Fast Personal Loans: Quick Cash Solutions for Your Needs

Fast personal loans can be a lifesaver when you need quick cash. They offer a simple solution to financial emergencies.

Imagine having the funds you need in just a few days or even hours. Personal loans are a flexible financial tool. Whether you need to cover unexpected medical bills, make urgent home repairs, or consolidate high-interest debt, a fast personal loan can help. Many lenders now offer quick approval processes, making it easier than ever to get the money you need. With so many options available, it’s important to choose a reliable lender. Upstart Personal Loans is one such option, providing quick and secure loans. Ready to learn more? Click here to explore Upstart Personal Loans.

Introduction To Fast Personal Loans

Fast personal loans provide quick access to funds for various needs. They are ideal for emergencies, unexpected expenses, or planned events. These loans offer a simple and fast application process. You receive the funds within a few days or even hours.

Understanding Fast Personal Loans

Fast personal loans are short-term loans. They are designed to provide immediate financial relief. The process is straightforward. You apply, get approved, and receive the money quickly. These loans are usually unsecured. This means you do not need to provide collateral. The interest rates may be higher compared to traditional loans. It is because the approval process is faster and less stringent.

Purpose And Benefits

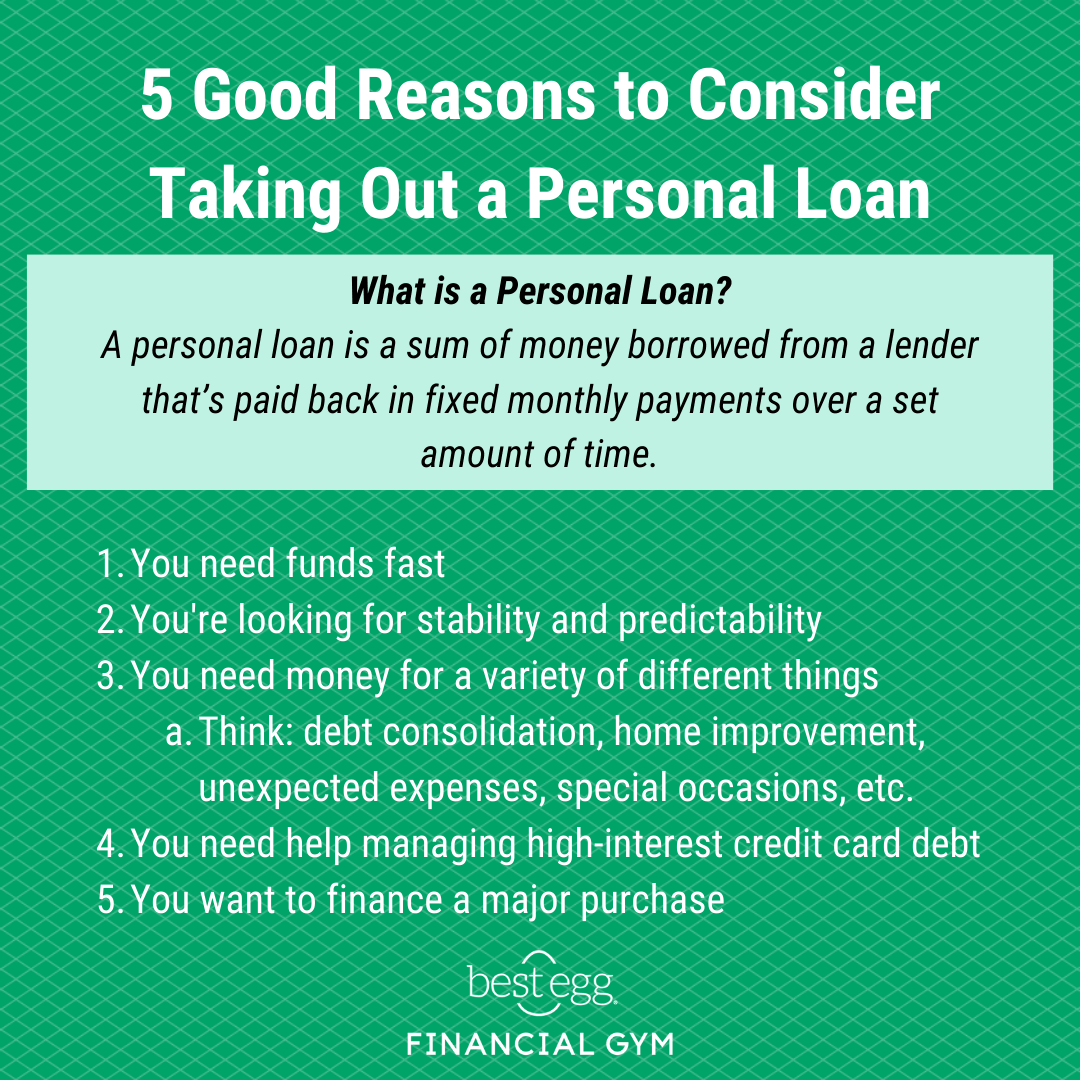

Fast personal loans serve multiple purposes. You can use them for:

- Emergency medical expenses

- Home repairs

- Car repairs

- Unexpected bills

- Travel expenses

The benefits of fast personal loans include:

| Benefit | Description |

|---|---|

| Quick Access to Funds | You receive the money within hours or days. |

| Easy Application Process | Applying for the loan is simple and straightforward. |

| No Collateral Required | You do not need to provide any assets as security. |

| Flexibility | You can use the funds for various needs. |

Fast personal loans offer a practical solution for urgent financial needs. They are accessible, flexible, and easy to obtain. Ensure you understand the terms and conditions before applying. This helps you manage your finances better and avoid potential pitfalls.

Key Features Of Fast Personal Loans

Fast personal loans provide the perfect solution for urgent financial needs. They offer quick access to funds, flexible repayment terms, and minimal paperwork. Here are some key features that make fast personal loans stand out:

Speedy Approval Process

One of the major benefits of fast personal loans is the quick approval process. Many lenders offer instant pre-approval within minutes. This ensures you get access to funds without long waiting times. The process is straightforward and designed to get you the money when you need it most.

Flexible Repayment Options

Fast personal loans come with flexible repayment terms. Borrowers can choose repayment plans that suit their financial situation. This flexibility allows you to manage your finances better and avoid defaulting on your loan.

| Repayment Option | Description |

|---|---|

| Monthly Payments | Make regular monthly payments over a set period |

| Bi-Weekly Payments | Make payments every two weeks to reduce interest |

| Lump Sum Payment | Pay off the loan in one large sum |

Minimal Documentation Required

Another advantage of fast personal loans is the minimal documentation. Traditional loans often require extensive paperwork, but fast personal loans streamline this process. Typically, you only need:

- Proof of identity (ID card, passport)

- Proof of income (pay stubs, bank statements)

- Credit score details

This minimal requirement speeds up the approval process and makes borrowing less stressful. It simplifies the entire experience, making it accessible even to those who may not have extensive financial records.

How Fast Personal Loans Work

Fast personal loans provide a quick and convenient way to access funds. These loans are designed for those who need money urgently and can be approved within a short time. Understanding the process and timeline is crucial for borrowers.

Application Process

The application process for fast personal loans is straightforward. Borrowers typically need to fill out an online application form. This form requires basic personal and financial information.

| Step | Description |

|---|---|

| 1 | Complete the online application form |

| 2 | Submit required documents (ID, proof of income) |

| 3 | Wait for the application review |

Borrowers may also need to provide additional documents. These can include bank statements and proof of employment.

Approval And Disbursement Timeline

The approval timeline for fast personal loans is usually very short. Most lenders review applications within a few hours. Some lenders can even provide instant approval.

- Approval Time: Typically within a few hours to one business day.

- Disbursement Time: Funds are often disbursed within 24 hours of approval.

Once approved, the funds are transferred directly to the borrower’s bank account. This swift process ensures that borrowers can access the funds they need without delay.

Fast personal loans are an excellent solution for urgent financial needs. By understanding the application and approval process, borrowers can make informed decisions and access funds quickly.

Pricing And Affordability

Understanding the pricing and affordability of fast personal loans is crucial. These loans offer quick access to funds, but you need to be aware of the costs involved. Let’s break down the key aspects of pricing and affordability.

Interest Rates And Fees

Fast personal loans often have varying interest rates and fees. The rates depend on your credit score, loan amount, and repayment term. Generally, interest rates for these loans range from 5% to 36%.

Additionally, some lenders may charge origination fees. These fees can be a percentage of the loan amount, typically ranging from 1% to 8%.

Other possible fees include:

- Late payment fees

- Prepayment penalties

- Administrative fees

Comparing Costs With Other Loan Types

When comparing fast personal loans with other loan types, consider the following:

| Loan Type | Average Interest Rate | Fees | Repayment Terms |

|---|---|---|---|

| Fast Personal Loans | 5% – 36% | 1% – 8% origination fees, other possible fees | 1 to 5 years |

| Credit Cards | 15% – 25% | Annual fees, late payment fees | Revolving |

| Home Equity Loans | 3% – 8% | Appraisal fees, closing costs | 5 to 30 years |

| Payday Loans | 200% – 400% | Flat fees per $100 borrowed | 2 weeks to 1 month |

Fast personal loans can be more affordable than payday loans but may have higher interest rates than home equity loans. Always evaluate your options and choose the loan that best fits your financial situation.

Pros And Cons Of Fast Personal Loans

Fast personal loans can be a lifesaver when you need quick cash. Before deciding, it’s important to understand their advantages and disadvantages.

Advantages

Quick Approval: Fast personal loans usually have a quick approval process. This is great for urgent financial needs.

Easy Application: The application process is straightforward. Most lenders offer online applications.

No Collateral Needed: These loans are typically unsecured. You don’t need to put up any assets as collateral.

Flexible Use: You can use the money for various purposes. This includes medical bills, travel, or home repairs.

Disadvantages

High Interest Rates: Fast personal loans often come with high interest rates. This makes them more expensive in the long run.

Short Repayment Terms: These loans usually need to be repaid quickly. Short terms can lead to higher monthly payments.

Fees and Penalties: There may be additional fees. Late payment penalties can also add up.

Impact on Credit Score: Missing payments can affect your credit score. This may make future borrowing more difficult.

Ideal Scenarios For Using Fast Personal Loans

Fast personal loans can be a lifeline in various financial situations. Knowing when to use them can help you make the most of this financial tool. Here are some ideal scenarios:

Emergency Expenses

Life is unpredictable. Unexpected medical bills or car repairs can arise. Fast personal loans offer quick access to funds. These loans can cover urgent expenses without delay. By providing quick funding, they help you address emergencies promptly.

Debt Consolidation

Managing multiple debts can be stressful. Fast personal loans can consolidate your debts into one payment. This simplifies your financial obligations. With lower interest rates, you can save money over time. Additionally, one monthly payment is easier to manage.

Unplanned Financial Needs

Sometimes, unexpected expenses pop up. A broken appliance or sudden travel can disrupt your budget. Fast personal loans provide the funds you need quickly. They help you manage these unplanned expenses without stress.

By understanding when to use fast personal loans, you can make smart financial decisions. Whether for emergencies, debt consolidation, or unplanned needs, these loans offer a quick solution.

Recommendations For Potential Borrowers

Fast personal loans can be a great solution for those needing quick cash. However, it’s crucial to understand who should consider these loans and how to choose the right provider. Below are some recommendations for potential borrowers.

Who Should Consider Fast Personal Loans

Fast personal loans are ideal for individuals facing urgent financial needs. These loans are suitable for:

- Emergency Expenses: Medical bills, car repairs, or urgent home repairs.

- Debt Consolidation: Combining multiple debts into a single, manageable payment.

- Unexpected Travel: Last-minute travel plans or family emergencies.

Fast personal loans should be considered by those who can repay the loan quickly. Borrowers with a stable income and a good credit score might find favorable terms.

Tips For Choosing The Right Loan Provider

Choosing the right loan provider is crucial for a smooth borrowing experience. Here are some tips to help you make an informed decision:

| Criteria | Details |

|---|---|

| Interest Rates | Compare the interest rates offered by different providers. Look for the lowest rates. |

| Fees and Charges | Check for any hidden fees or charges. Understand the total cost of the loan. |

| Repayment Terms | Ensure the repayment terms are flexible and suit your financial situation. |

| Customer Reviews | Read customer reviews and ratings to gauge the provider’s reputation. |

| Customer Support | Choose a provider that offers excellent customer support. |

Researching and comparing different loan providers can help you find the best option. Opt for reputable providers with transparent terms and conditions.

Frequently Asked Questions

What Are Fast Personal Loans?

Fast personal loans are loans that are approved and disbursed quickly. They help cover urgent financial needs. Most lenders approve these loans within a day.

How Do Fast Personal Loans Work?

Fast personal loans involve a quick application process. Lenders review your application swiftly. Once approved, funds are disbursed within 24 hours.

Are Fast Personal Loans Safe?

Fast personal loans are generally safe if obtained from reputable lenders. Always verify the lender’s credibility. Read the loan terms carefully before committing.

What Is The Eligibility For Fast Personal Loans?

Eligibility criteria vary by lender. Generally, applicants need a stable income, good credit score, and valid identification. Check specific lender requirements.

Conclusion

Fast personal loans provide a quick solution to urgent financial needs. They offer convenience and speed. Upstart Personal Loans is a great option. You can explore more at Upstart Personal Loans. This platform connects you with potential investors. It ensures secure transactions. It is easy to use and manage. Whether you need funds or wish to invest, Upstart is worth considering. Always assess your needs carefully before making a decision.