Personal Loan FAQs: Your Ultimate Guide to Borrowing Smart

Personal loans are a popular financial tool. They can help cover unexpected expenses.

But there are many questions about how they work. Understanding personal loans can be confusing. You might wonder about interest rates, repayment terms, or eligibility criteria. This blog post aims to answer the most common questions about personal loans. We’ll provide clear, straightforward answers. Whether you’re considering applying for a loan or just curious, this guide will help. By the end, you’ll have a better grasp of personal loans and how they can fit into your financial plan. For more details, check out Upstart Personal Loans at Upstart. Let’s dive into the world of personal loans and clear up any confusion.

Introduction To Personal Loans

Personal loans can be a great way to cover unexpected expenses, consolidate debt, or finance a large purchase. Understanding the basics of personal loans can help you make informed decisions about your financial future. This section will provide an overview of what personal loans are and their common uses.

What Is A Personal Loan?

A personal loan is a type of unsecured loan provided by banks, credit unions, or online lenders like Upstart Personal Loans. Unlike a mortgage or auto loan, personal loans do not require collateral. Borrowers can use the funds for various purposes, making them versatile and convenient.

Purpose And Common Uses

People use personal loans for many reasons. Here are some common uses:

- Debt Consolidation: Combine multiple debts into one loan with a single monthly payment.

- Home Improvement: Finance renovations or repairs to your home.

- Medical Expenses: Cover unexpected medical bills or procedures.

- Education: Pay for tuition, books, or other educational expenses.

- Major Purchases: Buy appliances, furniture, or other large items.

Using personal loans wisely can help you manage your finances more effectively. Evaluate your needs and ensure that you can comfortably repay the loan before applying.

Understanding The Application Process

Applying for a personal loan can seem complex. Knowing the steps and requirements will make it easier. Here, we will walk you through the process, including eligibility criteria, required documentation, and the steps to apply.

Eligibility Criteria

Before applying for a personal loan, ensure you meet the basic requirements. Most lenders will consider the following factors:

- Age: Applicants must be at least 18 years old.

- Income: A stable income source is crucial.

- Credit Score: A good credit score increases approval chances.

- Residency: Must be a resident of the country where the loan is sought.

Required Documentation

Gathering the necessary documents beforehand can speed up the application process. Commonly required documents include:

- Proof of Identity: Passport, driver’s license, or government ID.

- Proof of Address: Utility bills or rental agreement.

- Income Proof: Recent pay stubs, tax returns, or bank statements.

- Credit Report: A recent credit report may be required.

Steps To Apply

Follow these steps to apply for an Upstart personal loan:

- Check Eligibility: Visit the Upstart website and check if you meet the criteria.

- Complete the Application: Fill out the online form with accurate information.

- Submit Documentation: Upload the required documents for verification.

- Await Approval: The lender will review your application and documents.

- Receive Funds: Upon approval, the funds will be transferred to your account.

By understanding these steps, you can streamline your application process and secure a personal loan with ease.

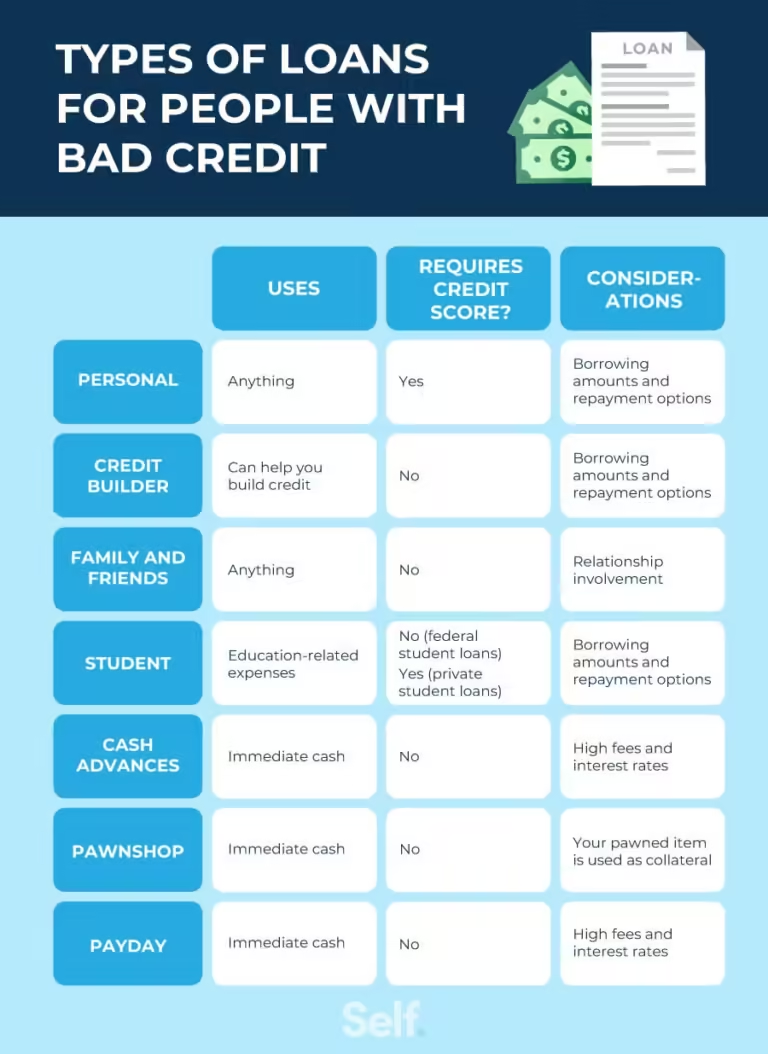

Types Of Personal Loans

Understanding the different types of personal loans can help you make informed financial decisions. Here’s a breakdown of the main categories:

Secured Vs. Unsecured Loans

Personal loans typically fall into two categories: secured and unsecured loans.

- Secured Loans: These loans require collateral, like a car or house. They often have lower interest rates due to the reduced risk for lenders.

- Unsecured Loans: These do not require collateral. They can have higher interest rates, as the lender takes on more risk.

Fixed-rate Vs. Variable-rate Loans

Another important distinction is between fixed-rate and variable-rate loans.

| Fixed-Rate Loans | Variable-Rate Loans |

|---|---|

| Interest rate remains constant throughout the loan term. | Interest rate fluctuates based on the market conditions. |

| Predictable monthly payments. | Monthly payments can vary. |

| Good for budgeting. | Risk of higher payments over time. |

Choosing the right type of personal loan depends on your financial situation and goals. Consider your needs and compare options carefully.

Key Features Of Personal Loans

Personal loans offer a versatile financial solution for various needs. Understanding the key features helps in making an informed decision. Below, we explore the essential aspects of personal loans.

Loan Amounts And Terms

Personal loans typically range from $1,000 to $50,000. The loan terms usually span from 12 to 60 months. Borrowers choose the amount and term based on their financial needs and repayment ability.

| Loan Amount | Loan Term |

|---|---|

| $1,000 – $50,000 | 12 – 60 months |

Interest Rates And Fees

Interest rates on personal loans can vary based on creditworthiness. Fixed rates generally range from 5% to 36%. It’s crucial to check for any additional fees, such as origination fees, late payment fees, or prepayment penalties.

- Interest Rates: 5% – 36% (fixed)

- Origination Fees: 1% – 8%

- Late Payment Fees: Varies by lender

- Prepayment Penalties: Some lenders may apply

Repayment Flexibility

Repayment flexibility is a significant feature of personal loans. Borrowers can choose from various repayment plans. Some lenders offer options like bi-weekly or monthly payments. Others allow payment adjustments or deferments under certain conditions.

- Bi-weekly or Monthly Payments: Choose the schedule that fits your budget.

- Payment Adjustments: Modify payments if your financial situation changes.

- Deferments: Some lenders allow deferments in case of financial hardship.

Understanding these features ensures you can select the right personal loan to meet your needs and financial situation.

Pros And Cons Of Personal Loans

Personal loans can be a useful financial tool. They can help in managing expenses, consolidating debt, or funding projects. But, like any financial product, they come with advantages and potential drawbacks. Here, we will explore both sides to help you make an informed decision.

Advantages Of Personal Loans

Personal loans offer several benefits:

- Flexibility: Use the funds for various needs like medical bills, home improvement, or debt consolidation.

- Fixed Interest Rates: Know exactly what your monthly payment will be, helping you budget more effectively.

- Quick Approval: Many lenders, including Upstart Personal Loans, provide fast approval and fund disbursement.

- Improve Credit Score: Timely payments on a personal loan can boost your credit score.

Potential Drawbacks

While personal loans have many benefits, there are also some potential drawbacks to consider:

- High Interest Rates: Compared to secured loans, personal loans can have higher interest rates, especially with poor credit.

- Fees: Some loans come with origination fees, late payment fees, or prepayment penalties.

- Debt Accumulation: Taking on a personal loan adds to your debt burden, impacting your overall financial health.

- Impact on Credit Score: Applying for a loan can temporarily lower your credit score due to the hard inquiry.

Common Questions About Personal Loans

Personal loans can be a great way to finance various needs. However, there are several common questions people have about them. Here, we address these questions to help you make informed decisions.

How Does Credit Score Affect Loan Approval?

Your credit score plays a significant role in loan approval. Lenders use it to assess your creditworthiness. A higher credit score indicates good financial behavior, increasing your chances of approval.

If your credit score is low, you might still get a loan, but it could have a higher interest rate. Maintaining a good credit score is essential for securing better loan terms.

Can I Use A Personal Loan For Any Purpose?

Personal loans offer flexibility. You can use them for various purposes, including:

- Home renovations

- Medical expenses

- Debt consolidation

- Travel

- Wedding expenses

However, some lenders might have restrictions. Always check the terms before applying.

What Happens If I Miss A Payment?

Missing a payment can have serious consequences. Here are some potential outcomes:

| Consequence | Details |

|---|---|

| Late Fees | Most lenders charge late fees if you miss a payment. |

| Credit Score Impact | Missing payments can lower your credit score. |

| Higher Interest Rates | Late payments may result in higher future interest rates. |

| Legal Action | Continued non-payment might lead to legal action. |

To avoid these issues, set up automatic payments or reminders. Communicate with your lender if you anticipate a payment problem.

Tips For Borrowing Smart

Borrowing smartly is key to managing your personal finances effectively. Making informed decisions can save you money and reduce financial stress. Here are some essential tips to help you navigate the process.

Comparing Loan Offers

Always compare multiple loan offers before deciding. Look at the interest rates, repayment terms, and fees. Create a table to visualize the differences:

| Loan Provider | Interest Rate | Repayment Term | Fees |

|---|---|---|---|

| Provider A | 5% | 3 years | $50 |

| Provider B | 6% | 5 years | $100 |

| Provider C | 4.5% | 4 years | $75 |

By comparing, you can choose the most affordable and suitable loan for your needs.

Understanding The Fine Print

Read all the terms and conditions carefully. Pay attention to:

- Interest Rate Type: Fixed or variable

- Prepayment Penalties: Fees for paying off the loan early

- Late Payment Fees: Charges for missing a payment

Understanding these details helps avoid unexpected costs and ensures you are fully informed about your obligations.

Managing Your Loan Responsibly

Once you have your loan, managing it responsibly is crucial. Here are some tips:

- Create a Budget: Track your income and expenses.

- Set Up Automatic Payments: Ensure timely payments to avoid late fees.

- Communicate with Lenders: Inform them if you face financial difficulties.

Good management of your loan ensures you maintain a good credit score and avoid financial pitfalls.

Frequently Asked Questions

What Is A Personal Loan?

A personal loan is an unsecured loan provided by banks, credit unions, or online lenders. It is used for personal expenses like debt consolidation, medical bills, or home renovations.

How Can I Apply For A Personal Loan?

You can apply for a personal loan online or in-person. You need to provide personal information, income details, and the purpose of the loan.

What Are The Eligibility Criteria For Personal Loans?

Eligibility criteria vary by lender. Common requirements include a good credit score, stable income, and minimal existing debt. Some lenders also consider your employment history.

How Long Does It Take To Get A Personal Loan?

Approval and disbursement time vary by lender. Some online lenders approve and disburse funds within 24 hours. Traditional banks may take a few days.

Conclusion

Personal loans can be a valuable financial tool. Understanding the FAQs helps you make informed decisions. For more information on personal loans, consider checking out Upstart Personal Loans. They offer user-friendly terms and secure processes. Always choose a trusted provider for your financial needs. Read more, ask questions, and stay informed. This ensures you get the best loan option suited for you.