Premium Credit Card Options: Unlock Exclusive Perks Today!

Premium credit cards offer a range of benefits. They provide perks that enhance your financial lifestyle.

Navigating the world of premium credit cards can be overwhelming. With so many options available, finding the best fit for your needs is crucial. Premium credit cards often come with high annual fees but also offer exclusive rewards, travel benefits, and superior customer service. These cards are designed for individuals who want to maximize their spending power and gain access to luxury experiences. Understanding the features and benefits of various premium credit card options will help you make an informed decision. Explore the possibilities and see how a premium credit card can elevate your financial experience. Discover more about Zable UK’s credit card options and see if they align with your goals by visiting Zable UK.

Introduction To Premium Credit Card Options

Premium credit cards offer exclusive benefits and rewards that can enhance your financial flexibility. These cards are designed for individuals who value luxury, convenience, and superior customer service. Let’s explore the key aspects of premium credit cards to help you decide if they are the right fit for you.

What Are Premium Credit Cards?

Premium credit cards come with higher annual fees but offer an array of perks. These perks include travel rewards, concierge services, and access to exclusive events. They also provide higher credit limits and better fraud protection.

For instance, Zable Credit Cards & Personal Loans offer unique features such as:

- Use of banking history to boost approval odds by up to 35%

- Virtual card usage via Apple Pay or Google Pay

- No impact on credit score when checking eligibility

- Representative APR: 48.9% (variable)

Who Should Consider A Premium Credit Card?

Premium credit cards are suitable for frequent travelers, high spenders, and individuals seeking enhanced security. They are also ideal for those who can manage high annual fees and take advantage of the rewards offered.

With a Zable credit card, users can:

- Build their credit score with timely payments

- Access financial insights and track spending

- Use a virtual card for immediate transactions

- Enjoy comprehensive customer support

Consider your lifestyle and spending habits to determine if a premium credit card aligns with your financial goals.

| Feature | Zable Credit Card |

|---|---|

| Credit Building | Yes, with timely payments |

| Virtual Card | Available via Apple Pay or Google Pay |

| Eligibility Check | No impact on credit score |

| Representative APR | 48.9% (variable) |

Before choosing a premium credit card, research and compare different options. Make sure the benefits outweigh the costs for your specific needs.

Key Features Of Premium Credit Cards

Premium credit cards offer numerous advantages that elevate the user experience. From exclusive rewards to travel benefits, these cards provide a range of features that add value to your financial life. Let’s explore some of the key features that make premium credit cards stand out.

Exclusive Rewards Programs

Premium credit cards often come with exclusive rewards programs. Cardholders can earn points, miles, or cashback on every purchase. These rewards can be redeemed for travel, merchandise, or statement credits. Some cards offer higher rewards rates for specific categories, such as dining or travel.

Travel Benefits And Perks

Travel is a significant focus for many premium credit cards. Cardholders can enjoy complimentary travel insurance, airport lounge access, and priority boarding. Additionally, many cards offer annual travel credits that can offset travel-related expenses, making your journeys more comfortable and cost-effective.

Concierge Services

Concierge services are another valuable feature of premium credit cards. These services can assist with travel bookings, dinner reservations, and event planning. A dedicated concierge team is available 24/7 to help cardholders with a wide range of requests, adding convenience and luxury to their daily lives.

Purchase Protection And Extended Warranties

Many premium credit cards offer purchase protection and extended warranties. Purchase protection can cover stolen or damaged items within a certain period after purchase. Extended warranties extend the manufacturer’s warranty by an additional year or more, providing peace of mind and added value for your purchases.

Access To Vip Events And Experiences

Premium credit cardholders often have access to VIP events and exclusive experiences. These can include concert tickets, sports events, and private dining experiences. These exclusive opportunities provide unique experiences that are not available to the general public, enhancing the cardholder’s lifestyle.

For more information on premium credit card options like Zable UK, you can visit their website at Zable UK.

Pricing And Affordability Of Premium Credit Cards

Premium credit cards offer numerous benefits such as rewards, travel perks, and exclusive access to events. However, understanding the pricing and affordability is essential before choosing one. This section will delve into the costs associated with premium credit cards, including annual fees, interest rates, and hidden costs you need to be aware of.

Annual Fees Breakdown

Premium credit cards often come with higher annual fees compared to regular cards. These fees can vary significantly depending on the card and the benefits offered. For example, Zable UK credit cards have a representative APR of 48.9% (variable) for assumed borrowing of £1200, which is critical to consider when calculating affordability.

| Credit Card | Annual Fee | Representative APR |

|---|---|---|

| Zable UK | Varies | 48.9% (variable) |

Interest Rates And How They Compare

Interest rates on premium credit cards can be quite high. For instance, Zable UK credit cards have a representative APR of 48.9% (variable). It’s important to compare these rates with other premium cards to ensure you get the best deal.

- Zable UK: 48.9% (variable) APR Add more comparisons as needed

Always consider the interest rates in relation to the benefits offered by the card. A higher APR might be worth it if the card provides substantial rewards or perks.

Hidden Costs To Be Aware Of

When considering a premium credit card, be aware of potential hidden costs. These can include:

- Late Payment Fees: Charges for missing payment deadlines.

- Foreign Transaction Fees: Fees for transactions made abroad.

- Cash Advance Fees: Charges for withdrawing cash using your credit card.

For Zable UK credit cards, there are no specific refund or return policies mentioned, so it’s crucial to understand all terms and conditions before applying.

Understanding these costs can help you make an informed decision and manage your finances better.

For more information on Zable UK credit cards, visit their official website.

Pros And Cons Of Using Premium Credit Cards

Premium credit cards offer many benefits and some drawbacks. Understanding these can help you decide if they are right for you.

Advantages Of Premium Credit Cards

- Exclusive Rewards: Premium cards often provide higher rewards rates and exclusive perks such as travel points, cashback, and access to airport lounges.

- Enhanced Security: These cards typically come with advanced security features, like fraud protection and virtual card usage.

- Credit Building: Responsible use can help improve your credit score, especially with cards like Zable, which offers tools for credit score management.

- Convenience: Features such as virtual card usage via Apple Pay or Google Pay make transactions easier and faster.

- Comprehensive Support: Premium cards often include superior customer service and support, such as Zable’s online chat and email assistance.

Potential Drawbacks To Consider

- High APR: Premium cards, like Zable’s, may have high annual percentage rates (APR), with Zable’s APR at 48.9% (variable).

- Annual Fees: Many premium cards come with significant annual fees which can offset the benefits if not used effectively.

- Credit Score Impact: While checking eligibility does not impact your credit score, misuse of the card can negatively affect it.

- Complex Terms: Understanding the terms and conditions, including fees and interest rates, can be more complex with premium cards.

In summary, while premium credit cards offer numerous advantages like higher rewards and enhanced security, they also come with potential drawbacks such as high APR and annual fees. Weighing these pros and cons can help you make an informed decision.

Ideal Users And Scenarios For Premium Credit Cards

Premium credit cards offer a range of benefits tailored to specific user needs. Understanding who benefits most from these cards ensures you maximize their value. Here, we’ll explore ideal users and scenarios for premium credit cards.

Frequent Travelers

Frequent travelers often gain the most from premium credit cards. These cards typically offer:

- Access to airport lounges

- Travel insurance coverage

- No foreign transaction fees

- Reward points for travel expenses

These features make travel more comfortable and cost-effective. For example, a premium card might provide access to over 1,000 airport lounges worldwide. Additionally, travel insurance covers trip cancellations, lost luggage, and medical emergencies.

High Spenders

High spenders often benefit from premium credit cards due to:

- High credit limits

- Enhanced reward points for every purchase

- Exclusive cashback offers

- Purchase protection and extended warranties

For instance, spending £2,000 monthly on a premium card can yield significant rewards and cashback. High credit limits also enable larger purchases without impacting your credit utilization ratio.

Individuals Seeking Exclusive Experiences

Premium credit cards also cater to those seeking exclusive experiences. Benefits include:

- Concierge services

- Access to special events

- Exclusive dining and entertainment offers

- Priority booking for high-demand events

Imagine attending a VIP concert or enjoying a gourmet dining experience, all facilitated by your premium credit card. These unique perks add significant value to your lifestyle.

For more information on premium credit cards like Zable Credit Cards, visit their website.

Conclusion: Is A Premium Credit Card Right For You?

Choosing a premium credit card is a significant decision. These cards offer exclusive benefits, but they also come with higher costs. To make the right choice, consider your financial situation and weigh the benefits against the costs.

Assessing Your Financial Situation

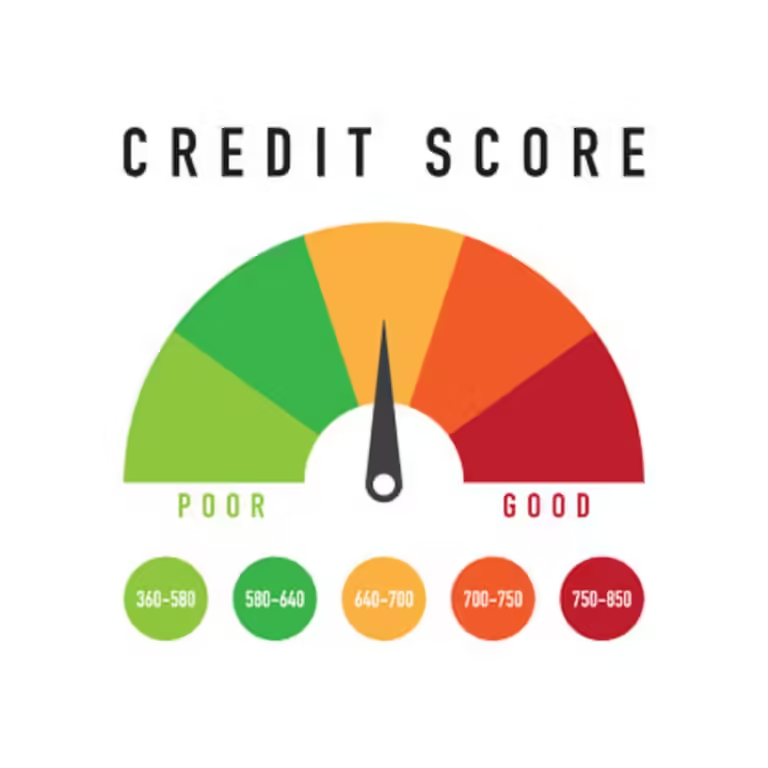

First, evaluate your current financial status. Do you have steady income and a good credit score? Premium credit cards often require strong financial health. Ensure you can manage the annual fees and higher interest rates associated with these cards.

| Criteria | Details |

|---|---|

| Income | Stable and sufficient to cover expenses |

| Credit Score | Good to excellent |

| Debt | Manageable and not overwhelming |

Weighing The Benefits Against The Costs

Premium credit cards offer numerous benefits. These include travel rewards, cash back, and exclusive perks. But these advantages come at a cost. Typically, they have high annual fees and interest rates. Compare these benefits with the fees.

- Travel Rewards: Access to airport lounges, free checked bags, and travel insurance

- Cash Back: Higher percentage on certain categories like dining and groceries

- Exclusive Perks: Concierge services, event access, and purchase protection

Ensure the benefits align with your spending habits and lifestyle. If you travel frequently or spend a lot on dining, the rewards may justify the costs.

Making An Informed Decision

Finally, gather all necessary information. Read the terms and conditions of the premium credit cards you are considering. Understand the fees, interest rates, and reward structures. Consider alternatives like Zable UK, which offers credit cards and personal loans to help build credit scores.

With Zable, users can apply online and access their credit scores without affecting their ratings. The representative APR is 48.9% (variable) for credit cards. For personal loans, the APR is 32.5%, with loan amounts ranging from £1,000 to £25,000.

Making an informed decision involves comparing all options. Weigh the benefits and costs of premium cards against your financial needs and goals.

Frequently Asked Questions

What Are Premium Credit Cards?

Premium credit cards offer exclusive benefits like travel rewards, higher credit limits, and concierge services. They often come with annual fees but provide luxury perks.

Are Premium Credit Cards Worth It?

Premium credit cards are worth it if you can utilize their benefits. They offer rewards, travel perks, and exclusive services that can outweigh the fees.

What Benefits Do Premium Credit Cards Offer?

Premium credit cards offer travel rewards, airport lounge access, concierge services, and higher credit limits. They also provide purchase protection and extended warranties.

How To Qualify For A Premium Credit Card?

To qualify for a premium credit card, you need a high credit score and a strong financial history. Income requirements also play a role.

Conclusion

Choosing a premium credit card can greatly enhance your financial management. Zable UK offers excellent options for credit cards and personal loans. Their products help build credit scores and provide financial insights. Applying is easy and doesn’t impact your credit score. Discover more about Zable Credit Cards & Personal Loans by visiting their official website. Start managing your finances smarter and more effectively today.