Flexible Repayment Options: Tailored Solutions for Your Needs

Flexible repayment options can make managing loans much easier. They allow borrowers to choose a plan that suits their financial situation.

In today’s fast-paced world, financial flexibility is essential. Upstart Personal Loans offers various repayment options to help you manage your finances better. Whether you’re dealing with unexpected expenses or planning a big purchase, having the ability to choose how you repay your loan can make a significant difference. Flexible repayment plans can reduce stress and provide peace of mind. With Upstart Personal Loans, you can find a repayment plan that fits your budget and lifestyle. Learn more about how these options can benefit you by exploring Upstart Personal Loans here.

Introduction To Flexible Repayment Options

Flexible repayment options allow borrowers to manage their loans based on their financial situation. These options can help reduce stress and provide more control over finances. Upstart Personal Loans offer various flexible repayment plans to meet different needs.

Understanding Flexible Repayment

Flexible repayment options let borrowers adjust their payment schedules. This can include changing payment amounts, dates, or extending the loan term. These adjustments help match the borrower’s current financial status, making loan management easier.

- Change Payment Amounts: Borrowers can increase or decrease their monthly payments.

- Adjust Payment Dates: Flexibility to choose or change the payment due date.

- Extend Loan Term: Lengthen the loan term to lower monthly payments.

Why Flexible Repayment Solutions Matter

Flexible repayment solutions are crucial for borrowers facing financial uncertainty. These options can prevent missed payments and avoid penalties. Additionally, they provide a safety net during unexpected financial changes.

Borrowers can maintain a good credit score by utilizing flexible repayment plans. Timely payments, even if adjusted, reflect positively on credit reports. This can lead to better loan terms in the future.

Here are some key benefits:

| Benefit | Explanation |

|---|---|

| Stress Reduction | Ease the financial burden with adaptable payment plans. |

| Better Credit Score | Maintain a good credit score with timely payments. |

| Financial Control | Adjust payments based on current financial status. |

Upstart Personal Loans understand the importance of flexibility. They offer various repayment options tailored to individual needs. Explore their offerings to find a plan that fits your financial situation. For more information, visit Upstart Personal Loans.

Key Features Of Flexible Repayment Options

Flexible repayment options offer significant benefits for borrowers. They provide the flexibility to tailor payments according to individual financial circumstances. Let’s explore the key features that make these options appealing.

Customizable Payment Schedules

With customizable payment schedules, borrowers can choose a payment plan that fits their financial situation. Options may include:

- Monthly payments

- Bi-weekly payments

- Quarterly payments

This flexibility helps in managing cash flow more effectively.

Interest Rate Adjustments

Flexible repayment plans often include interest rate adjustments. This can mean:

- Lower rates for timely payments

- Variable rates based on market conditions

- Fixed rates to secure predictable payments

Adjusting interest rates can help in reducing the total cost of the loan.

Deferment And Forbearance Options

In times of financial hardship, borrowers can benefit from deferment and forbearance options. These features allow:

- Temporary suspension of payments

- Reduced payments for a specific period

This can prevent defaulting on the loan and provide relief during tough times.

Early Repayment Benefits

Paying off loans early can bring substantial advantages. Early repayment benefits include:

- Saving on interest costs

- Improved credit score

- Financial freedom sooner

These benefits encourage borrowers to pay off their loans faster.

Upstart Personal Loans provide these flexible repayment options, helping borrowers manage their finances better. Visit the Upstart website for more details.

Pricing And Affordability

Flexible repayment options offer a unique advantage over traditional loans. Understanding the pricing and affordability of these options can help you make an informed decision. Below, we dive into cost comparisons, hidden fees, and the long-term financial impact of flexible repayment plans.

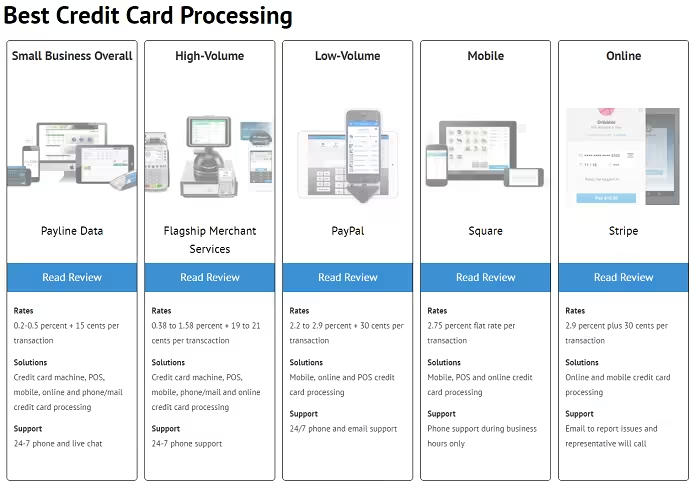

Cost Comparison With Traditional Loans

Flexible repayment options often come with varying interest rates and terms. This diversity allows borrowers to choose plans that fit their financial situation. Here’s a basic comparison between flexible repayment plans and traditional loans:

| Feature | Flexible Repayment Options | Traditional Loans |

|---|---|---|

| Interest Rates | Variable, based on credit score | Fixed, generally higher |

| Repayment Terms | Customizable | Fixed |

| Monthly Payments | Adjustable | Static |

| Early Repayment | Often allowed without penalties | May incur penalties |

Hidden Fees To Watch Out For

While flexible repayment options are appealing, it’s crucial to be aware of hidden fees. Here are some common fees to watch out for:

- Origination Fees: A fee charged for processing the loan.

- Late Payment Fees: Charged when a payment is late.

- Prepayment Penalties: Fees for paying off the loan early.

- Service Fees: Ongoing fees for maintaining the loan account.

These fees can add up quickly, affecting the overall cost of the loan. Always read the fine print and ask your lender about any potential hidden fees.

Long-term Financial Impact

Choosing a flexible repayment option can have significant long-term financial impacts. Here are some key considerations:

- Credit Score Improvement: Consistent, timely payments can boost your credit score.

- Debt Management: Customizable plans help manage debt more effectively.

- Interest Savings: Lower interest rates can lead to substantial savings over time.

- Financial Flexibility: Adjustable payments provide more financial freedom.

By understanding these impacts, you can make a well-informed decision that supports your financial health in the long run.

Pros And Cons Of Flexible Repayment Options

Flexible repayment options offer many benefits, but they also come with some drawbacks. Understanding both sides can help you decide if these plans suit your needs.

Advantages Of Flexible Repayment Plans

Flexible repayment plans allow more control over your financial commitments. Here are some key benefits:

- Customizable Payment Schedules: You can adjust payment dates to align with your paychecks.

- Reduced Financial Stress: Payments can be lower during financial hardship.

- Improved Credit Score: Consistent payments can positively impact your credit score.

- Easy Budgeting: Knowing your payment schedule helps in better financial planning.

Potential Drawbacks And Risks

While flexible repayment options are beneficial, they come with potential risks:

- Higher Interest Rates: Some flexible plans have higher interest rates.

- Extended Loan Terms: Longer repayment periods can lead to paying more in interest.

- Hidden Fees: Some plans might include hidden fees for flexibility.

- Complex Terms: Understanding the fine print can be challenging.

Real-world User Experiences

Users of Upstart Personal Loans have shared their experiences with flexible repayment options:

| User | Experience |

|---|---|

| Jane Doe | Found it easy to adjust payments during job transitions. |

| John Smith | Enjoyed lower payments during tough times but had higher interest rates. |

| Maria Garcia | Liked the customizable schedules but struggled with hidden fees. |

These experiences highlight the importance of thoroughly understanding the terms before opting for flexible repayment plans.

Specific Recommendations For Ideal Users

Flexible repayment options can significantly aid various users depending on their financial situations. Understanding who benefits the most from these options, the scenarios where they shine, and tips for selecting the right repayment plan can help individuals make informed decisions.

Who Benefits Most From Flexible Repayment?

Flexible repayment options are ideal for individuals with fluctuating incomes. Freelancers, gig workers, and those in seasonal employment can benefit immensely. These plans allow adjustments based on their earnings, ensuring they can manage repayments even during low-income periods.

Students and recent graduates also find these options helpful. Flexible repayment plans can align with their entry-level salaries, preventing financial strain. Moreover, individuals with variable expenses, such as unexpected medical bills, can adjust payments to maintain financial stability.

Scenarios Where Flexible Repayment Shines

There are specific scenarios where flexible repayment options prove beneficial. For instance, during economic downturns, these plans can reduce financial stress by allowing lower payments. Another scenario is during career transitions. Individuals switching jobs or starting a new business can benefit from the flexibility to adjust their payment schedules.

Additionally, those managing multiple debts can use flexible repayment plans to prioritize their financial obligations. Adjusting payments based on financial capability ensures they do not default on any loans.

Tips For Choosing The Right Repayment Plan

Choosing the right repayment plan requires careful consideration. First, assess your income pattern. If it fluctuates, opt for plans that offer the most flexibility. Second, evaluate your expenses. Ensure the plan allows adjustments during unexpected financial crises.

Third, consider the loan terms. Longer terms may offer lower payments but result in higher interest. Balance the need for lower payments with the total cost of the loan. Finally, check the lender’s policies. Ensure they offer easy modification options without hefty fees.

Flexible repayment options like those offered by Upstart Personal Loans can provide the necessary financial cushion. Ensuring you understand and choose the right plan can lead to better financial management and peace of mind.

Frequently Asked Questions

What Are Flexible Repayment Options?

Flexible repayment options allow borrowers to adjust their payment schedules. This can include changing due dates or payment amounts. It helps manage finances better.

How Do Flexible Repayment Plans Work?

Flexible repayment plans offer various payment schedules to suit your needs. They provide options like extended terms and adjustable payment amounts.

Who Can Benefit From Flexible Repayment Options?

Anyone facing financial challenges can benefit from flexible repayment options. It helps in managing debt more effectively and avoids default.

Are Flexible Repayment Options Available For All Loans?

Not all loans offer flexible repayment options. Check with your lender for availability. It’s more common in personal and student loans.

Conclusion

Choosing the right repayment option is crucial for financial stability. Flexible plans offer a personalized approach to managing debt. They provide peace of mind and financial control. With options like Upstart Personal Loans, tailored solutions become accessible. Explore more about these loans here. Remember, managing your finances well today ensures a secure future.