Credit Card Fraud Protection: Top Tips to Keep Your Money Safe

Credit card fraud is a serious issue. Protecting yourself is essential.

In today’s digital world, credit card fraud has become increasingly common. Thieves are always finding new ways to steal your information. Understanding how to protect yourself can save you from a lot of trouble. This guide on credit card fraud protection will help you learn the best ways to keep your finances safe. From recognizing common scams to using tools that safeguard your accounts, we cover everything you need to know. With the right knowledge and precautions, you can enjoy peace of mind and secure your hard-earned money. For a reliable and secure credit card, consider Zable UK. They offer features that help build and improve your credit score. Check them out here.

Introduction To Credit Card Fraud Protection

Credit card fraud is a serious issue affecting millions of individuals worldwide. Understanding how to protect your credit card information is crucial. This guide will introduce you to essential fraud protection measures.

Understanding Credit Card Fraud

Credit card fraud occurs when someone uses your card without permission. This can lead to unauthorized purchases and significant financial loss. Common types of credit card fraud include:

- Card-not-present fraud: When the card is not physically present during the transaction.

- Card-present fraud: When the card is stolen and used for in-person transactions.

- Phishing scams: Fraudsters tricking you into revealing card details.

- Skimming: Copying card information through devices attached to ATMs or point-of-sale terminals.

Recognizing the signs of fraud early can help you take prompt action to mitigate damage.

The Importance Of Protecting Your Credit Cards

Protecting your credit cards is vital for maintaining your financial health. Here are some key reasons:

- Avoid financial losses: Fraudulent transactions can deplete your funds.

- Maintain your credit score: Fraud can negatively impact your credit score.

- Prevent identity theft: Fraudsters can use your information for other illegal activities.

To protect your credit cards, consider the following tips:

| Protection Tips | Details |

|---|---|

| Monitor your accounts | Regularly check your statements for unauthorized transactions. |

| Use secure passwords | Ensure your online banking passwords are strong and unique. |

| Enable alerts | Set up transaction alerts to stay informed of any activity. |

| Be cautious online | Only shop on secure websites and avoid sharing card details via email. |

By taking these steps, you can significantly reduce the risk of credit card fraud and protect your financial well-being.

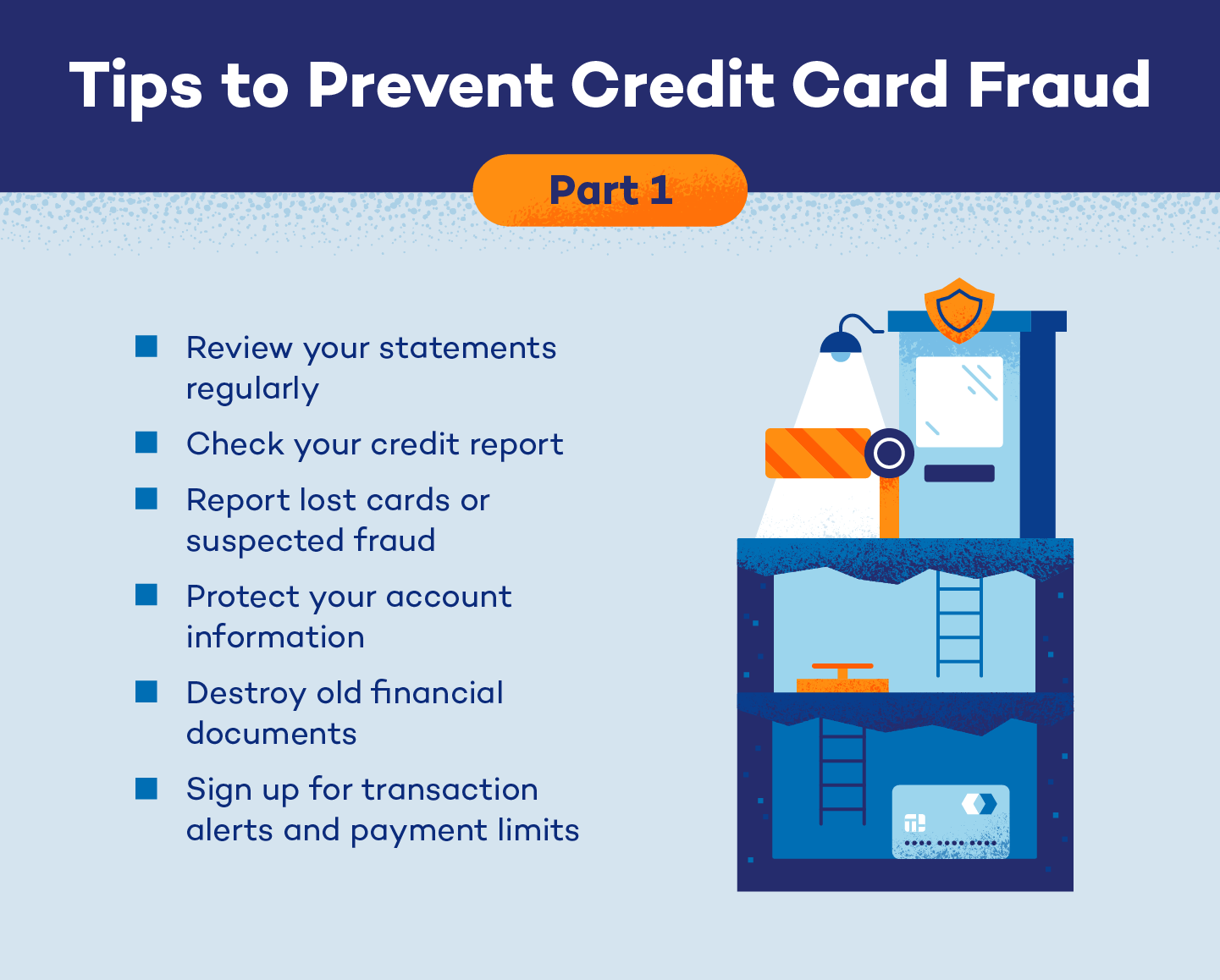

Top Tips For Preventing Credit Card Fraud

Preventing credit card fraud is crucial in maintaining your financial security. By taking proactive measures, you can protect your credit card information and avoid potential losses. Below are some essential tips to help safeguard your credit cards from fraud.

Regularly Monitor Your Account Activity

Regularly reviewing your account activity helps you identify any unauthorized transactions quickly. Check your account statements weekly or set aside time each month to review your expenses. This habit will help you spot discrepancies and report them immediately.

Use Strong And Unique Passwords

Using strong and unique passwords for your online banking and shopping accounts is essential. Avoid using easily guessable passwords such as “123456” or “password”. Instead, create complex passwords with a mix of letters, numbers, and special characters. Make sure each account has a different password to enhance security.

Enable Alerts And Notifications

Enabling alerts and notifications on your credit card account can help you stay informed about your transactions. Set up text or email alerts for large purchases, international transactions, or any suspicious activity. This way, you can act quickly if something seems off.

Be Cautious With Public Wi-fi

Using public Wi-Fi networks can expose your personal information to hackers. Avoid accessing your banking or shopping accounts when connected to public Wi-Fi. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your data and protect your information.

Recognize And Avoid Phishing Scams

Phishing scams are fraudulent attempts to obtain your personal information. Be wary of emails or messages asking for your credit card details or login information. Always verify the sender’s authenticity before clicking on any links or providing sensitive information. If in doubt, contact your credit card issuer directly.

Key Features Of Effective Fraud Protection Tools

Effective fraud protection tools are crucial for safeguarding your credit card information. These tools help detect and prevent unauthorized transactions, ensuring your financial security. Here, we explore the key features of these tools that can help protect your Zable credit card.

Real-time Transaction Alerts

One of the most effective features is real-time transaction alerts. These alerts notify you instantly via SMS or email when a transaction occurs. This immediate notification allows you to detect unauthorized activities quickly.

- Instant notifications for each transaction

- Helps to spot fraudulent activities immediately

- Available via SMS, email, or app notifications

Advanced Encryption Technologies

Advanced encryption technologies protect your sensitive information during transactions. This feature ensures that your data is secure and unreadable to unauthorized individuals.

| Type | Benefit |

|---|---|

| SSL Encryption | Secures data during transmission |

| Tokenization | Replaces sensitive data with unique symbols |

Multi-factor Authentication

Multi-factor authentication (MFA) adds an extra layer of security. It requires you to provide two or more verification factors to gain access to your account. This makes it harder for fraudsters to access your account.

- Something you know (password)

- Something you have (mobile device)

- Something you are (biometrics)

Fraud Detection Algorithms

Fraud detection algorithms analyze your spending patterns to identify suspicious activities. These algorithms use machine learning to spot anomalies and prevent fraud before it happens.

- Analyzes spending patterns

- Identifies unusual activities

- Prevents fraud proactively

Secure Mobile Payment Options

Secure mobile payment options like Apple Pay and Google Pay offer added security. These platforms use encryption and tokenization to keep your card information safe.

- Encrypted transactions

- Tokenized payments

- Convenient and secure

By utilizing these key features, Zable credit cards ensure robust protection against fraud. Stay vigilant and leverage these tools for your financial security.

Pricing And Affordability Of Fraud Protection Services

Protecting your credit card from fraud is crucial in today’s digital age. Understanding the pricing and affordability of fraud protection services can help you make informed decisions. Let’s explore the various aspects of these services, from free options to paid plans.

Free Vs. Paid Fraud Protection Services

Many services offer both free and paid fraud protection options. Free services typically include basic features such as transaction alerts and limited account monitoring. These can be a good starting point if you are on a tight budget.

Paid services, on the other hand, provide advanced features such as real-time alerts, comprehensive identity theft protection, and insurance coverage. The cost of these services can vary, but they generally offer more comprehensive protection compared to free options.

| Service Type | Features | Cost |

|---|---|---|

| Free | Basic alerts, limited monitoring | No cost |

| Paid | Real-time alerts, identity theft protection, insurance coverage | Varies |

Value For Money: What To Look For

When choosing a fraud protection service, it’s important to consider the value for money. Look for services that offer a balance between cost and features. Key aspects to consider include:

- Comprehensive monitoring

- Speed of alerts

- Insurance coverage

- Customer support availability

For instance, Zable UK offers credit cards with features like instant spending with virtual cards and free access to Equifax credit scores. Such features add value and convenience, making the service worth considering.

Bundled Services And Discounts

Many providers offer bundled services and discounts to make their fraud protection services more affordable. Bundled services often include additional features like credit monitoring and financial management tools.

For example, Zable UK provides spend tracking, rent reporting, and insights on improving your credit profile, all accessible via their app. Bundling these services together can save you money compared to purchasing each service separately.

Look for discounts or promotional offers that can reduce the overall cost. Many providers offer introductory discounts or reduced rates for long-term commitments.

Pros And Cons Of Various Fraud Protection Methods

Credit card fraud protection is crucial for safeguarding financial health. Different methods offer various benefits and limitations. Choosing the right one depends on individual needs and preferences. Let’s explore the pros and cons of some popular fraud protection methods.

Pros And Cons Of Using Credit Monitoring Services

Credit monitoring services keep an eye on your credit reports and notify you of any suspicious activity.

| Pros | Cons |

|---|---|

|

|

Advantages And Drawbacks Of Multi-factor Authentication

Multi-Factor Authentication (MFA) adds an extra layer of security by requiring more than one verification method to access accounts.

| Advantages | Drawbacks |

|---|---|

|

|

Benefits And Limitations Of Encryption Technologies

Encryption technologies protect data by converting it into a code, only accessible with a decryption key.

| Benefits | Limitations |

|---|---|

|

|

Understanding the pros and cons of these fraud protection methods helps in making informed decisions. Each method has its strengths and weaknesses. Choose the one that best fits your needs to keep your financial data safe.

Recommendations For Ideal Users And Scenarios

Credit card fraud is a growing concern. Protecting your financial details is crucial. Here are some recommendations for different users and scenarios.

Best Practices For Frequent Travelers

Frequent travelers face unique risks. Follow these tips to stay secure:

- Use virtual cards for online bookings.

- Enable real-time transaction alerts on your Zable app.

- Notify your card issuer about your travel plans.

- Use secure Wi-Fi networks for online transactions.

Travelling with a Zable card? Use its virtual card feature via Apple Pay or Google Pay for instant, secure spending.

Fraud Protection Tips For Online Shoppers

Online shopping is convenient but risky. Protect yourself with these tips:

- Shop on reputable websites only.

- Enable two-factor authentication for your accounts.

- Regularly monitor your transactions with Zable’s spending tracking feature.

- Use secure payment methods like Zable’s virtual card.

Zable offers instant spending with virtual cards, reducing the risk of fraud.

Advice For Small Business Owners

Small business owners face different challenges. Here are some tips:

- Use separate cards for personal and business expenses.

- Track your expenses with Zable’s spending tracking feature.

- Report rent payments with Zable’s rent reporting service to build credit.

- Review your financial statements regularly for any discrepancies.

Zable’s comprehensive financial tracking can help you manage your business expenses efficiently.

By following these recommendations, you can protect yourself from credit card fraud and enjoy the benefits of using Zable credit cards and personal loans.

Conclusion: Staying Vigilant In The Fight Against Credit Card Fraud

Staying vigilant in the fight against credit card fraud is crucial. With the rise of digital transactions, the risk of fraud has increased. Protecting your financial information demands constant awareness and proactive measures.

Recap Of Key Tips

- Monitor Transactions Regularly: Check your bank statements frequently.

- Use Strong Passwords: Ensure your passwords are unique and complex.

- Enable Alerts: Set up alerts for suspicious activities.

- Be Cautious Online: Avoid sharing personal information on unsecured websites.

- Report Suspicious Activities: Contact your bank if you notice any unusual transactions.

Encouragement To Stay Proactive

Stay proactive in safeguarding your financial data. Use tools like the Zable App to track spending and monitor credit scores. Awareness and action are your best defenses against fraud. Regularly updating yourself on security practices helps protect your financial well-being.

Remember, protecting your credit card information is an ongoing process. Stay informed, stay vigilant, and take advantage of the tools at your disposal. Your financial security depends on it.

Frequently Asked Questions

What Is Credit Card Fraud Protection?

Credit card fraud protection helps safeguard your card from unauthorized use. It includes monitoring, alerts, and security measures to prevent fraud.

How Can I Protect My Credit Card?

Protect your credit card by keeping it secure, using strong passwords, and regularly monitoring your statements for suspicious activity.

What Should I Do If My Card Is Stolen?

If your card is stolen, report it to your bank immediately. They will cancel the card and issue a new one.

Can I Get Reimbursed For Fraudulent Charges?

Yes, most banks reimburse fraudulent charges. Promptly report any unauthorized transactions to ensure reimbursement.

Conclusion

Protecting yourself from credit card fraud is crucial in today’s digital age. Stay vigilant. Use secure passwords and monitor your accounts regularly. Zable UK offers credit cards and personal loans to help build your credit score. Their app provides features like spending tracking and rent reporting. For more information, visit Zable UK. Stay safe and take control of your financial security.