Quick Loan Approval: Fast and Easy Financing Solutions

Need a quick loan approval? You’re not alone.

Many people seek fast solutions to financial needs. Getting a loan approved quickly can be a game-changer, especially when urgent expenses arise. Traditional loan processes can be slow and cumbersome. Fortunately, platforms like Upstart Personal Loans offer a streamlined approach. Upstart connects you with potential lenders, speeding up the approval process. It’s designed for those who need funds without the usual hassle. Read on to learn how this platform can help you secure a loan swiftly and efficiently. With Upstart, quick loan approval is within reach. Discover more about Upstart Personal Loans and start your application today. Click here to explore how Upstart can meet your financial needs.

Introduction To Quick Loan Approval

Quick loan approval is vital for those who need funds immediately. The process helps individuals and businesses obtain necessary financing without the usual long wait times. This section will explore the need for fast financing and provide an overview of quick loan approval solutions.

Understanding The Need For Fast Financing

There are many situations where fast financing is crucial:

- Emergency expenses

- Unexpected medical bills

- Home or car repairs

- Business opportunities

In such cases, waiting for traditional loan approval isn’t practical. Quick loan approval provides a solution, ensuring funds are available when needed most.

Overview Of Quick Loan Approval Solutions

Several platforms offer quick loan approval solutions. Among these is Upstart Personal Loans. This platform simplifies the loan application process, providing fast access to funds.

Key features of Upstart Personal Loans include:

| Feature | Description |

|---|---|

| User-friendly interface | Easy to navigate for both startups and backers |

| Secure platform | Ensures safe transactions |

| Easy login process | Simple for registered users |

Benefits of using Upstart Personal Loans:

- Helps startups secure necessary funding

- Provides a space for backers to discover and invest in new opportunities

- Enhances growth potential for emerging businesses

Quick loan approval solutions like Upstart Personal Loans ensure that financial help is available swiftly and securely.

Key Features Of Quick Loan Approval

Quick loan approval is essential for those who need funds fast. Understanding the key features can help you make an informed decision. Below, we discuss some of the standout features of quick loan approval processes.

Instant Application Process

With Upstart Personal Loans, the application process is instant and user-friendly. You can complete the entire application online, making it convenient and time-saving. The platform is designed to be intuitive, ensuring that even first-time users can navigate through the process without any hassle.

Minimal Documentation Required

One of the significant advantages of quick loan approval is the requirement for minimal documentation. Unlike traditional loans, which require extensive paperwork, Upstart Personal Loans only need basic identification and financial information. This streamlines the process, allowing you to get approved faster.

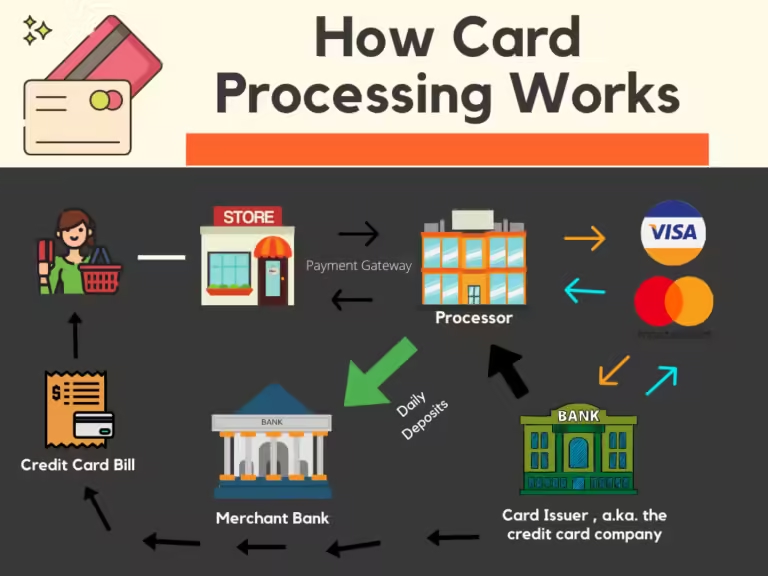

Automated Credit Check

Automated credit checks are another key feature of Upstart Personal Loans. The system automatically reviews your credit history and assesses your eligibility in real-time. This eliminates the need for manual checks, reducing the approval time significantly.

Rapid Disbursement Of Funds

Once approved, funds are disbursed rapidly. With Upstart Personal Loans, you can expect to receive the funds in your account within a short period. This quick disbursement is crucial for those who need immediate financial assistance.

| Feature | Details |

|---|---|

| Instant Application Process | Complete online in minutes |

| Minimal Documentation Required | Only basic documents needed |

| Automated Credit Check | Real-time credit assessment |

| Rapid Disbursement of Funds | Funds available shortly after approval |

These features make Upstart Personal Loans a preferred choice for quick loan approval. They ensure a seamless and swift process, providing you with the funds you need without delay.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of Upstart Personal Loans is crucial for prospective borrowers. This section will delve into the various aspects of costs, including interest rates, processing fees, and hidden charges. Detailed insights help you make informed decisions about your financial needs.

Interest Rates Comparison

Interest rates are one of the most significant factors when evaluating loan affordability. Upstart Personal Loans offer competitive interest rates, making them a viable option for many borrowers. The rates may vary based on your credit score, loan amount, and term length.

| Credit Score Range | Interest Rate Range |

|---|---|

| Excellent (720-850) | 5% – 8% |

| Good (690-719) | 8% – 12% |

| Fair (630-689) | 12% – 16% |

| Poor (300-629) | 16% – 30% |

Comparing these rates with other lenders can highlight Upstart’s competitive advantage. Lower rates can lead to significant savings over the loan term.

Processing Fees

Processing fees are often overlooked but can impact the overall cost of your loan. Upstart Personal Loans typically charge a processing fee that is deducted from your loan amount before disbursement.

- Origination Fee: 0% – 8% of the loan amount

- Late Payment Fee: $15 or 5% of the unpaid amount, whichever is higher

- Return Payment Fee: $15 per occurrence

Understanding these fees helps you anticipate the actual amount you will receive and manage your repayments effectively.

Hidden Charges And Transparency

Transparency in loan terms is essential to avoid unexpected costs. Upstart Personal Loans are known for their clear and upfront disclosure of fees. There are no hidden charges, ensuring that you know exactly what you are getting into.

Key points to consider:

- All fees are disclosed during the application process.

- No prepayment penalties, allowing you to pay off your loan early without extra costs.

- Detailed loan agreement provided, outlining all terms and conditions.

This level of transparency builds trust and helps you plan your finances better.

Pros And Cons Of Quick Loan Approval

Quick loan approval can be a game-changer for many. It offers convenience and speed, but it’s important to weigh both the advantages and potential drawbacks. Understanding these factors can help you make an informed decision.

Advantages Of Quick Loan Approval

Quick loan approval offers several benefits:

- Fast Access to Funds: You get the money you need quickly, often within a day.

- Convenience: The application process is usually straightforward and online.

- Emergency Situations: Ideal for urgent financial needs such as medical bills or urgent repairs.

- Less Documentation: Minimal paperwork compared to traditional loans.

- Flexible Usage: Use the funds for various personal expenses, from home improvements to debt consolidation.

Potential Drawbacks To Consider

While quick loan approval has its perks, there are some downsides:

- Higher Interest Rates: Quick loans often come with higher interest rates, increasing the overall cost.

- Shorter Repayment Terms: You might have less time to repay the loan, which could strain your finances.

- Hidden Fees: Some lenders may charge additional fees, so it’s crucial to read the fine print.

- Impact on Credit Score: Missing payments can negatively affect your credit score.

- Potential for Debt Cycle: The ease of obtaining these loans can lead to a cycle of debt if not managed properly.

Evaluating the pros and cons of quick loan approval can guide you in making a smart financial choice. Always consider your financial situation and read the terms carefully before proceeding.

| Advantages | Potential Drawbacks |

|---|---|

| Fast Access to Funds | Higher Interest Rates |

| Convenience | Shorter Repayment Terms |

| Emergency Situations | Hidden Fees |

| Less Documentation | Impact on Credit Score |

| Flexible Usage | Potential for Debt Cycle |

Specific Recommendations For Ideal Users

Quick loan approval can be a lifesaver in various situations. It’s important to know if you are an ideal user for such services. Here are some specific recommendations for different user categories.

For Emergencies And Unexpected Expenses

Emergencies can strike at any time. Quick loan approval can help you handle sudden medical bills, car repairs, or urgent home fixes. This can provide peace of mind when you need it most.

- Fast access to funds

- Minimal paperwork

- Immediate relief from financial stress

For Small Business Owners

Small business owners often need quick cash for various reasons. Whether it’s for purchasing inventory, dealing with unexpected costs, or expanding the business, quick loans can be very beneficial.

| Benefit | Details |

|---|---|

| Fast Funding | Enables immediate business operations |

| Simple Application | Less time spent on paperwork |

| Flexible Use | Funds can be used for various needs |

For Individuals With Poor Credit History

Getting a loan with a poor credit history can be challenging. Quick loan approval services like Upstart Personal Loans may offer you a chance even with a less-than-perfect credit score.

- Consider alternative credit data

- May have higher interest rates

- Opportunity to rebuild credit

Upstart Personal Loans can be a viable option. Their user-friendly interface and secure platform make the process easier. Visit their website for more details: Upstart Personal Loans.

Frequently Asked Questions

How To Get Quick Loan Approval?

To get quick loan approval, ensure all documents are ready. Have a good credit score and stable income.

What Factors Affect Quick Loan Approval?

Factors include your credit score, income stability, and debt-to-income ratio. Ensure all documents are accurate.

Can I Get A Quick Loan With Bad Credit?

Yes, it’s possible. However, interest rates may be higher. Consider lenders specializing in bad credit loans.

How Long Does Quick Loan Approval Take?

Quick loan approval can take as little as 24 hours. It depends on the lender and your preparedness.

Conclusion

Securing a quick loan approval can simplify your financial journey. Upstart Personal Loans offer a straightforward and efficient process. Ideal for those seeking fast funding. The user-friendly interface makes it easy. Safe transactions ensure your peace of mind. Ready to take the next step? Explore Upstart Personal Loans today. Click here to learn more. Simplify your funding with Upstart.