Credit Reporting Services: Boost Your Financial Health Today

Credit reporting services are essential for managing your financial health. They provide detailed insights into your credit history and scores.

Understanding how credit reporting services work is vital for making informed financial decisions. These services help you track your credit score, monitor spending, and identify any discrepancies that might affect your credit profile. Whether you’re looking to build or rebuild your credit, knowing your current credit status is the first step towards financial stability. One such service, offered by Zable UK, provides an excellent platform to manage your credit efficiently. With Zable, you can access your credit scores, track spending, and even report rent payments to boost your credit profile. Discover how Zable’s credit cards and personal loans can help you enhance your financial standing by visiting their website here.

:max_bytes(150000):strip_icc()/who-are-the-three-major-credit-bureaus-960416-Final-5c5363db46e0fb0001c07a68.png)

Introduction To Credit Reporting Services

Credit reporting services gather and provide information about individuals’ credit histories. They help lenders assess creditworthiness, offering insights into one’s financial reliability. These services play a crucial role in financial decision-making.

Credit reporting services play a crucial role in personal finance. They help individuals manage and improve their credit health. Understanding these services can lead to better financial decisions and opportunities.What Are Credit Reporting Services?

Credit reporting services collect and maintain credit information. They provide this data to lenders and other entities. These services create credit reports based on an individual’s financial behavior. Key components include:- Payment history

- Credit utilization

- Credit inquiries

- Public records

The Importance Of Credit Reporting In Financial Health

Maintaining good credit health is essential for financial stability. Credit reporting services provide insights into one’s credit status. Key benefits include:- Loan Approval: Lenders use credit reports to determine loan eligibility.

- Interest Rates: Better credit scores often lead to lower interest rates.

- Credit Monitoring: Regular updates help in tracking credit improvements.

- Fraud Detection: Identifying unusual activities early prevents fraud.

| Product | Features |

|---|---|

| Credit Card |

|

| Personal Loans |

|

Key Features Of Credit Reporting Services

Credit reporting services offer essential features for managing and improving your credit profile. Understanding these features can help you make informed financial decisions. Let’s explore the key features that these services provide:

Comprehensive Credit Reports

Credit reporting services offer comprehensive credit reports that detail your credit history. These reports include:

- Credit accounts

- Payment history

- Credit inquiries

- Public records

Having access to this information helps you understand your credit profile and identify areas for improvement.

Credit Score Monitoring

Monitoring your credit score regularly is crucial. Credit reporting services provide tools to track your credit score over time. With credit score monitoring, you can:

- Receive alerts for significant changes

- Track your progress

- Understand factors affecting your score

This feature helps you stay informed and take timely actions to maintain or improve your credit score.

Identity Theft Protection

Identity theft is a significant concern in today’s digital world. Credit reporting services offer identity theft protection to safeguard your personal information. This includes:

- Monitoring for suspicious activity

- Alerts for potential fraud

- Assistance in case of identity theft

With this protection, you can rest assured that your identity is being monitored and protected.

Credit Report Dispute Assistance

Errors on your credit report can negatively impact your credit score. Credit reporting services provide dispute assistance to help you correct inaccuracies. This service includes:

- Guidance on identifying errors

- Assistance in filing disputes

- Follow-up on dispute resolutions

Getting errors corrected promptly can improve your credit score and overall credit profile.

Pricing And Affordability Of Credit Reporting Services

Understanding the pricing and affordability of credit reporting services is essential. It helps individuals and businesses make informed decisions. Let’s dive into the different pricing tiers, the comparison between free and paid services, and the overall value for money.

Different Pricing Tiers Explained

Credit reporting services typically offer various pricing tiers. These tiers cater to different needs and budgets:

| Tier | Features | Cost |

|---|---|---|

| Basic |

|

Free |

| Standard |

|

£10/month |

| Premium |

|

£20/month |

Free Vs. Paid Services: What’s The Difference?

Many providers offer both free and paid services. Free services usually include basic features:

- Access to your credit score

- Limited credit report details

- Monthly updates

Paid services, on the other hand, provide more comprehensive features:

- Detailed credit reports

- Credit monitoring and alerts

- Identity theft protection

- More frequent updates

Choosing between free and paid services depends on your specific needs and budget.

Affordability And Value For Money

Affordability is a key consideration. Paid services must offer value for money. Assessing the benefits and features is crucial:

- Comprehensive credit monitoring can prevent identity theft.

- Frequent updates help track your credit health more accurately.

- Additional services, like spending tracking, enhance financial management.

For instance, Zable UK offers free access to Equifax credit scores and insights. Their credit card and personal loans come with competitive APR rates, making them a valuable choice for many.

Understanding your needs and the services offered ensures you get the best value for your money.

Pros And Cons Of Using Credit Reporting Services

Understanding the pros and cons of credit reporting services can help you make informed decisions. Here, we will explore both the advantages and potential drawbacks of utilizing these services.

Advantages Of Credit Reporting Services

Credit reporting services offer several key benefits:

- Free Access to Credit Scores: Services like Zable provide free access to your Equifax credit score and insights.

- Spending Tracking: Monitor all your accounts and track spending in one place via the Zable app.

- Credit Building: Build your credit history by reporting rent payments.

- No Credit Score Impact: Checking eligibility for credit cards or loans does not affect your credit score.

- Quick Approvals: Personal loans often receive approval within an hour, as seen with Zable’s quick loan service.

- Virtual Card Option: Instant spending via Apple Pay or Google Pay with a virtual card.

- Enhanced Approval Odds: Using banking history to boost approval chances by up to 35%.

- Customer Support: Fast and friendly customer support available seven days a week.

Potential Drawbacks And Limitations

While credit reporting services are beneficial, they also have some limitations:

- High APR Rates: Zable’s credit card has a representative APR of 48.9%, which can be expensive for some users.

- Loan Costs: Personal loans come with high APR rates, ranging from 9.9% to 49.9%, making them costly over time.

- Refund/Return Policies: Zable does not explicitly state refund or return policies, which could be a concern for some customers.

- Regulatory Oversight: Zable is regulated by the Gibraltar Financial Services Commission, which might differ from other regulatory bodies.

Considering these pros and cons can help you decide whether credit reporting services like Zable are right for you. Understanding their benefits and limitations ensures you make the best financial decisions for your needs.

Who Should Use Credit Reporting Services?

Understanding who benefits from credit reporting services is essential. These services help individuals and businesses maintain a healthy credit profile. Below, we will explore the ideal users and specific scenarios where credit reporting services are essential.

Ideal Users: Who Benefits The Most?

Credit reporting services are valuable for many people, including:

- Individuals Looking to Build Credit: Services like Zable UK are perfect for those starting their credit journey. They offer tools to track spending, access credit scores, and report rent payments.

- People Rebuilding Their Credit: If you have a poor credit history, Zable can help you improve it. Their features include using banking history to increase approval odds.

- Frequent Borrowers: Regular users of credit cards and personal loans benefit from understanding their credit status. Zable offers free access to Equifax credit scores and insights.

- Landlords and Tenants: Reporting rent payments can build credit history. Zable’s app helps monitor accounts and track spending in one place.

Specific Scenarios Where Credit Reporting Services Are Essential

There are situations where credit reporting services are not just helpful but essential:

- Applying for a Loan: Lenders review credit reports to decide on loan approvals. Zable offers quick approval for personal loans, often within an hour.

- Monitoring Financial Health: Regularly checking your credit report helps detect fraud. Zable’s app provides free credit score access and insights.

- Improving Creditworthiness: If you aim to increase your credit score, tracking your spending and managing credit responsibly is crucial. Zable’s virtual card option allows instant spending via Apple Pay or Google Pay.

- Renting or Leasing Property: Both landlords and tenants benefit from rent reporting. It builds a positive credit history, making future borrowing easier.

Credit reporting services are a crucial tool for anyone managing their finances. Whether you are building, rebuilding, or maintaining your credit, these services provide valuable insights and support.

Conclusion: Enhancing Your Financial Health With Credit Reporting Services

Understanding your credit score is vital for financial success. Credit reporting services provide valuable insights into your credit health. They help you track spending, manage debt, and improve your credit score. A service like Zable UK can be a great ally. Zable offers credit cards and personal loans, with tools to build or rebuild your credit profile.

Summary Of Key Takeaways

- Credit Monitoring: Regularly check your credit score.

- Spending Tracking: Use apps to monitor and control expenses.

- Credit Building: Report rent payments to build credit history.

- No Impact Checks: Check eligibility without affecting your credit score.

Steps To Get Started With Credit Reporting Services

- Choose a Service: Select a reliable service like Zable UK.

- Sign Up: Register online or via the app.

- Access Tools: Use the app to monitor your credit score and spending.

- Manage Debt: Apply for credit cards or personal loans if needed.

- Track Progress: Regularly check improvements in your credit profile.

Enhancing your financial health is a continuous process. Using credit reporting services like Zable UK can make it easier. With free access to Equifax credit score, spending tracking, and rent reporting, you can take control of your financial journey.

Frequently Asked Questions

What Are Credit Reporting Services?

Credit reporting services provide information about your credit history. They help lenders assess your creditworthiness. This includes details like payment history and credit accounts.

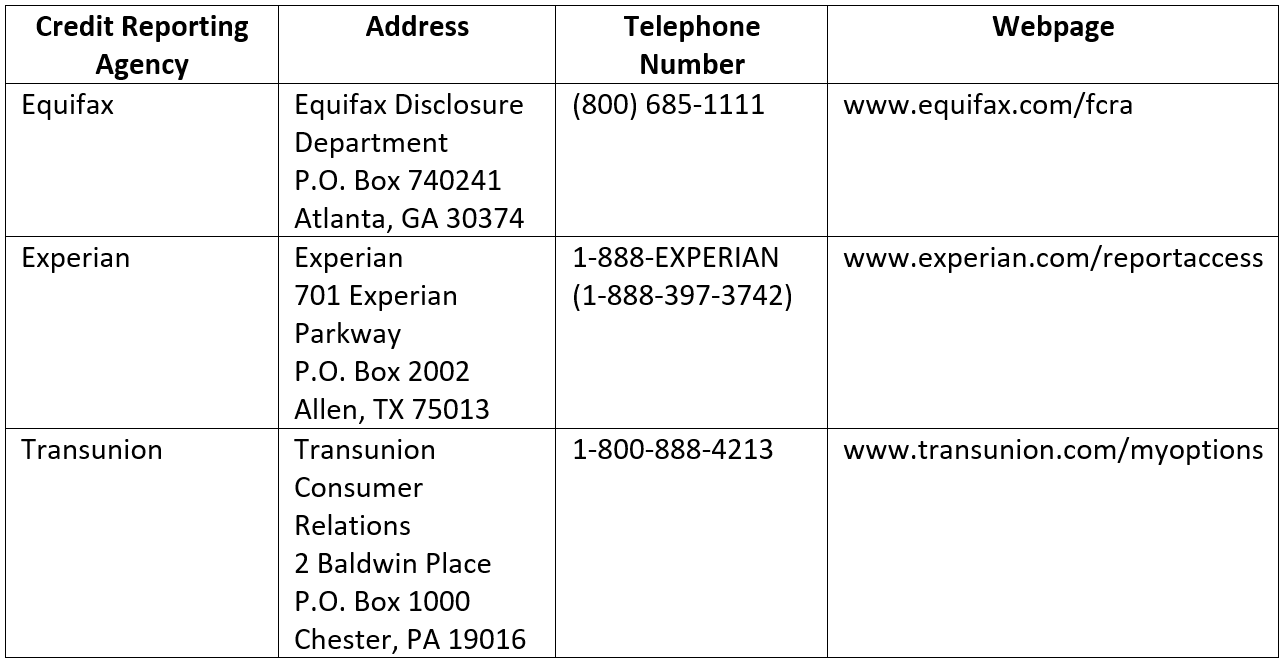

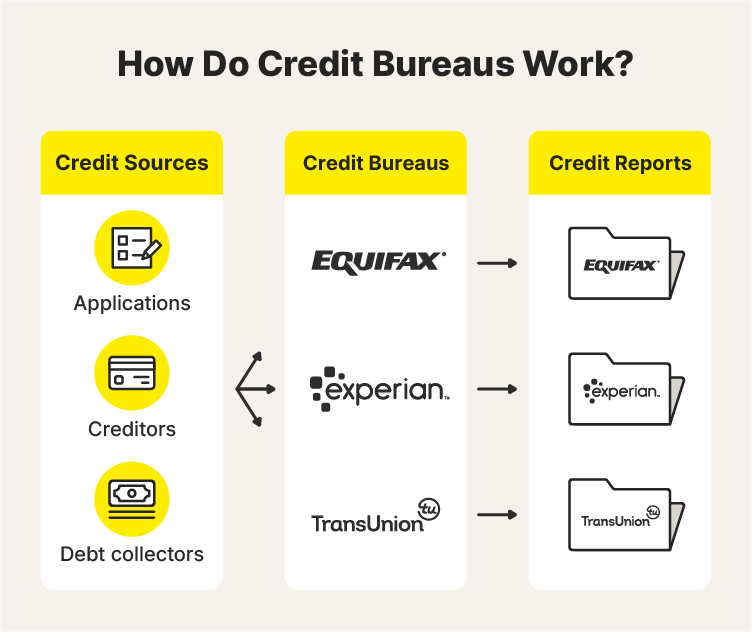

How Do Credit Reporting Services Work?

Credit reporting services collect data from creditors and public records. They compile this data into credit reports. These reports are then used by lenders to evaluate your credit risk.

Why Are Credit Reports Important?

Credit reports are crucial for obtaining loans and credit cards. They influence interest rates and approval chances. A good credit report can save you money.

Can I Access My Credit Report For Free?

Yes, you can access your credit report for free. AnnualCreditReport. com provides free reports from major credit bureaus. It’s wise to check your report regularly.

Conclusion

Understanding credit reporting services is essential for financial health. These services offer insights into your credit profile. They help in tracking spending and improving credit scores. Zable UK provides credit cards and personal loans. Their offerings include free access to your Equifax credit score. You can manage everything via their app. Interested in learning more? Check out Zable UK for detailed information here. Stay informed and make smart financial decisions today.