Online Personal Loans: Quick, Easy, and Hassle-Free Financing

Online personal loans offer a convenient way to borrow money. They are easy to apply for and can be processed quickly.

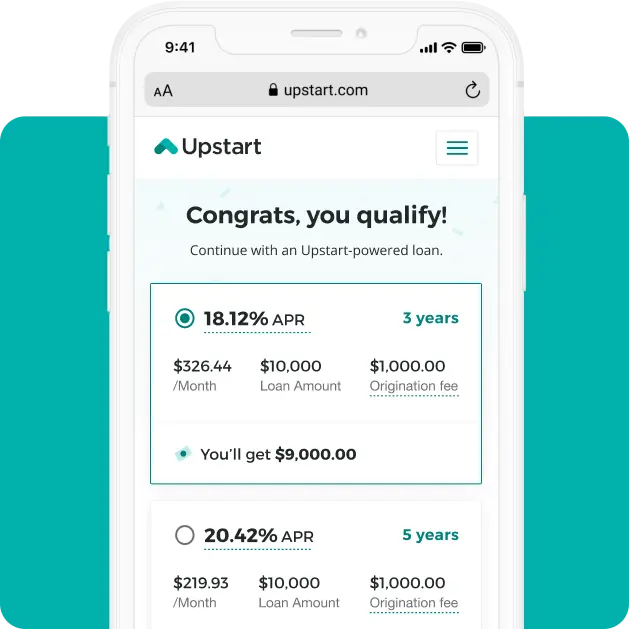

In today’s fast-paced world, financial needs can arise at any moment. Whether it’s unexpected medical bills, home repairs, or planning a special event, having access to quick funds is crucial. This is where online personal loans come into play. They provide a hassle-free way to get the money you need without the lengthy process of traditional loans. With just a few clicks, you can apply online and receive funds directly into your bank account. Plus, the approval process is often faster, making it a great option when you need money urgently. Discover the benefits and how you can apply for an online personal loan through Upstart Personal Loans today.

Introduction To Online Personal Loans

Online personal loans have gained popularity due to their convenience and accessibility. These loans provide an easy way to access funds without visiting a bank. Understanding the basics can help you make an informed decision.

What Are Online Personal Loans?

Online personal loans are unsecured loans that you can apply for over the internet. Unlike traditional loans, these do not require collateral. The application process is straightforward and quick. You typically receive the funds in your bank account within a few days.

There are various platforms offering online personal loans, including Upstart Personal Loans. These platforms use technology to assess your creditworthiness. They may look at your education, job history, and other factors.

Purpose And Benefits Of Online Personal Loans

Online personal loans serve multiple purposes. Here are some common uses:

- Debt consolidation

- Home improvements

- Medical expenses

- Major purchases

The benefits of online personal loans include:

| Benefit | Description |

|---|---|

| Convenience | Apply from home, 24/7 access |

| Fast Approval | Quick application and approval process |

| Competitive Rates | Often lower interest rates than credit cards |

| Flexible Terms | Choose repayment terms that suit your budget |

These advantages make online personal loans a great option for many borrowers. Platforms like Upstart Personal Loans offer additional security features. This ensures that your personal information remains safe during the application process.

Key Features Of Online Personal Loans

Online personal loans have become a popular option for many borrowers. They offer a range of features that make them attractive. Below, we explore some key features that make online personal loans stand out.

Convenient Application Process

The application process for online personal loans is highly convenient. Borrowers can apply from the comfort of their own home. This eliminates the need for physical visits to the bank. Applicants can fill out forms and submit documents online. This saves both time and effort.

Fast Approval Times

Online personal loans offer fast approval times. Many lenders provide instant decision-making. Some loans are approved within minutes. This is ideal for those who need funds quickly. The speed of approval is a significant advantage over traditional loans.

Flexible Repayment Terms

These loans often come with flexible repayment terms. Borrowers can choose repayment periods that suit their financial situation. Options range from a few months to several years. This flexibility helps manage monthly payments and budget better.

Competitive Interest Rates

Online personal loans usually have competitive interest rates. Lenders often offer lower rates to attract customers. This can result in significant savings over the life of the loan. Comparing rates from different lenders is easy and can help find the best deal.

No Collateral Required

Many online personal loans do not require collateral. This means borrowers do not need to pledge assets to secure the loan. This feature reduces the risk for borrowers. It also makes the loan accessible to more people, even those without substantial assets.

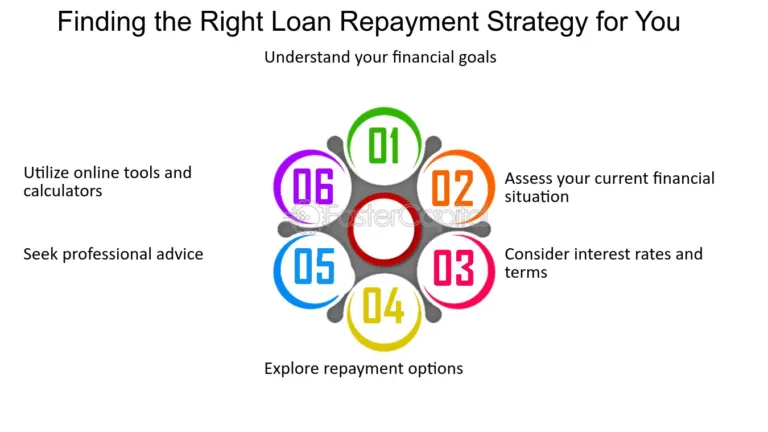

Pricing And Affordability

Understanding the costs of online personal loans is essential. Before diving in, knowing how interest rates and fees work helps you make an informed choice. Comparing these costs with traditional loans can reveal potential savings. Lastly, finding the best deals ensures affordability while meeting your financial needs.

Understanding Interest Rates And Fees

Interest rates on online personal loans vary. They depend on your credit score and the lender’s policies. Generally, better credit scores secure lower rates.

Fees can include:

- Origination fees: A percentage of the loan amount, usually deducted from the loan disbursement.

- Late payment fees: Charges if you miss a payment.

- Prepayment penalties: Fees for paying off your loan early.

Review the terms before signing. This ensures you know all potential costs. Many lenders offer a loan calculator. Use it to estimate your total cost, including interest and fees.

Comparing Costs With Traditional Loans

Online personal loans can be more competitive than traditional loans. Here’s a comparison table to illustrate potential differences:

| Criteria | Online Personal Loans | Traditional Loans |

|---|---|---|

| Interest Rates | Variable, often lower for good credit | Fixed, usually higher |

| Fees | May include origination and late fees | May include application and maintenance fees |

| Approval Speed | Fast, sometimes within 24 hours | Slower, can take days to weeks |

| Application Process | Simple and online | Complex, often in-person |

Online personal loans can provide faster access to funds. They often have fewer fees and lower rates. Traditional loans might offer more stability but can be more costly and time-consuming.

Tips For Finding The Best Deals

Finding the best deals on online personal loans requires research. Here are some tips:

- Check your credit score: Higher scores often mean lower rates.

- Compare multiple lenders: Look at different offers to find the best terms.

- Read reviews: See what other borrowers say about their experiences.

- Use loan calculators: Estimate your total repayment amount.

- Look for discounts: Some lenders offer rate discounts for autopay.

Always read the fine print. Understand all terms and conditions. This helps you avoid hidden fees and surprises.

Pros And Cons Of Online Personal Loans

Online personal loans offer a convenient way to access funds quickly. They have various advantages and potential drawbacks. Understanding these can help you make an informed decision.

Advantages Of Online Personal Loans

- Convenience: You can apply for an online personal loan from the comfort of your home.

- Speed: Online applications are processed quickly, often with same-day approval.

- Accessibility: Many online lenders are willing to work with borrowers who have lower credit scores.

- Transparency: Online platforms provide clear terms and conditions, helping you understand your loan better.

- Competitive Rates: Online lenders often offer competitive interest rates compared to traditional banks.

Potential Drawbacks To Consider

- Security Risks: There is a risk of data breaches and unauthorized access.

- Scams: Some online lenders may not be legitimate, leading to potential scams.

- Higher Interest Rates: Some online loans may have higher interest rates for those with poor credit.

- Fees: Be aware of potential fees, such as origination fees or prepayment penalties.

- Limited Interaction: Online loans lack face-to-face interaction, which some borrowers may prefer.

While online personal loans, such as those offered by Upstart Personal Loans, provide many benefits, it is essential to weigh these against the potential drawbacks. Ensure you choose a reputable lender and understand all terms before committing.

Who Should Consider Online Personal Loans?

Online personal loans offer a convenient way to access funds. But they are not suitable for everyone. Understanding who should consider these loans can help make better financial decisions.

Ideal Users And Scenarios

Online personal loans are ideal for individuals who need quick access to funds. These users typically include:

- Those with good to excellent credit scores

- People needing funds for debt consolidation

- Individuals looking to finance major purchases

- Emergency expenses like medical bills or car repairs

Consider Upstart Personal Loans if you fall into any of these categories. Their online process is simple and fast.

When To Avoid Online Personal Loans

Not everyone should opt for online personal loans. Here are scenarios when it is best to avoid them:

| Scenario | Reason |

|---|---|

| Poor credit score | Higher interest rates |

| Unstable income | Risk of default |

| Long-term financial issues | Short-term solution only |

Evaluate your financial stability before applying for an online personal loan. It’s crucial to ensure you can repay the amount borrowed.

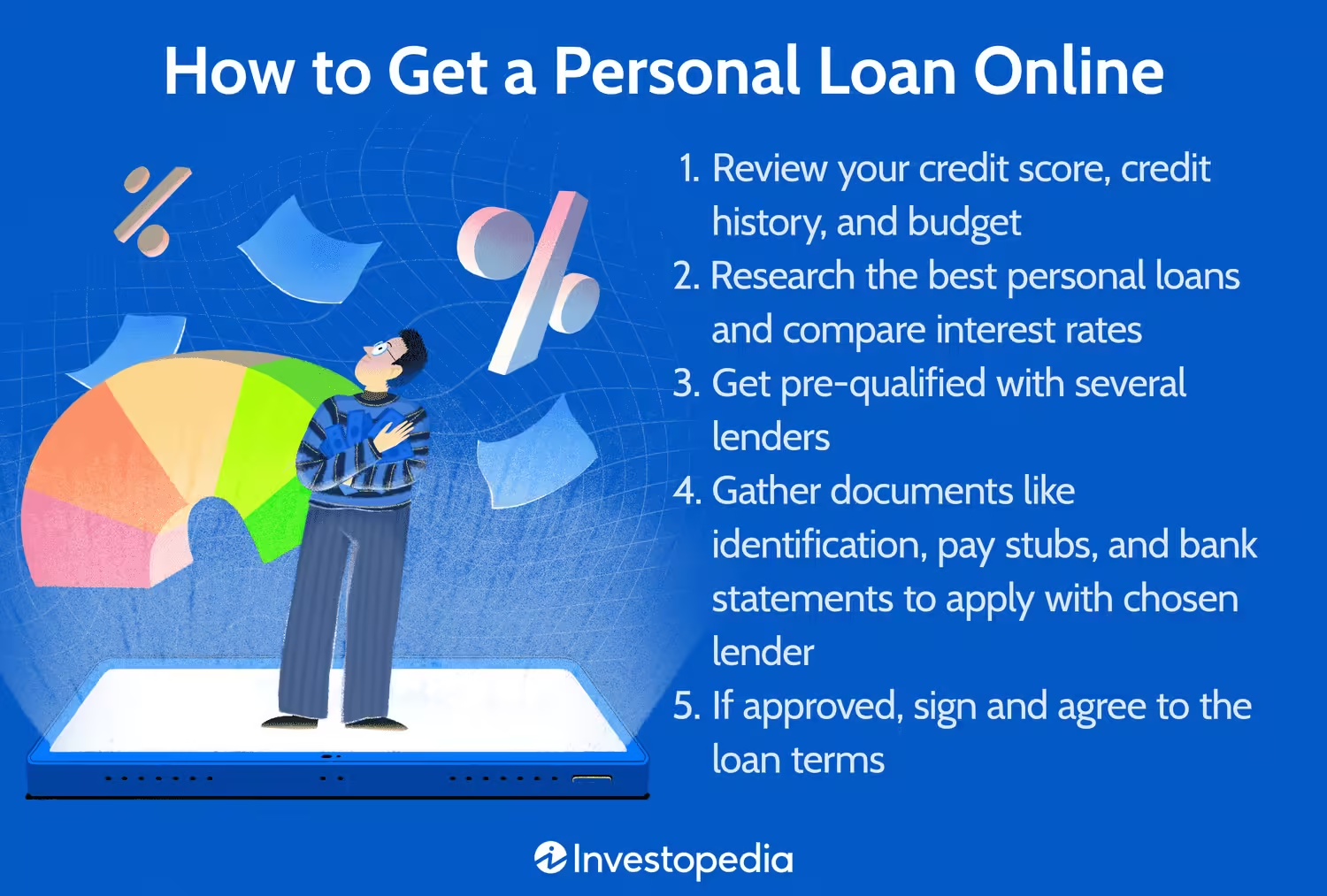

How To Apply For An Online Personal Loan

Applying for an online personal loan can be simple and quick. Understanding the process can help you get the funds you need without hassle. Follow this guide to learn how to apply for an online personal loan effectively.

Step-by-step Application Guide

Here is a step-by-step guide to help you through the application process:

- Choose a Lender: Research and select a reputable lender, like Upstart Personal Loans.

- Check Your Eligibility: Ensure you meet the lender’s eligibility criteria.

- Gather Required Documents: Collect all necessary documents and information.

- Complete the Application: Fill out the online application form on the lender’s website.

- Submit the Application: Review and submit your application.

- Wait for Approval: The lender will review your application and notify you of the decision.

- Receive Funds: If approved, the funds will be deposited into your account.

Documents And Information Needed

Having the right documents and information can speed up the application process. You will typically need:

- Personal Identification: Government-issued ID, such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Credit Information: Your credit score and history.

- Contact Information: Current address, phone number, and email.

- Employment Details: Employer’s name, your job title, and duration of employment.

Tips For A Successful Application

To increase your chances of approval, consider these tips:

- Maintain a Good Credit Score: Ensure your credit score is in good standing.

- Provide Accurate Information: Double-check your application for errors or omissions.

- Reduce Existing Debt: Lower your current debt to improve your debt-to-income ratio.

- Have a Stable Income: Demonstrate a consistent and reliable source of income.

- Follow Up: Contact the lender if you have not heard back within the expected timeframe.

By following these steps and tips, you can navigate the online personal loan application process with ease.

Frequently Asked Questions

What Are Online Personal Loans?

Online personal loans are loans you can apply for and receive online. They offer quick approval and funding. These loans are typically unsecured, meaning they don’t require collateral.

How Do I Apply For An Online Personal Loan?

To apply, visit a lender’s website, fill out an application form, and submit required documents. Approval and funding are usually quick.

Are Online Personal Loans Safe?

Yes, they are safe if you use reputable lenders. Ensure the website is secure. Check for customer reviews and ratings.

What Are The Benefits Of Online Personal Loans?

Online personal loans offer convenience, quick approval, and fast funding. They often have competitive interest rates. You can apply from anywhere.

Conclusion

Choosing the right online personal loan can be daunting. Upstart Personal Loans can help. They offer secure, easy-to-use loan services for your financial needs. Their security features ensure your information stays safe. You get peace of mind knowing your data is protected. Interested in learning more? Visit Upstart Personal Loans for details. Simplify your finances with a trusted loan provider. Take control of your financial future today.