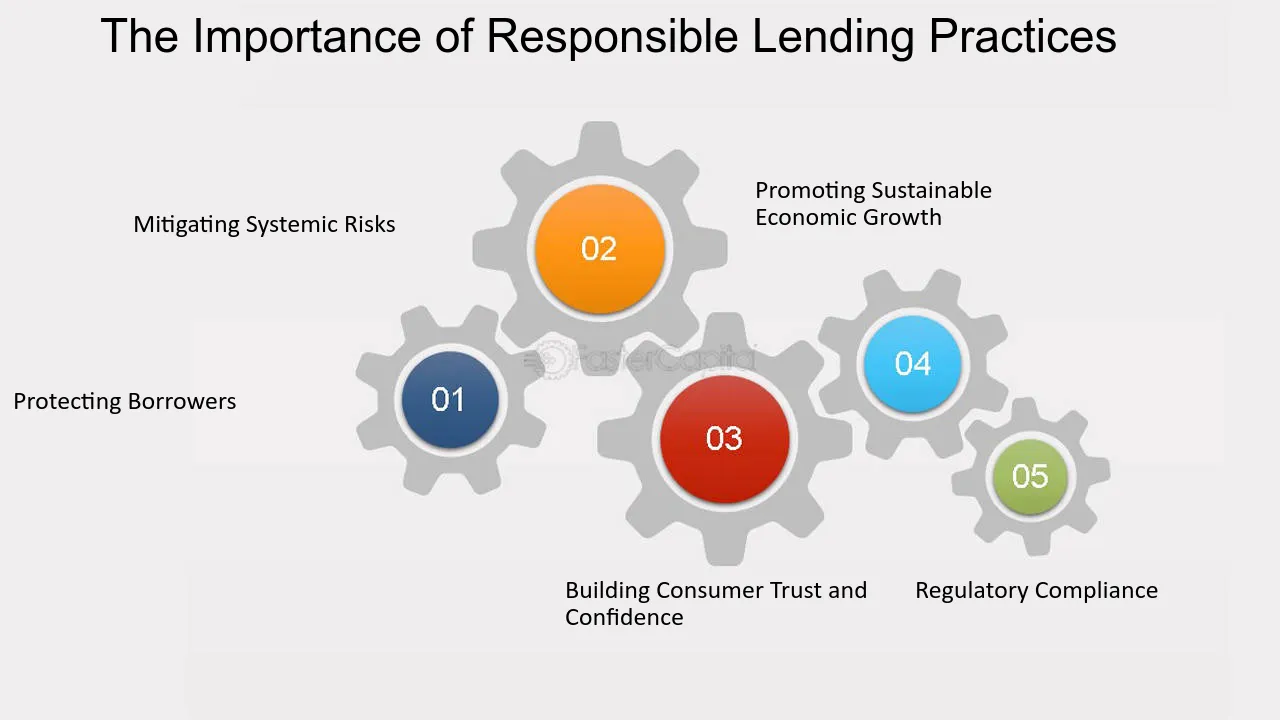

Responsible Lending Practices: Ensuring Financial Fairness and Integrity

Responsible lending practices are essential for financial stability. They ensure borrowers are treated fairly and loans are manageable.

Understanding responsible lending practices can help protect both lenders and borrowers. It minimizes financial risks and promotes trust in the financial system. For borrowers, responsible lending means getting a loan that matches their ability to repay. For lenders, it means assessing creditworthiness and providing clear information. This approach helps prevent financial stress and defaults, creating a healthier economy. If you’re considering a personal loan, it’s crucial to choose a lender that practices responsible lending. Upstart Personal Loans, for example, offers a transparent and fair lending process. Learn more about their offerings here.

Introduction To Responsible Lending Practices

Responsible lending practices are crucial for ensuring a fair and transparent financial environment. They help protect consumers and maintain the integrity of the financial system. In this section, we will explore the key aspects of responsible lending practices.

Understanding Responsible Lending

Responsible lending involves providing loans that are suitable for the borrower’s needs and financial situation. It means lenders must assess the borrower’s ability to repay the loan. This includes evaluating income, expenses, and other financial commitments.

Here are some essential elements of responsible lending:

- Thorough Assessment: Detailed evaluation of the borrower’s financial status.

- Transparency: Clear communication of loan terms and conditions.

- Affordability Checks: Ensuring the borrower can afford the loan repayments.

- Ethical Practices: Avoiding predatory lending and ensuring fair treatment.

Importance Of Financial Fairness And Integrity

Financial fairness and integrity are the cornerstones of responsible lending. They ensure that all parties involved in a financial transaction are treated equitably and transparently.

Here’s why they matter:

- Consumer Protection: Prevents borrowers from falling into unmanageable debt.

- Trust in Financial Systems: Builds trust between lenders and borrowers.

- Economic Stability: Contributes to the overall stability of the financial system.

- Fair Competition: Ensures a level playing field for all financial institutions.

Adopting responsible lending practices is not just about compliance. It is about fostering a healthy financial ecosystem that benefits everyone.

Key Principles Of Responsible Lending

Responsible lending practices ensure that borrowers are treated fairly and loans are given responsibly. These principles protect both the lender and the borrower, fostering a healthy financial system. Below are the key principles that guide responsible lending.

Transparency And Clear Communication

Lenders must provide clear and transparent information about loan terms. This includes the interest rates, fees, and repayment schedules. Borrowers should understand all costs associated with their loans.

- Interest Rates: Clearly state the annual percentage rate (APR).

- Fees: Disclose all fees, including late payment penalties.

- Repayment Schedule: Outline the payment amounts and due dates.

Assessing Borrower’s Ability To Repay

Before approving a loan, lenders should evaluate the borrower’s financial situation. This ensures that the borrower can repay the loan without undue hardship.

Key factors include:

- Income: Verify the borrower’s income to ensure they can meet repayments.

- Debt-to-Income Ratio: Calculate the ratio to assess financial stability.

- Credit History: Review the borrower’s credit report for past repayment behavior.

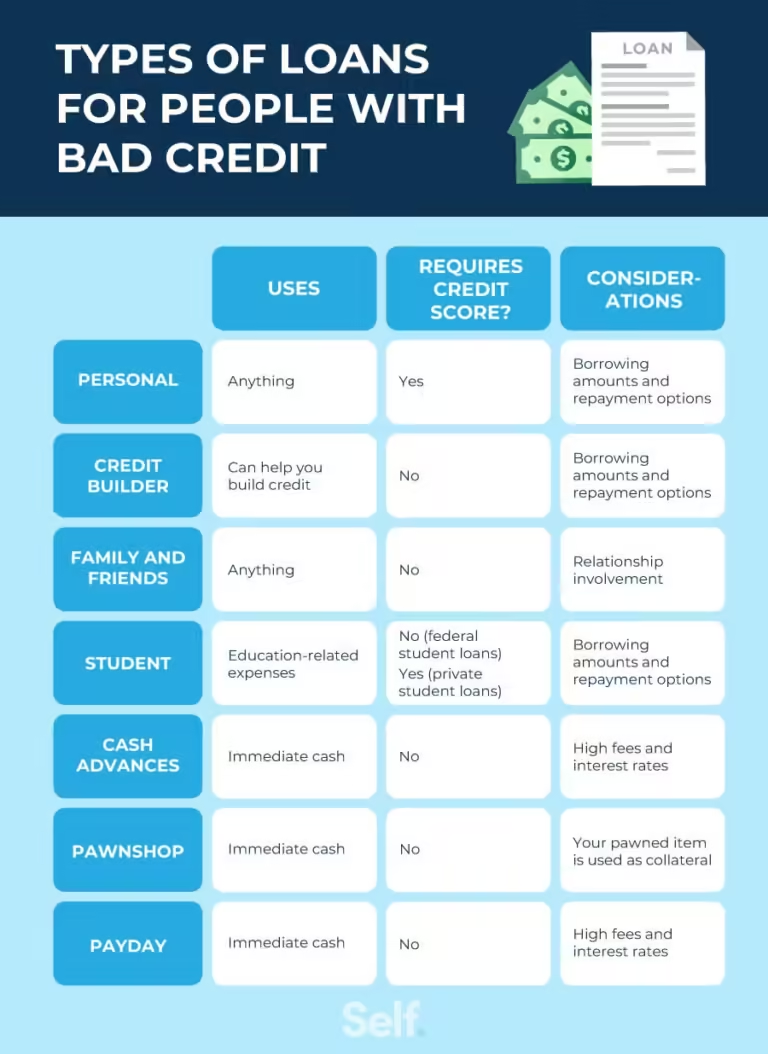

Avoiding Predatory Lending Practices

Responsible lenders avoid practices that take advantage of borrowers. These practices include charging excessive interest rates or hidden fees.

To prevent predatory lending:

- Reasonable Interest Rates: Offer competitive and fair interest rates.

- No Hidden Fees: Ensure all fees are disclosed upfront.

- Ethical Practices: Follow industry standards and ethical guidelines.

Unique Features Of Responsible Lending Practices

Responsible lending practices are essential to ensure borrowers are treated fairly and loans are managed sustainably. These practices not only protect borrowers but also foster trust and transparency in the lending process. Here, we’ll explore some unique features of responsible lending practices.

Comprehensive Credit Assessments

A key feature of responsible lending is conducting comprehensive credit assessments. Lenders evaluate a borrower’s credit history, income, and expenses to determine their ability to repay the loan. This thorough analysis helps in making informed lending decisions.

| Assessment Criteria | Details |

|---|---|

| Credit History | Review of past credit behavior |

| Income | Verification of income sources |

| Expenses | Analysis of current financial obligations |

Personalized Loan Terms

Responsible lenders offer personalized loan terms tailored to the borrower’s financial situation. This may include adjusting the loan amount, interest rate, and repayment schedule to ensure the loan is affordable.

- Custom loan amounts

- Flexible interest rates

- Tailored repayment schedules

Personalized terms help borrowers manage their debt more effectively and reduce the risk of default.

Financial Education And Counseling

Another important aspect is providing financial education and counseling. Lenders offer resources and support to help borrowers understand their financial options and manage their finances better.

These services may include:

- Budgeting advice

- Debt management strategies

- Workshops and seminars

By educating borrowers, lenders empower them to make informed financial decisions and improve their financial health.

Pricing And Affordability In Responsible Lending

Responsible lending practices ensure borrowers can afford their loans. Pricing and affordability are crucial aspects. They help maintain a balance between lender profitability and borrower well-being.

Fair Interest Rates

Fair interest rates are essential in responsible lending. Lenders should offer rates that reflect the borrower’s creditworthiness and market conditions. Fair rates help borrowers manage their repayments without undue financial stress.

- Competitive Rates: Lenders must provide rates that are competitive in the market.

- Risk-Based Pricing: Rates should be based on the borrower’s credit risk.

- Clear Communication: Borrowers must understand how their interest rates are determined.

Transparent Fee Structures

Transparency in fee structures builds trust between lenders and borrowers. All fees must be disclosed upfront, avoiding hidden charges. This clarity helps borrowers make informed decisions.

| Fee Type | Description |

|---|---|

| Application Fee | Charged for processing the loan application. |

| Origination Fee | Charged for creating the loan agreement. |

| Late Payment Fee | Charged for delayed payments. |

Flexible Repayment Options

Flexible repayment options enable borrowers to manage their finances effectively. Lenders should offer various repayment plans that cater to different financial situations. This flexibility reduces the risk of default and enhances borrower satisfaction.

- Installment Plans: Allow repayments in smaller, manageable amounts.

- Grace Periods: Offer a buffer time before penalties apply.

- Early Repayment: Enable borrowers to repay early without penalties.

Upstart Personal Loans exemplify responsible lending by adhering to these principles. Visit the Upstart Personal Loans website for more information.

Pros And Cons Of Responsible Lending Practices

Responsible lending practices are designed to ensure borrowers can repay their loans without undue hardship. They involve assessing a borrower’s ability to repay before approving a loan. While these practices offer many benefits, they also come with challenges for lenders and have significant impacts on the financial system.

Benefits For Borrowers

Responsible lending practices provide multiple benefits for borrowers:

- Reduced Risk of Over-Indebtedness: Borrowers are less likely to take on loans they cannot afford, reducing the risk of financial strain.

- Improved Financial Health: By ensuring loans are manageable, borrowers can maintain better financial stability and avoid default.

- Better Loan Terms: Responsible lending may lead to better interest rates and terms for borrowers who are assessed as low-risk.

- Enhanced Trust: Borrowers may feel more secure knowing lenders are committed to responsible lending practices.

Challenges For Lenders

While responsible lending is beneficial for borrowers, it presents several challenges for lenders:

- Increased Due Diligence: Lenders must conduct thorough assessments, which can be time-consuming and costly.

- Potential for Reduced Loan Approvals: Stricter criteria may result in fewer loans being approved, impacting lender profits.

- Compliance Costs: Adhering to responsible lending regulations requires ongoing investment in compliance and monitoring systems.

Impact On The Financial System

Responsible lending practices have a broader impact on the financial system:

| Positive Impact | Negative Impact |

|---|---|

| Stability: Reduced risk of widespread defaults contributes to financial system stability. | Access to Credit: Stricter lending criteria may limit access to credit for some individuals. |

| Consumer Protection: Enhanced protection for consumers can increase trust in the financial system. | Lender Profitability: The reduced number of loans may impact lender profitability. |

Overall, responsible lending practices balance protecting borrowers and ensuring the stability of the financial system, despite the challenges lenders may face.

Recommendations For Implementing Responsible Lending

Implementing responsible lending practices is crucial for maintaining a healthy financial ecosystem. It involves a balance between providing access to credit and ensuring borrowers can meet their repayment obligations. Below are some key recommendations for both lenders and borrowers, along with important regulatory considerations.

Best Practices For Lenders

- Thorough Credit Assessment: Conduct comprehensive credit assessments to evaluate the borrower’s ability to repay the loan.

- Transparent Terms: Ensure all loan terms are clearly communicated, including interest rates, fees, and repayment schedules.

- Responsible Marketing: Avoid misleading advertisements and ensure marketing materials are clear and truthful.

- Fair Treatment: Treat all borrowers fairly and without discrimination during the lending process.

- Regular Monitoring: Continuously monitor the borrower’s financial health to identify and address potential repayment issues early.

Guidelines For Borrowers

- Understand Your Needs: Assess your financial situation to determine how much you need to borrow.

- Read Terms Carefully: Review loan terms thoroughly to understand the interest rates, fees, and repayment obligations.

- Budget Wisely: Create a budget to ensure you can meet your repayment obligations without financial strain.

- Seek Advice: Consult financial advisors if unsure about any aspect of the loan.

- Maintain Communication: Stay in contact with your lender, especially if you face difficulties in making repayments.

Regulatory And Policy Considerations

Lenders must comply with regulatory requirements to promote responsible lending. Key considerations include:

| Regulation | Purpose |

|---|---|

| Truth in Lending Act (TILA) | Ensures clear disclosure of loan terms to protect consumers. |

| Fair Lending Laws | Prohibit discrimination in the lending process. |

| Debt Collection Practices | Regulate how lenders can collect overdue loans to protect borrowers from harassment. |

| Data Protection Regulations | Ensure borrower information is handled securely and confidentially. |

Adhering to these regulations helps maintain trust and integrity in the lending process, benefiting both lenders and borrowers.

Conclusion: The Future Of Responsible Lending

The future of responsible lending is promising. It aims to balance innovation with ethical practices. This ensures financial inclusion and sustainability.

Evolving Trends And Innovations

New trends are emerging in the lending industry. These trends focus on technology, transparency, and customer-centric solutions.

- Artificial Intelligence (AI): AI is being used to assess creditworthiness. It analyzes more data points, providing a fairer evaluation.

- Blockchain Technology: Blockchain ensures secure and transparent transactions. It reduces fraud and increases trust.

- Fintech Integration: Fintech companies are collaborating with traditional lenders. This improves efficiency and enhances customer experience.

These innovations are transforming lending practices. They make loans more accessible and fair.

Long-term Benefits For Society

Responsible lending has significant long-term benefits. It positively impacts individuals and society.

- Financial Inclusion: More people gain access to credit. This helps in reducing poverty and promoting economic growth.

- Economic Stability: Responsible lending prevents over-indebtedness. This ensures a stable and healthy economy.

- Consumer Protection: Ethical practices protect consumers from predatory lending. This builds trust and confidence in the financial system.

These benefits contribute to a more equitable and sustainable financial landscape.

Upstart Personal Loans is an example of a product adhering to responsible lending principles. To learn more, visit their official website.

Frequently Asked Questions

What Is Responsible Lending?

Responsible lending refers to practices ensuring borrowers can repay loans without financial strain. Lenders assess borrowers’ financial health.

Why Is Responsible Lending Important?

Responsible lending prevents borrowers from falling into unmanageable debt. It promotes financial stability and ethical lending practices.

How Do Lenders Ensure Responsible Lending?

Lenders ensure responsible lending by evaluating borrowers’ credit history, income, and financial stability. They offer suitable loan products.

What Are The Benefits Of Responsible Lending?

Responsible lending benefits borrowers by offering manageable loans and protecting their financial health. It reduces default rates for lenders.

Conclusion

Responsible lending practices benefit both lenders and borrowers. They ensure fairness and transparency. This builds trust and fosters long-term financial health. For more information on personal loans, visit Upstart Personal Loans. Always choose lenders who prioritize responsible practices. This will safeguard your financial future and provide peace of mind.