Secure Online Credit Services: Ultimate Guide to Safe Transactions

In today’s digital age, managing finances securely online is more important than ever. With numerous options available, finding the right service can be challenging.

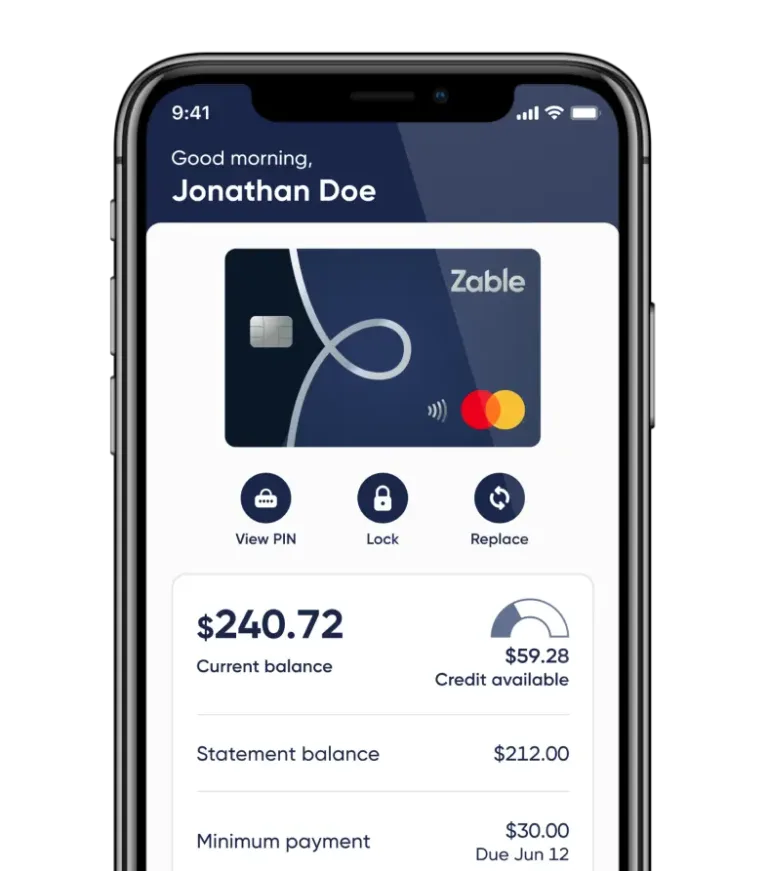

Zable UK offers a range of secure online credit services designed to help you build or improve your credit score. Whether you’re looking for a credit card or a personal loan, Zable provides solutions tailored to your needs. Their services include free credit score access, spend tracking, and even rent reporting to bolster your credit history. With features like instant virtual card access and fast loan approvals, Zable ensures convenience and security. Explore the benefits of using Zable UK for your financial needs and discover how you can take control of your credit journey today.

Introduction To Secure Online Credit Services

In the digital age, secure online credit services have become a vital part of financial management. These services offer convenience and efficiency, but their security is paramount. Understanding the importance of security in online transactions and the evolution of online credit services can help you make informed choices.

Understanding The Importance Of Security In Online Transactions

Security in online transactions is crucial. It protects your personal and financial information from fraud and theft. Online credit services, like those offered by Zable UK, use advanced encryption and security protocols. This ensures your data remains safe and secure.

Secure transactions also build trust between service providers and users. Knowing your financial information is protected allows you to use online services confidently. It reduces the risk of identity theft and unauthorized transactions.

Overview Of Online Credit Services And Their Evolution

Online credit services have evolved significantly. Initially, they were limited to basic credit checks and simple transactions. Today, they offer comprehensive financial solutions. Zable UK provides a range of services including credit cards and personal loans.

| Service | Main Features |

|---|---|

| Credit Card |

|

| Personal Loans |

|

These services are not only convenient but also help in building and improving credit scores. They offer free credit score access, spend tracking, and rent reporting to build credit history. This is particularly beneficial for those looking to improve their financial standing.

The evolution of online credit services has made financial management more accessible. With features like instant virtual cards and comprehensive spend tracking, managing finances has never been easier.

In summary, secure online credit services like those offered by Zable UK provide valuable tools for financial management. They ensure security and offer a range of features to help you build and maintain a good credit score.

Key Features Of Secure Online Credit Services

Secure online credit services offer a range of features designed to protect your financial information and ensure a smooth user experience. Below are some of the key features that make these services reliable and secure.

Encryption And Data Protection

One of the most important features of secure online credit services is encryption. It ensures that your data is protected as it travels between your device and the server. This prevents unauthorized access to your personal and financial information.

Additionally, secure services use data protection measures to store your information safely. This includes techniques like data masking and tokenization, which further safeguard your sensitive data.

Two-factor Authentication

To enhance security, many online credit services implement two-factor authentication (2FA). This requires you to provide two forms of identification before accessing your account. Typically, this includes your password and a code sent to your mobile device.

2FA adds an extra layer of security, making it harder for hackers to gain access to your account, even if they know your password.

Fraud Detection And Prevention

Secure online credit services employ advanced fraud detection systems. These systems monitor your account for suspicious activity and alert you if any unusual transactions are detected. This helps in preventing unauthorized transactions and protecting your funds.

Some services also offer fraud prevention tools, such as virtual card numbers for online purchases. These temporary numbers can be used for specific transactions, adding another layer of security.

User-friendly Interfaces

While security is crucial, the ease of use is also important. Secure online credit services provide user-friendly interfaces that make it easy to manage your account. This includes intuitive dashboards, easy navigation, and clear instructions.

For example, Zable UK offers instant virtual card access and spend tracking across all accounts. These features help you manage your finances efficiently while keeping your information secure.

| Feature | Description |

|---|---|

| Encryption | Protects data during transmission |

| Data Protection | Safeguards stored information |

| Two-Factor Authentication | Requires two forms of identification |

| Fraud Detection | Monitors for suspicious activity |

| User-Friendly Interfaces | Easy to navigate and manage |

By leveraging these key features, secure online credit services like Zable UK provide a safe and convenient way to manage your finances.

Pricing And Affordability Of Secure Online Credit Services

Understanding the pricing and affordability of secure online credit services is essential. This section explores various pricing models, the cost-benefit analysis, and the differences between free and paid services.

Breakdown Of Common Pricing Models

Secure online credit services often follow several pricing models. Here are some common ones:

| Service Type | Pricing Model | Example |

|---|---|---|

| Credit Card | Variable APR | 48.9% APR (Representative) |

| Personal Loan | Fixed APR | 32.5% APR (Representative) |

For instance, Zable Credit Cards have a variable APR of 48.9%, while Zable Personal Loans offer a fixed APR of 32.5%. The APR can vary based on the amount borrowed and the loan period.

Cost-benefit Analysis

Analyzing the costs and benefits of secure online credit services helps in making informed decisions. Let’s break down the benefits offered by Zable:

- Credit Building: Helps improve credit score with timely payments.

- Convenience: Instant virtual card access and fast loan approval.

- Financial Insights: Comprehensive spend tracking and credit score insights.

- No Credit Impact: Eligibility checks do not affect credit score.

While the interest rates might seem high, the benefits provided can outweigh the costs. For instance, the ability to track spending and access free credit scores can lead to better financial management.

Free Vs. Paid Services

Understanding the difference between free and paid services is crucial. Zable offers several free services:

- Free Equifax credit score access

- Spend tracking across all accounts

- Rent reporting to build credit history

Paid services, such as Zable Credit Cards and Personal Loans, come with interest rates. The credit card has a representative APR of 48.9%, and personal loans have a representative APR of 32.5%. Despite the costs, these services provide significant benefits like credit building and fast approval processes.

In summary, while free services provide essential tools for financial management, paid services offer additional benefits that can aid in building and improving credit scores.

Pros And Cons Of Secure Online Credit Services

Secure online credit services like Zable UK are becoming increasingly popular. They offer a convenient way to manage personal finances, build credit, and access loans. However, like any service, they come with their own set of pros and cons.

Advantages Of Using Secure Online Credit Services

- Credit Building: Zable helps build your credit score with timely payments.

- Convenience: Instant virtual card access and fast loan approvals.

- Financial Insights: Comprehensive spend tracking and free Equifax credit score access.

- No Credit Impact: Eligibility checks do not affect your credit score.

- Wide Range of Loan Amounts: From £1,000 to £25,000 over 1-5 years.

Common Drawbacks And Challenges

- High APR: Credit card APR is 48.9% (variable), and personal loans APR is 32.5%.

- Interest Rates: Credit card interest rate is 48.9% (variable) p.a., and personal loans interest rate is 27.0% p.a. (fixed).

- Refund Policies: Not explicitly mentioned, requiring customer support contact for inquiries.

- Customer Support: Limited hours for phone support, especially during holidays.

Real-world User Experiences

| Feature | Customer Feedback |

|---|---|

| Ease of Application | Users find the application process straightforward and quick. |

| Credit Score Improvement | Many customers report significant credit score improvements. |

| Customer Support | Mixed reviews; some appreciate the online chat, others find phone support hours restrictive. |

| Spend Tracking | Users value the comprehensive tracking across all accounts. |

Overall, Zable UK offers a reliable and convenient service for credit building and personal loans. While the APR and interest rates can be high, the benefits of instant access, credit score tracking, and easy application make it a worthwhile option for many.

Recommendations For Ideal Users And Scenarios

Secure online credit services like Zable UK provide immense value for a wide range of users. Understanding who can benefit the most from these services and how to use them effectively is crucial. Below are recommendations for ideal users and scenarios where Zable’s credit cards and personal loans can be highly beneficial.

Who Should Use Secure Online Credit Services?

Secure online credit services are ideal for individuals looking to build or improve their credit scores. They are especially beneficial for:

- Students: Students can start building their credit early with a Zable credit card, benefiting from instant spending with a virtual card and free credit score access.

- First-time credit users: Those new to credit can leverage Zable’s no-impact eligibility checks to assess their approval chances without affecting their credit scores.

- Individuals with poor credit history: Zable helps improve credit scores through timely payments and rent reporting.

- Freelancers and small business owners: They can manage cash flow with Zable’s fast approval personal loans, receiving funds in less than an hour.

Best Practices For Maximizing Security And Benefits

To maximize the benefits and ensure security while using Zable’s credit services, follow these best practices:

- Regularly monitor your credit score: Use the free Equifax credit score access provided by Zable to keep track of your credit health.

- Utilize virtual cards: For secure transactions, use the instant virtual card via Apple Pay or Google Pay.

- Track your spending: Make use of the spend tracking feature to stay on top of your finances and avoid overspending.

- Timely payments: Ensure timely payments on your credit card and personal loans to build a positive credit history.

- Leverage rent reporting: Use the rent reporting service to build your credit history if you are renting.

Case Studies Of Successful Implementations

Many users have successfully utilized Zable’s services to improve their financial health. Here are a few case studies:

| Case Study | Details |

|---|---|

| Student Credit Building | A university student used Zable’s credit card to start building credit early. By making small purchases and paying the balance in full each month, the student’s credit score improved significantly over a year. |

| Freelancer’s Cash Flow Management | A freelancer used Zable’s personal loan for cash flow management. The fast approval process allowed the freelancer to receive funds quickly, ensuring timely project delivery and client satisfaction. |

| Improving Poor Credit History | An individual with a poor credit history used Zable’s credit card and took advantage of rent reporting. Consistent on-time payments and reported rent improved their credit score, allowing them access to better financial products. |

Conclusion And Final Thoughts

Secure online credit services are essential in today’s digital world. They offer numerous benefits, from fast approvals to credit score building. Zable UK stands out with its robust features and customer-centric approach. Let’s delve deeper into the key points and future trends in this domain.

Recap Of Key Points

- Zable Credit Cards & Personal Loans: Designed to help individuals build or improve their credit scores.

- Credit Card Features: Instant spending with a virtual card, no impact on credit score for eligibility check, and approval odds boosted by up to 35%.

- Personal Loans: Fast approval, wide range of loan amounts, and enhanced approval chances using banking history.

- Additional Services: Free Equifax credit score access, spend tracking, and rent reporting to build credit history.

- Benefits: Helps build credit score with timely payments, instant virtual card access, fast loan approval, and comprehensive financial insights.

- Pricing: Competitive APR rates for both credit cards and personal loans, with detailed examples for better understanding.

Future Trends In Secure Online Credit Services

The future of secure online credit services looks promising with advancements in technology. Here are a few trends to watch:

- Increased Use of AI: AI will play a significant role in improving credit approval processes and fraud detection.

- Blockchain Technology: Blockchain can enhance security and transparency in transactions.

- Integration with Digital Wallets: More services will offer instant spending via digital wallets like Apple Pay or Google Pay.

- Enhanced Customer Insights: Improved spend tracking and financial insights will help customers make better financial decisions.

Final Recommendations

To make the most of secure online credit services, consider these recommendations:

- Research Thoroughly: Understand the features and benefits of different credit services. Choose the one that best meets your needs.

- Monitor Your Credit: Regularly check your credit score and report for any discrepancies. Use services that offer free credit score access.

- Utilize Technology: Take advantage of instant virtual cards and digital wallet integration for convenience.

- Stay Informed: Keep an eye on future trends and advancements in secure online credit services to stay ahead.

Zable UK offers a comprehensive suite of credit services that can help you build your credit score and manage your finances effectively. By following these recommendations, you can ensure a secure and beneficial experience with online credit services.

Frequently Asked Questions

What Are Secure Online Credit Services?

Secure online credit services protect your personal and financial information during transactions. They use encryption and other security measures to prevent unauthorized access.

How Can I Identify Secure Credit Services?

Look for HTTPS in the URL and security badges on the website. These indicate the site uses encryption for data protection.

Why Are Online Credit Services Important?

They offer convenience and speed for managing finances. Secure services ensure your information remains safe from fraud and theft.

What Features Do Secure Credit Services Offer?

They provide encryption, fraud detection, and multi-factor authentication. These features enhance the security of your transactions.

Conclusion

Securing online credit services is crucial for financial health. Zable UK offers reliable solutions, enhancing your credit score with ease. Their services include instant virtual card access and fast loan approvals. Plus, their tools help track spending and improve credit history. For more information, visit Zable UK. Protect your financial future today.