to-date information about your employment.

Zable considers banking history, which can increase approval chances by up to 35%. This is beneficial for applicants with lower incomes or non-traditional employment.

Existing Debt And Credit Utilization

Your existing debt and how you manage it is another crucial factor. High levels of debt or high credit utilization can negatively impact your approval chances.

Keeping your credit utilization below 30% is advisable. Zable’s spend tracking feature helps monitor all accounts in one place. This makes it easier to manage your debt and maintain a healthy credit utilization rate.

By understanding and managing these key factors, you can improve your chances of getting approved for a credit card. Zable offers tools and insights to help you on this journey, ensuring you make informed financial decisions.

Tips To Boost Your Credit Score Quickly

Improving your credit score can significantly enhance your chances of getting approved for a credit card. By following these tips, you can see quick improvements in your credit score.

Correcting Errors On Your Credit Report

Errors on your credit report can negatively impact your score. Regularly check your credit reports for inaccuracies. Dispute any errors you find with the credit bureau. Zable UK offers free access to your Equifax credit score, making it easier to monitor and correct any discrepancies.

Paying Down Existing Balances

High balances on your credit cards can lower your credit score. Focus on paying down existing balances to reduce your credit utilization ratio. Use the Zable app to track your spending and manage your payments efficiently.

Avoiding New Debt

Taking on new debt can further strain your credit score. Avoid applying for new credit cards or loans while trying to improve your score. Zable’s no-impact eligibility checks ensure you can check your chances without affecting your score.

Choosing The Right Credit Card For Easy Approval

Finding a credit card that offers easy approval can be challenging. Understanding your options and knowing what to look for can make the process simpler. Here are key factors to consider when choosing the right credit card for easy approval.

Secured Vs. Unsecured Credit Cards

Credit cards fall into two main categories: secured and unsecured. Secured credit cards require a cash deposit, which acts as collateral. This deposit typically equals your credit limit. Secured cards are ideal for those with bad or no credit.

Unsecured credit cards do not require a deposit. They are more common but may have stricter approval criteria. If you have a low credit score, an unsecured card might be harder to obtain.

| Card Type | Requirement | Best For |

|---|---|---|

| Secured Credit Card | Cash Deposit | Bad or No Credit |

| Unsecured Credit Card | No Deposit | Fair to Good Credit |

Cards Designed For Bad Or No Credit

Many credit cards are designed specifically for individuals with bad or no credit. These cards often have higher approval rates and can help you build your credit score. For instance, Zable Credit Cards are tailored for those looking to improve their credit scores with responsible use.

Consider cards that offer features such as:

- Free Credit Score: Access and monitor your Equifax credit score.

- Spend Tracking: Monitor all accounts in one place.

- Rent Reporting: Report rent payments to build your credit history.

- Instant Virtual Card: Use Apple Pay or Google Pay before the physical card arrives.

For example, the Zable app provides valuable financial tools and insights, making it easier to manage your finances and track spending.

Choosing the right credit card can significantly impact your financial health. By understanding the differences between secured and unsecured cards and selecting one designed for your credit situation, you can improve your approval odds and build a better financial future.

How To Improve Your Financial Profile

Improving your financial profile is crucial for easy credit card approval. A solid financial profile not only increases your chances of approval but also opens doors to better interest rates and financial products. Here, we will discuss key strategies to enhance your financial stability.

Stabilizing Your Income

Stable income is the foundation of a good financial profile. Lenders evaluate your income to ensure you can repay your debts. Here are some ways to stabilize your income:

- Secure a steady job with regular paychecks.

- Consider taking up a side job or freelance work.

- Invest in skills and education to increase your earning potential.

Having a consistent income stream reassures lenders of your repayment ability, making it easier to get credit card approval.

Managing Your Expenses Effectively

Effective expense management is crucial for maintaining a healthy financial profile. Here’s how you can manage your expenses better:

- Track your spending using tools like the Zable app.

- Create and stick to a monthly budget.

- Avoid unnecessary expenses and focus on savings.

Spend tracking helps you identify areas where you can cut costs and save more. The Zable app offers insights into your spending habits, helping you stay on top of your finances.

By stabilizing your income and managing your expenses, you enhance your financial profile, making it easier to qualify for credit cards, like those offered by Zable. Additionally, responsible use of credit cards can further boost your credit score, providing you with more financial opportunities.

Common Mistakes To Avoid

Applying for a credit card can be a smooth process if done correctly. However, many people make mistakes that can hinder their chances of approval. Here are some common mistakes to avoid for easy credit card approval.

Applying For Too Many Cards At Once

One of the most common mistakes is applying for multiple credit cards simultaneously. This can negatively impact your credit score. Each application triggers a hard inquiry on your credit report, which can lower your score.

Instead, apply for one card at a time and wait for the approval decision. This approach shows that you are responsible and cautious with your credit.

Ignoring Pre-approval Offers

Pre-approval offers can be a valuable tool when seeking a credit card. These offers indicate that you meet certain criteria set by the lender. Ignoring these offers could mean missing out on a card that fits your needs.

Take advantage of pre-approval offers by checking your mail or email regularly. Responding to these offers can increase your chances of getting approved for a credit card.

Summary Of Zable Credit Cards & Personal Loans

| Feature | Description |

|---|---|

| Credit Cards for Bad Credit | Helps improve credit scores with responsible use. |

| Personal Loans | Quick approval with most loans disbursed in less than an hour. |

| Free Credit Score | Access and monitor your Equifax credit score. |

| Spend Tracking | Monitor all accounts in one place. |

| Rent Reporting | Report rent payments to build credit history. |

| Instant Virtual Card | Use Apple Pay or Google Pay before the physical card arrives. |

Zable provides a range of tools to help you manage your finances effectively. Avoiding common mistakes can help you get the most out of their services.

Pros And Cons Of Rapid Credit Card Approval

Rapid credit card approval, like that offered by Zable UK, can be a game-changer for many. Understanding the benefits and drawbacks can help you make an informed decision. Here, we explore the pros and cons of quick credit card approval.

Benefits Of Quick Approval

Receiving fast approval for a credit card has several advantages:

- Instant Access to Funds: With quick approval, you can access funds almost immediately. Zable’s instant virtual card lets you use Apple Pay or Google Pay before the physical card arrives.

- Improved Approval Odds: Zable uses your banking history to increase approval chances by up to 35%. This is particularly beneficial for individuals with a less-than-perfect credit score.

- No Impact on Credit Score: Eligibility checks with Zable do not affect your credit score, making the application process stress-free.

- Convenience: The application process is straightforward and can be completed quickly through the Zable app. This saves time and effort.

- Financial Insights: Gain valuable insights into your credit history and spending habits with Zable’s financial tools. This helps in better financial management.

Potential Downsides To Consider

While rapid credit card approval has many benefits, there are potential downsides:

- High Interest Rates: Zable’s credit cards have a representative APR of 48.9% (variable). This can lead to high costs if balances are not paid off promptly.

- Risk of Over-Borrowing: Easy access to credit can tempt some to overspend. This can result in debt accumulation and financial strain.

- Eligibility Criteria: Despite improved approval odds, not everyone may qualify. Factors like banking history still play a crucial role.

- Repayment Terms: For personal loans, the terms can be stringent. With interest rates ranging from 9.9% to 49.9%, repayment amounts can be significant.

Considering these factors can help you make a balanced decision about whether rapid credit card approval is right for you.

Ideal Candidates For Rapid Credit Card Approval

Understanding who benefits from quick credit card approvals is essential. It ensures that applications are processed efficiently and meet the needs of the individual. Let’s explore the ideal candidates for rapid credit card approval with Zable UK.

Who Benefits The Most?

The individuals who benefit the most from rapid credit card approvals include those with bad credit looking to rebuild their credit score. They may have faced financial challenges in the past but are now seeking opportunities to improve their financial health.

Another group includes individuals needing instant access to a credit card. For example, they might be traveling or need to make urgent purchases. Virtual cards offered by Zable can be used immediately via Apple Pay or Google Pay.

Scenarios Where Quick Approval Is Crucial

There are several scenarios where quick credit card approval is crucial. Here are a few:

- Emergency Expenses: Sudden medical bills or urgent repairs.

- Travel Needs: Last-minute bookings or unexpected travel expenses.

- Building Credit: Individuals aiming to improve their credit score quickly.

- Rent Reporting: Reporting rent payments to build a credit history.

For these scenarios, Zable provides a fast and convenient credit card approval process, often disbursing personal loans in less than an hour.

| Scenario | Benefit |

|---|---|

| Emergency Expenses | Quick access to funds for urgent needs |

| Travel Needs | Immediate use of virtual cards for bookings |

| Building Credit | Improving credit score with responsible card use |

| Rent Reporting | Build credit history by reporting rent payments |

Zable’s credit cards and personal loans are tailored to meet these needs. Their services are designed to provide a seamless experience, from application to usage. This ensures that all users can manage their finances effectively.

Final Recommendations For Easy Credit Card Approval

Securing easy credit card approval can be a smooth process with the right strategies and resources. Here are some final recommendations to help you increase your chances of approval.

Summary Of Key Strategies

To enhance your chances of getting approved for a credit card, consider the following key strategies:

- Maintain a good credit score: Regularly monitor and manage your credit score.

- Reduce existing debt: Pay down outstanding balances to improve your credit utilization ratio.

- Check eligibility before applying: Use tools that allow you to check your eligibility without impacting your credit score.

- Provide accurate information: Ensure all the information in your application is accurate and up-to-date.

- Utilize financial insights: Use apps and tools to track your spending and improve financial habits.

Additional Resources And Tools

To further support your journey towards easy credit card approval, consider utilizing the following resources and tools:

| Resource | Benefit |

|---|---|

| Zable Credit Cards | Offers credit cards for those with bad credit, along with financial tools and insights. |

| Zable App | Monitor spending, track credit score, and manage finances in one place. |

| Equifax Credit Score | Access and monitor your credit score for free. |

| Online Financial Tools | Use various online tools to check eligibility and improve financial habits. |

These resources can help you better understand your financial situation and improve your chances of credit card approval.

Frequently Asked Questions

What Is Easy Credit Card Approval?

Easy credit card approval refers to the process of getting approved for a credit card with minimal requirements. This often includes cards for those with limited credit history or lower credit scores.

How Can I Get Approved Easily?

To get approved easily, choose a card that matches your credit profile. Ensure your credit report is accurate and keep your credit utilization low.

Which Credit Cards Have Easy Approval?

Credit cards with easy approval often include secured cards, student cards, and cards from issuers targeting those with fair or poor credit.

Are Secured Credit Cards Easier To Get?

Yes, secured credit cards are easier to get because they require a refundable security deposit. This reduces the risk for the issuer.

Conclusion

Securing easy credit card approval is within reach. With Zable Credit Cards & Personal Loans, you can manage finances effectively. Their app helps track spending and build credit scores. Ready to improve your credit? Apply for a Zable card today! Check out more details here.