Credit Card Application Process: Simplified Steps to Approval

Applying for a credit card can seem overwhelming at first. But understanding the steps can make it easier.

The credit card application process involves several important steps. From choosing the right card to submitting your application, each phase requires careful attention. Understanding these steps can help you secure the card that best fits your needs. Whether it’s your first time applying or you’re looking to expand your financial options, knowing what to expect can save time and reduce stress. Ready to dive into the process? Let’s explore how you can navigate it smoothly and find the best credit card for your lifestyle. For personal loans and more financial options, consider Upgrade.

Introduction To The Credit Card Application Process

Applying for a credit card can seem like a daunting task, but understanding the process can make it much easier. This guide will break down the steps and help you understand what to expect.

Understanding The Importance Of Credit Cards

Credit cards are more than just a convenient way to make purchases. They offer numerous benefits:

- Build Credit: Using a credit card responsibly can help you build a strong credit history.

- Rewards: Many credit cards offer rewards like cashback, points, or travel miles.

- Protection: Credit cards often come with fraud protection and purchase insurance.

Having a credit card can also provide a financial cushion in emergencies. It is essential to use them wisely to avoid debt.

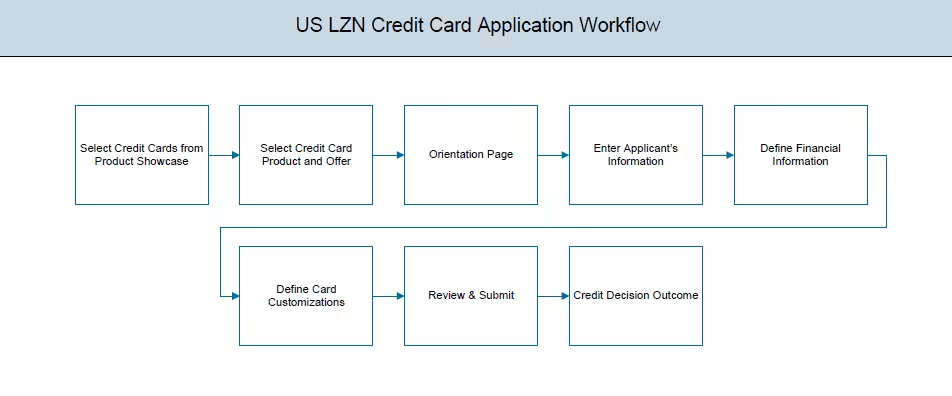

Overview Of The Application Process

The credit card application process typically involves several key steps:

- Research: Compare different credit card options to find the best fit for your needs.

- Check Eligibility: Ensure you meet the credit score and income requirements of the card you choose.

- Gather Documents: Prepare necessary documents like your identification, proof of income, and employment details.

- Submit Application: Fill out the application form with accurate information and submit it.

- Wait for Approval: The bank will review your application and decide whether to approve or deny it. This can take a few days to a couple of weeks.

- Receive Card: If approved, you will receive your credit card by mail. Activate it and start using it wisely.

By following these steps, you can ensure a smooth application process and increase your chances of approval.

Credit: docs.oracle.com

Preparing For Your Credit Card Application

Getting ready to apply for a credit card involves several steps. Proper preparation increases your chances of approval. This section will guide you through the essential steps.

Checking Your Credit Score

Your credit score is a key factor in the approval process. Lenders use it to gauge your creditworthiness. Here’s how you can check it:

- Request a free credit report from Annual Credit Report.

- Use credit monitoring services to keep track of your score.

- Ensure there are no errors in your report. Dispute any inaccuracies promptly.

Knowing your credit score helps you understand which credit cards you qualify for. It also helps you avoid unnecessary rejections.

Gathering Necessary Documentation

To complete your credit card application, you need to provide specific documents. Here’s what you need to gather:

| Documentation | Details |

|---|---|

| Proof of Identity | Driver’s license, passport, or state ID |

| Proof of Income | Recent pay stubs, tax returns, or bank statements |

| Proof of Address | Utility bills, lease agreement, or mortgage statement |

Having these documents ready speeds up the application process. It also shows the lender that you are a responsible borrower.

Choosing The Right Credit Card

Choosing the right credit card can be a daunting task. There are numerous factors to consider, including your financial needs, the terms of different credit cards, and the benefits they offer. This section will help you make an informed decision by evaluating your financial requirements and comparing different credit card offers.

Evaluating Your Financial Needs

Before applying for a credit card, it is crucial to assess your financial situation. Here are some key points to consider:

- Monthly Expenses: Understand your monthly spending habits and budget.

- Credit Score: Check your credit score, as it affects your eligibility.

- Income: Your income level can determine the type of credit card you qualify for.

- Debt: Assess your existing debt and how a new credit card will impact it.

By evaluating these factors, you can narrow down your options to credit cards that best suit your financial needs.

Comparing Different Credit Card Offers

Once you have assessed your financial needs, it’s time to compare different credit card offers. Here are some features to look for:

| Feature | Description |

|---|---|

| APR | The Annual Percentage Rate affects your interest payments. |

| Fees | Check for annual fees, late fees, and other charges. |

| Rewards | Look for cashback, points, or travel rewards. |

| Credit Limit | The maximum amount you can borrow on the card. |

Comparing these features will help you find a credit card that offers the best value for your needs. For example, if you prefer rewards, look for a card with cashback or points. If you want to save on interest, consider a card with a low APR.

In summary, choosing the right credit card involves evaluating your financial needs and comparing different offers. By focusing on key features like APR, fees, rewards, and credit limits, you can find a card that meets your requirements and helps you manage your finances effectively.

The Application Process: Step-by-step Guide

Applying for a credit card can seem overwhelming, but it doesn’t have to be. In this guide, we’ll walk you through each step of the application process. From filling out the form to submitting your application, we’ve got you covered.

Filling Out The Application Form

The first step in applying for a credit card is to fill out the application form. This form will ask for basic personal information such as your name, address, and social security number.

Here’s a list of common details you’ll need to provide:

- Full Name: As it appears on your government-issued ID.

- Address: Your current residential address.

- Social Security Number: To verify your identity and check your credit history.

- Income: Your annual income before taxes.

- Employment Status: Whether you are employed, self-employed, or unemployed.

Make sure all the information is accurate. Double-check for any errors to avoid delays in your application.

Submitting Your Application

Once you’ve completed the application form, the next step is to submit it. Most credit card applications can be submitted online for convenience. Ensure you review all the information before hitting the submit button.

Here’s what to do next:

- Review Your Information: Double-check all details for accuracy.

- Agree to Terms and Conditions: Read and accept the terms and conditions of the credit card.

- Submit the Application: Click the submit button to send your application for review.

After submitting, you may receive an instant decision, or it may take a few days. If approved, you will receive your new credit card in the mail.

Remember, the approval process may vary based on the credit card issuer’s policies.

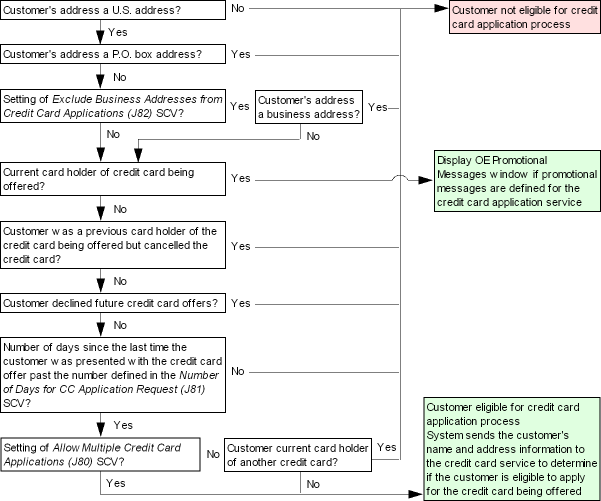

Understanding The Approval Process

Applying for a credit card can be a straightforward process. Yet, understanding how the approval process works can help you manage expectations. Let’s explore what happens after you submit your application and the factors that influence approval.

What Happens After Submission

Once you submit your credit card application, it goes through several steps:

- Initial Review: The credit card issuer reviews your application for completeness.

- Credit Check: They perform a credit check to understand your credit history.

- Verification: They verify your personal and financial information.

- Decision: Based on the above steps, they make a decision to approve or decline.

During the initial review, the issuer checks if all required fields are filled. They then perform a credit check to see your credit score and history. If your credit score is high, your chances of approval are better. Next, they verify the details you provided. This can include your employment status and income. Finally, they make a decision. If approved, you will receive your credit card in the mail.

Factors That Influence Approval

Several factors can influence whether your application gets approved:

| Factor | Importance |

|---|---|

| Credit Score | High credit scores increase approval chances. |

| Income | Stable income demonstrates repayment ability. |

| Debt-to-Income Ratio | Lower ratios indicate better financial health. |

| Credit History | Long, positive credit history is favorable. |

Your credit score is a key factor. Higher scores generally mean better chances. Your income also plays a role. Lenders want to see that you can repay your debts. A low debt-to-income ratio is another positive sign. It shows you manage debt well. Lastly, a long and positive credit history can significantly boost your approval chances.

Credit: www.researchgate.net

Tips For Increasing Your Chances Of Approval

Applying for a credit card can be an exciting yet daunting process. Boosting your approval chances requires strategic planning and careful consideration. Below are some actionable tips to help you get approved.

Improving Your Credit Score

Your credit score plays a crucial role in the approval process. Here are some steps to improve it:

- Check your credit report: Obtain a free copy and review it for errors.

- Pay bills on time: Timely payments have a significant impact on your score.

- Reduce debt: Lowering your credit card balances can improve your score.

- Avoid new debt: Limit applications for new credit until your score improves.

Choosing The Right Time To Apply

Timing your application is essential. Consider these factors:

| Factor | Why It Matters |

|---|---|

| Credit Utilization | Apply when your credit utilization is low to show responsible use. |

| Recent Credit Inquiries | Too many inquiries can lower your score. Space out your applications. |

| Financial Stability | Ensure a steady income and employment history to improve your chances. |

By following these tips, you increase your chances of getting approved for a credit card.

Common Mistakes To Avoid During Application

Applying for a credit card can be a daunting process. Many applicants make mistakes that could be avoided with a bit of preparation. Here, we will discuss some common mistakes to avoid during your credit card application process.

Providing Inaccurate Information

One of the most common mistakes is providing inaccurate information on your application. This can include incorrect income details, employment status, or personal information. Such errors can lead to your application being rejected or delayed.

- Double-check all the information before submitting the application.

- Ensure your income details match your official documents.

- Verify your employment status and contact information are correct.

Accurate information increases your chances of approval and helps avoid unnecessary complications.

Ignoring Credit Card Terms And Conditions

Many applicants ignore the terms and conditions of the credit card they are applying for. This can lead to unexpected fees or unfavorable terms.

- Read the terms and conditions carefully.

- Understand the APR, fees, and repayment terms.

- Look for any hidden charges or penalties.

Knowing the terms and conditions helps you make an informed decision and avoid future surprises.

| Key Term | Explanation |

|---|---|

| APR | Annual Percentage Rate, the interest rate for borrowing. |

| Fees | Charges that may apply, such as annual fees, late fees, etc. |

| Repayment Terms | Duration and conditions for repaying the borrowed amount. |

By avoiding these common mistakes, you can streamline your credit card application process and improve your chances of approval. Remember to provide accurate information and thoroughly review the terms and conditions of the credit card you are applying for.

Credit: www.researchgate.net

What To Do If Your Application Is Denied

Getting denied for a credit card can be disappointing. But it’s not the end of the road. Understanding the reasons and taking the right steps can help you improve your chances for future applications.

Understanding The Reasons For Denial

Credit card issuers may deny applications for several reasons. Common reasons include:

- Low credit score

- High debt-to-income ratio

- Recent late payments or defaults

- Insufficient income

- Too many recent credit inquiries

Each reason affects your credit profile differently. It’s crucial to identify the exact reason for your denial. Request a detailed explanation from the issuer. This will guide your next steps.

Steps To Take After A Denial

Once you understand why your application was denied, take these steps to improve your credit profile:

- Review Your Credit Report: Obtain a copy of your credit report from the three major bureaus: Equifax, Experian, and TransUnion. Look for errors or inaccuracies that may have impacted your score.

- Improve Your Credit Score: Pay bills on time, reduce outstanding debt, and avoid opening new credit accounts. Consistent, positive credit behavior can boost your score.

- Reduce Debt: Focus on paying down existing debt. A lower debt-to-income ratio improves your creditworthiness.

- Increase Your Income: Explore opportunities to increase your income. Higher income can make you more appealing to lenders.

- Wait Before Reapplying: Avoid applying for new credit immediately. Multiple inquiries can hurt your score. Wait at least six months before reapplying.

Taking these steps improves your chances of approval in the future. Remember, each action contributes to a stronger credit profile. Patience and persistence are key.

“`Conclusion: Final Thoughts On Simplifying The Credit Card Application Process

Understanding the credit card application process can feel overwhelming. Simplifying each step helps you navigate the journey with ease. Let’s review the key steps and encourage prospective applicants to take action.

Recap Of Key Steps

It’s important to remember the main steps in the application process:

- Evaluate Your Credit: Check your credit score. It influences your approval chances.

- Research Options: Compare different credit cards. Look for the best fit for your needs.

- Gather Documents: Collect necessary documents like proof of income and ID.

- Submit Application: Complete the application form. Provide accurate information.

- Wait for Approval: Wait for the bank’s decision. This can take a few days.

- Receive and Activate: Once approved, receive your card. Activate it immediately.

Encouragement For Prospective Applicants

Applying for a credit card may seem daunting. But with the right preparation, it becomes manageable. Evaluate your options carefully. Choose a card that aligns with your financial goals.

Stay organized. Ensure you have all necessary documents ready. This speeds up the process. Be honest in your application. Providing accurate information increases your approval chances.

Remember, the goal is to find a credit card that supports your financial health. Take the first step today. Empower your financial future with the right credit card.

Frequently Asked Questions

How To Apply For A Credit Card?

To apply for a credit card, choose a card, fill out an application form, and submit it with required documents.

What Documents Are Needed For Credit Card Application?

Required documents typically include proof of identity, proof of income, and address proof. Check the specific requirements of the card issuer.

How Long Does Credit Card Approval Take?

Approval times vary but usually take between a few minutes to a few weeks, depending on the issuer.

Can I Apply For Multiple Credit Cards?

Yes, you can apply for multiple credit cards. However, each application may impact your credit score.

Conclusion

The credit card application process is simpler than you might think. Start by gathering the necessary documents and researching suitable cards. Carefully review terms and conditions before applying. Ensure your credit score is in good shape. Choose a card that fits your financial needs. For more financial solutions, consider Upgrade. They offer personal loans with competitive rates and flexible terms. Remember, a well-chosen credit card can help build your financial future. Apply today with confidence.