Pre-Qualified Personal Loans: Unlock Your Financial Freedom Today

Pre-qualified personal loans offer a straightforward way to get funds quickly. These loans can simplify your financial planning and provide peace of mind.

In today’s financial landscape, securing the right loan can be challenging. Pre-qualified personal loans help by giving you an idea of what you might be eligible for without affecting your credit score. They save time and reduce uncertainty. With options like Upstart Personal Loans, you can explore personalized loan offers based on your unique profile. This approach ensures you find a loan that fits your needs and budget. Learn how you can benefit from pre-qualified personal loans and make informed decisions for your financial future. For more information, explore Upstart Personal Loans today.

Introduction To Pre-qualified Personal Loans

Pre-qualified personal loans offer a convenient way to understand your eligibility before applying. This process helps streamline your financial planning and ensures you are applying for loans within your reach. Let’s dive deeper into what pre-qualified personal loans are and why pre-qualification matters.

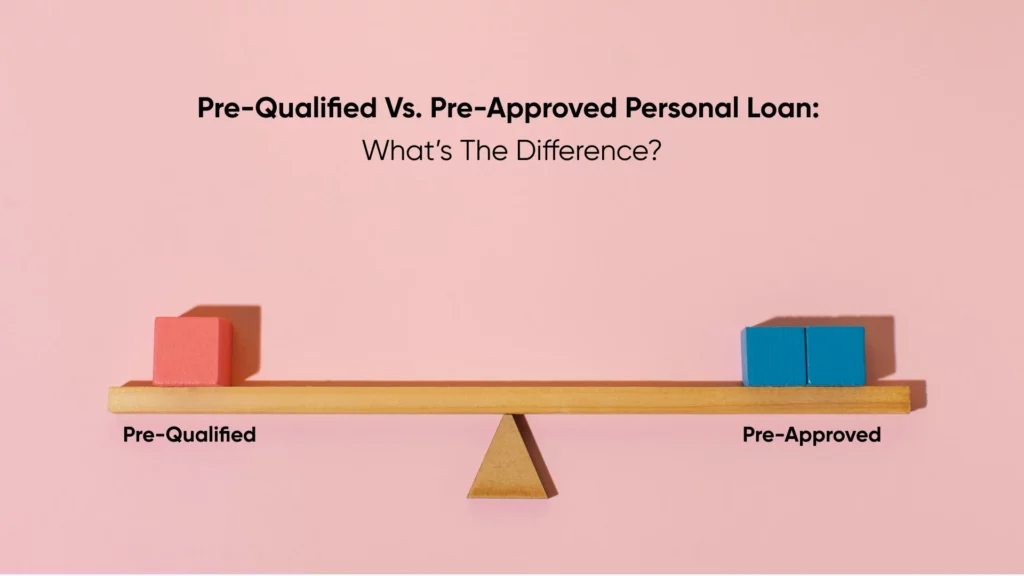

What Are Pre-qualified Personal Loans?

Pre-qualified personal loans provide an initial assessment of your eligibility for a loan. Lenders review your financial information to determine if you meet their basic criteria. This assessment does not guarantee approval, but it gives you an idea of your potential loan amount and terms.

Key Points:

- Initial assessment of eligibility

- Non-binding and does not affect your credit score

- Provides an estimated loan amount and terms

Why Pre-qualification Matters

Pre-qualification is crucial for several reasons. It helps you understand your borrowing capacity without impacting your credit score. You can compare different lenders and their offers. This process also saves time by narrowing down your options to loans you are likely to get approved for.

Benefits of Pre-Qualification:

- Understand your loan eligibility

- Compare multiple offers

- Save time and effort

- Plan your finances better

Key Features Of Pre-qualified Personal Loans

Pre-qualified personal loans offer several benefits that make them an attractive option for many borrowers. Understanding these key features can help you make an informed decision.

No Impact On Credit Score

One of the most significant advantages of pre-qualified personal loans is that they have no impact on your credit score. Lenders perform a soft credit check, which does not affect your credit score. This allows you to explore loan options without worrying about damaging your credit.

Quick And Easy Application Process

The application process for pre-qualified personal loans is designed to be quick and easy. Typically, you can complete the application online in just a few minutes. Here’s what you can expect:

- Fill out a simple form with basic personal and financial information.

- Receive a list of pre-qualified loan offers almost instantly.

- Choose the loan that best fits your needs and complete the formal application.

Tailored Loan Offers

Pre-qualified personal loans provide tailored loan offers based on your financial profile. This means that you will receive loan offers that are most likely to be approved, saving you time and effort. These offers consider factors such as:

- Credit score

- Income

- Debt-to-income ratio

Competitive Interest Rates

Pre-qualified personal loans often come with competitive interest rates. Lenders aim to attract qualified borrowers by offering favorable rates. This can result in significant savings over the life of the loan. Here’s a quick comparison of potential interest rates:

| Credit Score Range | Estimated Interest Rate |

|---|---|

| Excellent (720-850) | 5.99% – 11.99% |

| Good (690-719) | 12.00% – 15.99% |

| Fair (630-689) | 16.00% – 23.99% |

| Poor (300-629) | 24.00% and above |

By comparing these rates, you can find a loan that fits your financial situation.

Considering these key features, pre-qualified personal loans can be a smart choice for those seeking fast, convenient, and tailored financing options.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of Upstart Personal Loans can help you make informed decisions. This section breaks down the key aspects of interest rates, fee structures, and repayment terms to provide a clear picture of what to expect.

Interest Rates Overview

Interest rates are a critical factor in determining the total cost of a personal loan. Upstart Personal Loans offer competitive rates based on several factors:

- Credit Score: Higher scores typically result in lower rates.

- Loan Amount: Larger loans may have different rates.

- Loan Term: Shorter terms may offer lower rates.

Here’s a table to give an overview of potential interest rates:

| Credit Score Range | Interest Rate Range |

|---|---|

| Excellent (750+) | 5.99% – 10.99% |

| Good (700-749) | 11.00% – 15.99% |

| Fair (650-699) | 16.00% – 20.99% |

| Poor (600-649) | 21.00% – 29.99% |

Fee Structures Explained

Upstart Personal Loans come with various fees that you should be aware of:

- Origination Fee: A one-time fee charged at the start of the loan, typically between 0.5% and 8% of the loan amount.

- Late Payment Fee: This fee is charged if you miss a payment. It usually ranges from $15 to $30.

- Prepayment Penalty: Upstart does not charge a fee for paying off your loan early.

Understanding these fees can help you budget accordingly and avoid surprises.

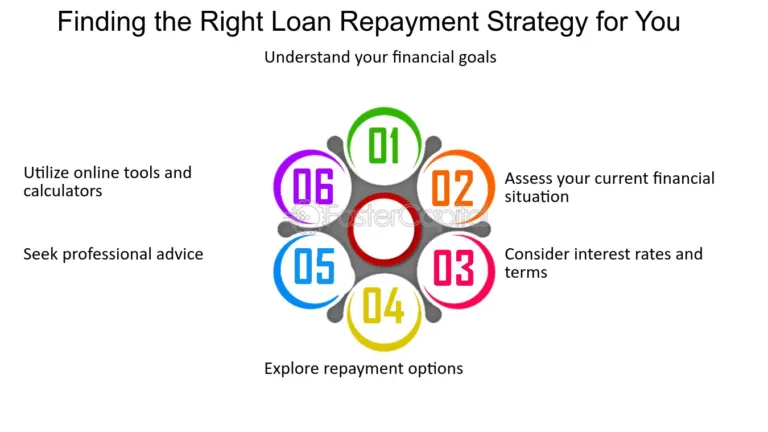

Repayment Terms And Flexibility

Repayment terms for Upstart Personal Loans are designed to offer flexibility:

- Loan Terms: You can choose between 3-year and 5-year terms.

- Monthly Payments: Fixed monthly payments ensure predictability in budgeting.

- Payment Flexibility: Upstart allows you to change your payment date if needed, subject to certain conditions.

Choosing the right term and understanding the payment structure can help you manage your finances better.

Pros And Cons Of Pre-qualified Personal Loans

Pre-qualified personal loans can be a great solution for many. Understanding their pros and cons is essential. This section will help you make an informed decision.

Advantages Of Pre-qualified Personal Loans

Pre-qualified personal loans offer several benefits. Here are some of the key advantages:

- Quick Process: You get an idea of the loan amount you may qualify for quickly.

- No Impact on Credit Score: The pre-qualification process usually involves a soft credit check, which doesn’t affect your credit score.

- Better Comparison: You can compare loan offers from different lenders without multiple hard inquiries on your credit report.

- Informed Decision: Knowing potential loan terms in advance helps you make a more informed borrowing decision.

Potential Drawbacks To Consider

While there are advantages, pre-qualified personal loans also come with some drawbacks. Here are a few potential issues to be aware of:

- Not a Guarantee: Pre-qualification does not guarantee loan approval or the terms offered. Final approval may vary based on a full credit check.

- Limited Offers: Some lenders may not provide pre-qualification offers, limiting your options.

- Possible Fees: Pre-qualified loans might come with origination fees or other costs that can affect the total loan amount.

- Interest Rates: The interest rate offered during pre-qualification may change upon final approval, potentially increasing your borrowing costs.

Specific Recommendations For Ideal Users

Pre-qualified personal loans offer several advantages for specific users. These loans are ideal for individuals who need quick access to funds, have a good credit score, or require a predictable repayment plan. Below are detailed insights into the best scenarios for using pre-qualified personal loans and who should avoid them.

Best Scenarios For Using Pre-qualified Personal Loans

Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single pre-qualified loan can simplify your finances. This approach often results in a lower interest rate, saving you money in the long run.

Home Improvement: Planning a renovation or need to make urgent repairs? A pre-qualified personal loan can provide the necessary funds quickly, helping you enhance your home’s value and comfort.

Medical Expenses: Unexpected medical bills can be overwhelming. A pre-qualified personal loan can cover these costs, ensuring you get the care you need without financial stress.

Major Purchases: Whether it’s a new appliance, a vehicle, or even a dream vacation, pre-qualified loans offer a straightforward way to finance significant purchases without tapping into your savings.

Who Should Avoid Pre-qualified Personal Loans?

Individuals with Poor Credit: If your credit score is low, pre-qualified personal loans may come with high interest rates. In this case, improving your credit score before applying could be more beneficial.

Uncertain Employment: If your job situation is unstable, taking on new debt can be risky. Ensure you have a stable income to manage loan repayments effectively.

Existing High Debt Load: If you already have significant debt, adding another loan could strain your finances. Prioritize paying off existing debts first.

Short-Term Needs: For short-term financial needs, other options like credit cards might be more suitable. Personal loans are better for long-term financing.

Conclusion: Unlock Your Financial Freedom Today

Unlock your financial freedom with Upstart Personal Loans. These loans offer a streamlined process for securing the funds you need. Whether you seek to consolidate debt, finance a major purchase, or cover unexpected expenses, Upstart Personal Loans can help.

Summary Of Benefits

| Benefit | Details |

|---|---|

| Flexible Loan Amounts | Choose loan amounts that suit your needs. |

| Competitive Interest Rates | Benefit from rates that are tailored to your credit profile. |

| Quick Approval | Get approved faster with a user-friendly application process. |

| No Prepayment Penalties | Repay your loan early without extra fees. |

Final Thoughts And Next Steps

Upstart Personal Loans can be your gateway to financial freedom. With flexible terms and competitive rates, these loans are designed with your needs in mind. The process is simple and fast, ensuring you get the funds you need without hassle.

To take the next step, visit the Upstart Personal Loans page. Start your application and unlock your financial freedom today.

Frequently Asked Questions

What Are Pre-qualified Personal Loans?

Pre-qualified personal loans are offers based on your credit profile. They don’t guarantee approval. They give an estimate of loan terms you may receive.

How To Get Pre-qualified For A Personal Loan?

To get pre-qualified, provide basic information to lenders. They will perform a soft credit check. This won’t affect your credit score.

Do Pre-qualified Personal Loans Affect Credit Score?

Pre-qualified personal loans don’t affect your credit score. Lenders perform a soft inquiry, which doesn’t impact your credit rating.

Are Pre-qualified Personal Loans Guaranteed?

Pre-qualified personal loans are not guaranteed. Final approval depends on a detailed review of your credit and financial information.

Conclusion

Pre-qualified personal loans offer a straightforward path to financial support. They streamline the loan process and can save time. With Upstart Personal Loans, getting started is easy. Enjoy a user-friendly experience and secure transactions. Visit the Upstart Personal Loans page to learn more. Access financial help without the hassle and move forward with confidence.