Best Credit Repair Services: Transform Your Credit Score Today

Are you struggling with a low credit score? Finding the right credit repair service can make a huge difference.

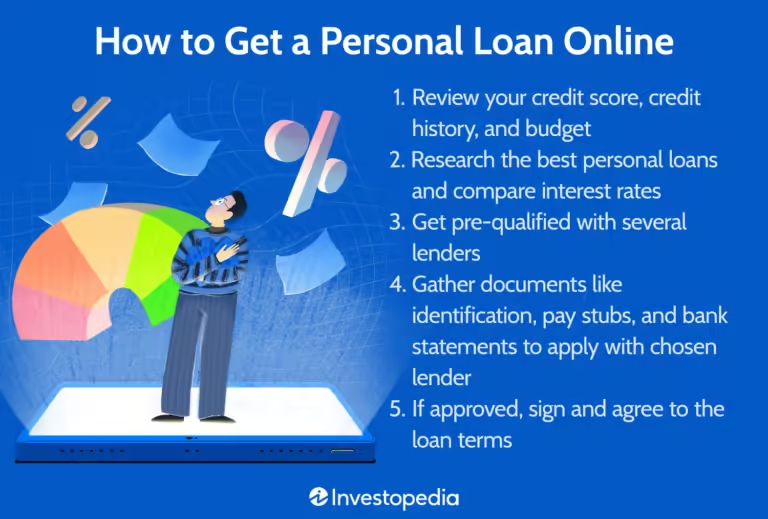

In this guide, we will explore the best credit repair services that can help you improve your credit score and achieve financial freedom. Credit repair services are designed to assist individuals in fixing their credit scores by disputing inaccuracies on credit reports, negotiating with creditors, and providing personalized advice. Having a good credit score is crucial for securing loans, credit cards, and better interest rates. With so many options available, choosing the right service can be overwhelming. That’s why we’ve researched and compiled a list of the best credit repair services, including features, benefits, and pricing details. Whether you’re looking to build your credit or need quick loan approval, our guide will help you find the best solution for your needs. For example, Zable UK offers credit cards and personal loans tailored to help users build their credit scores and manage finances effectively. With features like free credit score access, spending tracking, and rent reporting, Zable provides a comprehensive approach to credit repair. Learn more about Zable’s offerings here.

Introduction To Credit Repair Services

Understanding credit repair services is crucial for anyone looking to improve their credit score. These services can help you manage your finances better and achieve your financial goals. Let’s dive into what credit repair services are, why improving your credit score is important, and how services like Zable can assist you.

What Are Credit Repair Services?

Credit repair services help individuals improve their credit scores. They identify errors on credit reports and work to remove them. These services can also provide advice on managing your finances to avoid future issues. Many companies, like Zable UK, offer comprehensive tools to assist in this process.

Why Improving Your Credit Score Is Important

A higher credit score can open many doors. It can lead to better loan terms, lower interest rates, and increased approval odds for credit cards. For instance, Zable offers credit cards designed to help users build their credit scores. Here are some benefits of improving your credit score:

- Better loan terms: Lower interest rates and more favorable repayment conditions.

- Increased approval chances: Higher chances of getting approved for credit cards and loans.

- Financial freedom: Easier access to financial products and services.

Zable provides tools like free credit score access via Equifax and spending tracking. This helps users manage their finances more effectively and build a solid credit history.

| Feature | Description |

|---|---|

| Credit Cards | Designed for building credit. Quick approval process. |

| Personal Loans | Fast approval, often in less than an hour. |

| Free Credit Score | Access via Equifax to monitor and improve your score. |

| Spending Tracking | Track spending across all accounts for better financial management. |

Using credit repair services can significantly impact your financial health. Companies like Zable make the process easier and more efficient. They provide the tools and support needed to improve your credit score and achieve financial stability.

Key Features Of Top Credit Repair Services

Credit repair services offer various tools and features to help you improve your credit score. The best services provide comprehensive solutions tailored to individual needs. Here are some key features to look for in top credit repair services.

Personalized Credit Repair Plans

Top credit repair services create customized credit repair plans based on your unique financial situation. These plans target specific issues on your credit report and outline steps to resolve them.

- Individual assessment of your credit report

- Specific action steps to address negative items

- Regular updates and progress tracking

Credit Monitoring And Alerts

Effective credit repair services include credit monitoring and alerts. They keep you informed about changes in your credit report, helping you stay proactive.

- Real-time updates on credit score changes

- Notifications for new accounts or inquiries

- Alerts for any suspicious activity

Debt Management Tools

Comprehensive credit repair services offer debt management tools to help you manage existing debts more effectively. These tools assist in creating repayment plans and budgeting.

| Tool | Feature |

|---|---|

| Repayment Calculators | Estimate monthly payments and payoff timelines |

| Budget Planners | Create and track monthly budgets |

Credit Education Resources

The best credit repair services provide credit education resources. They help you understand credit scoring and how to maintain a good credit score.

- Access to articles and guides on credit management

- Webinars and workshops on financial literacy

- One-on-one credit counseling sessions

Top Credit Repair Services To Consider

Finding the best credit repair service can help you improve your credit score and achieve your financial goals. Here are some top credit repair services to consider:

Service A: Comprehensive Credit Repair

Service A offers a thorough approach to credit repair. They provide detailed credit reports and work with you to identify and dispute any inaccuracies. Their team of experts guides you through the process, ensuring that your credit score improves over time.

- Personalized credit analysis

- Dispute inaccuracies on your credit report

- Credit score monitoring

- Financial advice and support

Service B: Budget-friendly Options

For those who want effective credit repair without breaking the bank, Service B is a great choice. They offer affordable plans that still provide essential credit repair services. You can get help with disputing errors and managing your credit without spending too much.

| Plan | Monthly Cost | Services Included |

|---|---|---|

| Basic Plan | $49.99 | Credit report analysis, dispute letters |

| Standard Plan | $79.99 | All Basic Plan services, credit score monitoring |

| Premium Plan | $99.99 | All Standard Plan services, financial coaching |

Service C: Fast-track Credit Improvement

Service C focuses on accelerating your credit repair process. They offer quick solutions for those needing immediate improvements in their credit scores. Their fast-track service ensures that disputes are handled promptly, and results are seen sooner.

- Rapid dispute processing

- Priority customer support

- Credit score updates

- Custom action plans

:max_bytes(150000):strip_icc()/bestcreditrepaircompanies-cbf1142ebbe64ef793c63afaf64867ef.png)

Pricing And Affordability Breakdown

Understanding the pricing and affordability of credit repair services is crucial. This section breaks down the costs, what you get for your money, and compares different pricing models.

Cost Of Credit Repair Services

Credit repair services come with various costs. These can range from a one-time fee to monthly subscriptions. Here’s a general overview:

| Service Type | Average Cost |

|---|---|

| Initial Setup Fee | £50 – £100 |

| Monthly Subscription | £50 – £100 |

| One-Time Service | £300 – £500 |

What To Expect For Your Money

Paying for credit repair services should come with certain expectations. Here’s what you typically get:

- Credit Report Analysis: Detailed review of your credit report.

- Dispute Filing: Submission of disputes to credit bureaus.

- Credit Score Tracking: Regular updates on your credit score progress.

- Personalized Advice: Tailored tips to improve your credit.

For instance, Zable offers free credit score access, spending tracking, and rent reporting for building credit. This makes their service comprehensive.

Comparing Different Pricing Models

Credit repair services use different pricing models. Here’s a comparison:

| Model | Details |

|---|---|

| Monthly Subscription | Regular payments, ongoing support, includes multiple services. |

| Pay Per Deletion | Charges only for successful removals of negative items. |

| One-Time Fee | Single payment for a full-service package. |

To illustrate, Zable Credit Cards come with a 48.9% APR, making it vital to compare with others.

Choosing the right model depends on your needs. Monthly subscriptions offer continuous support. Pay per deletion is cost-effective if you have few negative items. One-time fees provide a comprehensive package without ongoing costs.

Pros And Cons Of Credit Repair Services

Credit repair services can be a valuable tool for those looking to improve their credit scores and manage their finances better. These services offer various benefits, but they also come with potential drawbacks. Understanding both sides can help you make an informed decision.

Advantages Of Using Credit Repair Services

- Expertise: Professionals handle the complex process of disputing inaccuracies on your credit report.

- Time-Saving: They can save you time by managing the paperwork and follow-ups required.

- Improved Credit Score: Successful disputes and corrections can lead to a higher credit score.

- Financial Advice: Many services also offer financial advice to help you maintain a good credit standing.

Potential Drawbacks To Consider

- Cost: Credit repair services can be expensive, often requiring monthly fees.

- No Guarantees: There is no guarantee that the service will be able to improve your credit score.

- Time-Consuming: The process can still take several months, even with professional help.

- Legal Risks: Some companies may use unethical practices that could lead to legal issues.

Real-world User Experiences

Users of credit repair services have varied experiences. Many report significant improvements in their credit scores, while others feel the results did not justify the costs. For instance, Zable Credit Cards & Personal Loans have over 123,000 positive reviews on platforms like Trustpilot, App Store, and Google Play. Users appreciate the quick loan approvals, friendly customer support, and the ability to track spending and credit scores easily.

However, some users express concerns about the high-interest rates and the lengthy time it takes to see improvements. It’s essential to weigh these pros and cons before deciding on a credit repair service.

:max_bytes(150000):strip_icc()/BestCreditRepairCompaniesRecirc-c69998e0889c4deca944218a9b912c76.png)

Who Should Use Credit Repair Services?

Credit repair services can be a valuable resource for individuals facing financial difficulties. These services help improve credit scores by addressing negative items on credit reports. But who exactly should consider using these services? Let’s explore this in detail.

Ideal Candidates For Credit Repair

Not everyone needs credit repair services. They are particularly useful for individuals who:

- Have a history of late payments

- Face high credit card balances

- Have accounts in collections

- Are struggling with charge-offs

- Have been declined for loans due to poor credit

Scenarios Where Credit Repair Services Are Beneficial

Credit repair services can be beneficial in various scenarios. For example:

| Scenario | Benefit |

|---|---|

| Denied Mortgage | Improve credit to qualify for a mortgage |

| High-Interest Rates | Lower interest rates by improving credit score |

| Job Applications | Enhance credit profile for background checks |

| Renting an Apartment | Meet credit requirements for renting |

When To Seek Professional Help

Knowing when to seek professional help is crucial. Consider professional credit repair services if:

- Your credit score is below 600

- You have multiple negative entries on your credit report

- You are overwhelmed by debt and need structured help

- You lack time to address credit issues yourself

- You have been unsuccessful in disputing errors on your credit report

Professional services provide expertise and resources that can help you achieve financial stability.

Conclusion: Achieve A Better Credit Score Today

Improving your credit score can open doors to better financial opportunities. Using the best credit repair services, such as those offered by Zable UK, can help you manage your credit effectively and build a stronger financial future.

Summary Of Benefits

- Build credit with Zable credit cards designed for this purpose.

- Quick loan approval, often in less than an hour.

- Free credit score access via Equifax.

- Spending tracking across all accounts.

- Rent reporting to help build credit history.

- Virtual card option for immediate use with Apple Pay or Google Pay.

- Customer support available seven days a week.

Encouragement To Take Action

Don’t let poor credit hold you back. Take advantage of the benefits offered by Zable UK’s credit repair services. It’s time to improve your credit score and secure a better financial future. Check your eligibility without impacting your credit score and start your journey to a better credit score today. Visit Zable UK to learn more and get started.

Frequently Asked Questions

What Is Credit Repair?

Credit repair involves fixing your credit to improve your credit score. This can help you secure better financial opportunities.

How Do Credit Repair Services Work?

Credit repair services analyze your credit report. They identify errors and negotiate with creditors to remove inaccuracies.

Are Credit Repair Services Worth It?

Yes, if you have errors on your credit report. They can help you save money by improving your credit score.

How Long Does Credit Repair Take?

Credit repair typically takes between three to six months. This depends on the complexity of your credit issues.

Conclusion

Choosing the best credit repair service is crucial. It can impact your financial future. Evaluate features and benefits carefully. Services like Zable Credit Cards and Personal Loans offer valuable tools. They help build credit and manage finances. Check eligibility with no impact on your score. Quick loan approvals are a plus. Their customer support is reliable and friendly. Over 123,000 positive reviews speak volumes. Start improving your credit today with Zable. Visit the official site here. Make an informed decision for better financial health.