Bad Credit Personal Loans: Your Path to Financial Freedom

Struggling with a low credit score? Bad credit personal loans can be a lifeline.

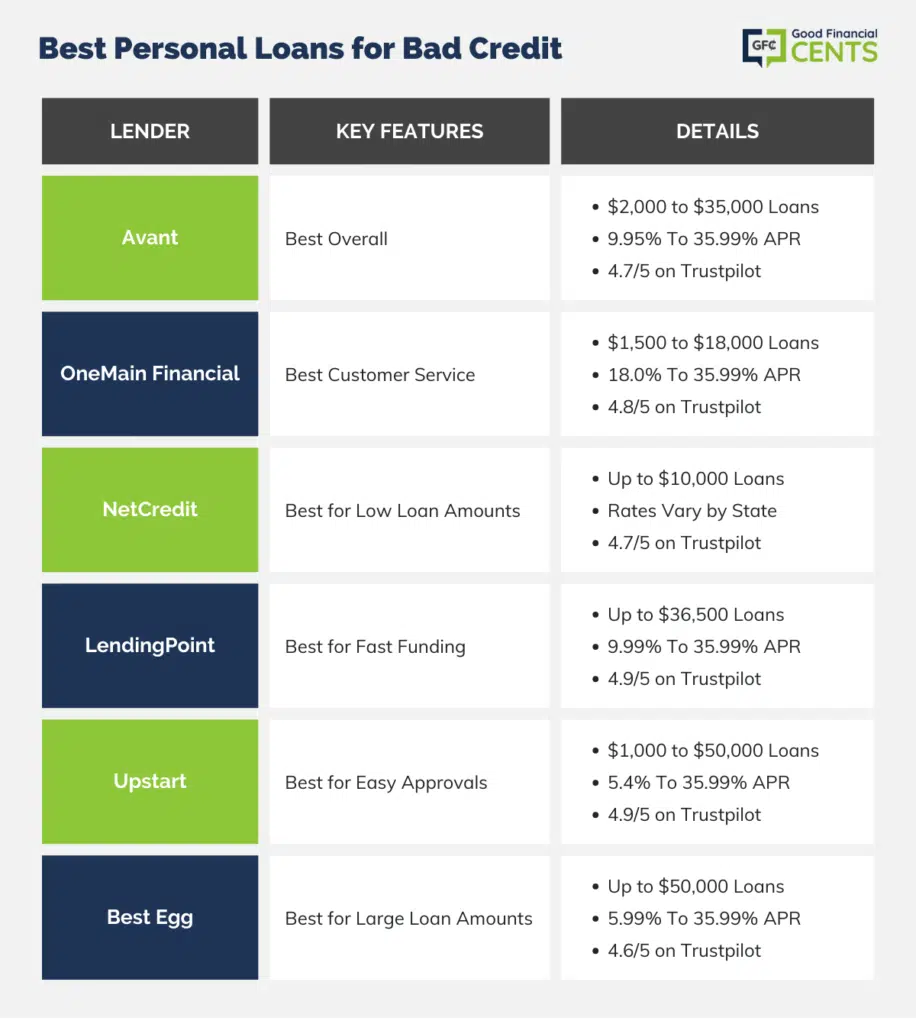

They offer a chance to rebuild credit while covering urgent expenses. Financial woes can strike anyone. Whether it’s unexpected bills or a significant purchase, people need solutions. Bad credit personal loans provide a way to secure funds even with a poor credit history. These loans can help manage emergencies and improve credit over time. Platforms like Upstart Personal Loans make it easier by connecting borrowers with lenders willing to take a chance. Interested in finding out more? Check out Upstart Personal Loans for options that might suit your needs. This introduction will guide you through understanding how these loans work and how they can assist you in financial recovery.

Introduction To Bad Credit Personal Loans

Bad credit personal loans can be a lifeline for individuals with poor credit scores. These loans provide access to funds for emergencies, debt consolidation, or other personal needs. Understanding the basics can help you make informed decisions.

Understanding Bad Credit

Bad credit usually means a credit score below 580. It can result from late payments, defaults, or high credit utilization. Lenders see individuals with bad credit as high-risk borrowers.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

Purpose Of Bad Credit Personal Loans

Bad credit personal loans serve various purposes:

- Debt Consolidation: Combine multiple debts into one loan.

- Emergency Expenses: Cover unexpected costs like medical bills or car repairs.

- Home Repairs: Fund necessary home improvements or repairs.

These loans can help improve your credit score if managed responsibly. Making timely payments can show lenders you are a reliable borrower.

For instance, Upstart Personal Loans can be a viable option. They connect borrowers with lenders, offering personalized loan rates. Visit their website for more details.

Key Features Of Bad Credit Personal Loans

Bad credit personal loans offer several key features that make them accessible and appealing to individuals with less-than-perfect credit scores. Understanding these features can help you make an informed decision. Let’s explore the most important aspects of these loans.

Flexible Eligibility Criteria

Bad credit personal loans often come with flexible eligibility criteria. Traditional loans require high credit scores, but these loans consider other factors. Lenders may look at your income, employment history, and ability to repay. This flexibility helps more people qualify for needed funds.

Quick Approval Process

A quick approval process is another key feature. Many lenders understand the urgency of financial needs. They aim to process applications swiftly. Some lenders offer same-day approval. This speed allows you to access funds when you need them most.

Variety Of Loan Options

Bad credit personal loans come in a variety of loan options. You can choose from secured or unsecured loans, depending on your situation. Secured loans require collateral, while unsecured loans do not. This variety provides flexibility to find a loan that suits your specific needs.

Customized Repayment Plans

Customized repayment plans are a significant benefit. Lenders often work with borrowers to create manageable repayment schedules. This customization ensures you can make payments without straining your finances. It’s an essential feature for maintaining financial stability.

In conclusion, bad credit personal loans provide flexible eligibility, quick approvals, various loan options, and customized repayment plans. These features make them a viable option for those with poor credit seeking financial assistance.

How Bad Credit Personal Loans Benefit You

Bad credit personal loans can be a lifesaver for many. These loans offer unique benefits that can help improve your financial situation. Here are some key ways they can benefit you:

Access To Necessary Funds

One of the biggest advantages of bad credit personal loans is the ability to access necessary funds quickly. Even with a poor credit score, you can secure the money you need. This can be essential for:

- Emergency expenses

- Medical bills

- Home repairs

- Car repairs

Having access to these funds can help you avoid further financial stress. It allows you to manage unforeseen expenses without turning to high-interest credit cards or payday loans.

Opportunity To Improve Credit Score

Bad credit personal loans also provide an opportunity to improve your credit score. By making timely payments, you can show lenders that you are responsible. This positive payment history is reported to credit bureaus, which can help boost your credit score over time.

This improvement can open doors to better financial opportunities in the future, such as lower interest rates on loans and better terms on credit cards.

Financial Planning And Stability

Another benefit of bad credit personal loans is that they can contribute to better financial planning and stability. With a set repayment plan, you can budget more effectively. Knowing exactly how much you need to pay each month helps you manage your finances better.

Creating a budget that includes your loan repayment can prevent overspending. It ensures you stay on track with your financial goals.

Additionally, it can reduce the need for borrowing from multiple sources, which can be confusing and difficult to manage. A single loan with a clear repayment schedule simplifies your finances.

Overall, bad credit personal loans offer several benefits. They provide immediate access to funds, a chance to improve your credit score, and contribute to financial stability. These loans can be a useful tool for managing and improving your financial health.

Pricing And Affordability

Understanding the pricing and affordability of bad credit personal loans is crucial. These loans often come with higher interest rates and fees. Comparing loan offers and budgeting for repayments helps in making informed decisions.

Interest Rates And Fees

Bad credit personal loans typically have higher interest rates due to the risk involved. It’s essential to check both the interest rates and any additional fees associated with the loan.

- Interest rates can range from 15% to 36%.

- Look for fees such as origination fees, late payment fees, and prepayment penalties.

Understanding the total cost of the loan helps in evaluating its affordability.

Comparing Loan Offers

Comparing multiple loan offers ensures you get the best terms. Consider using online comparison tools. Here’s a simple table to help:

| Loan Offer | Interest Rate | Fees | Monthly Payment |

|---|---|---|---|

| Loan A | 20% | $100 | $150 |

| Loan B | 25% | $200 | $175 |

Compare the total cost, monthly payments, and terms to choose the most affordable option.

Budgeting For Repayments

Creating a budget for loan repayments is essential. Calculate your monthly income and expenses. Include the loan repayment in your budget plan.

- List all sources of income.

- Deduct fixed monthly expenses (rent, utilities).

- Include variable expenses (food, transport).

- Allocate funds for loan repayment.

Ensure you have a buffer for unexpected expenses to avoid missing payments. This approach helps in managing repayments without financial strain.

Pros And Cons Of Bad Credit Personal Loans

Bad credit personal loans can be a lifeline for those with poor credit scores. They provide access to funds when traditional lenders say no. But, there are both benefits and drawbacks. Understanding these can help in making an informed decision.

Advantages Of Bad Credit Loans

- Accessibility: Even with a low credit score, you can still get approved.

- Quick Approval: These loans often have faster approval times.

- Debt Consolidation: They can help consolidate high-interest debts into one loan.

- Credit Improvement: Timely payments can improve your credit score over time.

Drawbacks To Consider

- High Interest Rates: Bad credit loans usually come with higher interest rates.

- Fees: Look out for origination fees and other hidden charges.

- Shorter Repayment Terms: Repayment periods can be shorter, increasing monthly payments.

- Potential Scams: Be cautious of predatory lenders targeting those with poor credit.

Real-world Usage And Feedback

Many users have found bad credit personal loans to be a helpful tool during financial emergencies. For example, Upstart Personal Loans, available at Upstart, is one such option. Users have praised its quick approval process and the potential for credit improvement.

However, it’s important to read reviews and understand the terms. Some users have mentioned high interest rates and fees as significant drawbacks. Always compare different lenders and understand all the terms before signing up.

Who Should Consider Bad Credit Personal Loans?

Bad credit personal loans can be a lifeline for those with less-than-perfect credit scores. These loans can provide necessary funds for emergencies, debt consolidation, or other immediate financial needs. Understanding who should consider these loans can help in making informed decisions.

Ideal Candidates For Bad Credit Loans

Individuals with low credit scores often struggle to get approved for traditional loans. Bad credit personal loans are ideal for those who have been denied by banks due to their credit history. These loans are particularly helpful for:

- People with a credit score below 580

- Those with recent credit issues, such as late payments or defaults

- Individuals with a limited credit history

These candidates may find it easier to qualify for bad credit loans, which can help improve their financial situation over time.

Scenarios Where These Loans Are Beneficial

Bad credit personal loans can be beneficial in various scenarios. Here are some common situations:

- Emergency Expenses: Unexpected medical bills or car repairs.

- Debt Consolidation: Combining multiple debts into a single payment.

- Home Repairs: Urgent repairs that cannot wait.

In these situations, having access to quick funds can be crucial for maintaining financial stability.

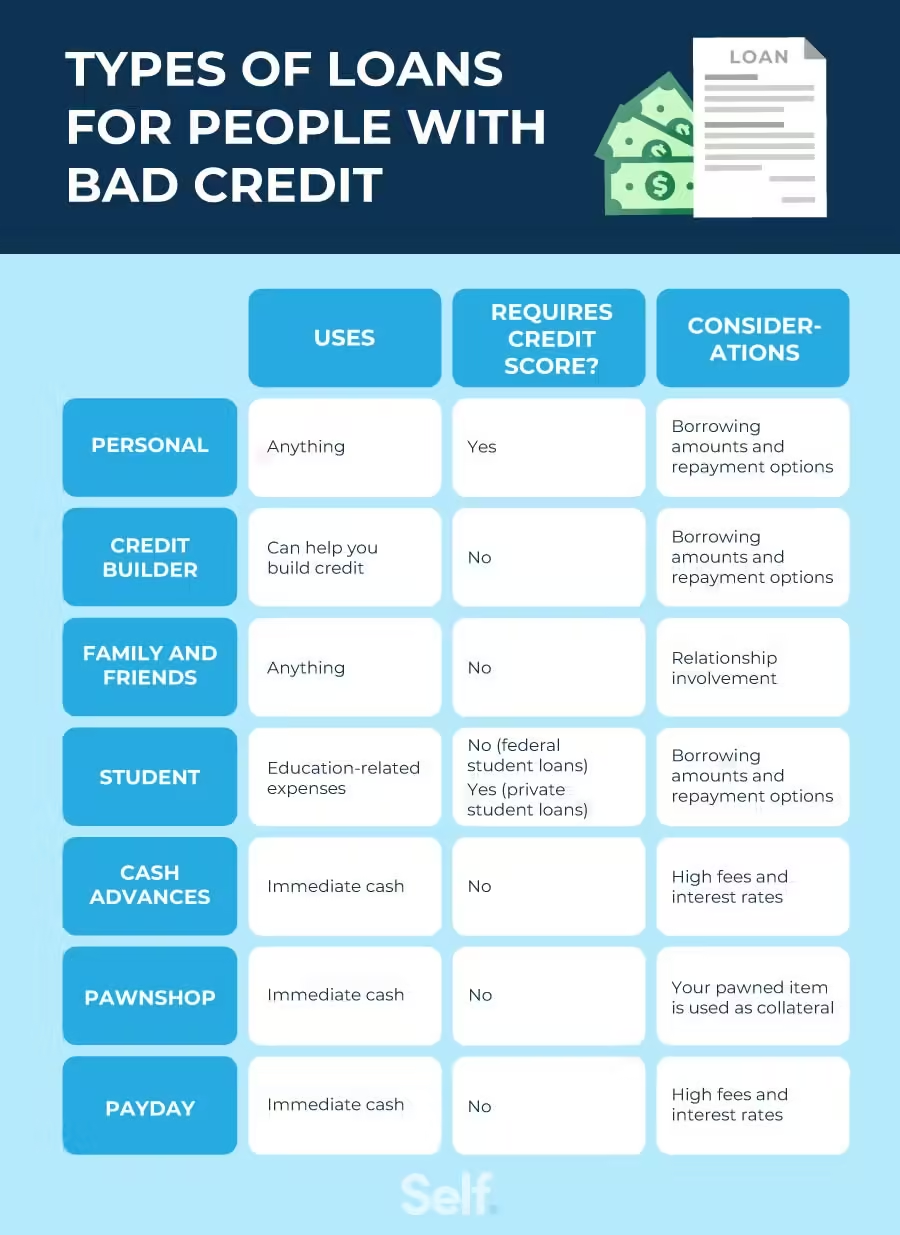

Alternative Solutions To Explore

While bad credit personal loans can be helpful, it is also important to consider other options. Here are some alternatives:

| Alternative | Description |

|---|---|

| Credit Counseling | Professional advice to manage debt and improve credit scores. |

| Secured Loans | Loans backed by collateral, often easier to qualify for. |

| Borrowing from Friends or Family | An option for those who have a support system. |

Exploring these alternatives can provide a broader view of available options, helping to make the best financial decision.

Conclusion: Achieving Financial Freedom

Securing a personal loan with bad credit can seem impossible. But, it is not. Bad credit personal loans offer a lifeline to financial freedom. They provide the opportunity to rebuild credit scores and manage debts effectively.

Summary Of Key Points

- Accessibility: Bad credit personal loans are accessible to individuals with poor credit scores.

- Rebuild Credit: Timely repayments can improve your credit score.

- Flexible Terms: These loans often come with flexible repayment terms.

- Debt Management: Consolidating debts into a single loan simplifies financial management.

Final Thoughts And Recommendations

Consider Upstart Personal Loans for your financial needs. They offer flexible terms and a user-friendly platform. Visit their website at Upstart Personal Loans for more information.

Evaluate your financial situation carefully. Choose a loan that fits your budget and repayment ability. Always read the terms and conditions before committing.

:max_bytes(150000):strip_icc()/are-personal-loans-bad-your-credit-score.asp_FINAL-44664c5b7c6b4d73b8ddc4699d545722.png)

Frequently Asked Questions

What Is A Bad Credit Personal Loan?

A bad credit personal loan is a loan designed for individuals with low credit scores. These loans often come with higher interest rates due to increased risk.

Can I Get A Personal Loan With Bad Credit?

Yes, you can get a personal loan with bad credit. Many lenders specialize in offering loans to individuals with poor credit scores.

How Do Bad Credit Loans Work?

Bad credit loans work similarly to regular loans. However, they usually have higher interest rates and stricter terms due to the increased risk to the lender.

Are There Risks With Bad Credit Personal Loans?

Yes, there are risks with bad credit personal loans. They often come with higher interest rates and fees, which can lead to higher overall costs.

Conclusion

Bad credit personal loans can be a lifeline. They offer financial relief. With careful management, these loans can help rebuild your credit. Consider options like Upstart Personal Loans for a solution. They connect you with potential backers. Visit Upstart Personal Loans to learn more. Make informed decisions and improve your financial health.