Debt Consolidation Loans: Simplify Your Finances Today

Debt consolidation loans can simplify your financial life. They merge multiple debts into one manageable payment.

This blog post will explore how these loans work and the benefits they offer. Debt can be overwhelming, especially when dealing with multiple payments each month. Debt consolidation loans offer a practical solution. By combining several debts into a single loan, you can simplify your finances and potentially reduce your interest rate. This makes managing your payments easier and can help you get out of debt faster. We will discuss the basics of debt consolidation loans, how they work, and why they might be a smart choice for you. If you are looking to take control of your finances, read on to learn more about debt consolidation loans and how they can help you achieve financial stability. Upstart Personal Loans offer a secure and efficient way to consolidate your debts. Their user identity verification and multi-step authentication process ensure safe access and increased user trust.

Introduction To Debt Consolidation Loans

Debt consolidation loans can help manage multiple debts. They combine various debts into a single loan. This simplifies payments and can save money on interest.

Understanding Debt Consolidation

Debt consolidation involves taking out one loan to pay off multiple debts. This can include credit cards, personal loans, and other liabilities. The new loan typically has a lower interest rate. This makes it easier to manage your finances.

For example, instead of paying three credit card bills, you pay one monthly installment. This single payment is usually lower than the sum of the individual debts. This can ease financial stress and improve your credit score over time.

Purpose And Benefits Of Debt Consolidation Loans

The primary purpose of debt consolidation loans is to streamline debt repayment. By consolidating your debts, you make one payment instead of many. This can make it easier to keep track of your payments.

Here are some key benefits:

- Lower Interest Rates: Consolidation loans often have lower interest rates than credit cards.

- Single Monthly Payment: Simplifies your finances by combining multiple debts into one payment.

- Improved Credit Score: On-time payments can positively impact your credit score.

- Reduced Stress: Easier to manage one debt rather than several.

Debt consolidation loans can be a smart financial move. They offer a clear path to becoming debt-free. Understanding how they work can help you make informed decisions.

| Feature | Description |

|---|---|

| Lower Interest Rates | Typically lower than credit cards |

| Single Monthly Payment | Combines multiple debts into one |

| Improved Credit Score | On-time payments can improve credit |

| Reduced Stress | Easier to manage one debt |

Key Features Of Debt Consolidation Loans

Debt consolidation loans offer several benefits that help manage your finances. They simplify your payments and can even improve your credit score. Let’s explore the key features of these loans.

Single Monthly Payment

With a debt consolidation loan, you replace multiple payments with a single one. This makes it easier to track your payments. You no longer have to worry about keeping up with different due dates. Simplified payments reduce stress and make budgeting easier.

Lower Interest Rates

Debt consolidation loans often come with lower interest rates compared to credit cards. This can save you money in the long run. Lower interest rates mean more of your payment goes toward reducing the principal. This helps you pay off your debt faster.

Fixed Repayment Schedule

These loans come with a fixed repayment schedule. You know exactly how much you need to pay each month. There are no surprises. A fixed schedule helps in planning your finances better. You can see the end date of your loan, giving you a clear goal to work towards.

Credit Score Improvement

Consolidating your debts can lead to credit score improvement. By making on-time payments on your loan, your credit score can go up. A higher credit score opens up better financial opportunities. It may even help you get lower interest rates on future loans.

Pricing And Affordability

Debt consolidation loans can simplify your finances. Understanding the costs involved is key. Let’s break down the pricing and affordability of these loans.

Interest Rates And Fees

Interest rates vary based on credit score and loan amount. Better credit scores usually mean lower rates. Debt consolidation loans may have fixed or variable rates. Fixed rates stay the same, while variable rates can change.

Fees are another factor. Common fees include:

- Origination fees

- Prepayment penalties

- Late payment fees

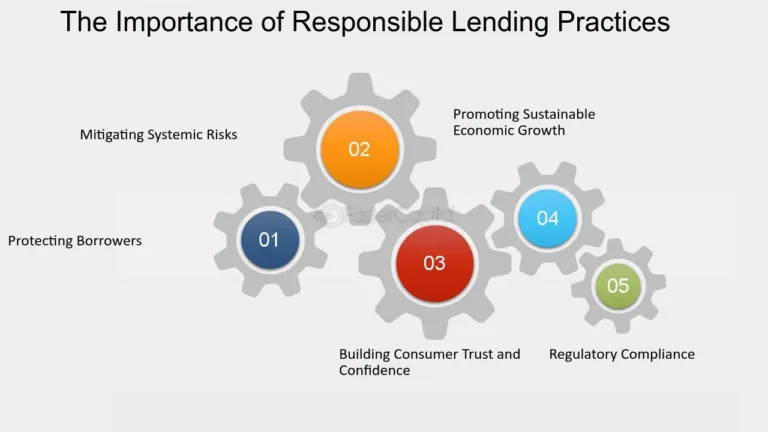

Check the terms carefully. Avoid loans with high fees. Upstart Personal Loans, for example, may offer competitive rates based on your profile.

Comparison With Other Financial Products

Debt consolidation loans differ from other financial products. Consider the following comparisons:

| Product | Interest Rates | Fees |

|---|---|---|

| Debt Consolidation Loan | Lower with good credit | Origination, late fees |

| Credit Cards | Higher, variable | Annual, late fees |

| Personal Loans | Varies widely | Origination, prepayment penalties |

Debt consolidation loans usually offer lower interest rates than credit cards. They can save you money in the long run. Personal loans might have similar rates but could include different fees.

Eligibility And Credit Requirements

Eligibility for debt consolidation loans depends on several factors. Credit score is crucial. Higher scores increase your chances of approval.

Other requirements might include:

- Proof of income

- Debt-to-income ratio

- Employment history

Upstart Personal Loans consider more than just your credit score. They may look at your education and job history. This could benefit those with less established credit.

Pros And Cons Of Debt Consolidation Loans

Debt consolidation loans can help manage multiple debts by combining them into one. This can simplify payments and potentially lower interest rates. But, like any financial product, it has its pros and cons.

Advantages Of Debt Consolidation Loans

Debt consolidation loans come with several advantages:

- Lower Interest Rates: By consolidating, you may secure a lower interest rate. This can save you money over time.

- Simplified Payments: Combining multiple debts into one loan means one monthly payment. This makes managing finances easier.

- Improved Credit Score: Consistent, on-time payments can improve your credit score. This can open up better financial opportunities.

- Fixed Repayment Schedule: These loans typically come with a fixed repayment schedule. This helps with budgeting and planning.

Potential Drawbacks To Consider

There are also potential drawbacks to consider:

- Fees and Costs: Some debt consolidation loans come with fees. These include origination fees and prepayment penalties.

- Longer Repayment Period: Lower monthly payments may mean a longer repayment period. This can result in paying more in interest over time.

- Risk of Accumulating More Debt: Consolidating debt doesn’t address the root cause of debt. Without proper financial discipline, you may accumulate more debt.

- Impact on Credit Score: Applying for a new loan can temporarily lower your credit score. This is due to the hard inquiry on your credit report.

Understanding these pros and cons can help you make an informed decision about debt consolidation loans. Always evaluate your financial situation and consult with a financial advisor if needed.

Recommendations For Ideal Users And Scenarios

Debt consolidation loans can be a powerful tool for managing multiple debts. They help users combine various debts into a single loan with a lower interest rate. Here are some recommendations for ideal users and scenarios.

Who Should Consider A Debt Consolidation Loan?

Debt consolidation loans are best suited for individuals with:

- Multiple high-interest debts

- Good to excellent credit scores

- Steady income sources

These loans are also ideal for people who find it challenging to manage multiple monthly payments.

Best Situations To Use Debt Consolidation Loans

Debt consolidation loans can be beneficial in the following scenarios:

- High-interest credit card debt: Consolidate to lower interest rates.

- Multiple loan payments: Simplify with one monthly payment.

- Paying off medical bills: Manage medical debts more efficiently.

Debt consolidation can also help if you need to improve your credit score. Making consistent payments on a single loan can boost your credit rating over time.

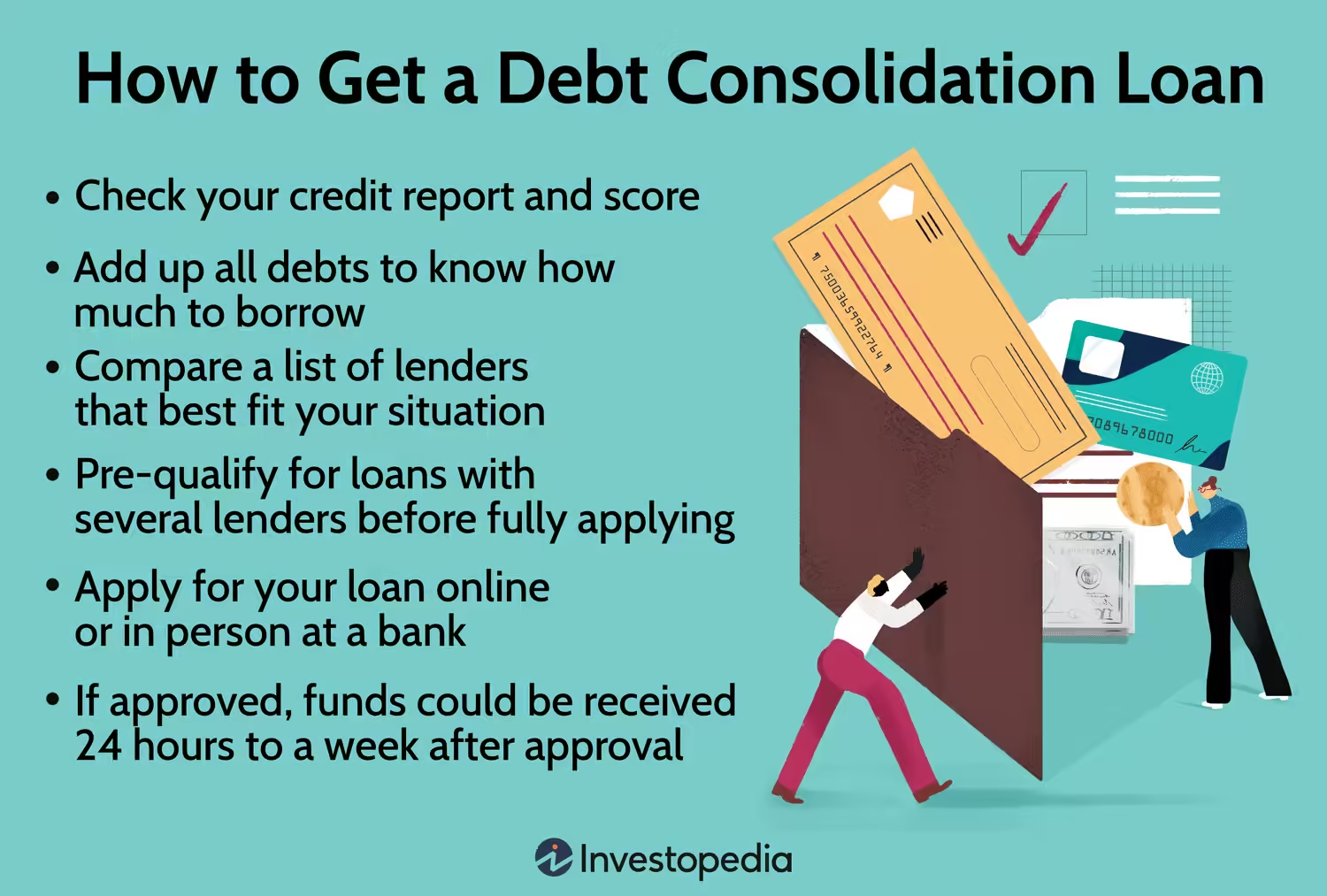

:max_bytes(150000):strip_icc()/debtconsolidation.asp-final-18e80676e0af4379a7962bfc4a0874de.png)

Conclusion: Is A Debt Consolidation Loan Right For You?

Deciding whether a debt consolidation loan is right for you can be challenging. This section will help summarize key points and guide your next steps.

Summary Of Key Points

- Debt consolidation loans can combine multiple debts into one payment.

- They often offer lower interest rates compared to credit cards.

- Simplifies managing debt with a single monthly payment.

- May improve your credit score if payments are made on time.

- Not suitable for all, especially those with very poor credit.

Final Thoughts And Next Steps

Consider your current financial situation before opting for a debt consolidation loan. Here are some steps to follow:

- Evaluate your total debt and current interest rates.

- Research different lenders and their terms.

- Check your credit score to see if you qualify.

- Calculate the total cost, including any fees.

- Consult a financial advisor if unsure.

Remember, your goal is to manage and reduce your debt. Ensure that the loan you choose meets your financial needs and helps you achieve debt freedom.

Frequently Asked Questions

What Is A Debt Consolidation Loan?

A debt consolidation loan combines multiple debts into one single loan. It simplifies payments and may reduce interest rates.

How Does Debt Consolidation Work?

Debt consolidation works by taking out a new loan to pay off existing debts. This results in one monthly payment.

Who Qualifies For Debt Consolidation Loans?

People with good credit scores typically qualify for debt consolidation loans. Lenders assess credit history and income.

Can Debt Consolidation Improve Credit Score?

Yes, debt consolidation can improve credit scores. It simplifies payments and reduces the risk of missed payments.

Conclusion

Debt consolidation loans can simplify managing multiple debts. They offer a single, lower-interest payment. This can ease your financial stress and improve credit. Consider exploring options like Upstart Personal Loans. They provide a secure, user-friendly platform. You can learn more about their offerings here. Research thoroughly to find a solution that fits your needs. Simplify your debts and regain financial control.