Credit Score Improvement Programs: Boost Your Financial Health

Improving your credit score can open doors to better financial opportunities. Credit score improvement programs can guide you on this path.

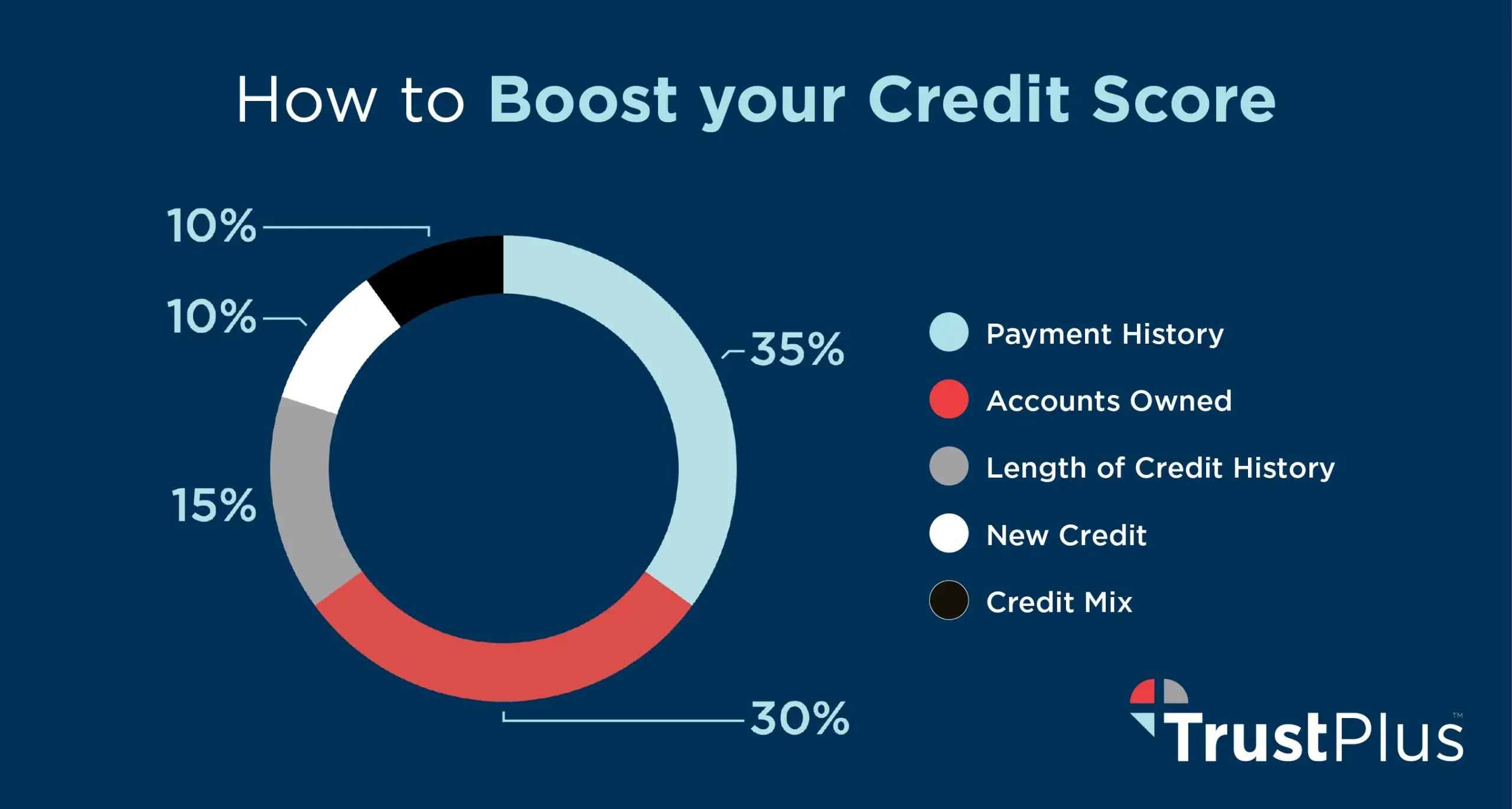

Credit scores are vital for financial health. They affect loan approvals, interest rates, and even job prospects. Many people struggle to understand how to improve their scores. This is where credit score improvement programs come in. These programs offer structured plans to help you raise your score. They provide actionable steps and personalized advice. By following a program, you can see a significant improvement in your credit score. Interested in boosting your financial standing? Explore these programs and take control of your financial future. To start your journey, consider using Nemo Money, a modern investment app designed to help users invest in global stocks and ETFs. Learn more about Nemo by visiting their official website.

Introduction To Credit Score Improvement Programs

Credit score improvement programs are designed to help individuals improve their credit scores. A good credit score is essential for financial stability. It affects your ability to secure loans, credit cards, and even employment.

What Are Credit Score Improvement Programs?

Credit score improvement programs offer tools and resources to help you manage your credit. These programs often include:

- Credit counseling

- Debt management plans

- Credit monitoring

They provide guidance on how to improve your credit behavior. This can include paying bills on time, reducing debt, and correcting errors on your credit report.

Importance Of Maintaining A Good Credit Score

Maintaining a good credit score is crucial for several reasons:

- Loan Approval: Lenders use credit scores to determine loan eligibility.

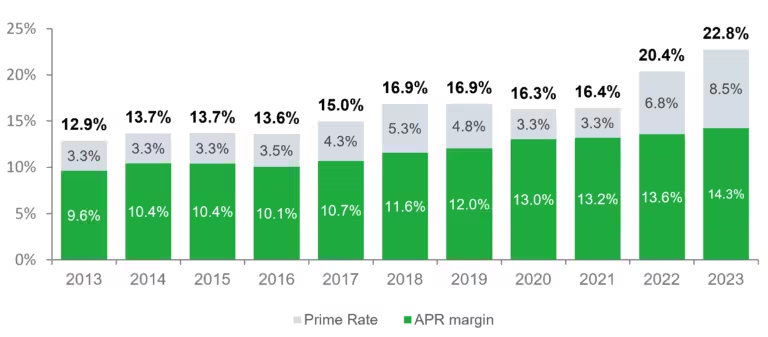

- Interest Rates: Higher scores often result in lower interest rates.

- Credit Limits: Good scores can lead to higher credit limits.

Additionally, a good credit score can impact your ability to rent an apartment. It also affects insurance premiums and job opportunities.

| Factor | Impact |

|---|---|

| Loan Approval | Higher chances with good credit |

| Interest Rates | Lower rates with higher scores |

| Credit Limits | Higher limits with good scores |

Consistently maintaining a good credit score can provide long-term financial benefits. Consider enrolling in a credit score improvement program. It can help you achieve and maintain a healthy credit score.

Key Features Of Credit Score Improvement Programs

Credit score improvement programs offer various tools and services to help you improve your credit score. These programs are designed to provide comprehensive support through credit monitoring, personalized analysis, debt management, and repair services. Here are the key features:

Credit Monitoring And Alerts

Credit monitoring services keep an eye on your credit report and notify you about any changes. This includes new accounts, credit inquiries, or any suspicious activities. Alerts help you stay informed and take immediate action if necessary. Regular monitoring ensures you stay on top of your credit health.

Personalized Credit Report Analysis

Personalized credit report analysis involves a detailed review of your credit report by experts. They identify errors, areas of improvement, and provide actionable insights. This helps you understand what factors are impacting your credit score the most. Personalized advice can guide you on steps to improve your creditworthiness.

Debt Management Tools

Debt management tools assist you in organizing and paying off your debts efficiently. These tools often include budgeting apps, debt payoff calculators, and payment reminders. Effective debt management is crucial for maintaining a healthy credit score. It helps you keep track of due dates and avoid late payments.

Credit Repair Services

Credit repair services focus on disputing errors in your credit report and negotiating with creditors. They aim to remove inaccurate information that negatively impacts your credit score. Professional assistance in credit repair can accelerate the process and help you achieve a better credit standing.

How Each Feature Benefits Users

Credit score improvement programs offer various features designed to help users. Understanding how each feature benefits users can make a significant difference in managing and improving their credit scores.

Proactive Credit Monitoring

Proactive credit monitoring keeps users informed about their credit status. This feature alerts users to any changes in their credit reports. Users can identify and address potential issues quickly. By staying aware of their credit status, users can take timely actions to protect and improve their credit scores.

Detailed Credit Report Insights

Detailed credit report insights provide users with an in-depth analysis of their credit reports. This feature breaks down complex credit information into easy-to-understand segments. Users can see which factors impact their credit scores the most. Understanding these factors helps users focus on areas that need improvement.

Effective Debt Reduction Strategies

Effective debt reduction strategies guide users on how to manage and reduce their debt. This feature offers practical tips and personalized plans. Users can pay off their debts more efficiently. Reducing debt can have a positive impact on credit scores, making this feature highly beneficial.

Professional Credit Repair Assistance

Professional credit repair assistance connects users with experts. These professionals can help users dispute errors on their credit reports. They also offer advice on improving credit scores. Having expert assistance can make the credit repair process smoother and more effective.

In summary, the features of proactive credit monitoring, detailed credit report insights, effective debt reduction strategies, and professional credit repair assistance provide significant benefits to users. These features help users stay informed, understand their credit reports, manage debt, and get expert help, all of which contribute to improving their credit scores.

Pricing And Affordability Of Credit Score Improvement Programs

Improving your credit score can be a crucial step toward financial stability. Understanding the pricing and affordability of credit score improvement programs helps you make informed decisions. This section will break down the costs, compare free vs. paid services, and assess value for money.

Cost Breakdown Of Popular Programs

Different programs offer varied pricing structures. Here is a breakdown:

| Program | Initial Fee | Monthly Fee | Features |

|---|---|---|---|

| Credit Repair Co. | $99 | $79/month | Personalized credit analysis, dispute letters |

| Score Boost Services | $89 | $69/month | Credit monitoring, debt negotiation |

| Credit Fixer | $75 | $65/month | Dispute management, credit coaching |

Free Vs. Paid Services

Free services offer basic features, while paid services provide comprehensive support. Here are the differences:

- Free Services: Basic credit reports, limited dispute letters.

- Paid Services: Advanced monitoring, personalized coaching, extensive dispute management.

Value For Money Considerations

When choosing a program, consider the value for money. Paid services can be worthwhile if they offer significant benefits. Evaluate the following:

- Comprehensive Support: Personalized advice and extensive dispute management.

- Credit Monitoring: Regular updates on your credit status.

- Customer Reviews: Positive feedback and high success rates.

These factors help determine if the cost aligns with the benefits provided.

Pros And Cons Of Credit Score Improvement Programs

Credit score improvement programs can be a valuable tool for those looking to enhance their financial standing. These programs offer various strategies to help users boost their credit scores. However, like any service, they come with both advantages and potential drawbacks. Understanding these can help you make an informed decision.

Advantages Of Using Credit Score Improvement Programs

Credit score improvement programs offer several benefits:

- Structured Guidance: These programs provide a clear roadmap to improve your credit score.

- Professional Assistance: Experts can negotiate with creditors on your behalf.

- Education: Many programs offer educational resources to help you understand credit better.

- Monitoring: Continuous monitoring of your credit report to track progress.

- Custom Solutions: Personalized plans based on individual financial situations.

Potential Drawbacks And Limitations

While beneficial, credit score improvement programs also have some limitations:

- Cost: Some programs charge high fees for their services.

- Scams: There are fraudulent companies that may exploit those in financial distress.

- No Quick Fixes: Credit score improvement is a gradual process, not an instant solution.

- Legal Restrictions: Some actions may be limited by legal constraints, depending on your location.

- Limited Control: You might have less control over negotiations if someone else is handling them.

In conclusion, while credit score improvement programs can provide structure and expertise, it’s important to weigh the costs and potential risks. Always research thoroughly to find a reputable program that fits your needs.

Specific Recommendations For Ideal Users

Credit score improvement programs offer a strategic approach to enhancing your financial health. These programs are not one-size-fits-all. They are designed for specific users who will benefit most from their features. Understanding who should use these programs and the scenarios where they are most beneficial can help you make an informed decision.

Who Should Use Credit Score Improvement Programs?

Credit score improvement programs are ideal for individuals facing financial challenges. If you have a low credit score, these programs can guide you to better financial practices. They are beneficial for:

- Young Adults: Starting out with little or no credit history.

- Individuals with Poor Credit: Those who have made financial mistakes in the past.

- Home Buyers: Preparing for a mortgage application.

- Loan Applicants: Looking to secure better loan terms and interest rates.

Scenarios Where Credit Score Improvement Programs Are Most Beneficial

Several scenarios make credit score improvement programs particularly useful:

- Recovering from Financial Hardship: If you have experienced job loss or medical emergencies, these programs can help you rebuild your credit.

- Preparing for Major Purchases: Planning to buy a home or car? A better credit score can save you money.

- Starting a Business: Entrepreneurs often need strong credit to secure funding. Improving your score can increase your chances of approval.

- Debt Management: Struggling with high debt? These programs can provide strategies to manage and reduce debt effectively.

By targeting the right users and addressing specific financial scenarios, credit score improvement programs can be a valuable tool for achieving financial stability.

Frequently Asked Questions

How Do Credit Score Improvement Programs Work?

Credit score improvement programs work by analyzing your credit report. They identify areas that need improvement. They then provide personalized strategies. These strategies help improve your credit score over time.

Are Credit Score Improvement Programs Effective?

Yes, credit score improvement programs can be effective. They offer tailored advice. This advice helps you make better financial decisions. Over time, these decisions can lead to a higher credit score.

How Long Does It Take To See Results?

The time to see results varies. It depends on your credit situation. Generally, you may start seeing improvements within three to six months.

What Are The Benefits Of A Higher Credit Score?

A higher credit score offers several benefits. You can get lower interest rates. You’ll have better loan approval chances. It can also lead to better credit card offers.

Conclusion

Improving your credit score is essential for financial health. Programs can help. They offer tailored solutions for better scores. Consider using tools like Nemo Money. Nemo provides secure, commission-free investments. It’s easy to start and offers global stock access. Want to learn more? Visit the Nemo Money site. Start your journey to a better credit score today.