Online Credit Tools: Boost Your Financial Health Today

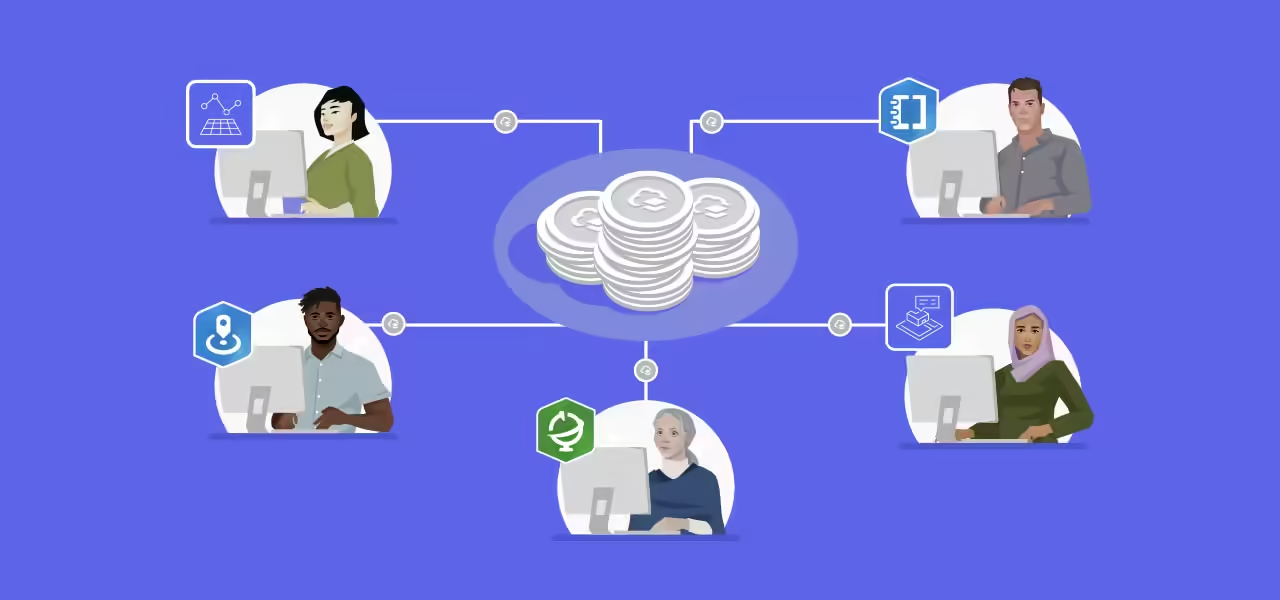

In today’s digital age, managing and improving your credit has never been easier, thanks to online credit tools. These tools offer a variety of features designed to help you stay on top of your financial game.

Online credit tools provide users with access to essential information about their credit scores and reports. They also offer tips and strategies for improving credit health. With the right tools, you can monitor your credit, identify potential issues, and take steps to enhance your financial standing. Investing in such tools can save you time and effort, and help you achieve your financial goals more efficiently. For those looking to invest wisely and manage their finances, tools like Nemo Money can be an excellent choice. Nemo allows users to invest in global stocks and ETFs without paying commissions, making it easier to grow your investments. For more information, visit Nemo Money.

Introduction To Online Credit Tools

In today’s digital age, managing your credit efficiently is crucial. Online credit tools offer a way to monitor, manage, and improve your credit score. These tools provide real-time insights and recommendations, helping you make informed financial decisions.

What Are Online Credit Tools?

Online credit tools are platforms that help users track and manage their credit scores. They provide access to credit reports and scores from various credit bureaus. These tools often include features such as:

- Credit Monitoring: Real-time alerts about changes to your credit report.

- Score Tracking: Regular updates on your credit score.

- Credit Improvement Tips: Personalized advice on how to improve your credit score.

- Identity Theft Protection: Alerts and assistance if your personal information is compromised.

Many online credit tools integrate with other financial services. For instance, Nemo Money offers investment opportunities in global stocks and ETFs. This allows users to manage their credit while investing for the future, all within a secure and regulated environment.

The Importance Of Managing Your Credit

Managing your credit is vital for several reasons:

- Loan Approval: A good credit score increases the likelihood of loan approvals.

- Interest Rates: Higher scores often lead to lower interest rates on loans and credit cards.

- Financial Security: Regular monitoring helps detect and prevent identity theft.

- Investment Opportunities: A good credit score can provide access to better investment options.

Using tools like Nemo Money, you can stay on top of your credit status. This aids in making smart financial decisions. Nemo offers features such as:

| Main Features | Details |

|---|---|

| Global Stock Investment | Access to 6,000 stocks and ETFs. |

| Commission-Free Trading | Trade without any commissions. |

| Secure Investment | Data secured with SSL encryption. |

| Regulated by ADGM | Fully compliant with ADGM FSRA regulations. |

| Nemo AI | AI-powered investing navigator. |

By integrating credit management with investment opportunities, Nemo Money provides a comprehensive financial management tool. This ensures that users can protect their credit and grow their investments simultaneously.

Key Features Of Online Credit Tools

Online credit tools offer a range of features to help users manage their credit efficiently. These tools are designed to provide valuable insights into credit scores, analyze credit reports, and offer tips for improving credit scores. Let’s explore the key features of these tools under the following headings:

Credit Score Monitoring

Credit score monitoring is a crucial feature of online credit tools. It allows users to keep track of their credit scores in real-time. This feature provides:

- Real-Time Updates: Regular updates on any changes to the credit score.

- Alerts: Notifications of significant changes or potential fraud.

- Historical Data: A history of credit score changes over time.

With these features, users can stay informed about their credit status and take action if necessary.

Credit Report Analysis

Credit report analysis helps users understand their credit reports in detail. This feature includes:

- Detailed Breakdown: Explanation of different sections of the credit report.

- Error Detection: Identification of errors or inaccuracies in the report.

- Improvement Areas: Highlighting areas that need attention for better credit scores.

By analyzing their credit reports, users can gain insights into their credit health and take steps to improve it.

Credit Score Improvement Tips

Credit score improvement tips are an essential part of online credit tools. These tips provide users with actionable advice to enhance their credit scores. Key tips include:

- Pay Bills on Time: Consistently paying bills on time to build a positive payment history.

- Reduce Debt: Keeping credit card balances low and reducing overall debt.

- Monitor Credit Utilization: Keeping credit utilization ratio below 30%.

- Check Credit Reports: Regularly checking credit reports for errors and disputing inaccuracies.

Following these tips can help users improve their credit scores over time.

These key features of online credit tools make it easier for users to monitor, analyze, and improve their credit scores efficiently.

How Online Credit Tools Benefit Users

Online credit tools, such as Nemo Money, offer numerous benefits to users seeking to manage and improve their financial health. These tools provide real-time insights, personalized advice, and robust fraud protection, making them indispensable in today’s digital age. Below, we explore how these tools can significantly benefit users.

Real-time Alerts For Credit Changes

One of the most significant advantages of using online credit tools is the ability to receive real-time alerts for credit changes. Users can stay informed about any updates to their credit reports, such as new accounts, inquiries, or changes in their credit scores. This immediate notification helps users address any discrepancies or unauthorized activities quickly.

- Instant notifications of credit score changes

- Alerts for new credit inquiries

- Updates on new accounts opened in your name

Personalized Financial Advice

Online credit tools like Nemo Money offer personalized financial advice tailored to each user’s financial situation. By analyzing spending habits, credit usage, and other financial behaviors, these tools can provide actionable recommendations to improve credit scores and overall financial health.

For instance, Nemo AI, a GPT-powered investing navigator, provides easy-to-digest answers and real-world statistics, helping users make informed investment decisions. Personalized advice can include:

- Strategies to lower credit card debt

- Suggestions for improving credit utilization

- Investment opportunities based on user preferences

Fraud Detection And Prevention

Another critical benefit of online credit tools is their ability to aid in fraud detection and prevention. By monitoring user accounts and transactions, these tools can quickly identify suspicious activities and alert users. This proactive approach helps protect users from identity theft and financial fraud.

Features that enhance fraud detection include:

- Continuous monitoring of credit reports

- Immediate alerts for unusual account activities

- Secure encryption of user data

Nemo Money, for example, ensures data security with SSL encryption and protection by the Securities Investor Protection Corporation (SIPC) for deposits up to $500,000, providing users with peace of mind.

Pricing And Affordability Of Online Credit Tools

Understanding the pricing and affordability of online credit tools is crucial. Nemo Money offers a range of options that cater to different needs and budgets. Below, we explore the different versions, subscription plans, and the overall value for money.

Free Vs. Paid Versions

Nemo Money provides both free and paid versions of its services. The free version includes basic features like commission-free trading on stocks and ETFs. This allows users to start investing without any initial cost.

In contrast, the paid version offers advanced features. These include access to the Nemo AI, a GPT-powered investing navigator. The AI provides easy-to-digest answers and real-world statistics, making it a valuable tool for serious investors.

Subscription Plans And Costs

Nemo Money’s subscription plans are designed to be affordable and flexible. Users can choose from various plans based on their investing needs. The basic plan is free and includes commission-free trading on stocks and ETFs.

Paid plans offer additional features. These may include enhanced customer support and access to premium tools. Users can find more details about these plans on the Nemo Money website.

| Plan | Cost | Features |

|---|---|---|

| Basic | Free | Commission-free trading, Basic customer support |

| Premium | Varies | Advanced tools, Enhanced customer support |

Value For Money

Nemo Money offers excellent value for money. The free plan allows users to invest without any initial costs. This is ideal for beginners. The paid plans, while costing more, provide significant benefits. These include access to the Nemo AI and enhanced support.

Investing with Nemo Money is secure. User data is protected with SSL encryption, and deposits up to $500,000 are safeguarded by the Securities Investor Protection Corporation (SIPC). This makes Nemo Money a trustworthy option for both new and experienced investors.

Pros And Cons Of Online Credit Tools

Online credit tools have become an essential part of managing personal finance. They offer convenience and flexibility, but they also come with some limitations. Understanding both the advantages and potential drawbacks can help you make informed decisions.

Advantages Of Using Online Credit Tools

Online credit tools offer several benefits:

- Accessibility: Access your credit information from anywhere, anytime.

- Real-Time Updates: Get instant updates on your credit score and reports.

- Convenience: Manage your finances without visiting a physical location.

- Comprehensive Insights: Many tools provide detailed analysis and personalized recommendations.

These tools often come with additional features. For instance, Nemo Money offers commission-free trading on 6,000 global stocks and ETFs. This means users can keep more of their profits. Nemo also ensures data security with SSL encryption and protects deposits up to $500,000.

Potential Drawbacks And Limitations

While online credit tools are beneficial, they have some limitations:

- Security Risks: Despite SSL encryption, there is always a risk of data breaches.

- Dependence on Technology: Users need a stable internet connection and reliable devices.

- Limited Personal Interaction: Lack of face-to-face support can be a drawback for some users.

- Fees and Charges: Some tools may have hidden fees, despite offering certain services for free.

For example, while Nemo Money does not charge commissions on trades, users are advised to understand the risks involved in investing. This includes the potential for financial loss, as highlighted in Nemo’s risk warning.

Understanding these pros and cons can help you decide if online credit tools are right for you. They offer great convenience and features, but it’s important to be aware of their limitations.

Ideal Users And Scenarios For Online Credit Tools

Online credit tools offer a range of benefits for diverse users. The right tool can help manage finances, improve credit scores, and secure better loan terms. Nemo Money provides a unique platform for both investment and credit management.

Who Should Use Online Credit Tools?

Online credit tools are designed for individuals who want to take control of their financial health. These tools are especially useful for:

- Young Professionals: They aim to build a strong credit history and manage student loans.

- Small Business Owners: They seek to monitor their credit and secure loans with favorable terms.

- Homebuyers: They need to improve their credit scores to qualify for mortgages.

- Investors: They aim to maximize their investment returns while keeping their credit in good standing.

Best Situations To Utilize Online Credit Tools

Several scenarios make online credit tools indispensable:

- Credit Score Monitoring: Regularly check your credit score to identify any discrepancies or fraud.

- Loan Applications: Use these tools to improve your credit score before applying for a loan to get better interest rates.

- Debt Management: Track and manage debt to avoid penalties and improve your financial health.

- Investment Planning: Use Nemo Money to diversify your investments while ensuring your credit remains strong.

By using online credit tools like Nemo Money, users can stay informed and make better financial decisions. These tools provide crucial insights and support for various financial scenarios.

Frequently Asked Questions

What Are Online Credit Tools?

Online credit tools are digital platforms that help users manage and monitor their credit scores and reports. They provide insights, tips, and resources to improve financial health.

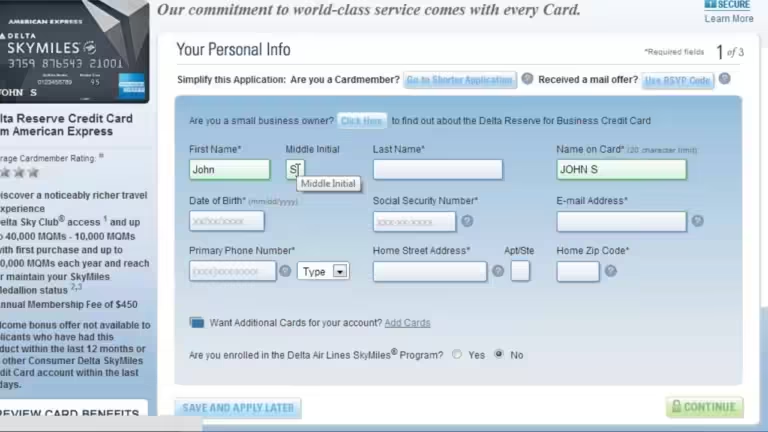

How Do Online Credit Tools Work?

Online credit tools collect and analyze your credit data from various sources. They display your credit score, report details, and offer personalized advice for improvement.

Are Online Credit Tools Safe?

Yes, reputable online credit tools use strong encryption and security measures. They protect your personal and financial information from unauthorized access.

Can Online Credit Tools Improve My Credit Score?

Online credit tools provide tips and strategies to improve your credit score. Consistently following their advice can help you achieve better financial health.

Conclusion

Online credit tools simplify financial management and investment decisions. They offer accessibility, ease, and security. Tools like Nemo provide commission-free trading and secure investments. With features like global stock access and AI support, they empower users. Whether investing in stocks or managing credit, these tools are essential. Ready to start investing? Explore Nemo Money for a seamless experience. Take control of your financial future today!