Zable UK Savings: Maximize Your Savings Potential Today!

Zable UK Savings Building a good credit score is important. Zable UK offers tools to help with that.

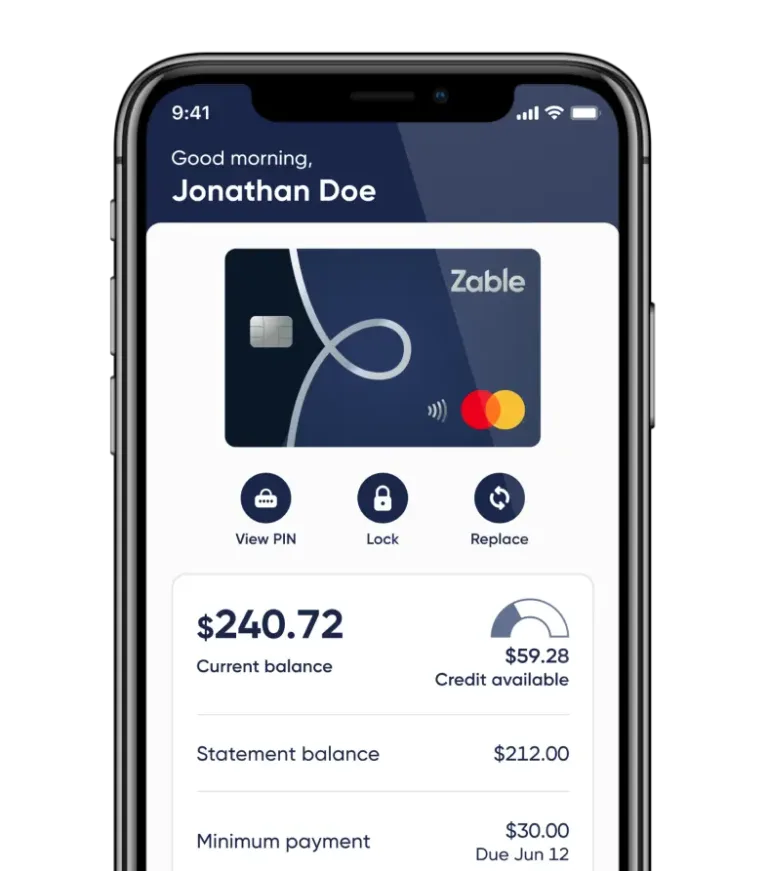

Their services include credit cards and personal loans designed for people wanting to improve their credit. Zable UK provides a range of financial products accessible through their app. Users can monitor spending, report rent, and track credit scores. Their credit cards and loans are designed to be user-friendly and quick to access. With features like instant use with Apple Pay or Google Pay and quick loan approval, Zable UK makes managing your finances straightforward. Checking eligibility for their services does not impact your credit score, making it easy to explore your options. Visit Zable UK to learn more.

Introduction To Zable Uk Savings

Welcome to the world of Zable UK Savings, where saving money and building credit is made simple. Zable offers unique financial products to help you manage your finances better. Let’s explore what Zable UK Savings is all about and how it can benefit you.

What Is Zable Uk Savings?

Zable UK Savings offers credit cards and personal loans designed to assist individuals in building or rebuilding their credit scores. These services are accessible through the Zable App. The app provides tools for monitoring spending, reporting rent, and tracking credit scores.

Purpose And Benefits Of Zable Uk Savings

Zable UK Savings aims to help users improve their financial health. Below are some key benefits:

- Build Credit Score: Both credit cards and personal loans are designed to help improve your credit score with responsible use.

- Instant Use: Eligible users can use virtual cards via Apple Pay or Google Pay immediately.

- Quick Loan Approval: Most personal loans are approved within an hour.

- Comprehensive Credit Insights: Access to credit score, spending tracking, and rent reporting for a complete financial overview.

- No Impact on Credit Score: Checking eligibility for both credit cards and personal loans does not affect your credit score.

With Zable UK Savings, managing finances becomes easier and more efficient. Use their credit cards and personal loans to gain control over your spending and build a strong credit history.

Key Features Of Zable Uk Savings

Zable UK Savings offers a range of features designed to help you manage and grow your savings efficiently. Explore the key features below to understand how Zable can benefit your financial goals.

Competitive Interest Rates

Zable UK provides competitive interest rates on savings accounts. This means your money works harder for you, helping you achieve your savings goals faster.

Easy Account Management

With the Zable App, managing your savings account is simple and convenient. The app allows you to:

- Monitor your balance

- Track transactions

- Set savings goals

These features ensure you have full control over your finances at your fingertips.

Flexible Savings Options

Zable UK Savings offers flexible options to suit your needs. You can choose from different types of savings accounts, each designed to cater to specific financial goals:

| Account Type | Features |

|---|---|

| Instant Access | Withdraw funds anytime without penalties |

| Fixed Term | Higher interest rates for fixed periods |

Secure Banking Experience

Your security is a top priority at Zable. The app uses state-of-the-art encryption to protect your data. Additionally, Zable is regulated by the Financial Conduct Authority (FCA), ensuring your funds are safeguarded.

Enjoy peace of mind knowing that your savings are in safe hands with Zable UK.

How Zable Uk Savings Stands Out

Zable UK Savings offers competitive interest rates and easy online account management. Customers enjoy secure savings and flexible options to grow their funds.

User-friendly Digital Platform

The Zable App allows users to easily manage their finances. The app offers features like: – Credit Score Tracking: Access and monitor your Equifax credit score. – Spending Tracking: View all your accounts in one place. – Instant Use: Eligible users can use virtual cards via Apple Pay or Google Pay immediately. This intuitive platform makes managing personal finance simple and effective.Customer Support And Service

Zable provides excellent customer support through various channels: – Online Chat: Available on the Zable website. – Email Support: Reach out at cards@zable.co.uk. – Phone Support: Call 020 3322 9128 (Mon-Fri: 9am-6pm). These options ensure users get prompt assistance whenever needed.Innovative Savings Tools

Zable offers tools designed to help users build or rebuild their credit score: – Credit Cards: Apply online without impacting your credit score. – Personal Loans: Quick approval, often within an hour. – Rent Reporting: Report rent payments to build credit history. – Comprehensive Credit Insights: Access credit score, spending tracking, and rent reporting. These tools help users gain a comprehensive understanding of their financial health. “`

Pricing And Affordability Of Zable Uk Savings

Understanding the pricing and affordability of Zable UK Savings is crucial. Let’s delve into the specifics to see how Zable stands out in the market.

Fee Structure

Zable UK’s fee structure is designed to be transparent. For credit cards, the interest rate is 48.9% (variable) p.a. with a representative APR of 48.9% (variable). For personal loans, interest rates range from 9.9% to 49.9% APR. These rates depend on the loan amount and term.

Here is a breakdown of the typical costs:

| Product | Interest Rate | Representative APR |

|---|---|---|

| Credit Card | 48.9% (variable) | 48.9% (variable) |

| Personal Loan | 9.9% – 49.9% | 32.5% APR |

Minimum Balance Requirements

Zable UK does not impose strict minimum balance requirements. This makes it accessible for many users. For credit cards, there’s no minimum balance required to keep the account active. Personal loans require no minimum balance either. This flexibility is beneficial for those with varying financial capabilities.

Comparison With Competitors

Comparing Zable UK with competitors highlights its affordability. Many credit card providers have higher APRs and stricter requirements. Here’s a quick comparison:

| Provider | Credit Card APR | Personal Loan APR | Minimum Balance |

|---|---|---|---|

| Zable UK | 48.9% (variable) | 9.9% – 49.9% | None |

| Competitor A | 59.9% | 12.5% – 49.9% | £500 |

| Competitor B | 54.9% | 10.9% – 49.9% | £1,000 |

Zable UK’s competitive rates and no minimum balance requirement make it a strong contender in the personal finance market.

Pros And Cons Of Zable Uk Savings

Choosing the right financial product can be challenging. Zable UK offers credit cards and personal loans to help build or rebuild credit scores. Understanding the pros and cons of Zable UK Savings is essential. This section breaks down the key advantages and potential drawbacks to consider.

Advantages Of Using Zable Uk Savings

- Build Credit Score: Zable credit cards and personal loans are designed to improve credit scores with responsible use.

- Instant Use: Eligible users can use virtual cards via Apple Pay or Google Pay immediately.

- Quick Loan Approval: Most personal loans are approved within an hour.

- Comprehensive Credit Insights: Users have access to their Equifax credit score, spending tracking, and rent reporting for a complete financial overview.

- No Impact on Credit Score: Checking eligibility for both credit cards and personal loans does not affect the credit score.

Potential Drawbacks To Consider

- High Interest Rates: Credit cards have a representative APR of 48.9% (variable). Personal loans have rates ranging from 9.9% to 49.9% APR.

- Customer Support Hours: Limited phone support hours, especially during the Christmas period.

- Regulatory Compliance: As Zable is a trading name of Lendable Ltd, it is crucial to understand their terms and conditions.

Recommendations For Ideal Users

Zable UK offers credit cards and personal loans that help individuals build or rebuild their credit scores. The services are designed to be user-friendly and accessible, providing various financial tools through the Zable App. But who are the ideal users for Zable UK Savings? Let’s explore the best scenarios and who will benefit the most.

Best Scenarios For Using Zable Uk Savings

Here are some scenarios where Zable UK Savings can be highly beneficial:

- Building Credit Score: Use Zable credit cards and loans to enhance your credit score.

- Quick Loan Approval: Need funds fast? Most personal loans get approved within an hour.

- Instant Card Use: Use virtual cards immediately via Apple Pay or Google Pay.

- Comprehensive Financial Tracking: Monitor spending and credit scores all in one place.

- Rent Reporting: Report your rent to improve your credit history without a mortgage.

Who Will Benefit The Most From Zable Uk Savings

Zable UK Savings is particularly beneficial for:

- Individuals with Poor Credit: Those looking to rebuild their credit scores will find Zable’s tools invaluable.

- First-Time Credit Users: New credit users can start building a strong credit history with Zable’s offerings.

- Renters: Renters who wish to boost their credit scores without a mortgage.

- Busy Professionals: Professionals needing quick loan approval and instant credit card use.

- Financial Trackers: Users who want to have a comprehensive view of their finances in one place.

With features like quick loan approval, instant card use, and comprehensive financial tracking, Zable UK Savings is a versatile tool for various financial needs.

Frequently Asked Questions

What Is Zable Uk Savings Account?

Zable UK Savings account is a high-yield savings account. It offers competitive interest rates. Ideal for growing your savings securely.

How Do I Open A Zable Uk Savings Account?

To open a Zable UK Savings account, visit their official website. Complete the online application form. Provide necessary identification documents.

What Are The Benefits Of Zable Uk Savings?

Zable UK Savings offers high interest rates. It ensures your money grows faster. It also provides easy online access and management.

Are There Any Fees For Zable Uk Savings?

Zable UK Savings account has no monthly fees. There are no hidden charges. It ensures maximum returns on your savings.

Conclusion

Zable UK offers valuable tools for improving your credit score. Their credit cards and personal loans are accessible and user-friendly. With instant use and quick approvals, managing finances becomes simpler. Zable’s app helps track spending and report rent. This can aid in building a stronger credit history. Ready to start improving your credit score? Visit Zable UK to learn more.