Debt Management Tools: Master Your Finances Today

Managing debt can be overwhelming. Debt management tools help you regain control.

With a variety of options available, it’s crucial to find the right tool for your needs. Debt management tools offer structured ways to handle your debt, ensuring you stay on track with payments. They provide clarity, helping you understand your financial situation better. These tools can range from budgeting apps to comprehensive debt consolidation services. Choosing the right tool can simplify your financial life, reduce stress, and help you achieve your financial goals faster. Whether you are dealing with credit card debt, student loans, or other types of debt, the right management tool can make a significant difference. Ready to explore some of the best debt management tools available? Dive in and discover the perfect solution for your financial needs. For smart investments, check out Nemo Money.

Introduction To Debt Management Tools

Managing debt can be overwhelming. Debt management tools can help streamline the process. These tools provide structured solutions to manage and reduce debt effectively.

Understanding Debt Management

Debt management involves planning and executing strategies to pay off debt. It can include budgeting, negotiating with creditors, and consolidating debt. Proper debt management reduces financial stress and improves credit scores.

Purpose Of Debt Management Tools

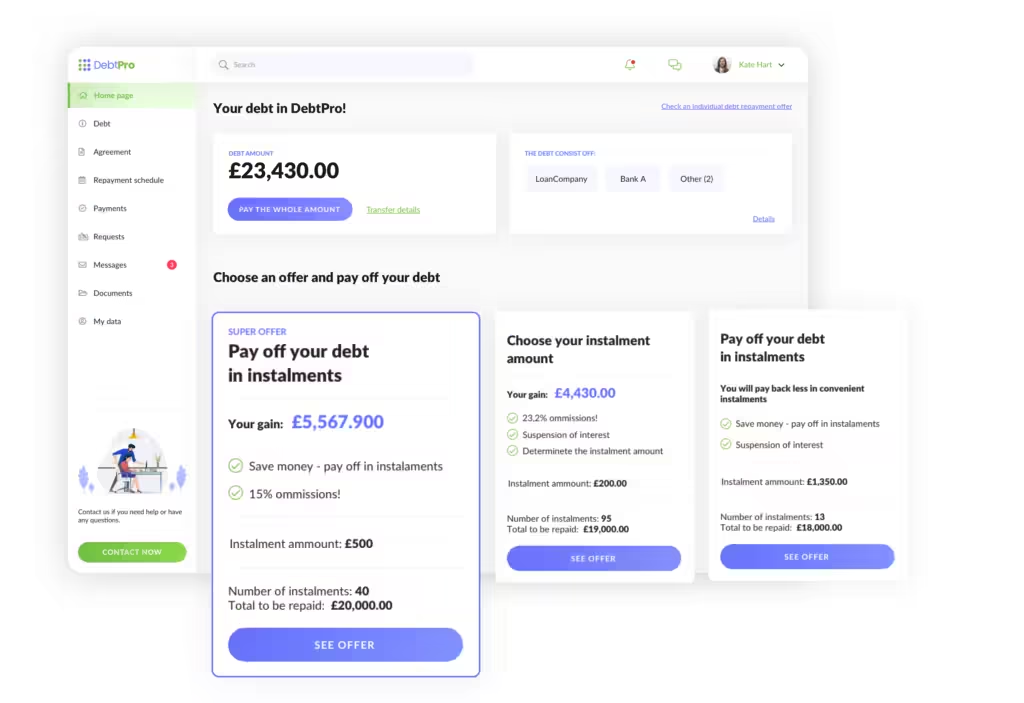

Debt management tools assist individuals in organizing and managing their debts. These tools offer features like tracking payments, calculating interest, and setting up repayment plans.

- Tracking Payments: Keep track of all due payments in one place.

- Calculating Interest: Understand how much interest you are paying.

- Setting Up Repayment Plans: Create structured plans to pay off debt.

Importance Of Managing Debt

Managing debt is crucial for financial stability. It helps avoid late fees, reduces interest payments, and improves credit scores. Effective debt management also reduces financial stress and helps achieve long-term financial goals.

Debt management tools make this process easier and more efficient, ensuring that you stay on top of your financial obligations.

Key Features Of Debt Management Tools

Debt management tools offer vital support for managing and reducing debt. These tools are equipped with various features that help users stay on top of their finances. Below are some key features of debt management tools:

Debt management tools often come with budgeting assistance features. These features help users create and stick to a budget. They provide a clear picture of income and expenses. By categorizing expenses, users can identify areas where they can cut back and save money.

With debt tracking and monitoring, users can keep track of all their debts in one place. This feature provides a detailed overview of outstanding balances, interest rates, and due dates. It allows users to monitor progress as they pay down their debts, helping them stay motivated.

One of the most useful features is payment reminders and automation. These tools send reminders for upcoming payments, ensuring users never miss a due date. Some tools also offer automatic payment options, which can help avoid late fees and improve credit scores.

Credit score monitoring is another valuable feature. It allows users to keep an eye on their credit score and understand how their debt repayment efforts are impacting it. Some tools offer tips on how to improve credit scores over time.

Many debt management tools provide financial education resources. These resources can include articles, tutorials, and webinars on various financial topics. By improving financial literacy, users can make more informed decisions and manage their debts more effectively.

Budgeting Assistance

Managing debt can be daunting. Nemo Money provides tools to simplify this process. Budgeting assistance is a vital feature. It helps users stay on top of their finances.

Creating A Customized Budget

Nemo Money allows you to create a customized budget. A personalized approach ensures your budget fits your lifestyle. Follow these steps to create your budget:

- Log into your Nemo Money account.

- Go to the budget creation tool.

- Input your monthly income and expenses.

- Allocate funds to different categories like rent, food, and savings.

- Review and adjust your budget as needed.

This process helps you see where your money goes. It also helps you plan for future expenses.

Tracking Expenses And Income

Tracking expenses and income is crucial. Nemo Money makes this easy. The app automatically tracks your spending and earnings. This feature includes:

- Automatic categorization of expenses.

- Real-time updates on your spending.

- Monthly summaries of your financial activity.

You can view these details anytime. This helps you stay informed about your financial health.

Identifying Spending Patterns

Understanding your spending patterns is essential. Nemo Money helps you identify these patterns. The app provides insights on your spending habits. Key features include:

- Visual charts and graphs.

- Detailed reports on spending categories.

- Tips for improving your spending habits.

By analyzing these patterns, you can make better financial decisions. This helps in reducing unnecessary expenses and increasing savings.

Nemo Money offers comprehensive budgeting assistance. It simplifies creating a budget, tracking expenses, and identifying spending patterns. Visit Nemo Money to learn more.

Debt Tracking And Monitoring

Managing debt can be stressful without the right tools. Debt tracking and monitoring help keep your finances in check. Using these tools, you can consolidate all debts, set goals, and track your progress.

Consolidating All Debts In One Place

Having all debts in one place makes it easier to manage them. Nemo Money offers a feature to aggregate multiple debts. You can see all your liabilities in a single dashboard. This unified view helps prioritize which debts to tackle first.

Setting Debt Reduction Goals

Setting clear, achievable goals is crucial for debt reduction. Nemo Money’s platform allows users to set personalized debt reduction targets. You can define your goals based on your financial situation. For example:

- Pay off high-interest credit cards first

- Reduce overall debt by 10% in six months

- Become debt-free in three years

Regular goal-setting keeps you focused and motivated.

Progress Tracking And Reporting

Monitoring your progress is essential for staying on track. Nemo Money provides detailed progress reports. You can view your debt reduction over time through charts and graphs. This visual representation helps understand your financial journey better. Features include:

- Monthly debt reduction summary

- Comparison of actual vs. targeted debt reduction

- Notifications for reaching milestones

These reports offer a clear snapshot of your financial health, making adjustments easier if needed.

To learn more about Nemo Money and its features, visit the official website.

Payment Reminders And Automation

Managing your finances can be challenging, but payment reminders and automation can simplify the process. These tools ensure you never miss a bill and help maintain a good credit score. Let’s explore how these features can benefit you.

Automated Bill Payments

Automated bill payments allow you to schedule payments for recurring expenses such as credit card bills, utilities, and rent. This feature eliminates the need to remember due dates and reduces the risk of missed payments. By automating your payments, you ensure your bills are paid on time, every time.

| Benefits of Automated Bill Payments |

|---|

| No need to remember due dates |

| Reduces risk of missed payments |

| Ensures timely bill payments |

Customizable Payment Reminders

With customizable payment reminders, you can set reminders for different types of payments. These reminders can be tailored to suit your preferences, such as receiving notifications via email or SMS. Customizable reminders help you stay on top of your financial obligations and avoid any surprises.

- Set reminders for different payments

- Receive notifications via email or SMS

- Stay on top of your financial obligations

Avoiding Late Fees And Penalties

Avoiding late fees and penalties is crucial for maintaining good financial health. By using payment reminders and automation, you can ensure that all your bills are paid on time. This helps you avoid unnecessary charges and keeps your credit score in good standing.

- Ensure timely bill payments

- Avoid unnecessary charges

- Maintain good credit score

Credit Score Monitoring

Keeping an eye on your credit score is vital for financial health. It helps you understand your creditworthiness and plan better for future financial needs. Nemo Money offers a seamless way to monitor your credit score efficiently.

Real-time Credit Score Updates

Real-time updates ensure you always know where you stand. Nemo Money provides instant alerts for any changes in your credit score, helping you stay proactive. This feature helps you avoid surprises and take timely actions to maintain or improve your credit score.

Credit Report Analysis

Analyzing your credit report can be overwhelming. Nemo Money simplifies this with easy-to-read reports. It breaks down complex data into understandable insights. This helps you pinpoint what affects your score and what you can do to improve it.

Here is what Nemo Money focuses on in credit report analysis:

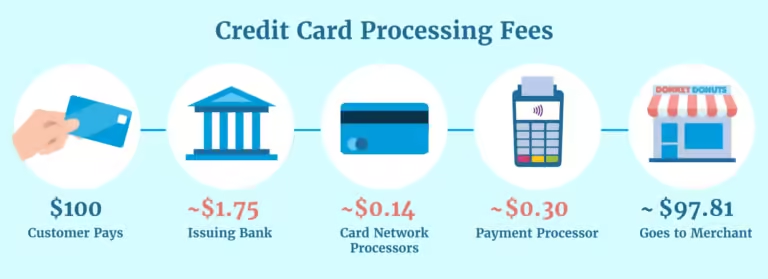

- Payment History: Past payments and any late payments.

- Credit Utilization: The ratio of your credit card balances to credit limits.

- Credit Mix: The variety of credit accounts you have.

- New Credit: Recent credit inquiries and new credit accounts.

- Length of Credit History: The age of your credit accounts.

Tips For Improving Credit Score

Improving your credit score can seem daunting. Nemo Money offers practical tips to help you boost your score:

- Pay bills on time: This is crucial for maintaining a good score.

- Reduce credit card balances: Keep balances low to improve credit utilization.

- Avoid new credit applications: Multiple inquiries can negatively impact your score.

- Check your credit report: Regular checks help identify and fix errors.

- Keep old accounts open: The age of your credit history matters.

By following these tips and leveraging Nemo Money’s tools, you can take control of your credit health. Visit Nemo Money for more details.

Financial Education Resources

Managing debt effectively starts with understanding the basics. Nemo Money offers a range of financial education resources designed to help users make informed decisions. These resources cover various aspects of debt management, investing, and credit card usage. Let’s explore the key educational tools Nemo Money provides.

Access To Educational Articles And Videos

Nemo Money provides a wealth of educational articles and videos that cover essential topics. These resources are curated to help users understand complex financial concepts in simple terms. Whether you’re new to investing or looking to manage your debt better, these articles and videos are a great starting point.

- Articles on debt management strategies

- Videos explaining credit card benefits and pitfalls

- Guides on investing in global stocks and ETFs

Interactive Tools And Calculators

Interactive tools and calculators are a part of Nemo Money’s offering. These tools help users to plan and manage their finances more effectively. Calculators can help estimate monthly payments, interest rates, and potential investment returns.

- Debt payoff calculator

- Investment growth calculator

- Budget planner

Webinars And Workshops

Nemo Money also hosts webinars and workshops for those who prefer interactive learning. These sessions cover various topics, from basic financial literacy to advanced investment strategies. Attendees can ask questions and get real-time answers from experts.

| Event | Date | Topic |

|---|---|---|

| Monthly Webinar | 1st Monday of every month | Introduction to Debt Management |

| Quarterly Workshop | Last Saturday of each quarter | Advanced Investment Strategies |

These resources are designed to provide users with the knowledge and tools they need to manage debt effectively and make smarter investment decisions.

Pricing And Affordability

Nemo Money offers various pricing options to suit different investment needs. Understanding these options helps users make informed decisions about their investment journey.

Free Vs Paid Versions

Nemo Money provides a commission-free service for all users. This means you can invest in 6,000 global stocks and ETFs without worrying about additional costs. The platform does not differentiate between free and paid versions since all users enjoy the benefits of commission-free investing.

Subscription Plans And Costs

Unlike many investment apps, Nemo Money does not have subscription fees. Users can access all features without needing to subscribe to a paid plan. This makes it an affordable option for both new and experienced investors.

Value For Money

Nemo Money ensures high value for users by offering several key benefits:

- Commission-Free Investing: No charges on stocks and ETFs, maximizing your returns.

- Secure Investments: SSL encryption and compliance with ADGM Data Protection Regulations.

- AI Assistance: Nemo AI provides investment insights, making smart decisions easier.

- Financial Security: Deposit protection up to $500,000 via SIPC.

With these features, Nemo Money stands out as a valuable tool for managing investments without hidden costs.

Pros And Cons Of Debt Management Tools

Debt management tools can simplify personal finance, but they come with both advantages and disadvantages. Understanding these pros and cons can help users make informed decisions about their financial well-being.

Advantages Of Using Debt Management Tools

Debt management tools offer several benefits that can help individuals manage their finances effectively. Below are some of the key advantages:

- Organized Payments: These tools help users keep track of due dates and payment amounts.

- Reduced Interest Rates: Some tools can negotiate lower interest rates with creditors.

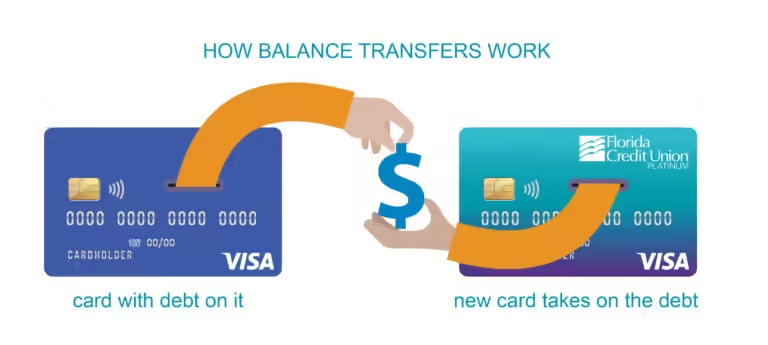

- Consolidation: Combining multiple debts into one payment can simplify management.

- Financial Planning: Tools often include budgeting features to help users manage expenses.

Potential Drawbacks And Limitations

While debt management tools offer many benefits, they also have some limitations. Here are a few potential drawbacks:

- Fees: Some tools may charge fees for their services, impacting overall savings.

- Credit Impact: Enrollment in a debt management plan can affect credit scores.

- Lack of Flexibility: Some plans may not accommodate changes in financial situations.

- Limited Types of Debt: These tools may not cover all types of debt, such as student loans.

User Reviews And Feedback

User experiences with debt management tools vary. Here are some common feedback points:

- Positive Reviews: Many users appreciate the ease of tracking payments and reduced stress.

- Negative Reviews: Some users report high fees and limited support for certain types of debt.

Overall, user feedback suggests that while debt management tools can be helpful, careful consideration of their costs and limitations is essential.

Ideal Users And Scenarios

Debt management tools can be a lifeline for those grappling with debt. These tools offer structured ways to handle financial obligations. They are designed to cater to a variety of users and situations.

Who Can Benefit Most From Debt Management Tools

- Individuals with Multiple Debts: People juggling multiple loans, credit cards, and bills find relief in these tools.

- Families: Families with tight budgets can use these tools to track and manage expenses effectively.

- Small Business Owners: Entrepreneurs can streamline debt payments and manage their cash flow better.

- Students: Students with education loans can use these tools to plan and manage their repayments.

Specific Scenarios Where These Tools Are Most Effective

Debt management tools shine in several scenarios:

- Debt Consolidation: Combining multiple debts into a single payment plan can reduce interest rates and simplify management.

- Budget Planning: Creating a detailed budget helps in identifying unnecessary expenses and redirecting funds towards debt repayment.

- Emergency Financial Situations: Quick access to financial data and repayment plans is crucial during unexpected financial crises.

- Credit Score Improvement: Consistent debt repayment helps in improving credit scores over time.

Recommendations For Different Financial Situations

| Financial Situation | Recommended Tool | Key Features |

|---|---|---|

| High-Interest Debt | Nemo Money | Commission-Free Investments, AI Assistance |

| Multiple Credit Cards | Debt Snowball Method | Focus on Smallest Debt First |

| Student Loans | Income-Driven Repayment Plans | Adjust Payments Based on Income |

| Small Business Loans | Business Debt Restructuring | Lower Interest Rates, Extended Payment Terms |

Choosing the right debt management tool depends on your specific needs. Nemo Money, for instance, offers advanced AI technology and user-friendly features for investment and debt management.

Frequently Asked Questions

What Are Debt Management Tools?

Debt management tools help individuals manage and reduce their debt. They include budgeting apps, debt payoff planners, and financial counseling services. These tools assist in tracking expenses, creating repayment plans, and providing financial education.

How Do Debt Management Tools Work?

Debt management tools work by organizing your finances and creating a structured repayment plan. They help track your spending, prioritize debts, and set payment reminders. These tools also provide insights and tips to improve financial habits.

Are Debt Management Tools Effective?

Yes, debt management tools are effective in reducing debt. They provide a clear overview of your financial situation. By using these tools, you can create realistic repayment plans, avoid missed payments, and ultimately achieve financial stability.

Can I Use Multiple Debt Management Tools?

Yes, you can use multiple debt management tools. Combining different tools can provide a comprehensive approach to managing your debt. Use a budgeting app alongside a debt payoff planner for better results.

Conclusion

Effective debt management tools can transform financial health. They help manage debts efficiently. Choose the right tool for your needs. Take control of your finances today. Explore options like Nemo Money. It’s an investment app with many benefits. Learn more about Nemo Money here. Make informed financial decisions and secure your future.