Credit Card For Bad Credit: Best Options to Rebuild Your Score

Credit Card For Bad Credit Struggling with bad credit? Don’t worry, you’re not alone.

Many people face this challenge, but there are solutions. Finding the right credit card for bad credit can seem daunting. It’s essential to rebuild your credit score and regain financial stability. With so many options available, it’s hard to know where to start. This blog post will guide you through the top credit cards designed for those with bad credit. We’ll explore the benefits and features that can help you get back on track. Ready to improve your financial health? Let’s dive in! For more investment opportunities, check out Nemo Money – an app that helps you invest in global stocks and ETFs with ease.

Introduction To Credit Cards For Bad Credit

Credit cards for bad credit, like the ones offered by Nemo Money, are designed to help individuals with poor credit scores. These cards provide a way to rebuild credit while managing finances effectively. This section will cover the essential aspects of credit cards for bad credit.

Understanding Bad Credit

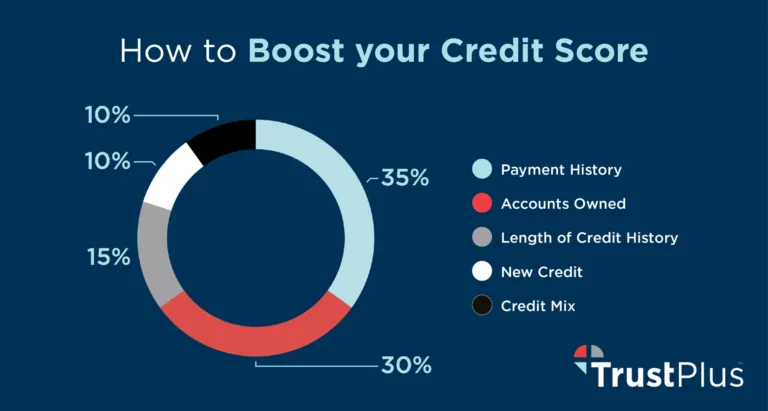

Bad credit refers to a low credit score, often due to missed payments, defaults, or high debt levels. Credit scores range from 300 to 850, and a score below 580 is considered poor. Bad credit can make it challenging to get approved for loans, mortgages, or even renting an apartment.

Rebuilding credit requires responsible financial behavior. It involves timely bill payments, reducing debt, and maintaining low credit card balances. Credit cards for bad credit can aid in this process by providing an opportunity to demonstrate financial responsibility.

Purpose Of Credit Cards For Bad Credit

Credit cards for bad credit serve several purposes:

- Rebuild Credit: These cards help improve credit scores by reporting to credit bureaus.

- Manage Finances: They offer a line of credit for everyday expenses, helping to manage cash flow.

- Learn Financial Discipline: Using these cards responsibly can teach financial discipline and budgeting skills.

Credit cards for bad credit typically have higher interest rates and lower credit limits. It’s crucial to use them wisely to avoid falling into more debt. By making small purchases and paying off the balance in full each month, cardholders can steadily improve their credit scores.

Nemo Money offers a range of financial products, including investment opportunities and credit cards. Their credit card options are designed to help users with bad credit rebuild their financial standing.

Benefits Of Using Credit Cards For Bad Credit

Here are some benefits:

| Benefit | Description |

|---|---|

| Credit Improvement | Regular use and timely payments boost credit scores. |

| Financial Management | Helps in budgeting and managing expenses. |

| Access to Credit | Provides a line of credit for emergencies and everyday use. |

By understanding and utilizing credit cards for bad credit, individuals can work towards a better financial future. Explore products like those from Nemo Money to find suitable options for rebuilding your credit.

Key Features Of Credit Cards Designed For Bad Credit

Credit cards designed for bad credit can be a lifeline for many. They help users build credit and improve their financial standing. These cards come with unique features tailored to meet the needs of those with low credit scores.

Low Credit Score Requirements

Many credit cards for bad credit have low credit score requirements. These cards are designed to help those who have struggled with credit in the past. Low credit score requirements make it easier for applicants to get approved. This feature is crucial for those trying to rebuild their credit history.

Secured Vs. Unsecured Options

Credit cards for bad credit often come in two types: secured and unsecured.

| Type | Features |

|---|---|

| Secured |

|

| Unsecured |

|

Credit Building Tools

These cards often include tools to help build credit. Credit building tools might include:

- Free credit score monitoring

- Educational resources on improving credit

- Alerts for payment due dates

These tools can be very helpful for those learning to manage their credit.

Reporting To Credit Bureaus

One of the most important features is reporting to credit bureaus. Most credit cards for bad credit report to all three major credit bureaus. Reporting to credit bureaus helps improve your credit score over time. This feature is essential for building a positive credit history.

Top Credit Cards For Bad Credit

Finding a credit card can be tough if you have bad credit. Fortunately, some options can help rebuild your credit score. Here are the top credit cards for bad credit:

Secured Credit Cards

Secured credit cards require a security deposit. This deposit usually becomes your credit limit. They are a great way to rebuild credit.

- Capital One Secured Mastercard: Requires a refundable security deposit of $49, $99, or $200.

- Discover it Secured: Earn 2% cashback at gas stations and restaurants.

Unsecured Credit Cards

Unsecured credit cards do not require a deposit. They often come with higher interest rates and fees.

- Credit One Bank Platinum Visa: Offers 1% cashback on eligible purchases.

- Indigo Platinum Mastercard: Pre-qualify with no impact on your credit score.

Student Credit Cards For Bad Credit

Student credit cards are designed for students with limited credit history. They often have lower credit limits and interest rates.

- Deserve EDU Mastercard for Students: No security deposit required, 1% cashback on all purchases.

- Journey Student Rewards from Capital One: 1% cashback on all purchases, plus an extra 0.25% if payments are made on time.

Retail Credit Cards

Retail credit cards are easier to get approved for. They often come with store-specific rewards and discounts.

- Target REDcard: 5% discount on Target purchases.

- Walmart Credit Card: 5% cashback on Walmart.com purchases.

Choosing the right credit card can help you rebuild your credit score. Make sure to use your card responsibly and make payments on time.

Detailed Breakdown Of Leading Options

Finding the right credit card for bad credit can be challenging. We have reviewed several options and highlighted their key features, benefits, and drawbacks. Here are the top three credit cards that cater to individuals with bad credit.

Card 1: Features, Benefits, And Drawbacks

Features:

- Low annual fee

- Reports to all three major credit bureaus

- Online account management

Benefits:

- Helps rebuild credit score

- Easy application process

- No security deposit required

Drawbacks:

- High APR

- Limited credit limit

- Foreign transaction fees

Card 2: Features, Benefits, And Drawbacks

Features:

- No annual fee

- Cash back on purchases

- Access to a higher credit limit after six months

Benefits:

- Rewards program

- Helps build credit history

- Flexible payment options

Drawbacks:

- High interest rates

- Requires good financial habits

- Penalty fees for late payments

Card 3: Features, Benefits, And Drawbacks

Features:

- Secured credit card

- Requires a security deposit

- Monthly credit score updates

Benefits:

- Guaranteed approval with a deposit

- Helps improve credit rating

- No credit check required

Drawbacks:

- Initial deposit needed

- Low credit limit

- Limited rewards

Pricing And Affordability

Finding a credit card for bad credit can be challenging, especially when considering pricing and affordability. Nemo Money offers a way to manage finances while rebuilding credit. Let’s explore the costs associated with these cards.

Annual Fees

Annual fees vary widely among credit cards for bad credit. Some cards charge no annual fee, while others may have fees up to $99. It is crucial to check the fee structure before applying. For those trying to rebuild credit, a card with a lower annual fee is more affordable.

Interest Rates

Interest rates on credit cards for bad credit are often higher than average. Nemo Money cards might offer competitive rates, but it is essential to compare different cards. Look for cards with the lowest possible APR to save money on interest payments.

Other Fees And Charges

Be aware of additional fees that could impact affordability. These fees might include:

- Late payment fees: Ranging from $25 to $40.

- Foreign transaction fees: Usually around 3% of the transaction amount.

- Balance transfer fees: Often 3% to 5% of the transferred amount.

Understanding these charges helps in selecting a credit card that fits your financial situation.

Pros And Cons Of Using Credit Cards For Bad Credit

Using credit cards for bad credit has its ups and downs. It’s important to weigh these factors before making a decision. Below, we outline the key advantages and disadvantages of using credit cards designed for individuals with bad credit.

Advantages

Credit cards for bad credit come with several benefits. These advantages can help improve your financial situation over time.

- Credit Building: Regular and responsible use helps rebuild your credit score.

- Accessible: Easier to obtain than traditional credit cards.

- Emergency Fund: Acts as a financial buffer in emergencies.

- Financial Discipline: Encourages better financial habits and budgeting.

- Online Purchases: Allows for convenient online shopping and bill payments.

Disadvantages

Despite the benefits, there are drawbacks to consider. Being aware of these disadvantages helps you avoid potential pitfalls.

- High Interest Rates: These cards often come with higher interest rates.

- Low Credit Limits: Initial credit limits are usually lower.

- Fees: Annual fees and other charges can add up quickly.

- Temptation to Overspend: The availability of credit can lead to overspending.

- Limited Rewards: Fewer rewards and perks compared to traditional credit cards.

Weighing these pros and cons can help you make an informed decision. Remember, using a credit card responsibly is key to improving your credit score.

Recommendations For Ideal Users

Choosing the right credit card is crucial, especially if you have bad credit. Different cards offer various benefits tailored to specific needs. This section provides recommendations for ideal users based on their preferences and requirements.

Best For Rebuilding Credit

If you aim to rebuild your credit, look for cards that report to all three major credit bureaus. Consider a secured credit card, where you deposit an amount equal to your credit limit. This helps you build a positive payment history.

- Secured Credit Cards: Require a refundable security deposit.

- Regular Reporting: Ensure the card reports to all major credit bureaus.

- Credit Monitoring Tools: Some cards offer free credit score monitoring.

Best For Low Fees

For those who want to avoid high fees, focus on credit cards with low or no annual fees. Some cards also offer low APR rates, which can help you save money on interest.

- Low Annual Fees: Look for cards with no or low annual fees.

- Low APR Rates: Compare interest rates to find the best deal.

- No Hidden Charges: Ensure transparency in fees and charges.

Best For Students

Students often need credit cards that cater to their specific financial needs. These cards usually offer low fees, rewards for good grades, and tools to help manage finances effectively.

- Student Rewards: Earn rewards for good grades or responsible use.

- Low Fees: Minimal annual fees and lower interest rates.

- Financial Education: Resources and tools to help students manage money.

Best For Everyday Purchases

For everyday purchases, look for credit cards that offer cash back or rewards points. These cards can help you save money on routine expenses.

- Cash Back Rewards: Earn a percentage back on purchases.

- Points or Miles: Accumulate points or miles for travel and other perks.

- Flexible Redemption: Use rewards for various options like cash, travel, or gift cards.

Tips For Successfully Rebuilding Credit

Rebuilding credit can feel overwhelming, but with the right steps, you can achieve it. Using a credit card responsibly is one of the effective ways to improve your credit score. Below are some essential tips to help you rebuild your credit successfully.

Using Credit Cards Responsibly

When it comes to using credit cards responsibly, there are several key practices to follow:

- Always pay your credit card bills on time.

- Keep your credit card balance low; ideally, under 30% of your credit limit.

- Use your credit card for small, manageable purchases.

- Avoid applying for multiple credit cards at once.

Paying your bills on time and keeping your balances low are crucial for maintaining a good credit score. These practices show lenders that you are a responsible borrower.

Monitoring Your Credit Score

Regularly monitoring your credit score helps you understand your credit health and track your progress. Here are some ways to monitor your credit score:

| Method | Description |

|---|---|

| Credit Report | Get a free credit report annually from each of the three major credit bureaus. |

| Credit Monitoring Services | Use services that provide regular updates on your credit score and alert you of any changes. |

By keeping an eye on your credit score, you can quickly address any discrepancies or issues that may arise.

Avoiding Common Pitfalls

While rebuilding your credit, it’s important to avoid common pitfalls that can hinder your progress. Some of these pitfalls include:

- Missing payments, which can significantly damage your credit score.

- Maxing out your credit cards, leading to high credit utilization ratios.

- Applying for too much new credit in a short period.

- Ignoring your credit report and not addressing errors promptly.

Avoiding these common mistakes will help you stay on track and steadily improve your credit score.

By following these tips and using credit cards responsibly, you can successfully rebuild your credit and achieve financial stability.

Frequently Asked Questions

What Is A Credit Card For Bad Credit?

A credit card for bad credit is designed for individuals with poor credit scores. These cards help rebuild credit through responsible use. They often have higher interest rates and lower credit limits.

How Can I Qualify For A Credit Card With Bad Credit?

Qualifying requires a valid identification, proof of income, and a bank account. Some cards may require a security deposit. Approval depends on the issuer’s criteria.

Do Credit Cards For Bad Credit Help Improve Credit?

Yes, they help improve credit if used responsibly. Make timely payments and keep balances low. Regular usage and timely payments boost credit scores over time.

What Are The Fees For Credit Cards For Bad Credit?

Fees vary but often include annual fees, higher interest rates, and possible security deposits. Always read the card’s terms and conditions before applying.

Conclusion

Choosing the right credit card can improve your financial health. Even with bad credit, options are available. Consider features like low fees and credit-building benefits. Nemo Money offers an investment app for potential growth. Explore their services to secure your financial future. Start investing easily with Nemo today. Click here to learn more. Remember, improving your credit takes time and smart choices. Stay consistent and patient. Your financial journey can change for the better.