Credit Card Perks: Unlock Exclusive Benefits and Rewards

Credit cards offer a range of perks. These benefits can enhance your financial experience.

From cashback rewards to travel points, credit card perks can add significant value to everyday spending. Understanding the various perks of credit cards can help you maximize their benefits. Whether you are looking to save money, earn rewards, or enjoy exclusive services, the right credit card can make a difference. For instance, cashback rewards return a percentage of your purchases, while travel points can reduce your vacation costs. Besides, some cards offer purchase protection, extended warranties, and access to special events. By choosing a card that aligns with your lifestyle, you can take full advantage of these perks. To explore more about investing and financial growth, check out Nemo Money here.

Introduction To Credit Card Perks

Credit cards offer more than just a way to make purchases. They come with a variety of perks that can add significant value to your financial life. Understanding these perks can help you make the most of your credit card.

What Are Credit Card Perks?

Credit card perks are the additional benefits provided by credit card companies to attract and retain customers. These perks can range from cashback rewards to travel insurance. Here are some common types of credit card perks:

- Cashback Rewards: Earn a percentage of your spending back in cash.

- Travel Points: Accumulate points that can be redeemed for flights, hotels, and more.

- Purchase Protection: Get coverage for damaged or stolen items bought with your card.

- Extended Warranties: Extend the manufacturer’s warranty on purchased items.

- Access to Exclusive Events: Enjoy special access to concerts, sports events, and more.

Why Credit Card Perks Matter

Understanding and using credit card perks can provide financial benefits beyond the basic use of the card. Here are some reasons why these perks matter:

- Cost Savings: Perks like cashback and discounts can save you money.

- Travel Benefits: Points and travel insurance can make your trips more affordable and secure.

- Security Features: Purchase protection and extended warranties offer peace of mind.

- Exclusive Access: Enjoy experiences that are not available to everyone.

By leveraging these perks, you can maximize the value of your credit card and enhance your overall financial well-being.

Key Features Of Credit Card Perks

Credit cards offer numerous perks that enhance your financial experience. These perks can make spending more rewarding and provide added security. Here are some key features of credit card perks:

Cashback Rewards: Earn While You Spend

One of the most attractive features of credit cards is cashback rewards. With cashback rewards, you earn back a small percentage of what you spend. This can be a great way to save money on everyday purchases.

For example, if your credit card offers 2% cashback on groceries, spending $100 would earn you $2 back. Over time, these savings add up and can be used for other expenses.

Travel Benefits: Making Your Trips More Enjoyable

Travel benefits are another popular perk. Many credit cards offer rewards like free checked bags, priority boarding, and access to airport lounges. These benefits can make traveling more comfortable and less stressful.

Some cards also offer travel insurance, which can cover unexpected events like trip cancellations or lost luggage. This provides peace of mind when you’re on the go.

Purchase Protection: Safeguarding Your Purchases

Credit cards often come with purchase protection. This means that if an item you buy is damaged or stolen, you can be reimbursed. This feature is especially useful for expensive or high-risk purchases.

Additionally, many cards offer extended warranties on items you buy, giving you extra coverage beyond the manufacturer’s warranty.

Exclusive Access: Vip Events And Offers

Some credit cards provide exclusive access to events and special offers. This can include tickets to concerts, sports events, or VIP experiences. Cardholders might also get early access to sales or special discounts at certain retailers.

These perks can provide unique opportunities and savings that are not available to the general public.

Reward Points: Turning Spending Into Savings

Many credit cards offer reward points that you can accumulate with each purchase. These points can be redeemed for various rewards, such as merchandise, gift cards, or even cash.

For instance, a card might offer 1 point per dollar spent. Over time, these points can add up to significant savings. Some cards even offer bonus points for spending in specific categories, like dining or travel.

| Feature | Benefit |

|---|---|

| Cashback Rewards | Earn back a percentage of your spending |

| Travel Benefits | Free checked bags, priority boarding, lounge access |

| Purchase Protection | Reimbursement for damaged or stolen items |

| Exclusive Access | VIP events and special offers |

| Reward Points | Redeem points for rewards and savings |

Pricing And Affordability Of Credit Cards With Perks

Credit cards offer various perks, but understanding their costs and affordability is crucial. This section delves into the pricing components of credit cards, helping you make informed decisions.

Annual Fees: Weighing The Costs

Many credit cards with perks come with an annual fee. This fee can range from $0 to several hundred dollars. It’s essential to weigh the costs against the benefits offered. A card with a $95 annual fee might provide rewards that far exceed this cost.

| Card Type | Annual Fee | Key Perks |

|---|---|---|

| Basic Rewards Card | $0 | Cashback on everyday purchases |

| Premium Travel Card | $450 | Airport lounge access, travel credits |

Interest Rates: Understanding The Financial Impact

Credit cards come with varying interest rates. These rates can significantly impact your finances if you carry a balance. A lower interest rate card is preferable if you plan to carry a balance.

- APR (Annual Percentage Rate): Typically ranges from 12% to 24%.

- Promotional APR: Some cards offer 0% APR for an introductory period.

Understanding these rates helps in avoiding high-interest charges. Always read the fine print on the APR terms.

Promotional Offers: Getting The Best Deal

Many credit cards offer promotional deals to attract new users. These promotions can include sign-up bonuses, 0% APR introductory periods, and more.

- Sign-Up Bonuses: Earn extra points or cashback after meeting a spending threshold.

- 0% Intro APR: Pay no interest on purchases or balance transfers for a specified period.

- First-Year Fee Waiver: Some cards waive the annual fee for the first year.

These offers can provide significant value but remember to evaluate their long-term benefits.

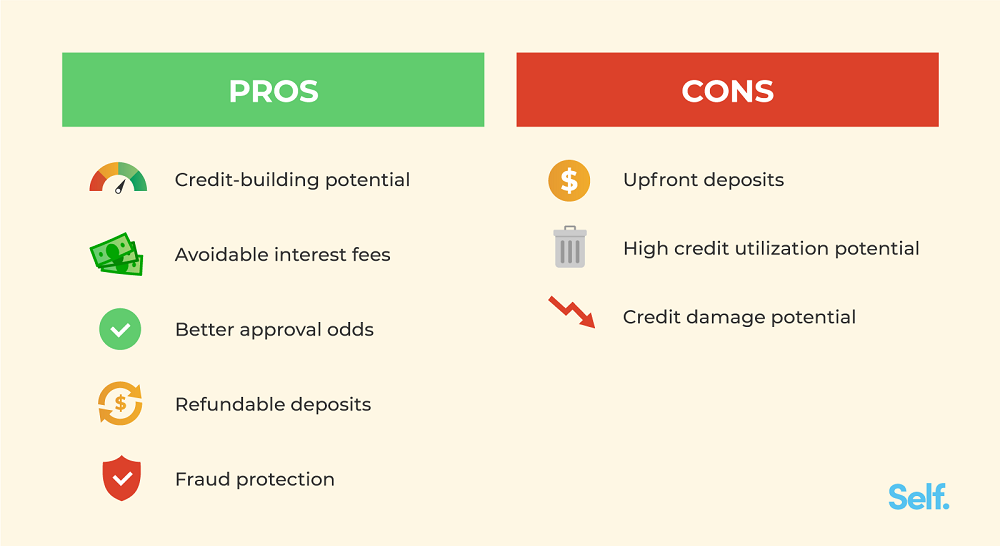

Pros And Cons Of Credit Card Perks

Credit cards offer a variety of perks that can enhance your financial experience. However, like any financial tool, these perks come with their own set of pros and cons. Let’s explore the advantages and potential pitfalls of credit card perks.

Advantages: Maximizing Your Benefits

Credit card perks can provide numerous benefits, helping you save money and earn rewards. Here are some of the key advantages:

- Rewards Programs: Earn points, miles, or cashback on your purchases.

- Travel Benefits: Enjoy perks like free checked bags, priority boarding, and airport lounge access.

- Purchase Protection: Get coverage for damaged or stolen items purchased with your card.

- Extended Warranties: Extend the manufacturer’s warranty on eligible purchases.

- Sign-Up Bonuses: Receive substantial bonuses for meeting initial spending requirements.

Disadvantages: Potential Pitfalls To Avoid

While credit card perks can be enticing, they also come with potential drawbacks. Here are some pitfalls to be aware of:

- High Interest Rates: Carrying a balance can lead to significant interest charges.

- Annual Fees: Some cards charge high annual fees, which can offset the perks.

- Complex Terms: Understanding the terms and conditions of perks can be complicated.

- Overspending: The allure of rewards can lead to unnecessary spending.

- Credit Score Impact: Mismanaging your card can negatively impact your credit score.

Recommendations For Ideal Users

Credit cards come with various perks, making them ideal for different types of users. Identifying the best card for your needs can help you maximize the benefits. Here’s a guide on which credit cards are best suited for frequent travelers, everyday shoppers, online shoppers, and high-spenders.

Best For Frequent Travelers

Frequent travelers need credit cards that offer travel-related benefits. These cards often provide:

- Airline Miles: Accumulate miles for every dollar spent, which can be redeemed for flights.

- Travel Insurance: Coverage for trip cancellations, lost luggage, and medical emergencies.

- Lounge Access: Enjoy exclusive lounges at airports for a comfortable waiting experience.

These perks can save money and enhance travel experiences.

Best For Everyday Shoppers

Everyday shoppers benefit from credit cards that offer rewards on regular purchases. Look for cards that provide:

- Cashback: Earn a percentage of your spending back on groceries, gas, and dining.

- Discounts: Special offers and discounts at partner stores.

- Flexible Rewards: Points that can be redeemed for various products and services.

These cards help in saving on daily expenses.

Best For Online Shoppers

Online shoppers should choose credit cards with perks tailored for digital transactions. Key benefits include:

- Enhanced Security: Advanced fraud protection and secure online transactions.

- Exclusive Deals: Special offers and discounts on various e-commerce platforms.

- Reward Points: Points for every dollar spent online, redeemable for various rewards.

These features ensure safe and rewarding online shopping experiences.

Best For High-spenders

High-spenders should opt for credit cards that offer luxury perks and high reward rates. Such cards often include:

- Premium Rewards: Higher points or cashback on large purchases.

- Luxury Perks: Exclusive access to events, fine dining, and concierge services.

- Travel Benefits: Complimentary upgrades, free checked bags, and priority boarding.

These perks cater to a lavish lifestyle and provide significant value.

Conclusion: Unlocking The Full Potential Of Credit Card Perks

Understanding and utilizing credit card perks can significantly enhance your financial experience. Whether you enjoy travel rewards, cash-back offers, or exclusive discounts, credit cards come with numerous benefits. Let’s delve deeper into the key points and recommendations for making the most of these perks.

Summary Of Key Points

- Travel Rewards: Use credit cards to earn miles and points for flights and hotels.

- Cash-Back Offers: Get a percentage of your spending back in cash or statement credits.

- Exclusive Discounts: Access special deals and discounts at selected retailers and services.

- Security Features: Benefit from fraud protection and secure transactions.

- Convenience: Enjoy the ease of making purchases without carrying cash.

Final Thoughts And Recommendations

To unlock the full potential of your credit card perks, follow these recommendations:

- Choose the Right Card: Select a card that aligns with your spending habits and lifestyle.

- Stay Informed: Regularly check your card’s rewards program and promotional offers.

- Pay on Time: Avoid interest charges and late fees by paying your balance in full each month.

- Utilize All Benefits: Make sure to use all available perks such as travel insurance, purchase protection, and concierge services.

- Monitor Your Spending: Keep track of your expenses to maximize rewards and avoid overspending.

Credit cards offer a variety of perks that can enhance your financial experience. By choosing the right card and staying informed about its benefits, you can enjoy significant savings and added convenience.

Frequently Asked Questions

What Are Common Credit Card Perks?

Common credit card perks include cashback rewards, travel points, and purchase protection. Many cards also offer fraud protection and extended warranties.

How Do Cashback Rewards Work?

Cashback rewards give a percentage of your purchases back as cash. This can be redeemed as statement credits or direct deposits.

Are Travel Points Better Than Cashback?

Travel points can offer more value if you travel frequently. They often provide higher redemption rates on flights and hotels.

Do All Credit Cards Offer Purchase Protection?

Not all credit cards offer purchase protection. It’s important to check the card’s terms and conditions before applying.

Conclusion

Credit card perks offer many benefits for smart consumers. Enjoy rewards, cashback, and travel points. Manage your spending and build credit history effectively. To make the most of your finances, consider investing with Nemo. Nemo provides a seamless way to invest in stocks and ETFs. It’s commission-free and secure, making it a great choice. Start investing today and grow your wealth with confidence. Remember, credit card perks and smart investments can enhance your financial journey. Explore your options and make informed decisions for a brighter future.